Hyperliquid (HYPE) just recorded its biggest surge in months, rising 65% to near its two-month high of $34.5. This rapid price increase comes after weeks of sideways trading, making it highly attractive to Derivative traders.

Despite HYPE's impressive surge, current momentum indicators suggest uncertainty. Many investors are wondering whether HYPE will continue to rise or is preparing for a correction phase.

HYPE traders are pouring money in.

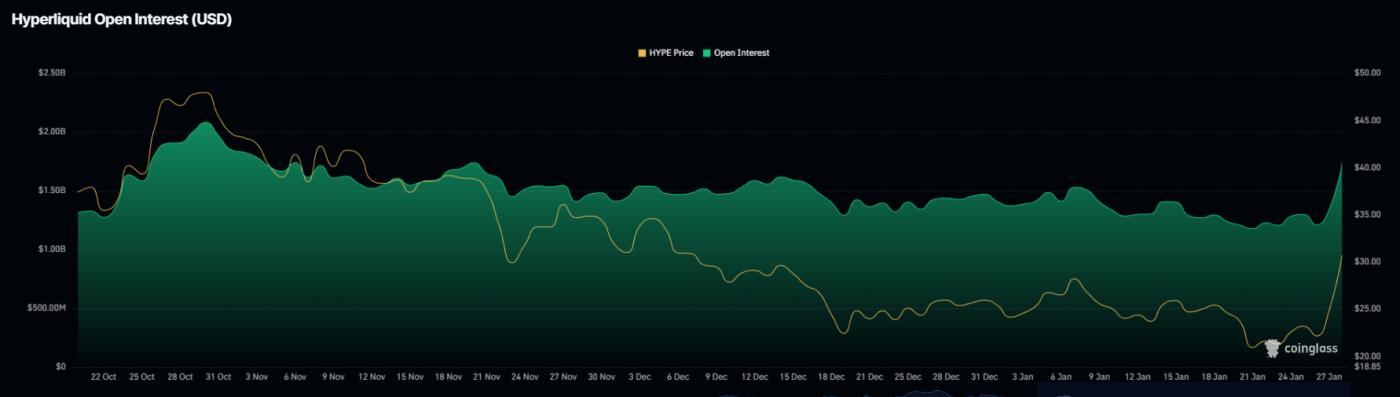

Market sentiment regarding Hyperliquid surged dramatically as Derivative trading became more active. In 48 hours, Open Interest increased 43%, from $1.21 billion to $1.73 billion. Such a rapid increase in Open Interest indicates that many new positions were opened rather than short positions being closed. This typically reflects traders' confidence in the likelihood of further price increases.

Funding rates remained positive throughout the price surge, confirming that buy orders outnumbered short orders. A positive funding rate coupled with rising open interest indicates that traders are willing to pay extra to hold their buy positions in the expectation of further price increases.

Want more Token analysis updates? Sign up for the daily Crypto newsletter from Editor Harsh Notariya here .

Open Interest HYPE. Source: Coinglass

Open Interest HYPE. Source: CoinglassThis type of market structure often helps sustain the upward trend in the short term, but also increases the risk of liquidation if sentiment unexpectedly reverses.

From a macroeconomic perspective, momentum indicators are signaling caution. HYPE's Relative Strength Index (RSI) has surpassed 70.0 in recent days, entering the overbought zone. This warns that buying pressure may have dried up after the sharp price increase.

In the past, RSI movements to a similar level to Hyperliquid often signaled a rapid price correction. When buying momentum peaked, early investors typically took profits, creating selling pressure that led to a sharp correction. Currently, if demand doesn't increase, the market could repeat this trend.

RSI HYPE. Source: TradingView

RSI HYPE. Source: TradingViewHYPE prices are approaching a critical testing threshold.

Over the past seven days, the price of HYPE has surged from $20.9 to $34.5, a 65% increase. This surge coincided with strong gains in many traditional commodities such as gold and silver. Hyperliquid's HIP-3 open interest skyrocketed to $793 million on January 26-27, 2026, up from $260 million a month earlier. This reflects the growing demand for decentralized commodity trading and alternative market models.

Despite the positive market sentiment, the price trend remains difficult to predict. Around the $34.5 USD mark, HYPE is testing a crucial area. If the Token breaks above $35.3 USD and holds above this level, the uptrend could continue. In that case, technical analysis suggests HYPE could head towards the $42.4 USD price range in the short term.

HYPE price analysis. Source: TradingView

HYPE price analysis. Source: TradingViewHowever, downside risk remains quite significant if market sentiment deteriorates. If HYPE fails to hold above $30.8, a sharp correction is highly likely. In that case, the price of HYPE could fall to around $26.8 if selling pressure intensifies. This scenario would break bullish forecasts and signal a period of repositioning in the market.