The Fed kept interest rates unchanged, and expectations of an early cut faded, causing Bitcoin to fall below the $90,000 mark again. Photo: Bloomberg

The Fed kept interest rates unchanged, and expectations of an early cut faded, causing Bitcoin to fall below the $90,000 mark again. Photo: Bloomberg

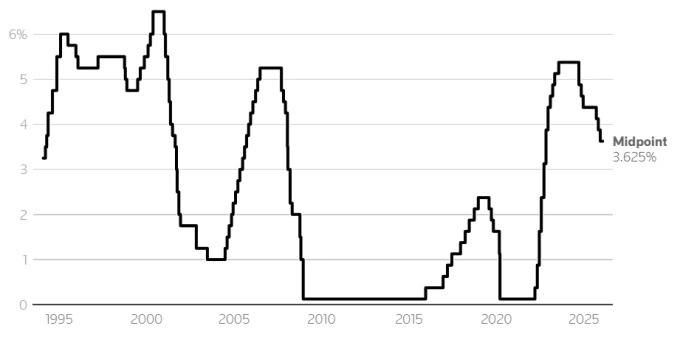

In the early hours of January 29th, the US Federal Reserve (Fed) decided to keep its benchmark interest rate unchanged at 3.5-3.75% in its first policy meeting of the year, ending a sharp reversal in market expectations that had been betting on an early interest rate cut as early as 2026. This development is one of the main factors causing the cryptocurrency market to continue lacking upward momentum.

Medium benchmark interest rate in the US from 1995 to 2025. Source: Reuters (January 29, 2026)

In a statement following its two-day meeting, the Fed said: “Economic activity remains strong. Inflation continues to accelerate, and the labor market is showing some signs of stabilization.” While acknowledging the continued slow job growth, the U.S. central bank no longer stressed the risk of a rapid weakening of the labor market, suggesting that officials are less concerned about a sudden economic slowdown.

Some Fed officials have recently indicated they want to fully observe the impact of the three monetary policy adjustments over the past year before considering the next step. Prior to the meeting, the US labor market was assessed as relatively balanced, with a slowdown in job seekers due to the Trump administration's stricter immigration policies . The unemployment rate in December fell to 4.4%.

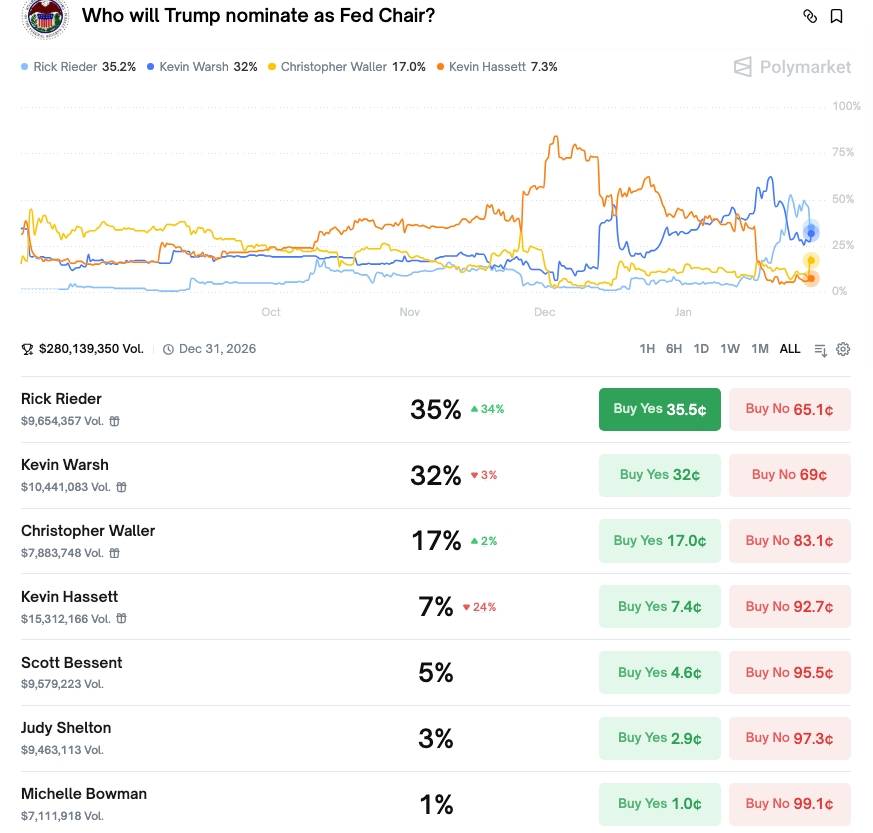

However, the decision to maintain the policy did not receive unanimous agreement. Two members of the Board of Governors, Christopher Waller – a potential candidate for the next Fed chairmanship – and Stephen Miran, President Trump's nominee for interim governor, voted against it, arguing that the Fed should lower interest rates by another 25 basis points.

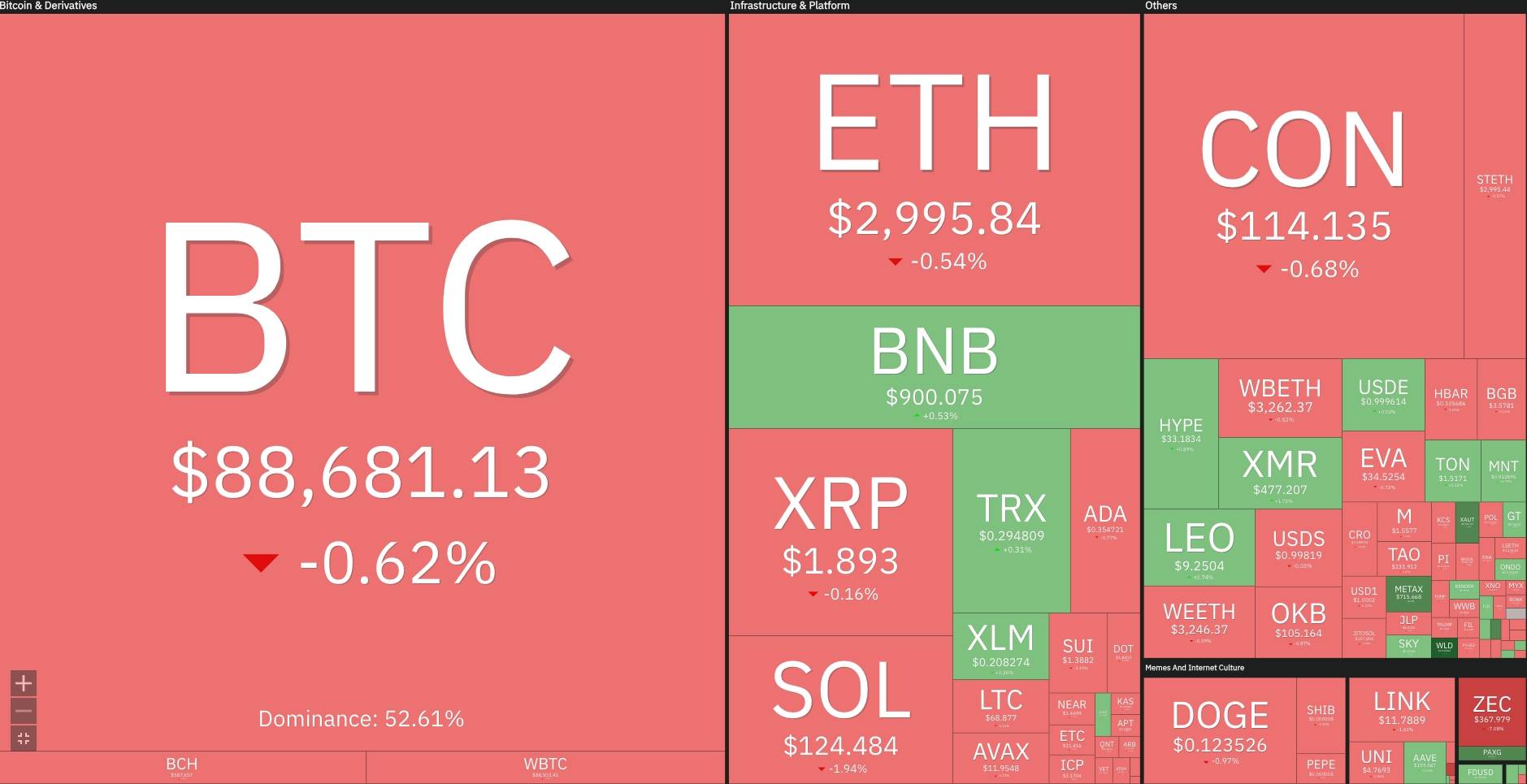

Following the Fed's decision, Bitcoin traded around $89,500, virtually unchanged from before the meeting, before falling 1.3% compared to 24 hours earlier. At the time of reporting, the leading coin was priced at $88,000. Ethereum lost the $3,000 mark, while other altcoins like Solana and XRP fluctuated within a 1-2% range. Overall, red remained the dominant color in this morning's trading session.

Fluctuations of top cryptocurrencies at 09:30 AM on January 29, 2026

Fluctuations of top cryptocurrencies at 09:30 AM on January 29, 2026

The US stock market saw narrow fluctuations; the S&P 500 briefly surpassed 7,000 points for the first time in history but closed slightly down 0.57 points, the Dow Jones rose only 12 points, and the Nasdaq Composite edged up 0.2%.

Meanwhile, gold prices continued to climb to $5,414 per ounce, before extending their gains into the morning of January 29th and at one point exceeding $5,585 per ounce. The US dollar recovered strongly during the session after its earlier sharp decline.

Just two months ago, traders were Chia on policy prospects, with markets pricing in a 40% probability of a Fed rate cut in January. However, by the end of November, this likelihood had rapidly diminished. Ahead of the meeting, the shift in expectations was almost complete, with markets pricing in a near 99% probability of keeping rates unchanged, eliminating much of the short-term easing expectation and reinforcing the view that the Fed would maintain its tightening stance at least through the first quarter.

Although the January decision closed the door to an early rate cut scenario, expectations of further easing haven't completely disappeared. According to the CME FedWatch tool, the probability of the Fed cutting interest rates at the March meeting is only about 16%, while this possibility increased to nearly 30% in April. Investors are increasingly convinced that the Fed will only begin easing when there is clear evidence that inflation is returning to its target trajectory, rather than reacting prematurely to localized slowdowns.

Nick Ruck, Director of Research at LVRG Research, commented that the decision to keep interest rates unchanged reflects Dai concerns about inflation amid the US economy's continued resilience. “If Chairman Jerome Powell sends a message that interest rates will remain high for an extended period or hints at fewer cuts in 2026, risk assets including Bitcoin could face further pressure in the short term,” he said.

This meeting is taking place against a backdrop of intense scrutiny of the Fed's independence. Last week, the U.S. Supreme Court heard arguments in a case involving Governor Lisa Cook, in which the justices questioned whether President Donald Trump had the right to fire her over allegations of mortgage fraud. Mid-month, Fed Chairman Jerome Powell also released a rare video responding to pressure from the White House , stating that he is under investigation by federal prosecutors in connection with last year's hearing on a project to renovate the Fed's Washington headquarters.

This was also one of Powell's last three meetings as Fed Chairman. His term ends on May 15th, and President Trump is expected to announce his successor as early as this week.

Predicted percentages for the next Fed Chair candidate. Source: Polymarket (January 29, 2026)

Coin68 compilation