Bitcoin's price failed to keep pace with gold's surge, as the precious metal rose by $500/oz in just 72 hours, setting a new record above $5,500/oz.

Bitcoin's price failed to keep pace with gold's surge, as the precious metal rose by $500/oz in just 72 hours, setting a new record above $5,500/oz.

Data from TradingView shows that the BTC/USD pair nearly reached $90,500 before reversing and falling back to around $88,800.

Meanwhile, the value of the US dollar is plummeting, as US President Donald Trump is willing to accept a weaker dollar as a means to an end. U.S. export support tools .

US stocks opened nearly flat for the day, as the Federal Reserve kept its benchmark interest rate unchanged.

Amidst increasing macroeconomic uncertainty, Bitcoin and altcoins have failed to capitalize on market momentum, continuing to fluctuate within their familiar narrow price range.

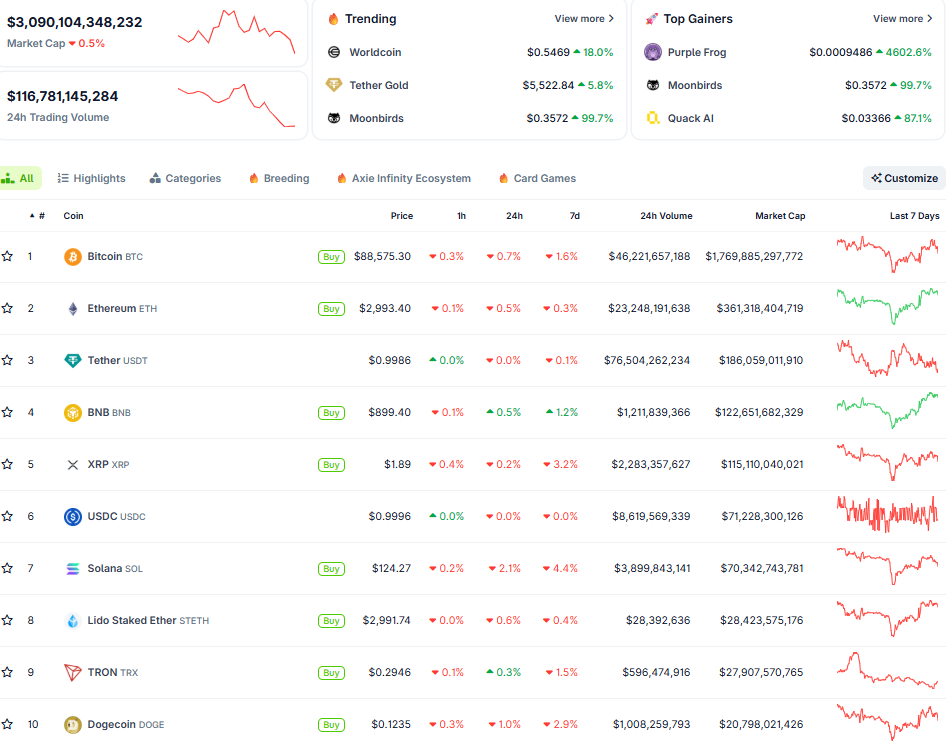

Crypto market developments on January 29th (Source: CoinGecko)

Crypto market developments on January 29th (Source: CoinGecko)Here are some noteworthy points:

Bitcoin ( BTC ): Bitcoin has been trading within a narrow range since mid-November, with support around $85,000 and resistance near $95,000, fluctuating between these two levels without forming a clear trend.

According to Deribit, the high volume of options on short-term maturities – especially put options – indicates that investors are actively managing risk.

Upward price movements may soon encounter supply pressure from risk-reduction activity, while corrective movements quickly see buying pressure from position rebalancing. Momentum therefore has to work harder to expand, Deribit explains.

Traders are closely monitoring the $93,500 price level, where a large number of leveraged short positions are concentrated.

Data from CoinGlass shows that approximately $4.5 billion worth of Short positions are concentrated around the $93,500 mark. If Bitcoin enters this price range, forced liquidations could trigger a chain reaction.

However, participation in the spot market remains uneven. The Bitcoin Premium Index on Coinbase, a measure of spot BTC demand in the US, continues to be in deep negative territory. This suggests that the current rally is largely driven by Derivative and leverage, rather than genuine buying from US investors.

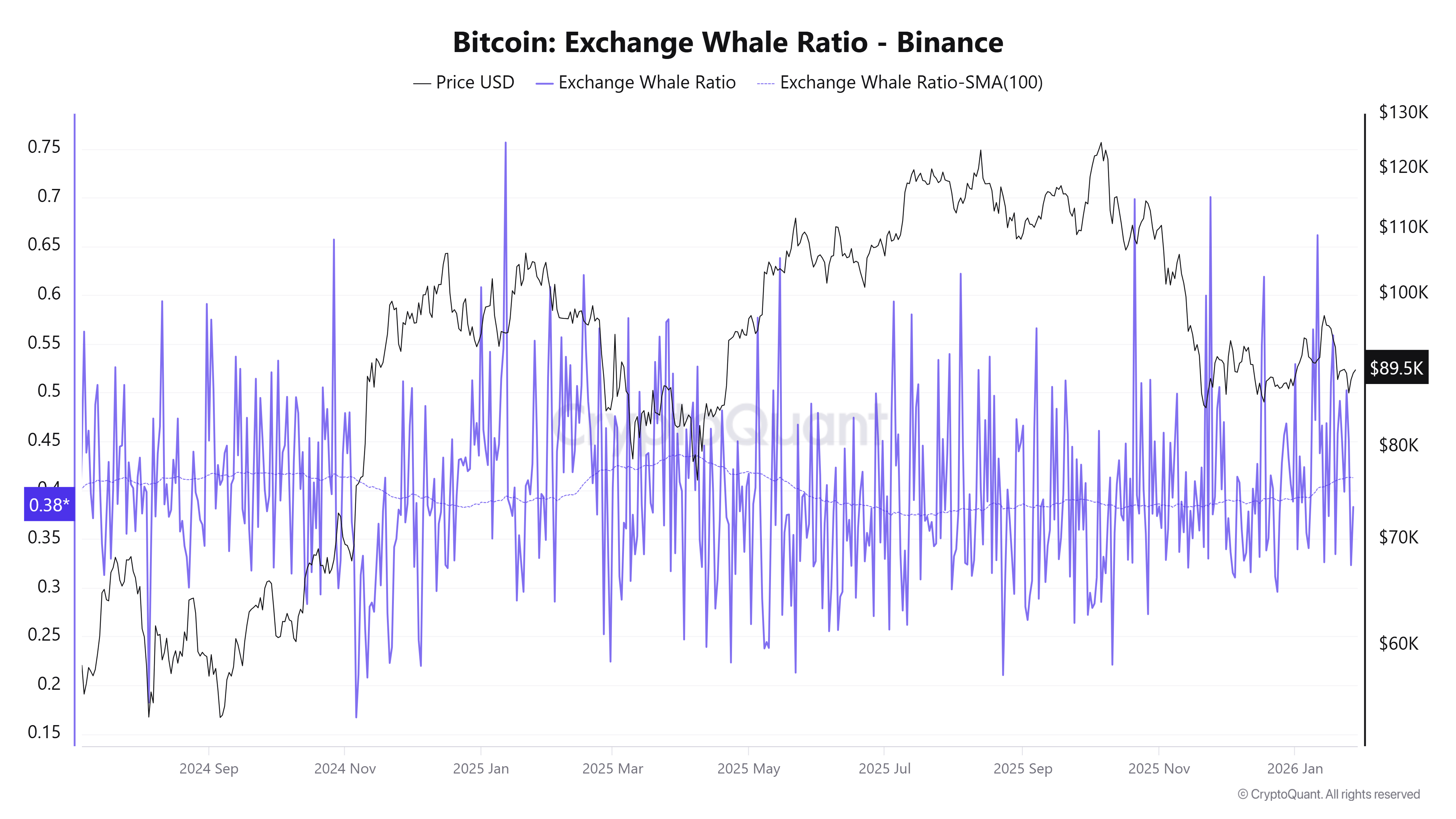

Furthermore, the "Whale Ratio" indicator is sending a neutral to cautious signal, suggesting that whales haven't sold aggressively, but they also haven't actively accumulated shares to drive an upward trend.

The "Whale Ratio" index on Binance (Source: CryptoQuant)

Worldcoin ( WLD ): WLD rose more than 15%, reaching $0.53, thanks to news that World will be partnering with OpenAI. According to Forbes, OpenAI is developing a "biometric social network" to verify real users and eliminate bots. The team is considering using Apple's Face ID or World Orb – World's own iris scanner.

Although there has been no official confirmation of a collaboration between OpenAI and World, the rumors were hot enough to push $WLD up by more than +40%, before correcting back to its current level.

The current problem is that World is still facing legal hurdles and is banned in a number of countries: Thailand, the Philippines, Hong Kong, Kenya, Spain, China, etc., due to concerns about how it handles personal data.

Ethereum ( ETH ): ETH remains within a broad consolidation zone, bounded by $2,700 below and $3,400 above. Price movements within this zone indicate a supply-demand equilibrium, with no clear trend yet formed. The Dip continues to Vai as a reaction zone, with buying pressure appearing regularly.

Besides price movements, the fundamental indicators of the Ethereum network remain stable. Recent on-chain data shows that volume on the Ethereum network has remained high for several consecutive weeks, reflecting stable network usage even as the price consolidates.

Furthermore, data from DeFi tracking platforms shows that the TVL on Ethereum remains above $45 billion. While TVL can fluctuate depending on the statistical methodology, the continued presence of Capital in the ecosystem demonstrates sustained participation from both institutional and retail investors.