Most L2 tokens fail because governance sits idle, yields fragment, and incentives leak.

@katana fixes this with its No Idle Capital design, forcing KAT into governance or liquidity roles.

—

► Katana Design

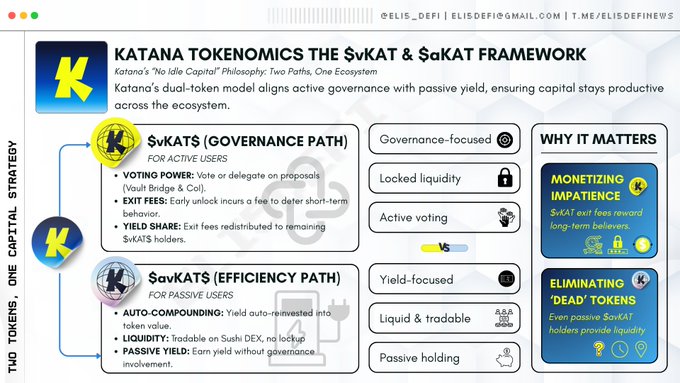

Katana splits KAT utility into governance and efficiency paths so capital is always productive.

$KAT → Base asset unlocking utility only when deployed productively

$vKAT → Locked governance token for voting power and capital allocation

$avKAT → Liquid, yield-focused token for passive capital efficiency

—

❶ vKAT: The Governance Path

vKAT ties governance influence directly to locked capital, favoring long-term commitment.

Emissions → liquidity → volume/activity → fees → rewards to aligned voters → repeat.

vKAT holders vote or delegate to direct Vault Bridge yields and Chain-Owned Liquidity (CoL) allocations. Early exits pay an exit fee redistributed to remaining holders.

—

❷ avKAT: The Efficiency Path

avKAT keeps capital liquid while auto-compounding protocol yield.

Emissions → liquidity → volume/activity → fees → auto-compounded value → repeat.

avKAT will be freely tradable on @SushiSwap with no protocol exit fees. Users enter or exit via market liquidity, accepting slippage.

— Disclaimer

Looks promising fr

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content