➥ Why Cash-and-Carry Works Better on HyENA

In the current market landscape, yield is often chased at the expense of unnecessary risk.

A classic delta-neutral Long Spot and Short Perp cash-and-carry strategy has quietly outperformed similar setups on @hyenatrade.

Here is the breakdown of the funding data and mechanics driving this yield.

— — —

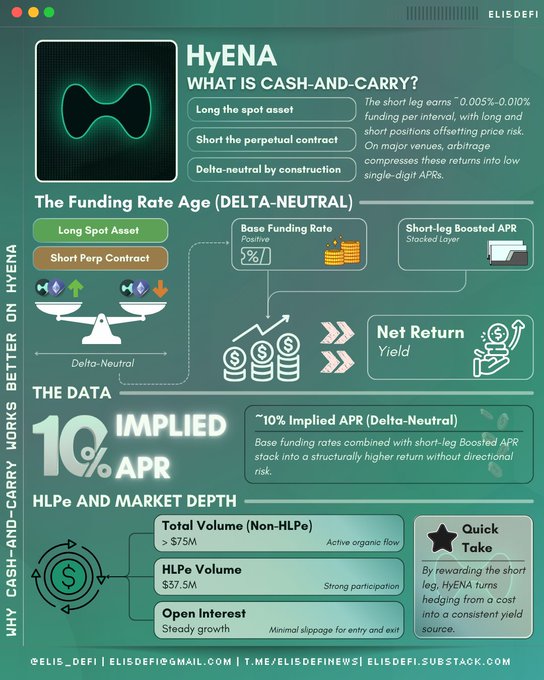

► What is Cash-and-Carry Strategy?

Cash-and-carry is a delta-neutral strategy where you long the spot asset and short its perpetual contract.

▸ The short leg earns funding payments, typically ~0.005% to 0.010% per interval on liquid markets

▸ Price exposure is largely offset between the long and short positions

▸ Annualized funding on major venues often compresses to low single-digit APRs

This baseline is widely used, but outcomes depend entirely on funding conditions and incentive design.

—

► The Key Differentiator: Short-leg Boosted APR

Traditionally:

▸ Incentives and boosts favored long positions or liquidity providers

▸ Shorts earned funding but received no additional rewards

▸ Delta-neutral strategies faced persistent yield drag on the short leg

HyENA changed this:

▸ Boosted APR now applies directly to the short leg

▸ Funding and Boosted APR stack into a layered yield

▸ Returns remain smoother during periods of funding compression

This shifts the short hedge from a cost center into a consistent yield source.

—

► What The Numbers Imply

Recent snapshots show HyENA’s incentive structure materially improves cash-and-carry returns without increasing risk.

▸ Base funding rates sit around ~0.0100% per interval on $ETH and $HYPE

▸ When annualized and combined with the short-leg Boosted APR, this implies ~10% APR

▸ This applies to the same delta-neutral profile that earns low single-digit returns on major CEXs due to arbitrage

These returns come from incentive design, not leverage or additional exposure.

—

► HLPe and Market Depth

Liquidity determines whether cash-and-carry can be executed at scale, and HLPe (Hyperliquid LP) data confirms sufficient depth.

▸ Total Volume (Non-HLPe): Over $75M recently, indicating active organic trading flow

▸ HLPe Volume: Around $37.5M, reflecting strong participation in the liquidity vault

▸ Open Interest: Steady growth across ETH and HYPE, supporting efficient entry and exit

—

► Why this Matters

HyENA enables delta-neutral capital to earn around ~10% implied APR without leverage or added directional exposure.

By incentivizing the short leg, funding and Boosted APR stack, improving returns without changing risk.

Combined with HLPe liquidity depth, this makes cash-and-carry viable for real size deployment.

— Understand more about hyENA here:

Eli5DeFi

@Eli5defi

01-22

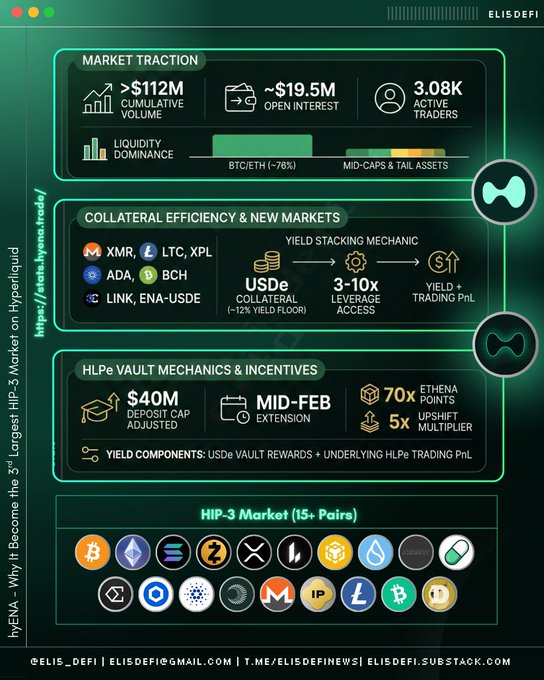

hyENA has shown solid traction on @HyperliquidX as one of the leading HIP-3 DEX.

The metrics says it all.

▸ ~$715M cumulative trading volume

▸ ~$36M 24h volume

▸ ~$45.5M open interest

▸ 8.17K unique users

▸ ~$344K $USDe rewards distributed

To date, @hyenatrade is now the

— Disclaimer

this is good quality protocol

HyENA maxi spotted

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content