Amid the precious metals frenzy, Dan Bin quietly withdrew from the cryptocurrency arena.

Written by: Nicky, Foresight News

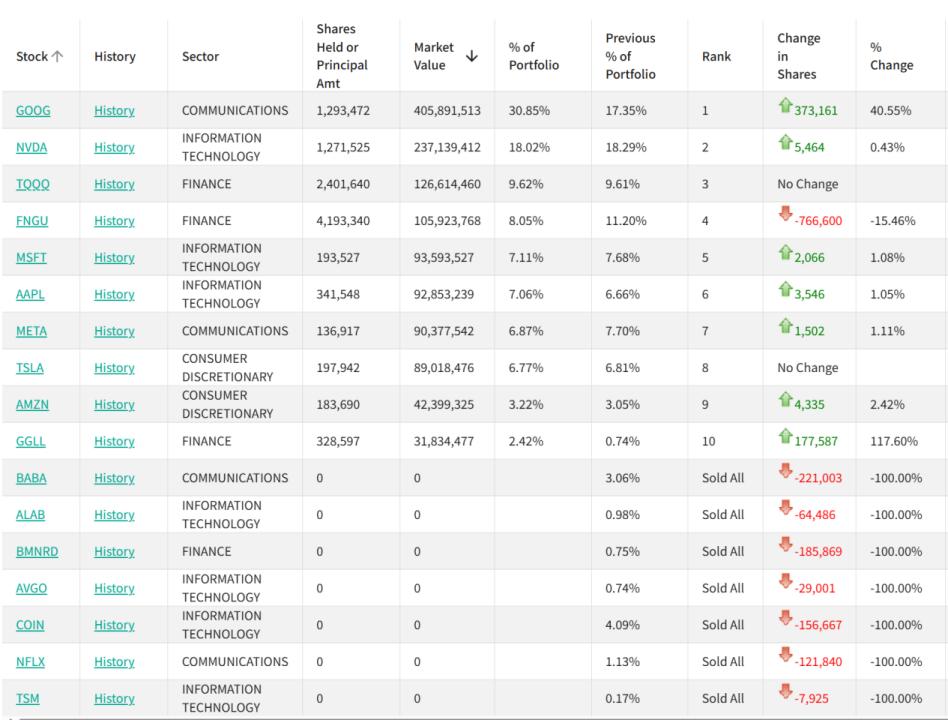

Recently, a document submitted to the U.S. Securities and Exchange Commission quietly revealed a remarkable "exit": Oriental Harbor Overseas Fund, managed by private equity mogul Dan Bin, completely liquidated all cryptocurrency-related stocks in the fourth quarter of 2025.

Coinbase, the globally renowned US cryptocurrency exchange, along with another Ethereum treasury company, BitMine, has disappeared from the fund's holdings list. Oriental Harbor cleared out its entire holdings of 156,900 Coinbase shares purchased in Q2 2025 (valued at $52.8735 million in Q3) and 185,900 BitMine shares purchased in Q3 ($9.6522 million).

Coinbase stock fell 32.99% in the fourth quarter of 2025, and BitMine fell 47.71%. Based on these figures, Oriental Harbor's maximum loss was $22.0486 million, a loss rate of 35.26%, with Coinbase's maximum loss at $17.4429 million and BitMine's maximum loss at $4.605 million.

In other words, even investment guru Dan Bin has lost a fortune in this cryptocurrency speculation.

Dan Bin himself has been involved in investment since 1992. Due to his long-term heavy investment in companies such as Kweichow Moutai and Tencent, he has been called by many media outlets one of the "most successful Chinese to replicate Buffett".

The Shenzhen Oriental Harbor Investment Management Co., Ltd., which he leads, was established in 2004 and is one of the earliest private equity firms in China. It has long adhered to the value investment philosophy of "growing together with great companies". Currently, its assets under management are approximately RMB 30 billion, and its overseas funds in the US stock market are approximately USD 1.316 billion. Over the past ten years, its annualized returns in China and abroad have been approximately 25% and 28%, respectively.

In addition, Dan Bin's story with Bitcoin began much earlier than most people imagine.

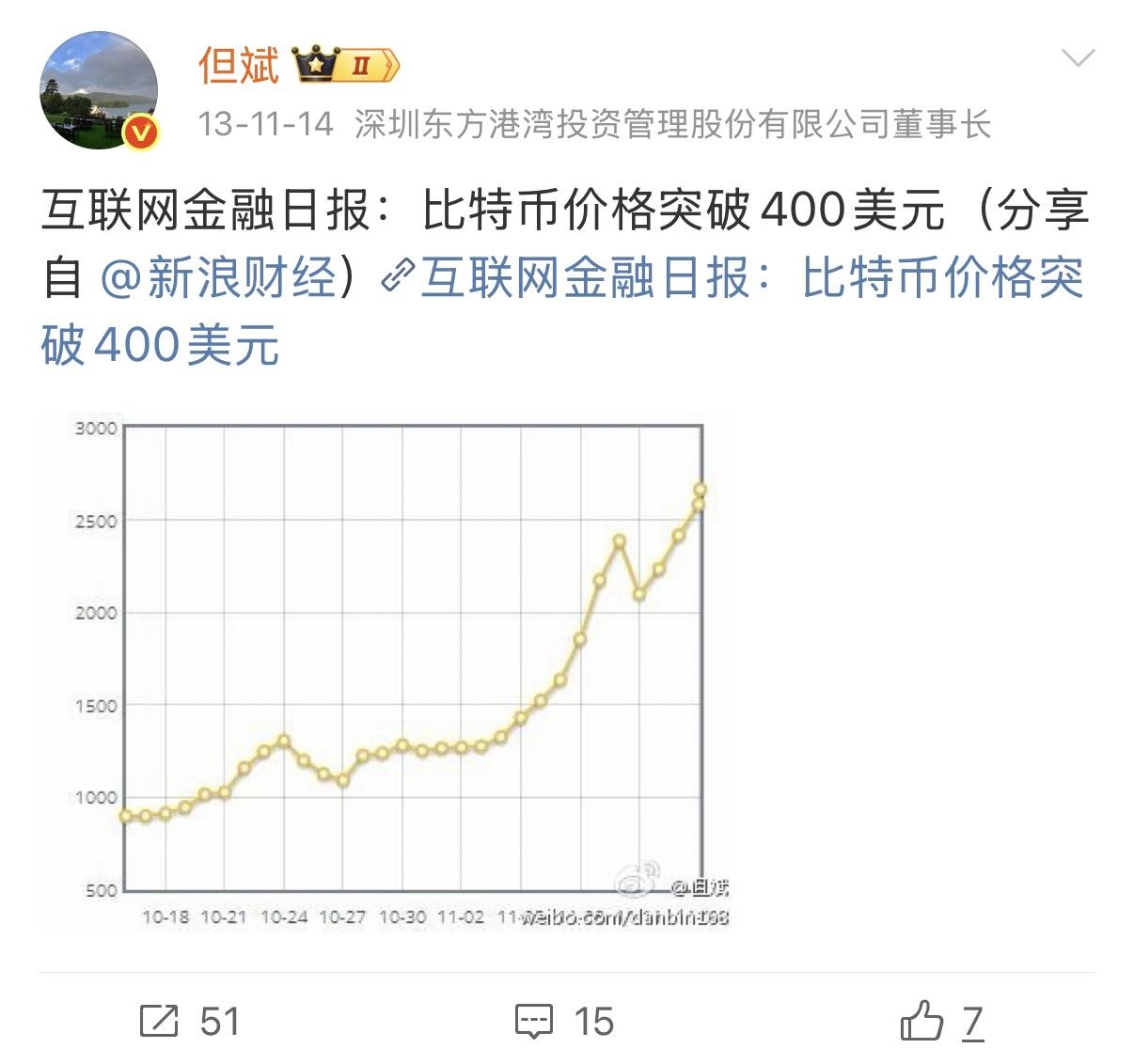

In November 2013, when the price of Bitcoin broke through $400, which was still a pipe dream for the general public, Dan Bin had already forwarded the news on Weibo.

A few months later, he visited a Bitcoin mining farm in Shenzhen and listened to the enthusiastic discussions among the young people. He lamented on Weibo that it "felt like listening to gibberish." At that time, he was much like an onlooker standing outside a lively party, curiously peering in but not stepping inside.

In the years that followed, his Weibo account became an "unofficial news station" for Bitcoin price updates. When the price broke $3,000 in 2017, and he commented on Justin Sun's "Buffett lunch" in 2019, his attention never left this wild new phenomenon.

2021 saw a climax when the world's first Bitcoin ETF was launched. Dan Bin publicly stated that it was "very possible" for Bitcoin to rise to $400,000, and revealed that he had already used his personal funds to buy 1% of the Bitcoin ETF—"to maintain curiosity about new things," he explained.

However, personal curiosity is one thing, but investing real money from his multi-billion dollar fund is quite another. Dan Bin appeared extremely cautious.

It wasn't until the second quarter of 2025 that Oriental Harbor Overseas Fund first ventured into the cryptocurrency market, purchasing approximately $55 million worth of Coinbase stock. At that time, the market was booming, and Coinbase's stock price soared. In the third quarter, the fund further increased its investment, acquiring shares in BitMine, a company related to the Ethereum treasury concept. The market began to speculate: was this leading figure in value investing about to fully embrace cryptocurrency?

In a December 2025 interview on the talk show "Mysterious and Unsettling," Dan Bin revealed his inner thoughts. He acknowledged that cryptocurrency, after its legalization, has become mainstream and is an important trend. However, he immediately shifted his focus, comparing Bitcoin to gold, a "non-interest-bearing asset." He posed a sharp question: "Where do you put the same amount of money to generate the most efficiency?" For him, the answer seemed to be tilting towards those tech giants that can continuously generate profits.

Sure enough, the fund's holdings in the fourth quarter of last year provided the final answer. Not only did it liquidate its positions in Coinbase and BitMine, but it also exited several other stocks, including Alibaba and Netflix. The recovered "ammunition" was then heavily concentrated on Google, making it the absolute largest holding. Dan Bin's entire strategy was focused on core AI giants such as Google, Nvidia, and Microsoft.

This sell-off is not surprising. In Dan Bin's investment philosophy, "efficiency" has always been the core.

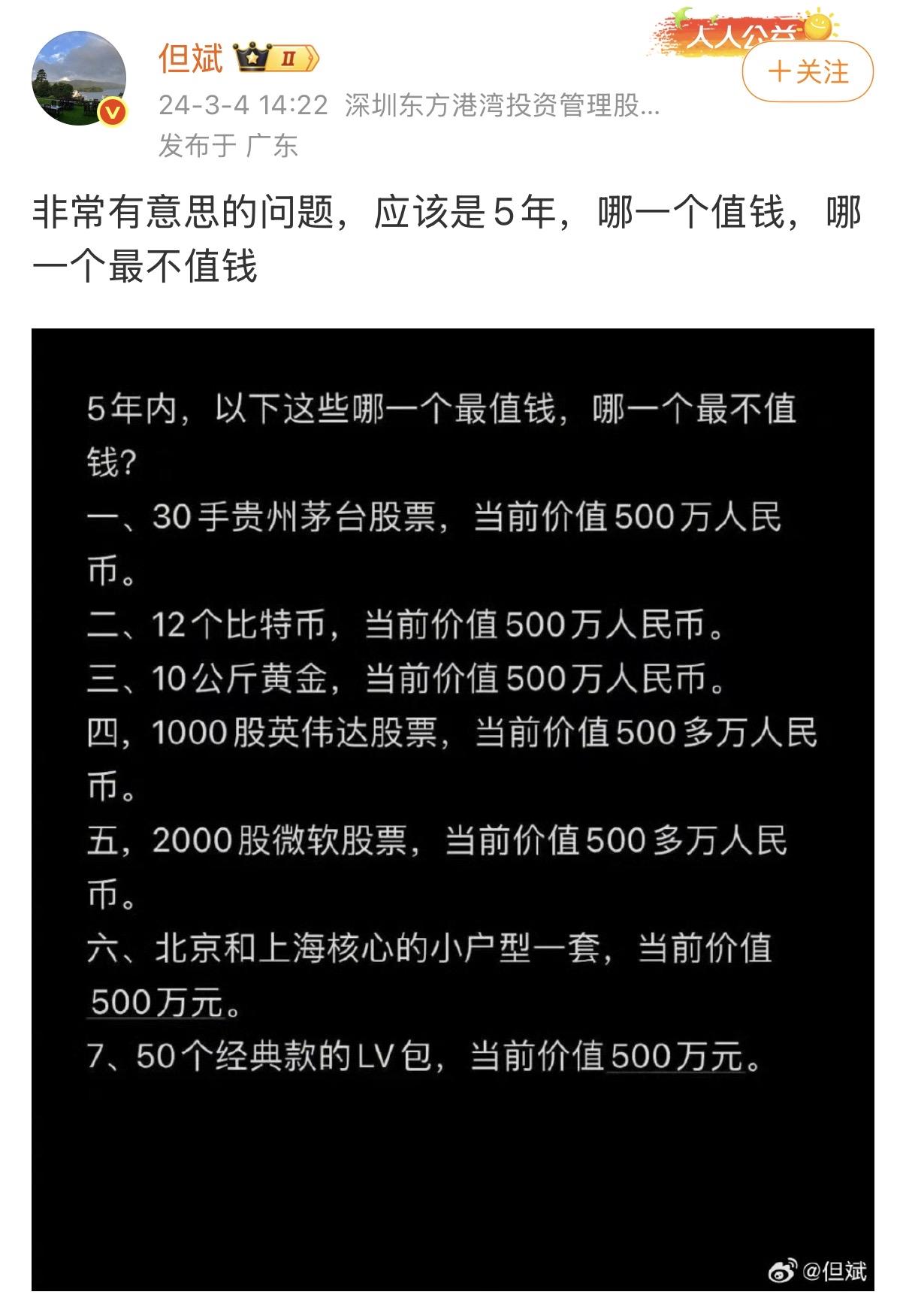

In March 2024, he launched an interesting poll: With 5 million RMB, should one buy 30 lots of Moutai liquor, 12 Bitcoins, 10 kilograms of gold, or 1,000 shares of Nvidia? This is a fundamental question about asset efficiency. Although he personally still believes in the long-term trend of Bitcoin, even saying in October of last year that "if blockchain technology is not disrupted, Bitcoin will definitely continue to rise," for the fund, he has to make a more drastic choice.

As of January 29th, 30 lots of Moutai liquor were worth 4.31 million RMB, 10 kilograms of gold were worth 12.43 million RMB, 12 Bitcoins were worth 7.35 million RMB, 10,000 shares of Nvidia (with a 1:10 stock split in 2024) were worth 13.3 million RMB, and 2,000 shares of Microsoft were worth 6.69 million RMB.

In his view, artificial intelligence is currently the "mainstream" with higher certainty and greater potential. AI technology is reshaping all industries, and companies like Google and Nvidia not only possess technological barriers but are also "interest-bearing assets" that continuously generate cash flow. In contrast, highly volatile cryptocurrencies are more like "faith assets" that need to wait for market consensus.