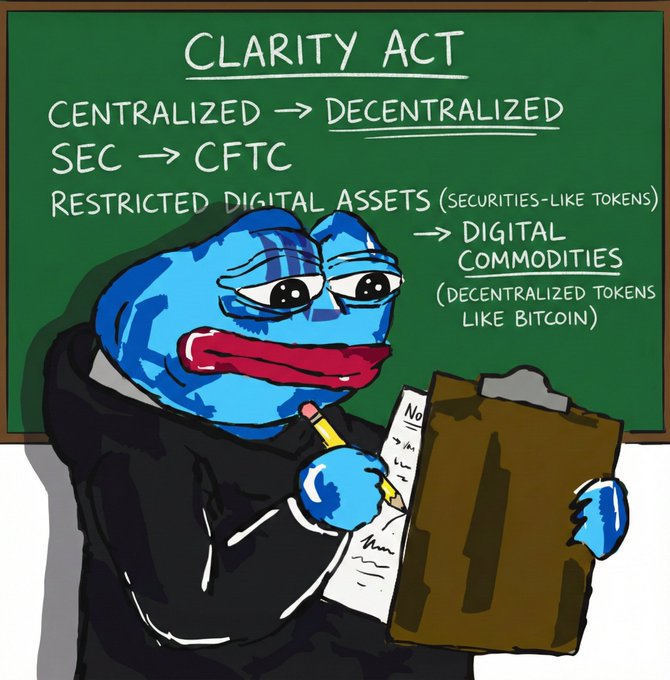

⏰What happened in Crypto in the last ~24h: - [DEGEN] $ELON - Chamath’s '$ELON' post triggers massive speculative pump for Solana meme coin (MC 9M) - $SENT, $ELSA listed on Bithumb spot - $SENT Listed on Upbit spot - $INX Listed on Bybit pre-market - $RENDER Listed on Robinhood spot - $HYPE Hyperliquid team unlocks drop to 140K HYPE as supply pressure eases - $ETH Ethereum Foundation launches $220M security fund using recovered DAO hack assets - $ETH ERC-8004 launches decentralized standard for Ethereum’s autonomous AI agent economy - $FT Andre Cronje’s Flying Tulip raises additional funds amid $1.3 billion soft commitments - Bybit to rollout IBAN accounts in February, introducing neobank features to platform - Robinhood invests in crypto platform Talos at $1.5 billion valuation - Escape Velocity raises $62 million to bet on DePIN crypto networks - US regulators prepare growth-focused crypto rules to provide industry clarity - UAE Central Bank-sanctioned USD stablecoin launches for regulated digital asset settlement ————————————————— $ELON - Chamath’s post "Just let me buy $ELON" triggered a massive speculative pump for a Solana-based meme coin despite having no official connection. The token’s market cap skyrocketed from thousands to millions of dollars within hours as traders capitalized on the celebrity ticker mention. This event highlights how social media catalysts drive explosive, high-risk cycles in the volatile meme coin market. $SENT , $ELSA - Bithumb is adding Sentient (SENT) on the Ethereum network and HeyElsa (ELSA) on the BASE network to its KRW market. Trading for SENT begins at 17:30 and ELSA at 18:00 on January 29, 2026, with base prices of 42.07 KRW and 182 KRW, respectively. SENT focuses on open-source AGI networking, while ELSA provides AI-driven DeFi (DeFAI) transaction solutions. $INX - Bybit has listed the INXUSDT perpetual contract on its Pre-market platform, starting January 29, 2026, at 9:30 AM UTC. $INX is a pioneering digital asset that completed the first-ever SEC-registered IPO on the blockchain, representing a regulated security. oken holders are entitled to a 40% share of INX Limited's cumulative net operating cash flow and receive discounts on trading fees within its ecosystem. $RENDER - Robinhood listed RENDER on spot. RENDER is the native utility token of the Render Network, a decentralized platform that connects users in need of GPU power with distributed computing providers. It facilitates payments for high-demand tasks such as 3D rendering, visual effects, and other compute-intensive workloads. The token ensures a secure and efficient exchange of value within the network’s decentralized infrastructure. $HYPE - Hyperliquid’s team unlocks are trending downward, with only 140K HYPE scheduled for February, compared to 1.2M in January and 2.6M in December. The significant decrease suggests the team may be re-locking a majority of their allocated units after initial profit-taking. This reduction in circulating supply pressure is being viewed as a potential positive signal for the HYPE token’s market stability. $ETH - The Ethereum Foundation established a $220M security fund using unclaimed assets from the historic 2016 DAO hack to enhance long-term network resilience. The fund will provide grants for critical research, audits, and formal verification while staking a portion of the capital to ensure a self-sustaining revenue stream. This initiative sets a new benchmark for blockchain security governance, prioritizing proactive defense mechanisms against evolving digital threats. $ETH - The 8004 Foundation launched ERC-8004 to establish a decentralized infrastructure for the autonomous AI agent economy on the Ethereum mainnet. The standard introduces unified registries for agent identity, reputation, and task validation, enabling trustless machine-to-machine interactions. It aims to transform Ethereum into a global coordination layer where AI agents can securely discover, collaborate, and transact without intermediaries. $FT - Flying Tulip raised an additional $25.5 million in private funding, bringing its total institutional capital to $225.5 million at a $1 billion valuation. The project has also secured $50 million through public sales on Curated, with a total of $1.36 billion in commitments ahead of its CoinList launch. All funding rounds feature a "perpetual put" structure, allowing contributors to redeem their original principal at any time by burning their tokens. Bybit plans to launch IBAN accounts in February, integrating neobank features like SEPA transfers directly into its crypto exchange. The new service will allow users to bridge digital assets and traditional banking through a single interface for easier fiat-to-crypto transactions. This initiative aims to simplify crypto adoption by providing global users with more seamless on-chain and off-chain connectivity. Robinhood is investing in institutional crypto trading platform Talos at a $1.5 billion valuation. The strategic move aims to bolster Robinhood's institutional offerings and expand its digital asset infrastructure. This partnership underscores the growing convergence between retail-focused brokerages and institutional-grade crypto technology. Escape Velocity raised a $62 million fund to invest in Decentralized Physical Infrastructure Networks (DePIN). The fund targets projects that use crypto incentives to build real-world infrastructure, such as solar energy and telescopes. This initiative underscores the growing institutional conviction in blockchain's ability to coordinate large-scale physical assets. US regulators are shifting toward a growth-oriented framework for digital assets to foster industry innovation and domestic leadership. The initiative aims to provide clear legal definitions and guidelines, moving away from the previous "regulation by enforcement" approach. This regulatory reset is expected to encourage institutional participation and provide the clarity needed for long-term market stability. The UAE's first central bank-sanctioned USD stablecoin has officially launched to facilitate regulated digital asset settlements. Developed under the Central Bank's oversight, the stablecoin aims to provide a secure and transparent bridge between traditional finance and the digital economy. This initiative strengthens the UAE's position as a leading global hub for regulated blockchain innovation and institutional crypto adoption. ———————————————— ➬ Follow me @layerggofficial , TG: t.me/layergg 📷Sharing is welcome, just a nod to the source would be appreciated. 💞Please Like + Retweet if you enjoy this

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content