Most P/S ratios in crypto are lying to you.

P/S = Market Cap ÷ Revenue

It tells you how much you're paying for every $1 of revenue.

1. Low P/S (2x) = paying $2 per $1 revenue. Cheaper.

2. High P/S (20x) = paying $20 per $1 revenue. Pricier.

But in crypto, this breaks down:

- Not all tokens receive revenue

- Not all revenue goes to holders

- Circulating supply ≠ eligible supply

A protocol can print $100M in fees while token holders see nothing.

Effective Revenue Multiplier is the fix here:

→ Only count supply that actually receives cashflow

→ Only count cashflow that actually reaches holders

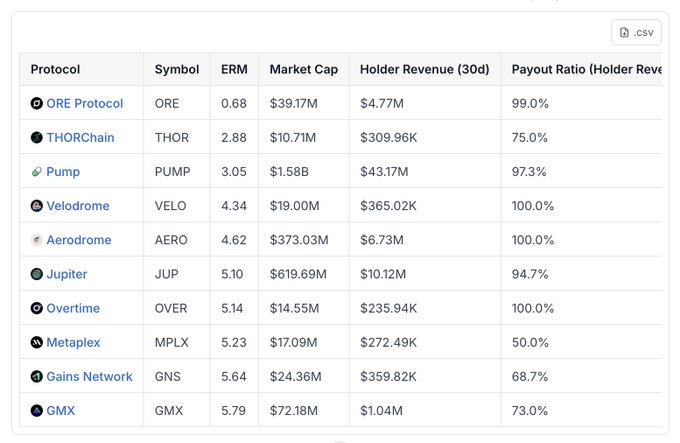

Here are the tokens with the strongest ERM👇

$PUMP $JUP $AERO are the ones with biggest mcap.

(A lower ERM indicates a more efficient valuation from a token holder's cash flow perspective)

h/t to @DefiLlama for the data

Cashflow alignment matters more than raw fees.

ERM exposes real value.

True bro

thank you Yas, i love $JUP and $AERO

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content