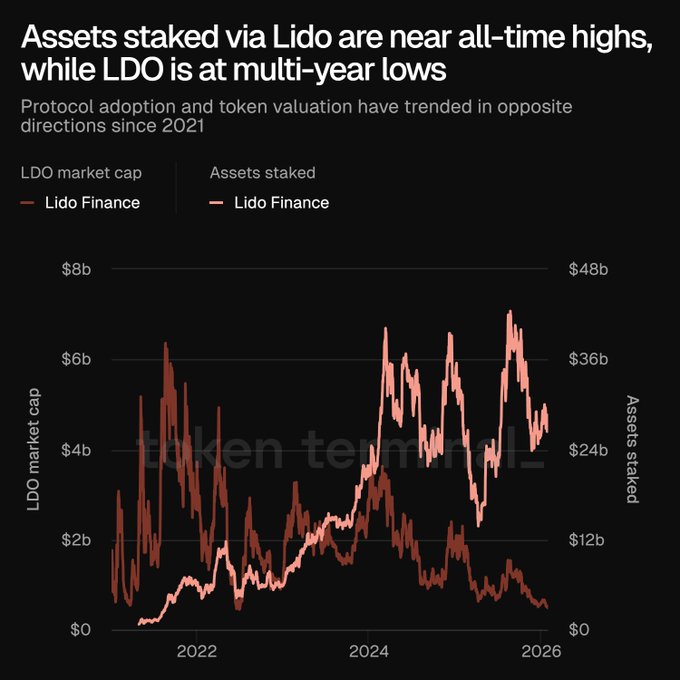

Lido is the perfect story of a sound business with poor tokenomics. Staked assets remain near ATHs, while $LDO is down -97% from its ATH. - Cost of revenue stands at 90% - Meanwhile, incentives have not increased earnings over the past year. $LDO used to be thought of as an $ETH beta, if only they would drive some of that revenue back to token holders. Data: @tokenterminal

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content