This article is machine translated

Show original

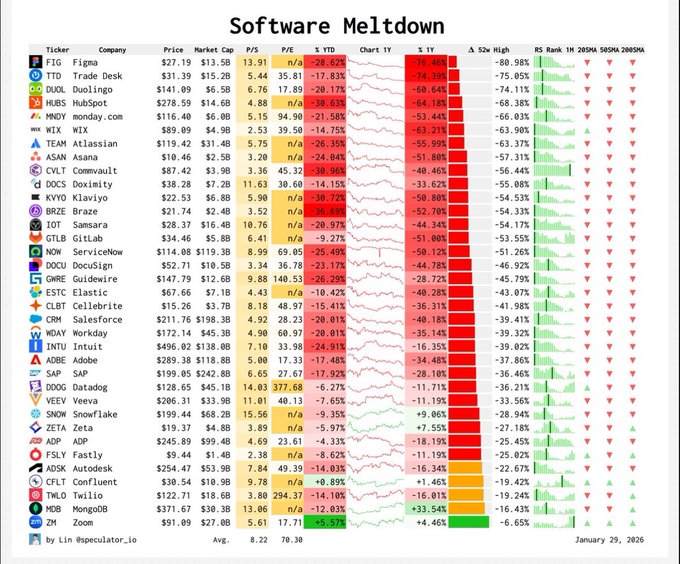

⚠️ Not just gold and silver, but US software stocks have also crashed, experiencing their worst start to the year in years!

As the Nasdaq nears its all-time high, several traditional SaaS companies have seen their biggest weekly declines.

The launch of Claude Cowork AI, showcasing unprecedented capabilities and speed of change, has significantly accelerated the divergence in performance between software stocks and other sectors of the technology sector!

For the past decade or so, the US software sector has benefited from a triple advantage:

1) Low interest rates → extremely low discount rates → extreme long-term cash flow

2) SaaS model → high gross margins + high renewal rates → the ability to tell a lifetime value story

3) Cloud transformation → the market is willing to pay a premium for certain growth.

The result is a typical phenomenon: As long as you are a SaaS company + high growth + good ARR—even if you're not profitable, you can still get 15-30 times earnings.

However, the emergence of AI has brought the marginal cost of some software functions close to zero, leading to a significant shift in investment – from application-layer SaaS to AI infrastructure, computing power, chips, and platform-level models. Following this trend, regardless of how cheap the stock price is or how much it falls, there seems to be no reason to hold software stocks at present!

I think it might be because Binance listed on the stock exchange 🙃

👀 Today's Best: Scapegoat

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content