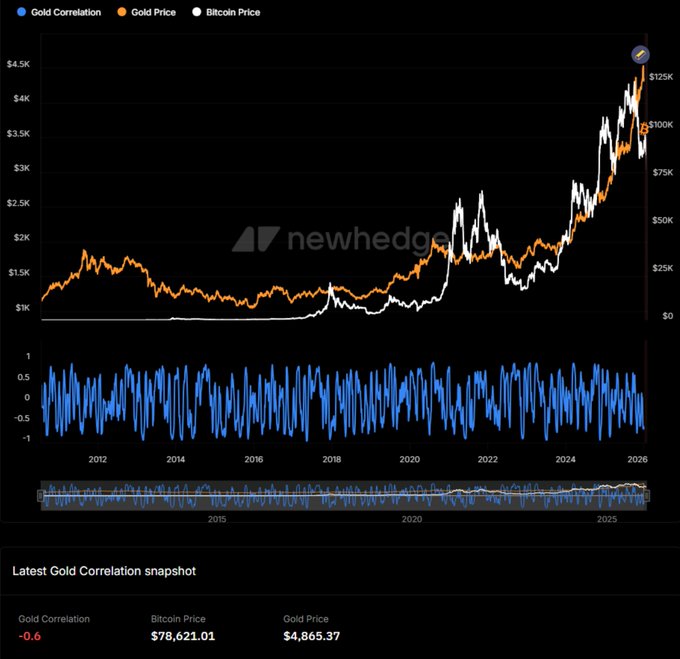

✦ Post-Jan 2026 parabolic rallies in safe-havens & crypto

→ massive profit-taking + USD rebound

→ leveraged positions unwind = liquidations spike

→ precious metals crash hardest - silver > gold due to industrial/ETF overextension

→ crypto follows with correlated risk-off - $BTC / $ETH dip but hold better

→ broader volatility ↑ - expect more swings on Fed cues, policy, or macro data

Top assets by total valuation

> Gold: ~$34.1T

> Silver: ~$4.8T

> #Bitcoin: ~$1.56T

> #Ethereum: ~$290B

lower <> higher?

Lower 👀

This full year will be filled if sudden movements.

Volatility is maximum in uncertain times

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content