Macro risks mounted, sentiment turned weak — Project 0 drew liquidity attention | Frontier Lab Weekly

Market Overview

This week, the cryptocurrency market experienced a significant downturn, with both BTC and ETH showing sharp declines. BTC fell 8.98% this week, ETH dropped 13.32%, and TOTAL3 decreased by 8.61%. The market sentiment index plummeted from 37 last week to 14, entering the extreme fear zone.

Stablecoin Market Dynamics

The total market capitalization of stablecoins experienced a substantial decline, with both USDT and USDC showing synchronized massive drops:

- USDT: Market cap reached $186.5 billion, down 1.38% week-over-week, amplifying last week’s capital outflow trend. This indicates that as market prices fell this week, non-U.S. investors continued their previous risk-averse exit behavior.

- USDC: Market cap stands at $70.2 billion, down 4.48% week-over-week, continuing its steep decline. The outflow scale has reached $3 billion, indicating U.S. Investors opted for risk-averse exits amid this week’s price drop.

BTC Market Trading Volume

This week’s BTC market trading activity saw a slight increase compared to last week. Data shows that the combined trading volume of BTC on Binance and Coinbase reached 164,879 BTC this week, slightly up from last week’s 150,717 BTC. Binance’s volume rose from 100,317 BTC to 112,599 BTC, while Coinbase’s volume increased from 50,400 BTC to 52,280 BTC, reflecting that investor sentiment remains cautious.

BTC ETF Market Trading Volume

This week’s BTC ETF market trading volume increased compared to last week. Taking BlackRock’s IBIT — the largest by market share — as, as an example, this week’s trading volume reached 244 million shares, a slight increase from last week’s 327 million shares.

Market Driver Analysis

Institutional Capital Flows Maintain Net Outflow Trend

This week, BTC and ETH spot ETFs and listed treasury companies continued last week’s weak buying power and intensified selling pressure amid sustained price declines. This resulted in overall selling volume significantly exceeding buying volume, clearly reflecting investors’ ongoing cautious risk-averse stance.

Geopolitical Risks Fuel Market Anxiety

A key driver of this week’s volatile downturn was the abrupt escalation in Iran-related tensions. The U.S. deployment of military forces near Iran, coupled with Iran’s forceful response, rapidly heightened regional instability in the Middle East, amplifying market uncertainty.

Precious Metals Market Diverts Capital

This week, precious metals like gold and silver hit new highs, attracting substantial market liquidity inflows. This triggered continuous capital outflows from the crypto market, further exacerbating its already tight liquidity conditions. Additionally, the sudden sharp declines in precious metals markets on Thursday and Friday triggered a significant drop in the crypto market.

Shift in Macroeconomic Expectations

This week, news emerged regarding Kevin Warsh as a potential candidate for the next Federal Reserve Chair. His hawkish stance and firm commitment to inflation control, combined with persistent and rising U.S. inflation data, further diminished market expectations for future rate cuts, dampening sentiment. Simultaneously, the risk of another U.S. government shutdown this weekend weighed on overall market sentiment due to potential liquidity shortages.

Key Events Forecast for Next Week

Crucial Employment Data Approaching

The upcoming release of key U.S. employment metrics — including January ADP employment figures, unemployment rate, and nonfarm payrolls — will be closely scrutinized by the Fed. These data points are expected to significantly impact markets, potentially increasing short-term volatility.

Precious Metals Market Outlook

Next week, precious metals’ trajectory will continue influencing the crypto market. Should gold and silver prices end their correction and resume upward momentum, this could persistently drive liquidity outflows from the crypto market.

Institutional Buying Power Emerges as Core Indicator

This week, BTC and ETH-related treasury companies and spot ETFs continued net selling, signaling deeply pessimistic market sentiment. Next week, these institutions’ capital flows should be closely monitored as a key indicator, with their shifts directly reflecting shifts in market confidence.

Persistent Impact of Geopolitical Tensions

Continued monitoring of Iran’s situation is essential. Should tensions escalate — such, such as direct U.S. intervention in the conflict — it will amplify global instability and significantly influence next week’s market trajectory.

Market Outlook

Purchasing Power Faces Tests

Next week, the purchasing power of treasury companies and spot ETFs remains uncertain, with their decisions largely contingent on market movements. Should upcoming macroeconomic data prove unfavorable, market participants may reduce purchases for short-term risk aversion, potentially triggering rapid price declines.

Adhere Strictly to Defensive Strategies

Considering institutional capital flows, macroeconomic uncertainties, capital diversion effects in precious metals markets, and geopolitical risks, investors should maintain heightened caution and prepare defensively.

Next Week’s Forecast Targets

Bearish Targets: SOMI, MOVE

SOMI:

High-performance Layer 1 vision shattered; chain-wide data plunge faces unlocking crisis

Project Fundamentals and Positioning

Somnia is a high-performance Layer 1 blockchain built for real-time on-chain applications like immersive gaming and social networks. Unlike traditional solutions, it avoids sidechains or off-chain workarounds to deliver seamless scalability and low costs. Somnia is EVM-compatible and rooted in gaming and metaverse innovation, empowering developers to create accessible, high-performance virtual economies and communities.

Fundamental Data Severely Deteriorating

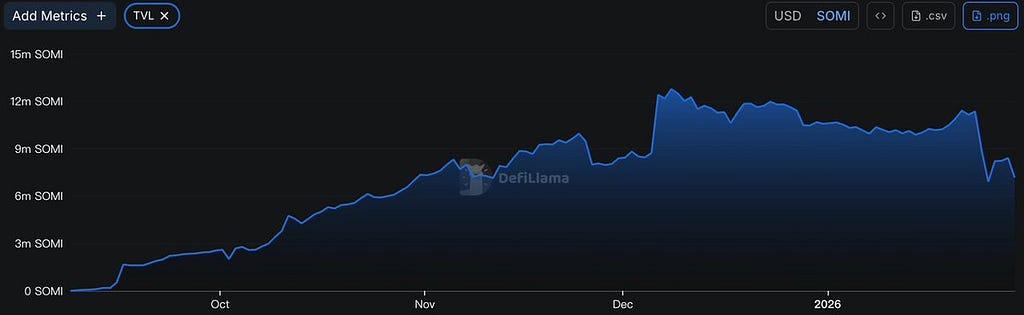

- Massive Capital Flight: Somnia’s on-chain TVL has plummeted 45.93% from its peak and continues declining, indicating severe lack of investor confidence and persistent capital outflows.

- Plummeting On-Chain Activity: Daily transaction fees have fallen to approximately $300, a drastic drop from historical highs, signaling near-zero user engagement and critically low project utilization.

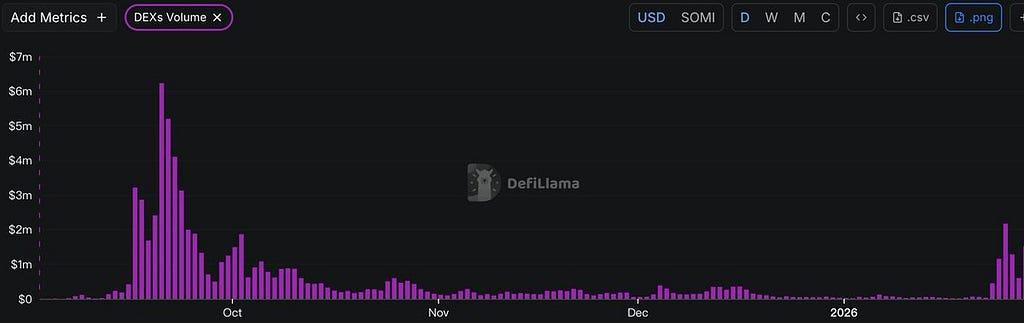

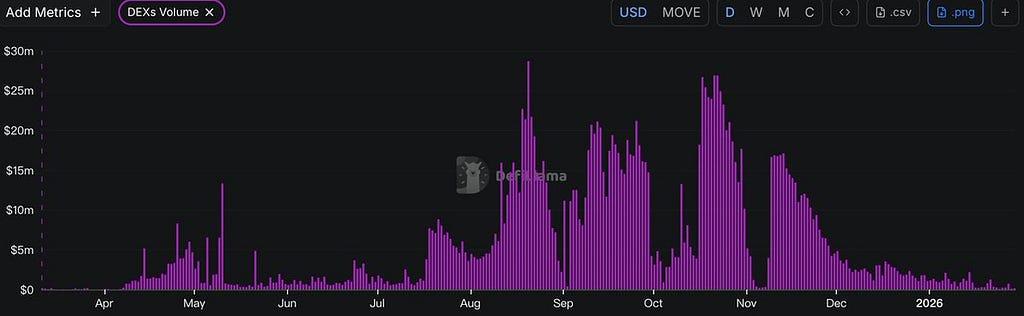

- Persistent DEX Volume Contraction: On-chain DEX trading volume exhibits a continuous downward trajectory. Although it has rebounded slightly, it remains at a low level of $250,000/day, reflecting severely insufficient trading demand and depleted ecosystem liquidity.

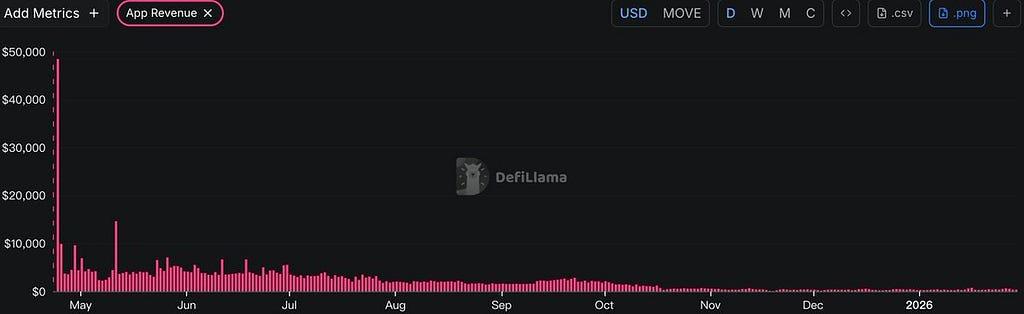

- Collapse of Ecosystem Application Revenue: While on-chain ecosystem project revenues have seen some recovery, total daily income remains only around $240. This indicates applications have largely lost their user base, with the entire ecosystem in a state of stagnation.

Token Unlock Risk Assessment

- Unlock Scale and Timing Both Adverse: 8.75 million SOMI tokens will unlock on February 2nd. This massive unlock occurs at a critical juncture when the project’s fundamentals have deteriorated across the board, making the timing extremely unfavorable.

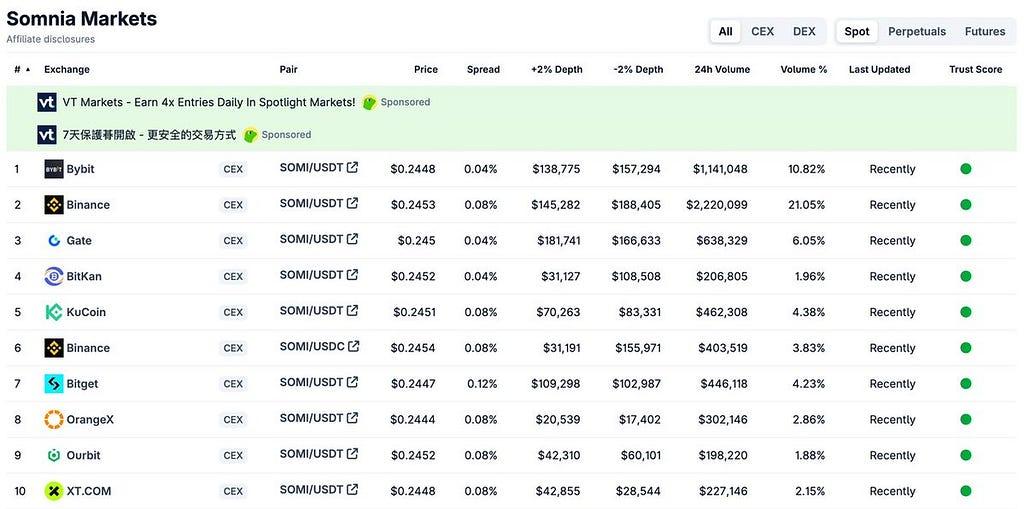

- Seriously Insufficient Market Absorption Capacity: With an average daily trading volume of only around $2 million, the market liquidity is clearly unable to effectively absorb the new supply relative to the 8.75 million tokens unlocked, creating significant selling pressure.

- Strong Selling Motivation Among Unlock Recipients: Under the linear unlocking schedule, this release primarily involves institutional investors and the project team. Amid the project’s pronounced downturn, these holders possess strong cash-out incentives and are highly likely to exit via selling.

- Weak Liquidity Depth: The relatively low daily trading volume reflects severely insufficient market depth, incapable of effectively cushioning the price impact from this massive token release.

Summary

Somnia faces comprehensive fundamental deterioration: TVL has fallen 45.93%, with on-chain fees, DEX trading volume, and ecosystem revenue all declining across the board, while user activity has nearly reached zero. The February 2 unlocking of 8.75 million tokens will create massive selling pressure within the context of weak liquidity averaging $2 million daily. The strong cash-out motivation among institutional investors and the team further exacerbates the risk of sell-offs.

MOVE:

Move Language L2 Project Faces Dual Crisis of Fundamental Collapse and Unlocking Pressure

Project Fundamentals and Positioning

Movement is an Ethereum L2 built on the Move programming language, aiming to bring Move’s security and performance to various blockchain ecosystems, including Ethereum. It enhances Ethereum’s network by constructing an L2 solution that improves transaction speed and efficiency while addressing scalability, interoperability, and security vulnerabilities.

Fundamental Metrics Severely Deteriorate

- Stablecoin Market Cap Continues to Shrink: On-chain stablecoin market cap has dropped from $67.09 million to $42.44 million, a 36.74% decline, indicating sustained capital outflows from the Movement ecosystem and eroding market confidence.

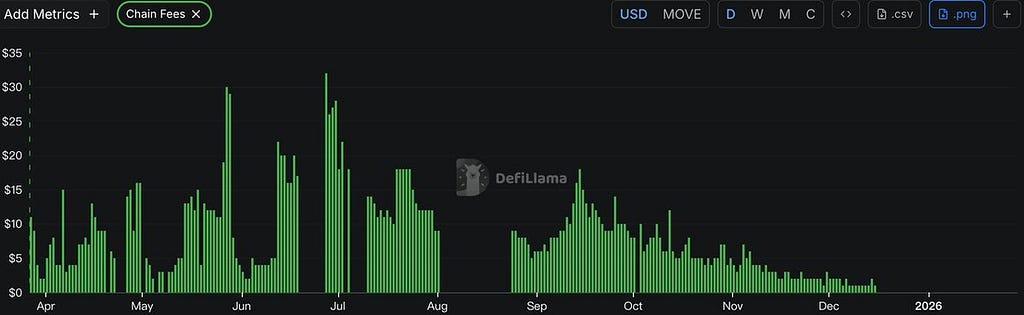

- On-Chain Activity Halted: On-chain fee data shows Movement’s daily transaction fees have recently reached zero, directly reflecting the disappearance of on-chain activity.

- Persistent Decline in DEX Volume: On-chain DEX trading volume shows a continuous downward trend, currently sustaining only around $170,000 daily, indicating diminishing on-chain trading activity.

- Extremely Low Ecosystem Project Revenue: The combined daily revenue of all applications on the Movement chain is approximately $300 and continues to decline, signaling the ecosystem is on the brink of collapse.

Token Unlock Risk Assessment

- Unlock scale and timing are unfavorable: On February 8, 161.83 million MOVE tokens will be unlocked, representing 1.62% of the total locked supply. This unlock occurs at a critical juncture when the project’s fundamentals continue to deteriorate.

- Seriously Insufficient Market Absorption Capacity: MOVE tokens’ average daily trading volume is only around $600,000. Market liquidity is clearly inadequate to effectively absorb the upcoming unlocked tokens, creating significant selling pressure.

- Strong Selling Motivation Among Unlock Recipients: Analysis of the linear unlock schedule indicates this release primarily involves institutional investors and the project team. Given the project’s current pronounced downturn, these holders possess strong cash-out incentives and are highly likely to exit via selling.

- Weak liquidity depth: The relatively small daily trading volume reflects insufficient market depth, unable to effectively cushion the price impact from token unlocking.

Summary

The Movement project faces multiple systemic risks,

Business: Stablecoin market cap has shrunk by 37.44%, on-chain fees have dropped to zero, DEX trading volume continues to decline, and ecosystem revenue is only $300/day. -

Capital: The upcoming unlock of 161.83 million MOVE tokens on February 8 will create significant selling pressure in a market with only $600,000 in average daily trading volume. The unlocking entities are institutional investors and the team, who have strong cash-out motivations. The convergence of multiple bearish factors exerts sustained downward pressure on the MOVE token price, making it difficult to reverse the downtrend in the short term.

Next Week’s Token Unlock Schedule

(Amounts Exceeding $1 Million)

Weekly Hot Topics

TVL Surges 987% in 2 Days! Project 0 Breaks $1 Billion Mark, Deconstructing Solana’s Prime Broker “Liquidity Devouring” Logic

Background

For a long time, fragmented on-chain liquidity has been the biggest challenge for DeFi investors. Transferring funds between projects involves complex operations and high gas fees, leading to the emergence of various “intent-driven” projects. Recently, Project 0 — a lending platform aggregating Solana’s on-chain liquidity — suddenly surged in popularity. Within two days, its Total Value Locked (TVL) skyrocketed by 987%, attracting nearly $900 million in inflows and surpassing the $1 billion TVL milestone.

Project 0 is a unified collateral protocol on the Solana chain. It enables users to manage their entire DeFi portfolio through a unified collateral and risk management mechanism, thereby eliminating capital inefficiency.

On-Chain Data Analysis

TVL

Project 0’s TVL data reveals a recent nearly tenfold surge, surpassing the $1 billion threshold. Furthermore, the composition of Project 0’s TVL reveals that USDS and USDC dominate the market.

Lending Volume

Project 0’s lending volume has not increased proportionally with its TVL growth. This indicates that most users are primarily depositing funds into Project 0.

Deposit APY

Project 0’s official website indicates an exceptionally high deposit rate of 6.73% for USDS, creating favorable conditions for on-chain arbitrage users to engage in revolving loans.

Reasons for Rapid Data Growth

Between January 27 and 30, 2026, Project 0’s TVL not only achieved exponential quantitative growth but also underwent a qualitative transformation from a single lending protocol to a full-ecosystem Prime Broker. This transformation primarily stems from two key factors:

1.Integration with Drift Lending Markets

Project 0 announced its official integration with Drift Protocol on January 28, 2026. This integration formally connected Project 0 to Drift’s seven stablecoin pools. As a leading perpetual futures and lending platform on the Solana chain, Drift possesses a substantial native user base and capital reserves. Prior to integration, these funds were confined to Drift’s ecosystem. Post-integration, users can now manage Drift positions directly through Project 0’s unified interface. During the integration period, the APYs for USDC and USDS on Drift surged to 30% and 13%, respectively. This excess yield incentivized massive inflows of stablecoins through Project 0’s channels, transforming Drift’s high returns from an exclusive benefit for Drift users into a shared resource for the entire Project 0 ecosystem.

2.Unified Margin

Project 0 recently implemented its Unified Margin feature. Under traditional DeFi models, USDS deposited in Kamino could only be borrowed within Kamino, while SOL deposited in Drift could only be traded on Drift — resulting in severe capital fragmentation. Project 0 breaks this barrier through “account abstraction.” With Drift’s integration, users can now combine Kamino deposit certificates and Drift deposits as unified collateral pools. This architecture significantly unlocks liquidity for idle assets.

Investor Participation Strategies for Project 0

1.Participate in Drift Earn

Since Drift recently launched its Earn section, USDC borrowing rates have surged to exceptional levels (exceeding 30%). Users can access the Earn section on Drift’s official website, select USDC on the Borrow/Lend page, and earn yields at the current supply rate. As of now, the Earn interface shows USDC supply APY >30%, making it suitable for “short-term high-yield hunting” with idle stablecoins.

2.Kamino Stablecoin Strategy

This strategy suits investors with lower risk tolerance seeking stable returns. Kamino’s strategy vaults smooth returns through automated liquidity management. Users can navigate to Kamino’s interface, click Lend to access the Stables section, select a strategy vault, and click Deposit. Currently, PYUSD offers a 7.3% APY, while USDS provides a 6.79% APY.

3.Project 0 LST Recycling Strategy

This strategy suits investors with higher risk tolerance seeking substantial returns. Users can deposit LST (e.g., mSOL/jitoSOL/dSOL) as collateral on Project 0’s official website under Strategies/Unified Borrow, borrow stablecoins or SOL, and reinvest into the supply side to create a cycle. Since most assets in Project 0 currently offer high APYs, this strategy remains viable. However, closely monitor price and rate fluctuations to avoid liquidation and negative interest rates.

Crypto Events Next Week

- Monday (February 2): US January ISM Manufacturing PMI

- Wednesday (February 4): US January ADP Employment Report

- Thursday (February 5): US Initial Jobless Claims (Week Ending January 31)

- Friday (February 6): US January Unemployment Rate; US January Seasonally Adjusted Nonfarm Payrolls

Sector Performance

By weekly return rate, the DeFi sector performed best, while GameFi underperformed.

- DeFi Sector: LINK, HYPE, UNI, AAVE, and SKY dominate the DeFi sector, collectively accounting for 83.87% of the total. Weekly price changes: -12.41%, 36.03%, -13.32%, -10.76%, -2.89%. This indicates that the largest projects in DeFi outperformed counterparts in other sectors this week, driving DeFi’s top performance.

- GameFi Sector: AXS, SAND, MANA, GALA, and IMX hold significant weight in the GameFi sector, collectively accounting for 68.78%. This week’s respective gains/losses were: -21.45%, -28.76%, -28.79%, -16.91%, and -19.53%. It is evident that the largest projects within the GameFi sector experienced steeper declines this week compared to other sectors, resulting in the GameFi sector’s worst performance.

Summary

This week, the cryptocurrency market experienced a pronounced downtrend under multiple pressures. BTC and ETH recorded weekly declines of 8.98% and 13.32%, respectively, while the TOTAL3 index — reflecting the broader altcoin market — fell by 8.61%. Market pessimism intensified sharply, with the Fear & Greed Index plummeting from 37 last week to 14 — entering the “Extreme Fear” zone. Capital outflows dominated this week, as the total market cap of stablecoins declined significantly. USDT and USDC saw weekly market cap contractions of 1.38% and 4.48% respectively, indicating accelerated risk-averse exits by both international and U.S. investors. Despite the price decline, BTC trading volume on major exchanges saw a slight uptick. This does not signal a rebound in sentiment but rather reflects intensified panic selling and short-term speculation amid the downtrend, indicating overall market confidence remains fragile.

Amid the broader market downturn, certain projects still captured attention. Project 0, a unified margin protocol within the Solana ecosystem, emerged as this week’s standout. Through integration with Drift Protocol and the launch of unified margin functionality, its Total Value Locked (TVL) surged nearly tenfold in just two days, surpassing the $1 billion threshold. By pooling liquidity across different protocols and offering annualized yields of up to 30% on stablecoin deposits, the project attracted massive capital inflows, providing high-yield-seeking investors with a new arbitrage strategy.

Looking ahead to next week, the market outlook remains challenging, and investors should adopt a highly cautious defensive strategy. On the macro front, key upcoming U.S. data releases — including ADP employment, unemployment rate, and nonfarm payrolls — will command market attention, with any disappointing figures potentially triggering sharp volatility. Simultaneously, the recovery of institutional buying power will serve as a core indicator for gauging market confidence, while evolving geopolitical tensions remain a Damocles sword hanging over the market. Therefore, until clear signs of stabilization emerge, strictly controlling positions and avoiding high-risk assets will be the prudent approach to navigating the current complex landscape.