Author: Nick Sawinyh

Compiled by: TechFlow TechFlow

TechFlow Guide:

With the geopolitical situation expected to fluctuate in 2026, tokenized real-world assets (RWAs) have moved from the experimental stage to a pillar industry. This article provides a detailed overview of the current tokenized gold market, which is worth over $5.1 billion, as well as the phenomenal rise in silver and the on-chain status of emerging industrial metals.

The article not only compares the competitive landscape of giants like Tether Gold (XAUt) and Pax Gold (PAXG), but also delves into how high-performance networks like Solana and Hyperliquid are reshaping metal derivatives trading. For investors looking to hedge against inflation in the Web3 era, this is an invaluable industry blueprint.

The full text is as follows:

The combination of precious metals and blockchain technology reached a turning point in 2026. What began as an experimental concept has now evolved into a multi-billion dollar market, fundamentally changing how investors gain exposure to gold, silver, and other metals. The market capitalization of the tokenized gold market alone has surpassed $5.1 billion, while the total value locked (TVL) in the broader tokenized commodities sector currently exceeds $4.4 billion.

This shift is driven by a confluence of forces: gold prices hovering around $5,000 per ounce; silver breaking through $90 per ounce after a stunning rebound of over 140% in 2025; and blockchain infrastructure finally achieving institutional-grade reliability. For investors seeking safe-haven assets amid geopolitical uncertainty, tokenized metals offer the best of both worlds—the enduring value of physical commodities and the efficiency, accessibility, and programmability of digital assets.

This guide explores everything you need to know about tokenized metals in 2026: key players, on-chain markets, DeFi opportunities, perpetual contracts, and where this rapidly evolving market is headed.

The Tokenized Gold Market

Market Overview

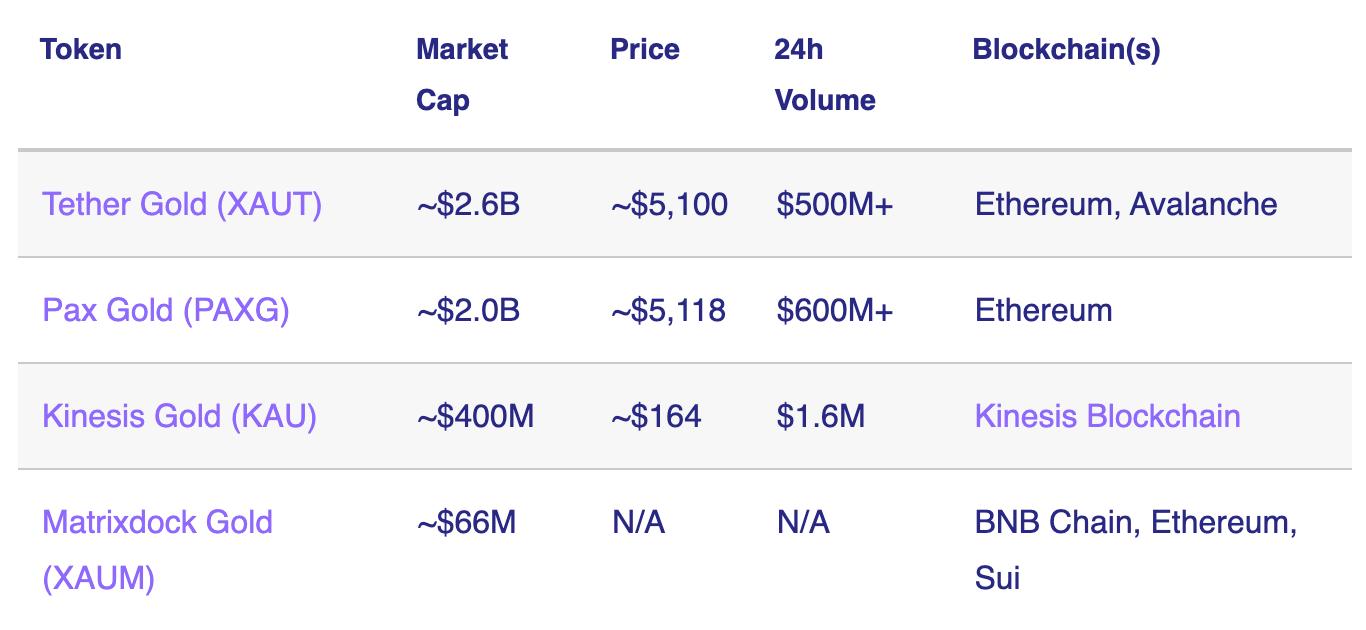

Tokenized gold remains the dominant category among tokenized metals, with two giants controlling approximately 89-95% of the market share: Tether Gold (XAUt) and Pax Gold (PAXG).

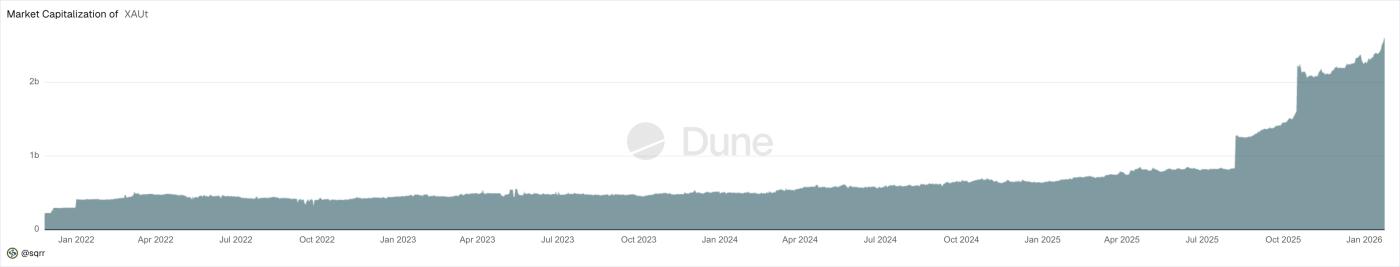

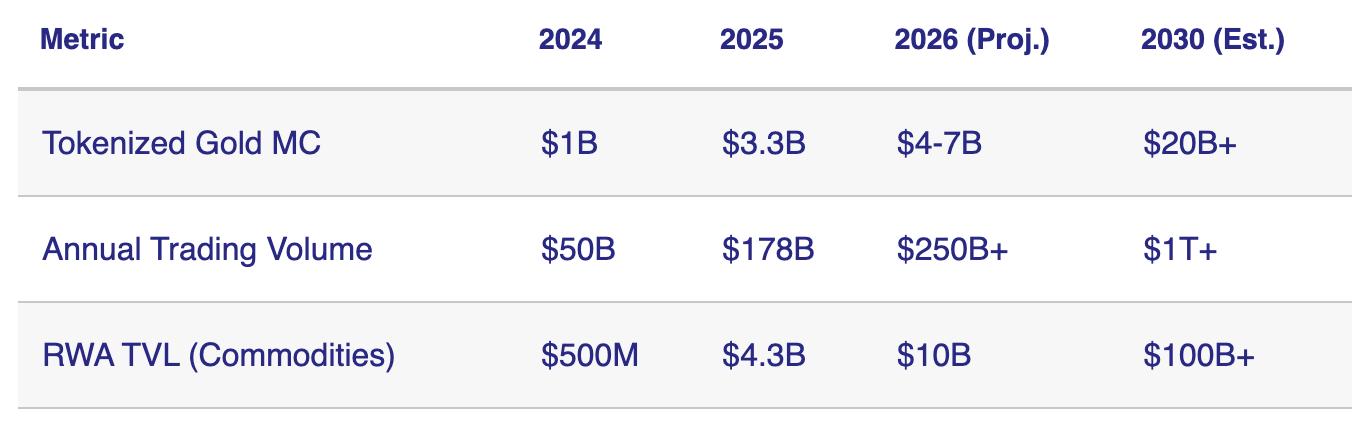

The industry's growth has been explosive: in 2025, trading volume in tokenized gold reached $178 billion, surpassing all similar products except for one U.S.-listed gold ETF. This represents a 227% year-over-year increase compared to 2024 (when its market capitalization was approximately $1 billion).

Tether Gold (XAUt): Market Leader

XAUt has become the largest tokenized gold asset, backed by over 375,000 ounces of LBMA (London Bullion Market Association) certified gold stored in Swiss vaults – representing over 12.7 metric tons of physical gold. The token is issued by Tether subsidiary TG Commodities, with each token representing one ounce of pure gold.

Dune, Tether Gold (XAUt) Data Analysis

Core features:

- It will account for 75% of tokenized gold trading volume in 2025.

- Providing income-generating options through DeFi integration

- Multi-chain support (Ethereum, Avalanche)

- It possesses direct ownership of the allocated physical gold and supports serial number lookup.

The token has garnered significant attention during periods of geopolitical tension. In January 2026, XAUt broke through $5,100, rising nearly 10% since the beginning of the year, amid what analysts called a “triple threat” crisis—involving Greenland sovereignty tensions, Denmark’s liquidation of US Treasury bonds, and Japan’s fiscal instability.

Pax Gold (PAXG): Institutional Choice

PAXG, issued by Paxos Trust Company under the supervision of the New York State Department of Financial Services (NYDFS), is the second largest tokenized gold asset with a market capitalization of approximately $2 billion and a circulating supply of approximately 380,000 tokens.

Core advantages:

- Fully compliant under NYDFS regulations

- Monthly independent audits

- Supports redemption in physical gold bars or cash.

- Backed by London Good Delivery standard gold bars stored in LBMA certified vaults.

PAXG attracts a specific market segment: institutions, asset managers, and compliance-oriented investors who prioritize regulatory clarity. While trading volumes are typically lower than XAUt, PAXG sees greater participation from entities requiring a transparent reporting framework.

Kinesis Gold (KAU)

Kinesis Gold employs a unique model that transforms physical gold into a yield-generating digital currency. Unlike XAUt and PAXG, which represent one ounce, KAU represents one gram of gold. The platform offers a complete currency system, including the Kinesis Mastercard, which can be used anywhere the network accepts, and passive earnings from transaction fees within the Kinesis currency system.

Matrixdock Gold (XAUM)

Matrixdock Gold is a newcomer backed by crypto financial services company Matrixport. XAUM features multi-chain availability (BNB Chain, Ethereum, Sui) and integration with Matrixport's extensive suite of crypto-native financial products.

How Tokenized Gold Works

The tokenization of physical gold follows a structured, multi-step approach designed to ensure transparency, security, and compliance:

- Acquisition and Custody: Physical gold is procured by institutional custodians such as Brinks or Loomis and stored in audited vaults (typically in London, Switzerland, or Singapore), usually with comprehensive insurance. Each gold bar is assigned a unique serial number and verified to ensure compliance with LBMA delivery standards.

- Minting Tokens: Ownership is registered through smart contracts on blockchains such as Ethereum. Each token corresponds to a specific amount of gold. The token is cryptographically linked to a specific gold bar with a verifiable serial number. This link is stored on-chain or in a verifiable offline database, allowing token holders to trace their ownership of a specific physical asset.

- Price Oracles and Market Making: Token prices are maintained through oracle networks such as Chainlink, which track spot gold prices from COMEX, LBMA, and major gold and silver traders. These oracles provide price feeds, enabling automated market makers (AMMs) to maintain liquidity and achieve near-instant price discovery on decentralized exchanges.

- Redemption: Holders can redeem their tokens for physical gold or cash value, but there is usually a minimum redemption amount. Physical withdrawals typically start from a whole gold bar (approximately 400 ounces). Cash redemptions usually support smaller amounts, with fees ranging from 0.5% to 2% depending on the issuer.

Tokenized Silver and Beyond

The Silver Surge

Silver is one of the best-performing assets in 2026. After achieving a year-on-year growth of over 140% in 2025, spot silver prices continued their strong momentum at the beginning of 2026, breaking through $90 per ounce and even briefly approaching the $100 mark. Driven by investor demand, supply shortages, and industrial consumption (such as solar panels and electronic devices), the global market capitalization of silver has climbed to trillions of dollars.

While the tokenized silver market is smaller than the gold market at approximately $420 million, it is experiencing steady growth. The sector is led by Kinesis Silver (KAG), with a market capitalization of approximately $414 million.

How tokenized silver works

Tokenized silver aims to provide crypto users with direct exposure to silver prices, and typically falls into the following categories:

- Physically Collateralized Tokens: Each token is backed by physical silver (such as Kinesis Silver) stored in a vault.

- ETF-linked tokens: The representation of traditional financial silver ETFs on the blockchain (such as the SLV tokenized version provided by Ondo).

- Fragmented tokens measured in grams: designed to lower the barrier to entry and provide convenience for small investors.

Kinesis Silver (KAG): Industry Leader

Kinesis Silver (KAG) employs a unique model that transforms physical silver into a yield-bearing digital currency. Its core features include:

- 1:1 Fully Collateralized: Backed 1:1 by physical silver that has been allocated and audited from a global vault network.

- Passive income: Income comes from a share of transaction fees within the Kinesis Monetary System.

- Strong payment capabilities: You can make purchases at any location that accepts the Kinesis Mastercard payment network.

- High-standard compliance audits: Independent physical audits are conducted regularly every six months by leading inspection experts.

Silver possesses the dual attributes of a precious metal and an industrial raw material (crucial for solar panels, electronics, and medical devices), making it highly attractive to investors seeking to diversify their investments beyond pure monetary metals.

Emerging metals: platinum, palladium and more

While gold and silver dominate the current tokenization process, infrastructure is paving the way for a broader commodities revolution:

- Platinum: Platinum is crucial for automotive catalytic converters and hydrogen fuel cells. Currently, platinum tokenization is gaining momentum through platforms like Wealth99 and specialized protocols. Each token typically represents partial ownership of an LBMA (London Bullion Market Association) certified platinum bar.

- Palladium: Widely used in automotive applications and green energy. Tokenized palladium provides better liquidity and faster settlement speeds to markets that were previously illiquid.

- Industrial Metals: According to recent market reports, the market capitalization of tokenized industrial metals such as copper, lithium, nickel, and aluminum is approximately $75 million as of 2025, and they are becoming the next frontier for the tokenization of real-world assets (RWAs).

- Rare Earth Elements: Pilot projects are emerging for rare earth elements, which are crucial for electric vehicle batteries and renewable energy infrastructure, although challenges remain in regulation and custody.

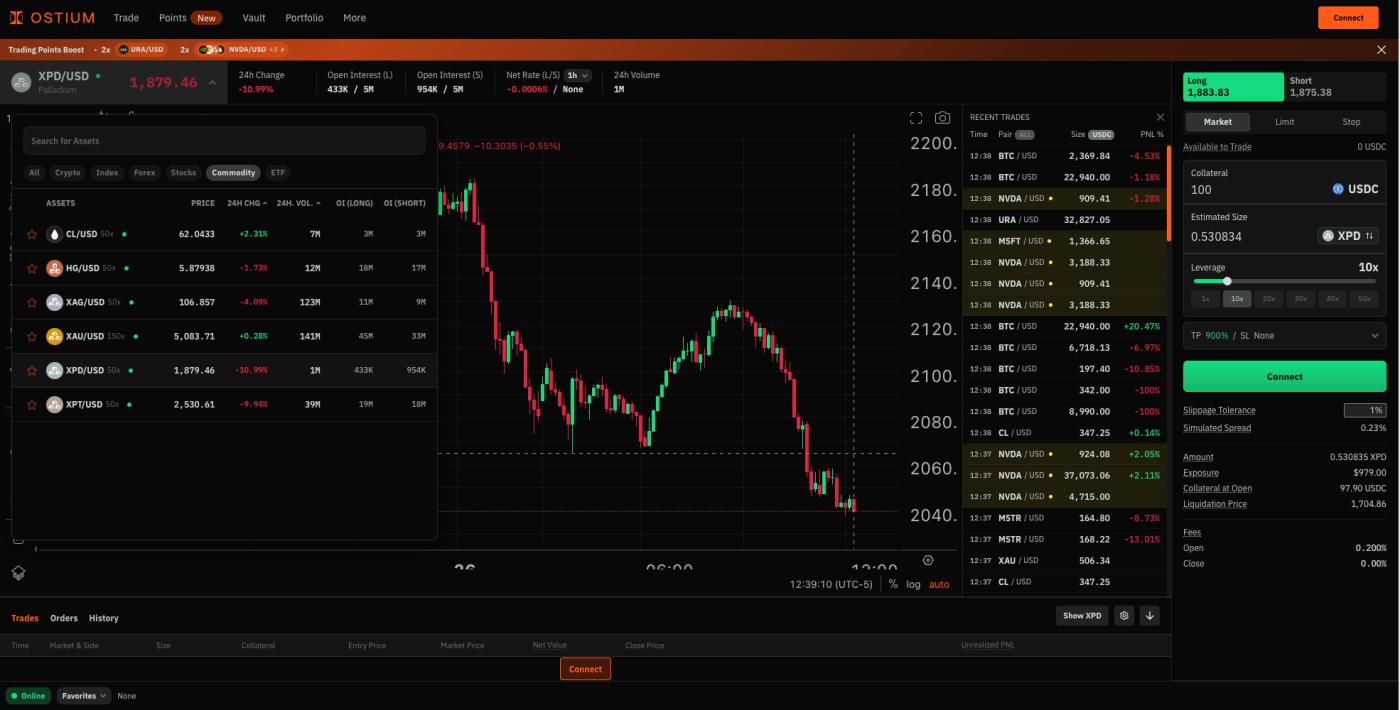

Currently, Ostium Labs is the only platform that allows on-chain trading of platinum and palladium.

Ethereum: The dominant public blockchain

Ethereum remains the primary blockchain for tokenized gold such as PAXG (Pax Gold) and XAUT (Tether Gold), thanks to:

- Deep liquidity pools.

- Mature DeFi infrastructure, such as Uniswap, Aave, and Compound.

- Familiarity with the organization.

- It integrates a Chainlink oracle to provide reliable metal price feeds.

EVM Chain Expansion

The tokenized metals market is increasingly showing a multi-chain trend, with assets available on multiple networks:

- Avalanche: Offers low-fee options for XAUT and XAGx Silver tokens and provides subnet-based scaling solutions for institutional use cases.

- BNB Chain: An expansion of Matrixdock Gold (XAUM) and Ondo, aimed at attracting users in the Asian market and the Binance ecosystem.

- Sui: An emerging on-chain commodity project leveraging the Move programming language and parallel execution capabilities.

- Mantle: Ondo has invested $29 million in USDY integration, targeting institutional vault use cases.

Solana: A High-Throughput Alternative

By early 2026, Solana had become a major hub for the tokenization of Real-World Assets (RWAs), with the total value of non-stablecoin RWAs exceeding $1 billion. The network's high throughput (sub-second finality) and low transaction costs make it ideal for tokenizing commodities.

Ondo Finance on Solana: In January 2026, Ondo Finance launched over 200 tokenized assets on Solana, including stocks, ETFs, bonds, and commodities. This expansion includes:

- Gold and silver ETF exposure (equivalent to GLD and SLV).

- Hooking tools for bulk commodities.

- 24/7 trading.

- Near-instantaneous settlement.

Since its debut in September 2025, Ondo currently accounts for more than 65% of all tokenized RWAs on Solana, with a total value locked (TVL) of over $460 million and a cumulative trading volume exceeding $6.8 billion.

Other Solana projects worth noting:

- DeFiCarrot: Offers leveraged TURBOGOLD products.

- xStocksFi: Offers tokens for on-chain gold exposure $GLDx. ()

Derivatives Market: Perpetual Futures for Metals

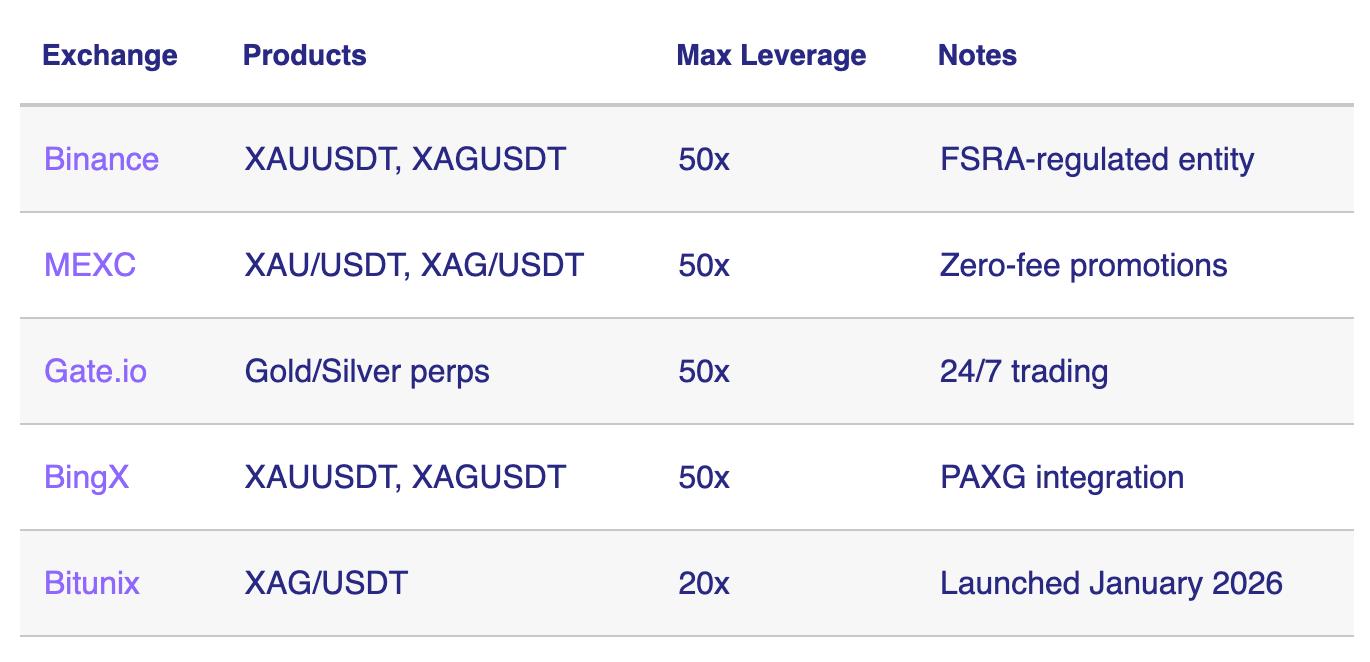

Binance Gold Perpetual Contracts

In January 2026, Binance launched a landmark product: TradFi perpetual contracts for gold (XAUUSDT) and silver (XAGUSDT). This marks an important bridge between traditional finance and crypto infrastructure.

Contract Specifications:

- Settlement method: USDT margin

- Leverage: Up to 50 times

- Trading hours: 24/7 (all day)

- Pricing mechanism: The price is smoothed by EWMA (Exponentially Weighted Moving Average) during non-trading hours by a combination of index prices from multiple suppliers.

- Regulation: Offered through Nest Exchange Limited and regulated by Abu Dhabi Global Market (ADGM) FSRA.

The market response was extremely enthusiastic—analysts estimate that commodity-linked derivatives accounted for approximately 15% of Binance's total futures trading volume within days of their launch. During the testing phase, over 80,000 users joined the waiting list, and the XAU/USD trading pair alone saw a single-day trading volume exceeding $100 million.

Important note: These contracts do not represent ownership of the physical metal—they are purely price-tracking derivatives.

Other CEX (Centralized Exchange) products

Several centralized exchanges currently offer perpetual contracts for precious metals:

DeFi perpetual contract platform

The decentralized perpetual contract market is booming, with total trading volume reaching $1 trillion in the fourth quarter of 2025 alone.

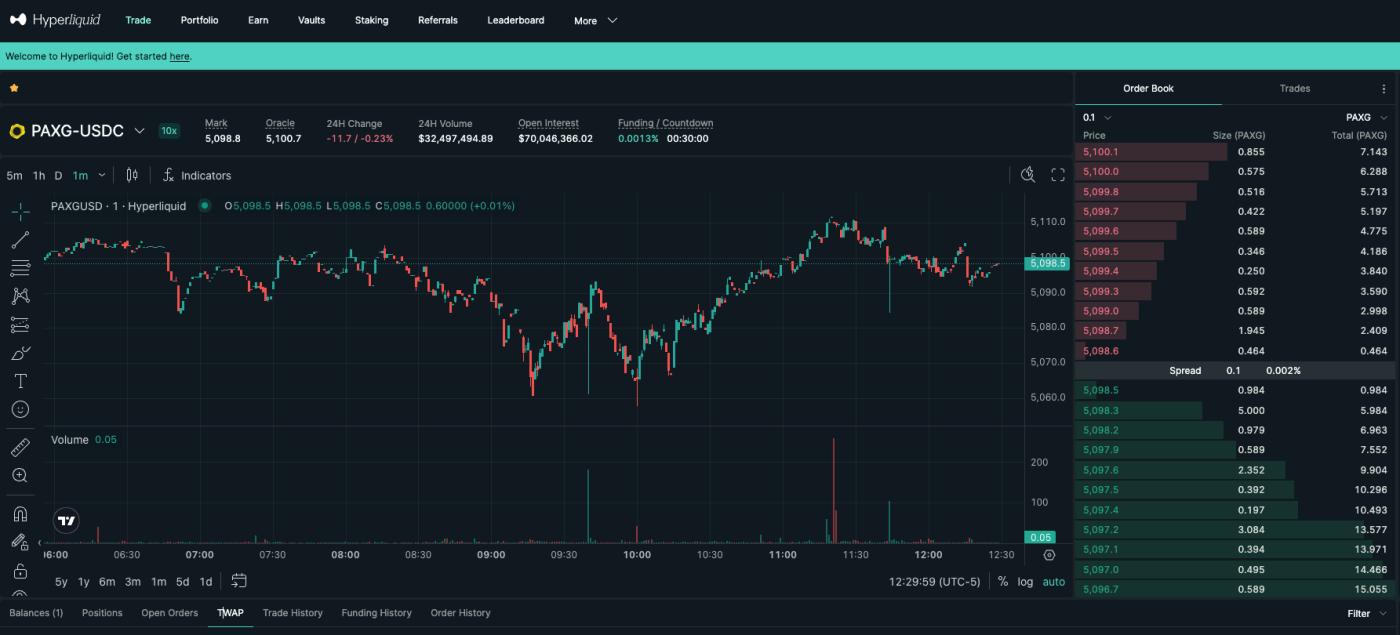

Hyperliquid Perpetual Contracts: Gold, Silver, Copper

Hyperliquid has rapidly established its dominant position in the decentralized perpetual contract trading space. The platform accounts for 69% of daily active users on DEXs, with a weekly trading volume of $40.7 billion and open interest (OI) of $9.57 billion, making it one of the most liquid venues in the industry.

At the heart of Hyperliquid is its custom Layer-1 chain, HyperCore , designed specifically for speed and reliability:

- Sub-second transaction finality

- Processing up to 200,000 orders per second

- Fully On-Chain Order Book

- Supports seamless integration with MetaMask

Its unique feature is the HIP-3 framework , which allows for the listing of traditional financial assets (including commodities) without a license:

- Gold: Token contracts such as PAXG and XAUT have become mainstream, frequently ranking among the top ten in 24-hour trading volume.

- Silver: Perpetual contracts are showing unusually high activity, with daily trading volume frequently exceeding $1 billion.

- Copper: Provides exposure to industrial metals, enabling traders to access a wider range of markets.

This expansion into tokenized commodities underscores Hyperliquid's vision: to create a fully decentralized market for cryptocurrencies and traditional financial derivatives, bringing liquidity, speed, and accessibility to markets that were once confined to institutions.

GMX: Trading XAUT Gold

GMX is a decentralized spot and perpetual exchange on Arbitrum and Avalanche, emphasizing low fees and oracle pricing.

Features: Offers perpetual-style trading with no expiration date, achieves deep liquidity through GM pools, and ensures that XAUT prices are aligned with spot gold.

Ostium Perps

Ostium Labs is working to develop the next generation of perpetual contract markets centered on RWAs (Real-World Assets), providing traders with a decentralized way to access real-world assets such as precious and industrial metals.

The platform's infrastructure is designed for high speed, transparency, and efficiency, supporting an increasingly rich suite of perpetual metal contracts:

- Gold : The cornerstone for traders seeking stable, highly liquid precious metal exposure.

- Silver : One of the most actively traded industrial and precious metals on the platform.

- Copper : Provides exposure to industrial metals and global economic trends.

- Palladium : Supports targeted trading for high-demand automotive and technology applications.

- Platinum : Provides access to another key precious metal market with strong industrial applications.

Ostium's approach enables these RWA markets to exist entirely on-chain, giving users the advantages of decentralized liquidity, transparent pricing, and permissionless access. By bridging traditional financial commodities with DeFi (decentralized finance), Ostium is creating entirely new ways for traders to speculate, hedge, and gain exposure to real-world assets—all without the need for intermediaries.

DeFi Opportunities for Tokenized Gold

The most appealing aspect of tokenized gold lies in its programmability within decentralized finance. Unlike traditional gold sitting idle in vaults, on-chain gold can generate returns and serve as collateral.

Liquidity provision on decentralized exchanges (DEXs)

Tokenized gold, such as PAXG (Pax Gold) and XAUt (Tether Gold), is actively traded on decentralized exchanges like Uniswap v2 and v3, Curve, Fluid, and Balancer. On these platforms, liquidity providers (LPs) can earn trading fees by providing funds to pools such as PAXG/USDC or PAXG/WETH.

- Risks: Impermanent Loss may occur if price fluctuations exceed the selected range; additionally, Ethereum gas fees may materially impact profitability.

- Earning potential: Earnings come from transaction fees that are proportional to the trading volume of the fund pool. Depending on the trading activity, the rewards may be low or highly volatile.

As of this writing, the 30-day average annualized yield (APY) of the most actively traded tokenized gold pools on Uniswap ranges from 10% to 25%, reflecting strong trading activity and concentrated liquidity positions.

Loan Agreement

XAUt can be used as segregated collateral on Aave , allowing users to borrow funds without exposing themselves to the risks of other assets.

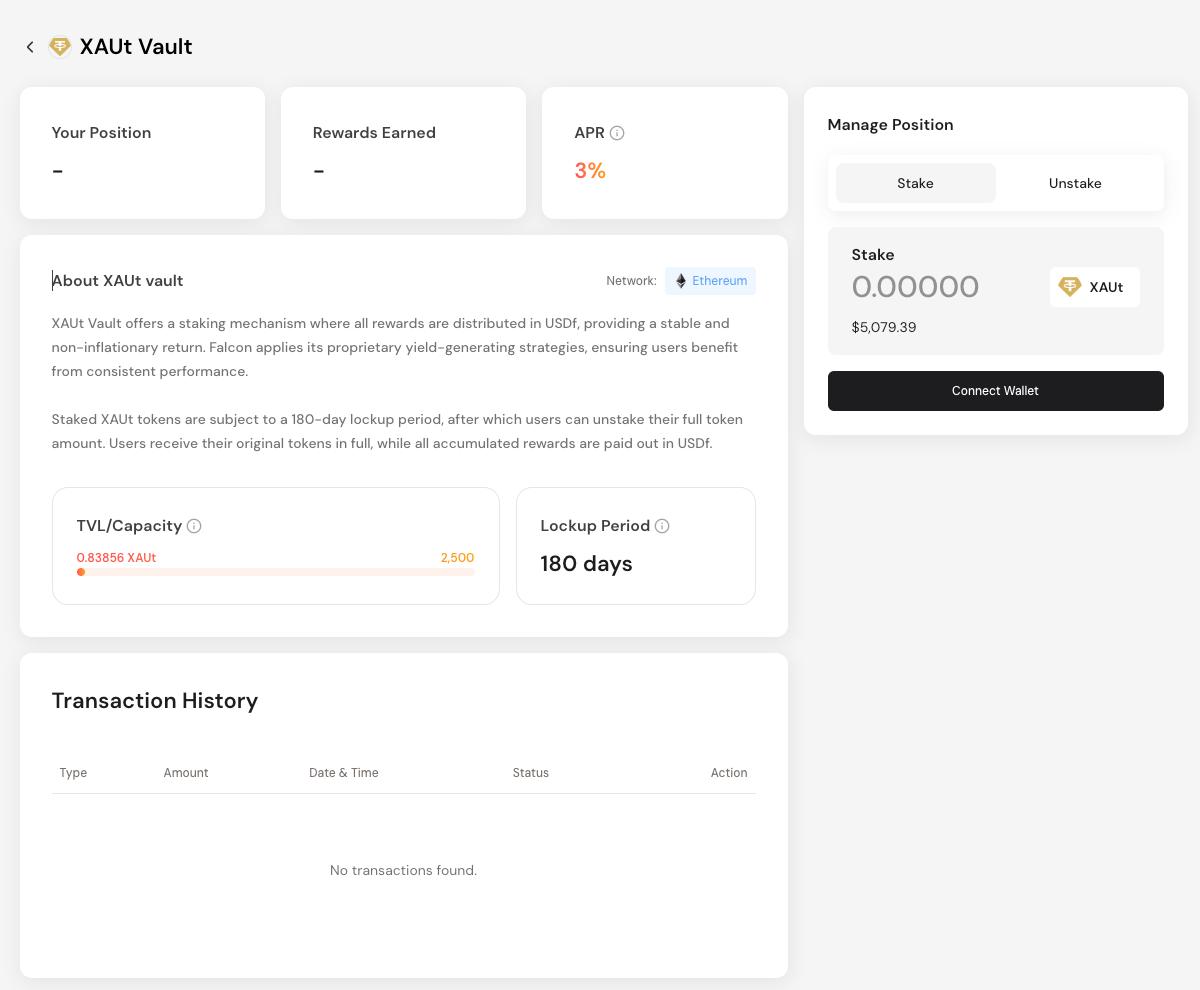

Falcon Finance XAUt Collateral Vault

Some protocols (such as Falcon Finance ) have launched staking products for tokenized gold (such as the XAUt Staking Vault). By locking up tokenized gold for a fixed period, investors can earn yields in the form of synthetic stable assets (such as USDF).

- Operating Mechanism: Users lock XAUt in a Vault and, according to the protocol, periodically receive returns paid in synthetic or diversified assets.

- Expected Returns: The target annualized return (APR) for this vault strategy is reportedly around 3-5% , but the actual incentives and risk profile will vary depending on the agreement and market conditions.

- Risk considerations: Smart contract risks and protocol-specific token economics are key factors.

Real-world assets (RWA) market background

The massive RWA wave

Tokenized metals exist within the rapidly expanding real-world asset (RWA) tokenization race. As of January 2026:

- RWA's total value locked (TVL) exceeds $21 billion (a significant increase from approximately $17 billion at the end of 2025).

- Including stablecoins: the total value of tokenized real-world assets exceeds $317 billion.

- RWA holders: There are nearly 600,000 direct holders of the tokenized asset, a twofold increase since 2024.

- Industry forecast: According to McKinsey , the industry could reach $2 trillion by 2030.

Tokenized Commodity Segments

Within the RWA space, as of early 2026, the market capitalization of tokenized commodities had grown to approximately $4.48 billion.

The core advantages of tokenized metals

- Accessibility: Fragmented ownership allows investors to purchase gold for as little as $1; 24/7 global trading eliminates market closure restrictions; no need to worry about storage issues, as the custodian is responsible for the physical security of the gold.

- Liquidity: Near-instant settlement replaces the T+2 settlement of traditional markets. Deep liquidity on large platforms supports large transactions with extremely low slippage, while cross-chain transfer capabilities allow assets to flow freely between different networks.

- Transparency: On-chain verified ownership forms an immutable transaction record. Regular third-party audits verify physical backing, and on-chain Proof of Reserves (PoR) allows anyone to verify whether the supply matches the reserves.

- Utility: It can be used as collateral for DeFi lending protocols, enabling "borrowing without selling tokens"; it can generate passive income through staking or liquidity mining.

Risks worth noting

Custody and Counterparty Risks: Relying on centralized custodians for physical storage creates a single point of failure. Issuer solvency concerns arise if the issuing entity faces financial difficulties. Reliance on audit integrity requires investors to trust third-party auditors. Furthermore, redemption restrictions, including minimum redemption amounts and geographic location limitations, may prevent users from immediately receiving physical assets.

Technical Risks: Smart contract vulnerabilities have already caused billions of dollars in losses in the DeFi space. Blockchain network congestion or outages can prevent transaction execution. Oracle manipulation or failure can lead to incorrect pricing. Furthermore, cross-chain bridge vulnerabilities are a significant attack vector facing multi-chain tokens.

Market Risks: Price fluctuations in the underlying metal directly impact token value. Liquidity constraints during periods of market stress may hinder investor exits. Under extreme conditions, tokens may experience depegging from the spot price. For perpetual contracts, leveraged liquidations could result in assets being worthless.

Regulatory uncertainty and the evolving legal classifications of tokenized commodities present compliance challenges. Differences in requirements across jurisdictions impact global accessibility. Enforcement of Anti-Money Laundering/Know Your Customer (AML/KYC) regulations may add additional requirements. Potential restrictions on DeFi integration could diminish the asset's utility.

Future Outlook

Market Forecast

With the deepening of on-chain infrastructure, institutional participation, and integration of real-world assets, the tokenized metals and broader RWA (Real-World Asset) tokenization market is expected to continue expanding. Recent data shows that tokenized commodities are on the rise, led by gold and supported by increasing attention to other metals.

The estimates from early 2024 represented the nascent tokenization market, when standardized reporting was still incomplete.

Conclusion

Tokenized metals represent one of the most compelling intersections between traditional finance and blockchain innovation. With the tokenized gold market alone exceeding $5 billion, it's no longer an experiment but a well-functioning market offering tangible advantages over traditional precious metal investments.

For investors, the appeal is self-evident: owning gold or silver with the click of a button, trading 24/7 without time restrictions, using positions as collateral in DeFi, and eliminating the hassle of physical storage. For traders, perpetual contracts offer leveraged exposure to metals without worrying about expiration dates or physical delivery.

However, this market is not without risks. Reliance on custody, smart contract vulnerabilities, regulatory uncertainty, and liquidity constraints during periods of stress all warrant careful consideration. Due diligence on issuers, audit reports, and redemption mechanisms remains crucial.

As we move into 2026, the infrastructure continues to mature. Hyperliquid's dominant DEX platform, Ondo's expansion into Solana, and the broader RWA boom all point to a future where the lines between traditional and digital commodity markets will become increasingly blurred.

The $32 trillion gold market is moving on-chain. Whether you're a long-term holder seeking hedging exposure or a trader looking to profit from volatility, tokenized metals offer tools that simply didn't exist a few years ago. The future of commodities is being written on the blockchain, and it's happening right now.