Silver had its worst day since 1980 last friday.

Down 30%+ in a single session making it one of the largest drops in 275 years of data.

→ AGQ forced to dump ~4B as it rebalanced

→ Options dealers short gamma, selling into the crash

→ CME hiked margins 47%, triggering liquidations everywhere

Everyone was positioned the same way. Liquidity vanished making the price fall hard. But the fundamentals are unchanged.

1. Solar demand still growing

2. China export restrictions started Jan 1

3. Supply deficit still 95M oz/year

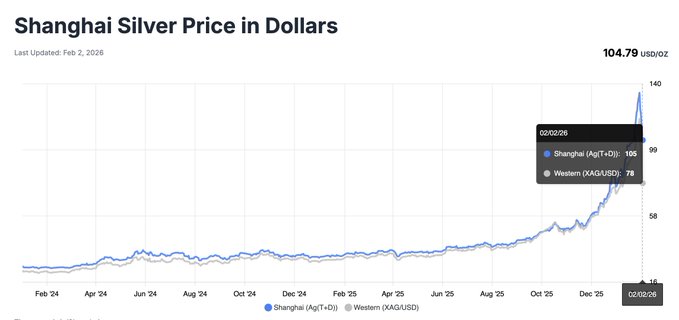

In Shanghai, currently silver is selling off hard but holding ~$100. Meanwhile, the current price on China’s largest ecom platform is $160/oz whereas in the west it is trading at ~$83/oz.

I still believe this is a positioning.

YashasEdu

@YashasEdu

01-30

Silver hit $121 yesterday.

Now it's at $98.

Nearly 20% down in 24 hours and I'm more bullish than ever.

Here's why🧵

new dips in coming months

Web2 fomo silver, wait to dip is smart

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content