Hyperliquid announced that it is expanding into “outcome trading”—a type of trading based on outcome scenarios, which can be used for prediction markets or limited-risk options products. This feature (shortened to Outcomes) will be included as an extension of the HIP-4 upgrade and will initially be tested on the testnet.

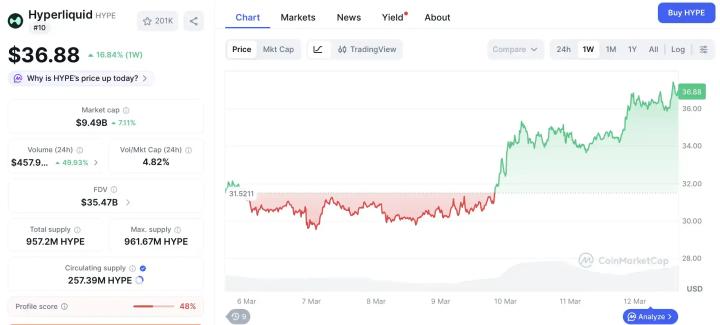

This move comes at a time when prediction markets are making a strong comeback, with many large exchanges also looking to compete with leading platforms. At the same time, the crypto options market is also growing. Hyperliquid (HYPE) – an optimal Layer 1 option for perps trading – has recorded a cumulative Volume of nearly $42 billion and recently reached a new peak in open interest.

The project development team says user demand for both areas is huge, and builders may come up with many new applications.

According to the description, Outcomes adds a “safer” product class to options: “outcome” contracts are 100% collateralized and risk-limited, operating like binary/digital options but without leverage, margin calls, or the risk of liquidation. The contracts will be settled in the USDH stablecoin and run on HyperCore – the core order matching engine of the DEX.

HIP-4 was proposed in mid-2024, aiming to implement "Event Futures" (outcome-based contracts, similar to prediction markets) as an extension of HIP-3. This proposal is still under development.

Follow CoinMoi to stay updated on the hottest issues in the crypto market. Okay!!

The article "Hyperliquid 'encroaches' on prediction markets" first appeared on CoinMoi .