Hyperliquid , which holds a dominant position in the crypto derivatives market, is now trying to extend its reach into another trillion-dollar market that is experiencing explosive growth: the prediction market .

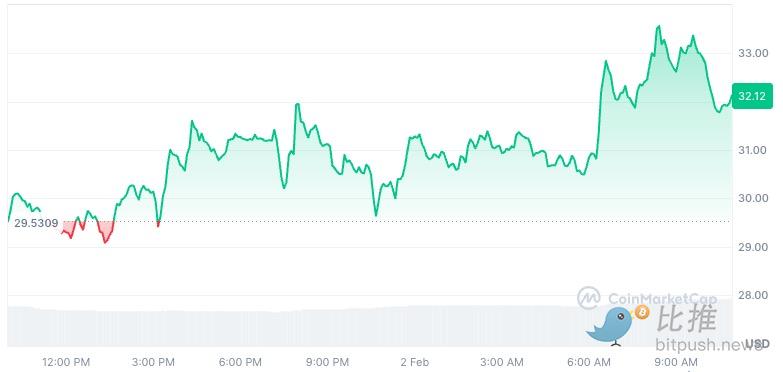

Today, Hyperliquid officially announced the testing of a new feature called "Outcomes." This news immediately ignited enthusiasm in the secondary market, with its native token HYPE recording a gain of over 10% within 24 hours, pushing its price above the $30 mark.

With Polymarket dominating on-chain traffic and Kalshi and Coinbase joining forces to reap the rewards in the compliance market, Hyperliquid's entry is by no means a simple "following the trend," but rather a game-changing move that leverages its absolute advantage in native underlying performance to redefine the rules of the game.

What are Outcomes?

According to the official HIP-4 proposal, Outcomes is not a simple betting interface; its design is based on the following three core logics:

1. Full collateralization, risk of liquidation.

Unlike leveraged perpetual contracts, Outcomes follows the principle of "do what you can afford." It uses full collateral and settles within a fixed range. This means that regardless of market fluctuations, as long as the settlement date has not arrived, traders' positions will not face forced liquidation, fundamentally eliminating the risk of margin calls.

2. Nonlinear settlement, larger strategy space

Outcomes introduces a non-linear settlement mechanism. For traders, this is equivalent to gaining flexibility close to that of options, allowing them to build more complex hedging tools, no longer limited to simple "yes" or "no" binary games, thus opening up greater space in risk management and strategy combination.

3. Native integration, enabling seamless liquidity.

Outcomes will be deeply integrated into HyperLiquid's underlying chain, HyperCore, and priced in the native stablecoin USDH. More importantly, it can share cross margin margin with the platform's existing spot and perpetual contracts. This means that users can seamlessly integrate multiple trading strategies within the same margin account, truly achieving interoperability and reuse of liquidity.

Multiple factions vie for control: Who will ultimately predict the market's outcome?

The current prediction market is experiencing a "1995 browser war" moment, resulting in four distinct business paths:

| Dimension | Polymarket | Kalshi | Coinbase / Gemini | Hyperliquid (Outcomes) |

| Core positioning | Traffic and Information Center | Compliance Prediction Pioneer | Monetizing retail traffic | Hedging desks for professional traders |

| Regulatory attributes | Offshore, Decentralized | CFTC Strictly Regulates (DCM License) | Regulated retail integration | High-performance on-chain L1 |

| Trading Logic | Binary (Yes/No) | Event Contract | Embedded transactions (cooperation model) | Full collateral + non-linear settlement |

| competitive advantage | Social discussion, first-mover advantage | Institutional trust and legal protection | Extremely high retail investor penetration rate | Endogenous liquidity, high-performance order book |

Polymarket sells "opinions"; it is a barometer of social hot topics.

Kalshi sells "compliance," attracting US domestic funds seeking to avoid legal risks.

Coinbase, on the other hand, is a "lower-dimensional attack," turning the prediction market into a mass-market consumer product through built-in features in its app;

Hyperliquid's logic is the most hardcore: it doesn't require you to click Yes or No on a webpage; it allows you to short BTC while simultaneously buying an Outcomes contract based on "better-than-expected non-farm payroll data" to hedge against macroeconomic risks.

The community is currently most concerned about the synergistic effect between HIP-3 (permissionless listing) and HIP-4 (Outcomes).

Under this architecture, Hyperliquid's evolution path is clear: first, it will be officially deployed to "canonical markets" based on objective data sources, such as interest rates and macroeconomic indicators; then, permissionless deployment will begin.

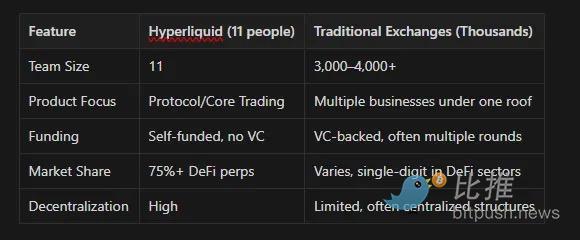

Behind this strategy lies Hyperliquid's legendary team advantage. It's hard to imagine that this behemoth, boasting over $1.1 billion in annualized revenue and trading volume comparable to top-tier CEXs, is supported by a core team of only about 11 people. This "special forces" team, composed of Harvard and MIT graduates and elite quantitative hedge fund professionals, achieves an astonishing efficiency of over $100 million in annualized revenue per person. It is precisely because of this extremely lean team and short decision-making paths that Hyperliquid can iterate so rapidly.

A veteran DeFi observer stated, "Coinbase's entry validates the business model, but it remains centralized. Hyperliquid's Outcomes challenges the premise that the endgame of prediction markets lies not in social media, but in financialization. The true potential of on-chain finance will only open up when prediction results become as smooth as buying and selling stocks, and when margin sharing is possible with futures."

Is HYPE significantly undervalued?

Currently, Hyperliquid HIP-3 open interest (OI) has surged to $1 billion, and the total 24-hour trading volume across the platform has soared to $4.8 billion, setting a new all-time record.

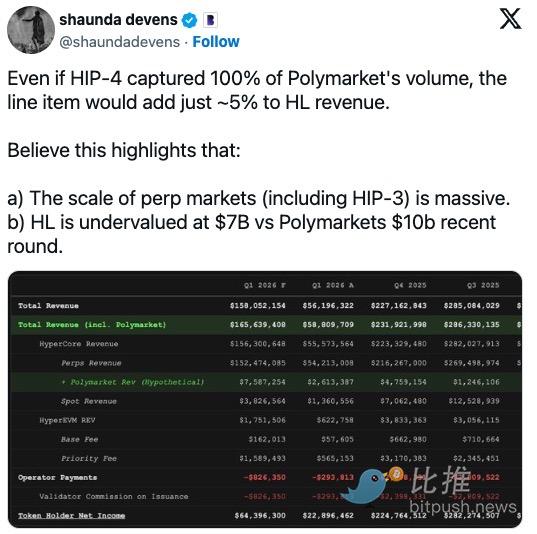

Regarding this move, Blockworks researcher Shawda Devens believes it further supports the upside potential of Hyperliquid's valuation.

Devens points out that even though HIP-4 consumes 100% of Polymarket's trading volume, its contribution to Hyperliquid's revenue is only about 5%.

This data may seem surprising at first glance, but the underlying logic lies in the sheer size of the perpetual contract market (including the long-tail assets brought by HIP-3). Devens believes that Hyperliquid's current valuation of approximately $7 billion is significantly undervalued compared to Polymarket's latest valuation of $10 billion (based on 2025 funding data). The launch of Outcomes completes the final piece of its comprehensive financial portfolio.

Despite the high market sentiment, it's important to note that Outcomes is currently in the testnet phase, and the exact timeline for its mainnet launch has not yet been announced. However, with the explosive growth of the HyperEVM ecosystem, mainstream service providers such as Kalshi or Crypto.com could theoretically migrate to the Hyperliquid chain using the HIP-4 protocol in the future.

In summary, prediction markets are entering their golden age. In the US, thanks to increased regulatory transparency, Kalshi's partnership with Coinbase has expanded prediction markets to cover all 50 states; similar growth momentum is also strong in the EU and Asia. For Hyperliquid, Outcomes is not just a simple gamble; it's the final piece of the puzzle in building its "on-chain Wall Street."

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush