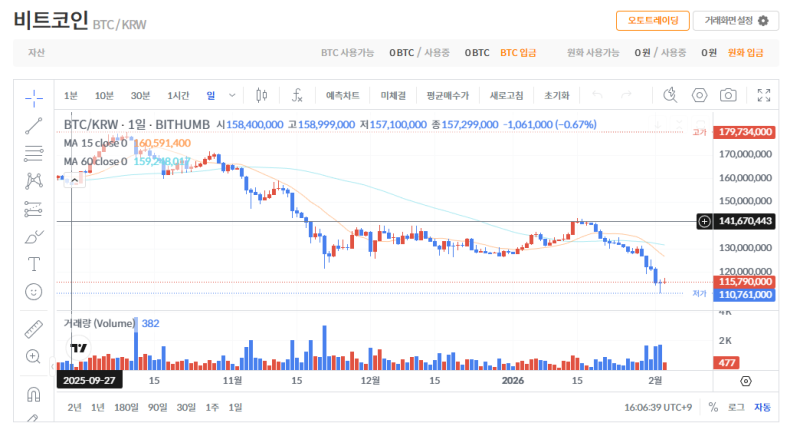

BTC enters a short-term correction phase, defending $75,000 for four consecutive trading days.

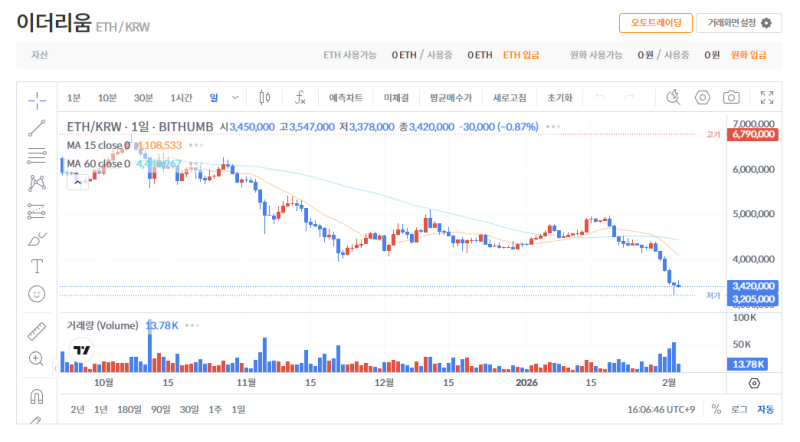

ETH: A test of support at a mid- to long-term trend turning point

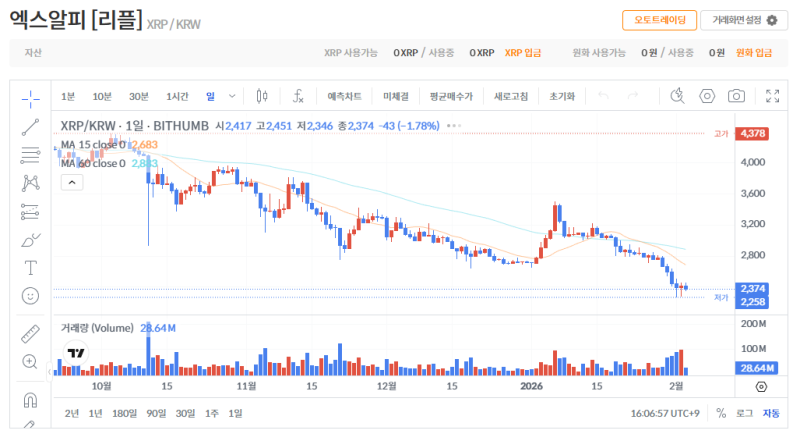

XRP Approaches Key Buy Levels, Highlighting Potential for Technical Rebound

As of 4:00 PM today , Bitcoin is trading in the low $78,000 range. In the short term, a breakout of $75,340 is a key variable. If that level collapses, further corrections to around $68,770 are possible. However, for a rebound, analysts believe a stabilization of the $78,905 and $79,595 levels is necessary.

As of 4:00 PM , Ethereum (ETH) is trading in the low $2,300 range. The market sees the ability to hold the $2,145 and $2,130 ranges based on weekly and monthly closing prices as key indicators of the continuation of the medium-term trend in the virtual asset market.

XRP continues its bearish trend around $1.60. Technically, the $1.513 and $1.445 levels are seen as potential rebound areas, and the inflow of supply and demand at these support levels will likely determine the short-term direction.

Market experts see this trend as a phase of directional exploration following a short-term adjustment rather than a trend breakdown.

The fact that Tether dominance is moving sideways while encountering resistance at its high suggests that further downward pressure is limited, but the analysis also suggests that if Bitcoin clearly breaks below $75,000, a mid-term downtrend reversal cannot be ruled out.

Some analysts, noting that similar situations in the past have often seen short-term technical rebounds following large-scale sell-offs, are evaluating the current market cycle as a "short-term rebound potential zone amid high volatility." However, the prevailing opinion is that a conservative approach is necessary until clear buying inflows are confirmed in the spot market.

Reporter Jeong Ha-yeon yomwork8824@blockstreet.co.kr