Matt Hougan believes that the Crypto Winter began in January 2025, and spring is just around the corner.

Written by Matt Hougan, Chief Investment Officer, Bitwise

Compiled by: Chopper, Foresight News

The bad news is: we've been in a Crypto Winter since January 2025. The good news is: we're probably closer to the end of the winter than we were to its beginning.

I want to say something obvious, because I believe it will help you make informed decisions in the coming months: We are in the midst of a full-blown Crypto Winter.

I've noticed that this is rarely discussed online or in mainstream media, but it's an undeniable fact. Bitcoin is down 39% from its all-time high in October 2025, Ethereum is down 53%, and many other crypto assets have fallen even more.

The important thing is to recognize its true nature. This is not a bull market correction, nor is it a dip. This is a thorough winter, comparable to 2022, as harsh as the one Leonardo DiCaprio experienced in "The Revenant." The causes of this winter range from excessive leverage to large-scale profit-taking by early investors.

For me, acknowledging and accepting this made everything incredibly clear.

Why are crypto prices falling despite continuous positive developments in areas like application adoption and regulation? Because we are in the deep waters of a Crypto Winter. Why is the new Federal Reserve Chairman a supporter of Bitcoin, yet the crypto fear and greed index is at historically high levels? Because we are in a Crypto Winter.

Those who experienced the crypto winters of 2018 or 2022 will remember that in the depths of a downturn, positive news is meaningless. We won't see a rebound simply because Wall Street is hiring heavily or Morgan Stanley is increasing its crypto investment. These things are important in the long run, but not now. The Crypto Winter won't end in frenzy; it will only end when everyone is exhausted.

So when will this winter end? The good news is: I think we're nearing the end.

Historical patterns of the Crypto Winter

Crypto Winter typically last about 13 months. For example, Bitcoin peaked in December 2017 and bottomed out in December 2018; it peaked in October 2021 and bottomed out in November 2022.

Based on this cycle, we're still going to have to go through a difficult period. After all, Bitcoin peaked in October 2025; are we really going to have to wait until November 2026? I don't think so.

After doing more analysis of the current economic downturn, I've become increasingly aware that it actually started as early as January 2025. The reason we can't see it is because the inflows into ETFs and Crypto Treasury (DAT) have masked the truth.

ETF and DAT fund flows mask the harsh winter of 2025.

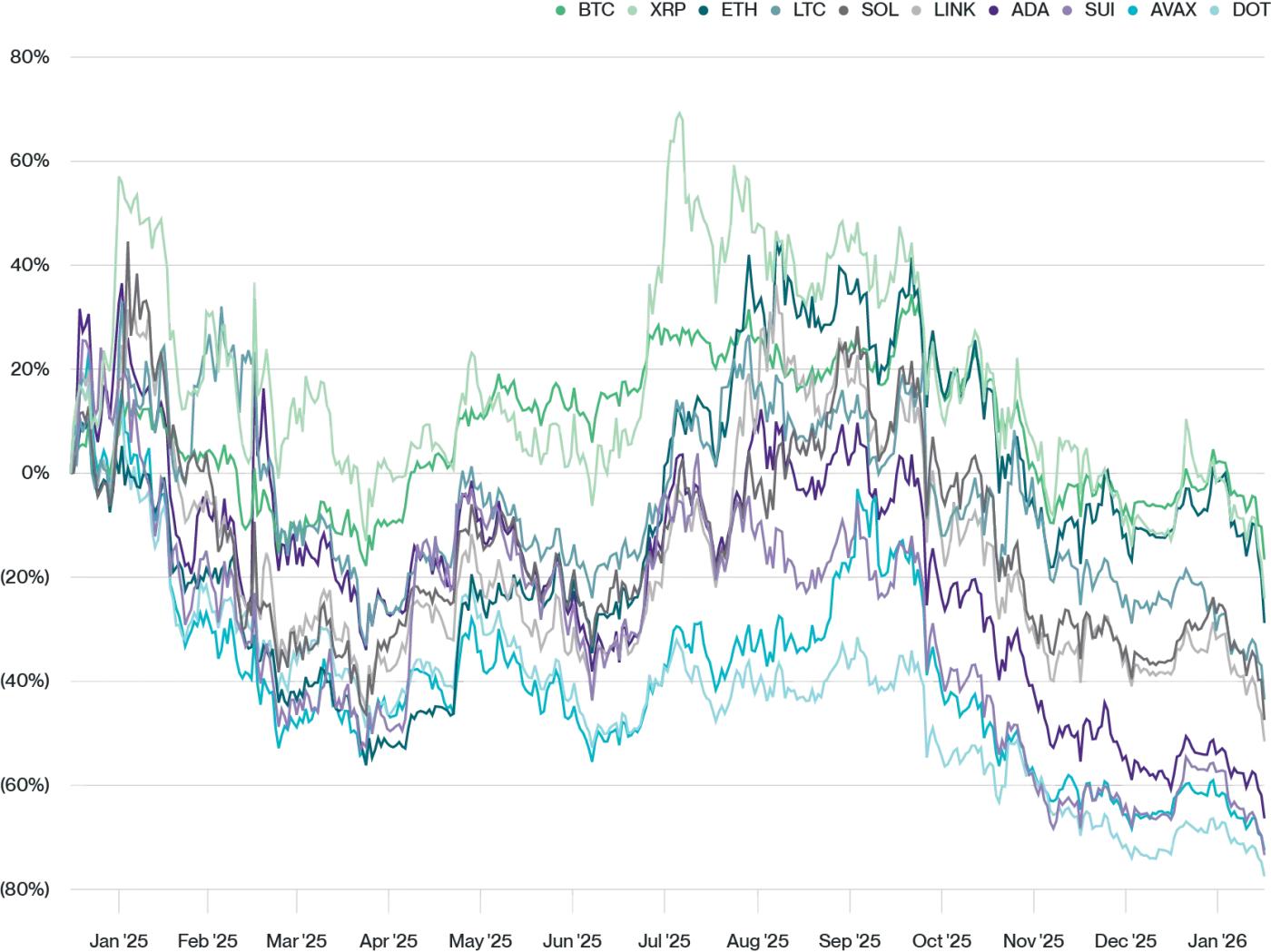

Take a close look at this chart showing the performance of the Bitwise 10 Large Cap Crypto Index constituents since January 1, 2025.

Returns of the Bitwise 10 Large Cap Crypto Index constituents from 2025 to present. Source: Bitwise Asset Management

They are clearly divided into three categories:

- The first asset class (BTC, ETH, XRP) performed reasonably well, falling 10.3% to 19.9%.

- The second asset class (SOL, LTC, LINK) experienced a standard bear market, falling 36.9% to 46.2%.

- The third category of assets (ADA, AVAX, SUI, DOT) suffered a bloodbath, falling 61.9% to 74.7%.

The core difference between these three asset classes lies primarily in whether institutions have access to invest in them. The first class of assets received massive inflows of funds from ETFs/DAT throughout the year; the second class of assets had an ETF approved in 2025; and the third class of assets never did. (Note: XRP is an exception; it didn't have an ETF at the beginning of 2025, yet it performed well. This may be because XRP faced a potentially fatal lawsuit from the US SEC at the beginning of 2025, which was subsequently withdrawn, leading to a significant rebound in its asset value.)

The scale of institutional support is staggering. For example, during the period shown in the chart, ETFs and DAT collectively purchased 744,417 Bitcoins, worth approximately $75 billion. Imagine how low Bitcoin would have fallen without this $75 billion in support? I'd guess it would have dropped by about 60%.

The retail investor market has been in a brutal downturn since January 2025. Institutional funds, however, have masked this fact for some of its assets.

The darkest hour is always before dawn.

What needs to be remembered at this moment is that there are actually a lot of real positive factors in the crypto space. Regulatory progress is real, institutional adoption is real, stablecoins and asset tokenization are real, and Wall Street's embrace is real.

In a bear market, positive news may be ignored, but it doesn't disappear. It's stored up as potential energy. Once the clouds clear and market sentiment returns to normal, this accumulated potential energy will be released in a retaliatory manner. What can dispel the clouds? Strong economic growth triggering a broad rebound in risk assets, positive signals from the Clarity Act, signs of sovereign nations adopting Bitcoin, or simply the passage of time.

As a veteran who has weathered multiple Crypto Winter, I can tell you that the feeling before the winter ended was very similar to what it is now: despair, helplessness, and depression. However, the current market pullback has not changed the fundamentals of the crypto market in the slightest.

I believe we will rebound faster and more forcefully. After all, the winter began in January 2025. Spring is certainly not far away.