The crypto industry faces a dilemma of "good coins are hard to find".

Most tokens have no value.

Most tokens are not treated with the same level of importance by the teams as equity, both legally and strategically. Because teams have not given tokens the same level of importance as equity in the past, the market has reflected this through token prices.

Today I want to share two sets of data that give me optimism about the future of token development after 2026:

1. MegaETH's KPI Plan

2. Cap's stablecoin airdrop

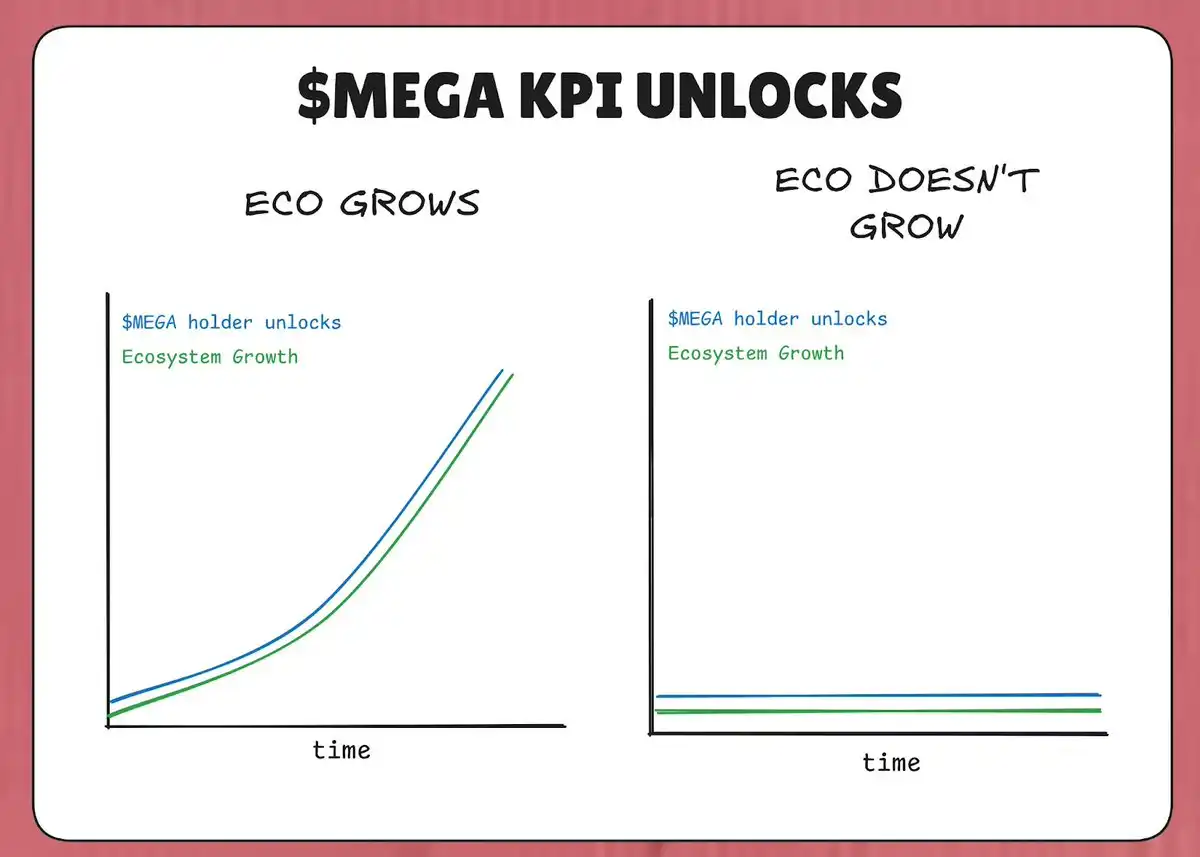

MegaETH has locked 53% of its total supply of MEGA tokens in a "KPI program." The logic is: if MegaETH does not meet its KPIs (Key Performance Indicators), these tokens will not be unlocked.

Therefore, in the worst-case scenario, even if the ecosystem fails to grow, at least no more tokens will flood the market, diluting holders. MEGA tokens will only enter the market when the MegaETH ecosystem truly grows (based on KPIs).

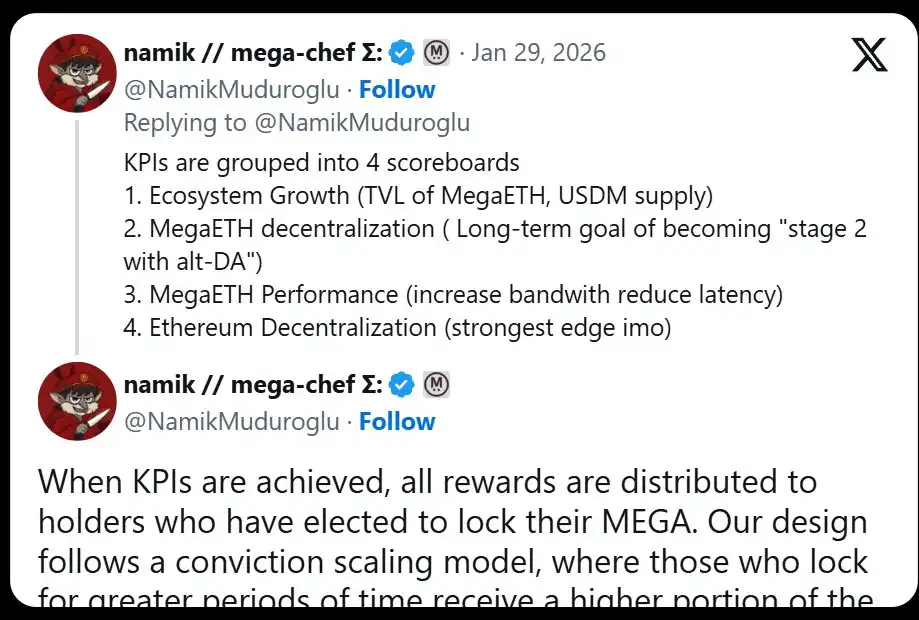

The plan's KPIs are divided into four major performance indicators:

1. Ecosystem growth (TVL, USDM supply)

2. MegaETH Decentralization (L2Beat Phase Progress)

3. MegaETH Performance (IBRL)

4. Ethereum's Decentralization

Therefore, in theory, as MegaETH achieves its KPI targets, its value should rise accordingly, thereby mitigating the impact of MEGA dilution on market prices.

This strategy is similar to Tesla's "rewards only for achieving targets" compensation philosophy for Musk. In 2018, Tesla granted Musk an equity compensation plan, vesting in installments, which would only be realized if Tesla simultaneously achieved its phased market capitalization and revenue targets. Musk would only receive compensation when Tesla's revenue grew and its market capitalization increased.

MegaETH is trying to apply the same logic to its token economics. "More supply" is not a given—it is something the protocol must achieve in exchange for delivering tangible results on meaningful performance metrics.

Unlike Musk's Tesla benchmark, I don't see anything about using MEGA market capitalization as a KPI target in Namik's KPI goals—perhaps for legal reasons. But as a publicly traded MEGA investor, this KPI is indeed very interesting to me.

Another interesting aspect of this KPI plan is who gets the MEGA when the KPI is achieved. According to Namik's tweet, those who stake MEGA in the lock-up contract are the ones who unlock it.

Those who lock up more MEGA tokens for a longer period will receive 53% of the MEGA tokens that enter the market.

The logic behind it is quite straightforward: dilute MEGA and distribute it to those who have proven themselves to be MEGA holders and who are willing to hold more MEGA—that is, those who are least likely to sell MEGA.

It's worth emphasizing that this also comes with risks. We have seen historical cases where similar structures have encountered serious problems. Consider this excerpt from Cobie's article: "(Content)"

If you are pessimistic about tokens, a crypto skeptic, or simply bearish, this consistency issue is exactly what you're worried about.

Alternatively, looking at the same article: "Staking mechanisms should be designed to support the goals of the ecosystem."

Locking tokens in a way that reflects the value growth of the MegaETH ecosystem is a far superior design to any ordinary staking mechanism from the liquidity mining era of 2020-2022. Back then, tokens were continuously issued regardless of the team's fundamental progress or ecosystem growth.

Therefore, the net effect is MEGA dilution:

• Constrained by the growth of the MegaETH ecosystem

• Dilute it to the hands of the least likely person to sell MEGA

This does not guarantee that MEGA's value will increase as a result—the market will ultimately go its own way. However, it is an effective and sincere attempt to address the core structural problems affecting the entire crypto token industry.

In the past, the team has been distributing tokens in a "spray-and-pray" manner within the ecosystem—airdrops, mining rewards, subsidies, etc.—which the team wouldn't have done if they were distributing something of real value.

Because the team distributed the tokens as worthless governance tokens, the market priced them as worthless governance tokens as well.

After Binance launched MEGA token futures on its platform (a strategy Binance has historically used to blackmail the team), you can see the same philosophy behind MegaETH's listing on CEXs:

Hopefully, the team will become more cautious about token distribution. If the team starts to treat the token as a rare asset, the market may respond accordingly.

The stablecoin protocol Cap introduced a "stabledrop" instead of a traditional airdrop. Instead of airdropping the native governance token CAP, they distributed the native stablecoin cUSD to users who earned Cap points.

This approach rewards farmers with real value, thus fulfilling the social contract. Users who deposit USDC into the Cap supply side bear the risks and opportunity costs of the smart contract, and the stablecoin airdrop compensates them accordingly.

As for those who want CAP itself, Cap is conducting a token sale through Uniswap CCA. Anyone who wants to acquire CAP tokens must become a genuine investor and commit actual funds.

The combination of stablecoin airdrops and token sales filters out steadfast long-term holders. Traditional CAP airdrops tend to flow to speculative users who might sell immediately. By requiring capital investment through token sales, CAP ensures that it flows to participants willing to bear all downside risk in exchange for upside potential—a group more inclined to hold for the long term.

In theory, this structure increases CAP's chances of success by creating a core group of holders aligned with the protocol's long-term vision, rather than by using an imprecise airdrop mechanism that distributes tokens to those who only care about short-term gains.

The protocol has become smarter and more precise in its token distribution mechanism. It's no longer a shotgun-style, indiscriminate token issuance—MegaETH and Cap have chosen to rigorously screen who can obtain their tokens.

"Maximizing distribution" is a thing of the past—perhaps a toxic legacy of the Gensler era. Instead, both teams are pursuing the optimization of holder concentration to build a more stable core holder group.

I expect that as more applications launch in 2026, they can observe and learn from these strategies, and even improve upon them. In this way, the problem of "good coins being hard to find" will no longer be a problem, and we will only have "high-quality tokens" left.