By Eric, Foresight News

Original title: Middle Eastern tycoons become the biggest financial backers of the crypto

On the morning of January 31, Beijing time, according to a report by The Wall Street Journal citing sources familiar with the matter, four days before Trump's inauguration, a close associate of an Abu Dhabi royal family member secretly signed an agreement with the Trump family to acquire a 49% stake in the Trump family's crypto project, World Liberty Financial ( WIFI ), for $500 million.

According to reports, of Aryam's initial $250 million investment, $187 million went to two companies owned by the Trump family, and another $31 million went to entities associated with WiFi co-founders Zak Folkman and Chase Herro.

According to a video released by Fox News on X this morning Beijing time, Trump's response to this in an interview was somewhat vague: "I was unaware of it; my son and family members handled the matter."

The report states that the generous company is called Aryam Investment, and this investment makes Aryam the largest shareholder of WIFI and the only known investor in the company besides its founder.

Standing behind Aryam is Sheikh Tahnoun bin Zayed Al Nahyan (hereinafter referred to as Tahnoun), the chairman of the board of directors ofMGX .

The protagonist of the story, Tahnoun, is the son of Sheikh Zayed Bin Sultan Al-nahayan, the founding father of the UAE , and the younger brother of the current president, Sheikh Mohamed bin Zayed Al Nahyan. He manages $1.5 trillion in national assets and private funds. Backed by what is arguably one of the wealthiest families on the planet, MGX, a joint venture between Abu Dhabi's sovereign wealth fund and G42, the UAE's most renowned AI technology group, has a history of lavish and successful investments.

MGX's core mission is to "build AI infrastructure for the global economy," positioning itself as a long-term, strategic capital provider. Its investments are primarily focused on three areas: AI infrastructure, semiconductors, and core AI technologies and applications, with a target asset management scale of $100 billion. By 2025, MGX had already invested tens of billions of dollars in the US, participating in projects including the $40 billion acquisition of Aligned Data Centers, the $500 billion Stargate Project, and financing rounds for AI giants such as OpenAI, Databricks, Anthropic, and xAI.

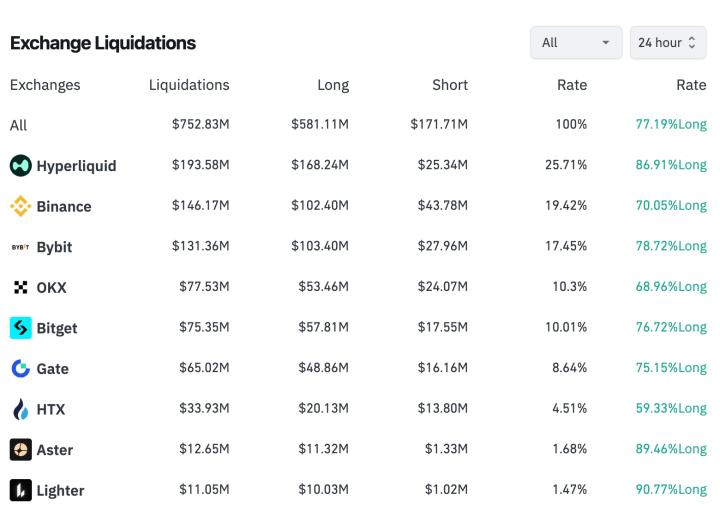

In March 2025, MGX announced a $2 billion investment in Binance, which CoinDesk later revealed would be paid in USD1. If the Wall Street Journal's report is accurate, then MGX's investment in Binance using USD1, a USD stablecoin issued by Wi-Fi, and Binance's subsequent two high-yield USD1 investment promotions become plausible explanations: it wasn't MGX intentionally currying favor, but rather that the two companies shared common investors. Driven by the combined efforts of these three giants, USD1's issuance surged to fifth place in less than a year, surpassing FDUSD and PayPal's PYUSD, second only to Ethena's USDe. If only centralized stablecoins are considered, USD1 lags behind only the two "big brothers," USDT and USDC.

Furthermore, MGX recently acquired approximately 15% of the equity in TikTok's new US entity as a key non-Chinese shareholder. Therefore, the $2 billion investment in Binance and the $500 million investment in WIFI seem insignificant compared to MGX and Tahnoon's bets on US tech companies. However, the $2.5 billion investment not only occupies two of the top five spots in single-round funding in the Web3 industry in 2025, but also accounts for more than 10% of the total funding in the industry in 2025.

Although not as well-known as a16z or Paradigm, UAE capital had already begun investing heavily in Web3 long before MGX was established.

Abu Dhabi's sovereign wealth fund has invested in crypto payment company Ramp and crypto wallet technology company Dfns, and already held $400 million worth of BlackRock Bitcoin spot ETF shares as of May 2025. Cypher Capital, founded in Dubai in 2022, has invested in Web3 companies such as Sui, Sei Network, zkPass, Ton, Berachain, Aethir, zkLink, and Jambo in recent years, and is known as the "Middle Eastern a16z".

In addition, there are Sigma Capital, which established a $100 million fund in early January 2025, and M2 Capital, which invested $20 million in Ethena, etc. "Oil money" has already penetrated every aspect of Web3.

The UAE has a very tolerant attitude towards crypto and is one of the fastest countries to advance crypto legislation. The Dubai Virtual Assets Regulatory Authority (VARA) is the world's first independent regulatory body specifically for virtual assets, and Abu Dhabi Global Market (ADGM) was one of the first entities to launch a comprehensive digital asset framework regulatory sandbox. Companies such as Tether, Circle, and Ripple have already obtained operating licenses or permits in the UAE. Binance, on the other hand, received full regulatory authorization from the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority (FSRA) in December 2025, becoming the first crypto exchage to obtain a global license under the ADGM framework.

Besides Binance, OKX and Bybit, two Chinese-owned exchanges, have also obtained VARA operating licenses. Kraken and Crypto.com are the US compliance representatives in the UAE. Furthermore, Backpack, which emerged after FTX's collapse, announced in October 2023 that it had obtained a Virtual Asset Service Provider (VASP) license from VARA. For these exchanges seeking compliant operations globally, the UAE's provision of funding, land, and licenses effectively makes it a "financial backer."

In December 2025, when Binance received full authorization from the FSRA, Fortune magazine reported that Binance had moved its headquarters to Abu Dhabi, a fact that Binance CEO Richard Teng did not deny.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush