Authors: Azuma, Mandy

Original title: Is Binance still the world's largest exchange?

For a long time, Binance has been known as the "world's largest exchange" in the crypto world, but recently, I have begun to have increasingly strong doubts about this label that has long been ingrained in the minds of retail investors.

Of course, with its vast matrix of public chains, ecosystems, wallets, and VC footprint, Binance remains the most influential super platform in the crypto industry today—this is undisputed.

What truly deserves a re-examination is another, more fundamental question: In the most essential and crucial battleground for exchanges —trading itself, especially in the large-scale, high-fee contract market that determines price levels—is Binance firmly in the top position in the industry? Does it still possess an absolute advantage that is difficult for other competitors to shake? And in terms of innovation leadership in other niche areas, are there any players who surpass Binance?

The reason I'm raising this question isn't because of a short-term data change, but because of a series of small things that have happened recently—they may not seem significant on their own, but together they are gradually shaking my existing perception of Binance's market position.

Contract transaction volume faces challenges

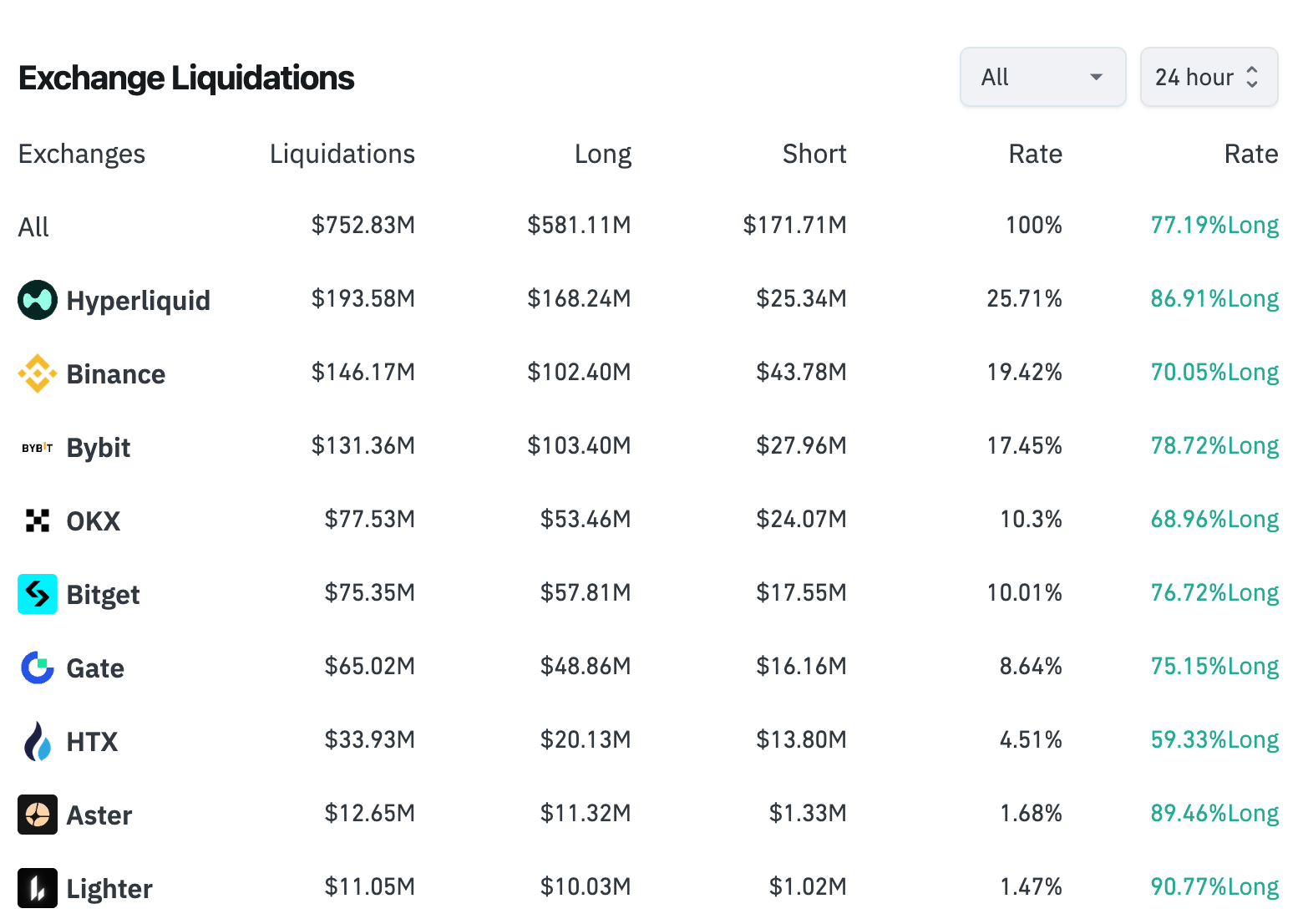

Firstly, in the recent volatile market, Hyperliquid's liquidation data has surpassed Binance's. As shown in the chart below, Hyperliquid's liquidation amount in the last 24 hours was approximately $193 million, while Binance's was $146 million.

Odaily Note: Data is from Coinglass, current time as of 14:00 on February 2nd.

One point of contention here is that Binance limits its liquidation data push frequency to a maximum of once per second, so data platforms like Coinglass may experience some delays when scraping it.

However, based on the information we've observed, there is indeed an increasing number of large investors choosing to place orders on Hyperliquid. Typical examples include "Machi Big Brother," "1011 Insider Whale," James Wynn, AguilaTrades, " CZ Opponent," "14-Game Winning Whale," Gambler@qwatio, Low-Stack Degen, and the other eight prominent figures… You can criticize them as gambling addicts, but where there are gambling addicts, there is turnover, and turnover is the lifeblood of exchanges.

This situation arises because, compared to the unavoidable "black box" nature of CEXs, Hyperliquid executes all orders, transactions, clearing, and settlements on-chain, naturally possessing advantages in transparency and fairness. In the first half of last year, a prominent figure who had founded several well-known projects over the years (whose name I won't mention) experienced targeted liquidation on a CEX (not Binance), losing hundreds of millions of dollars. The platform, however, never disclosed the details of its internal order matching and clearing processes.

The liquidity of mainstream cryptocurrencies has been surpassed in some areas.

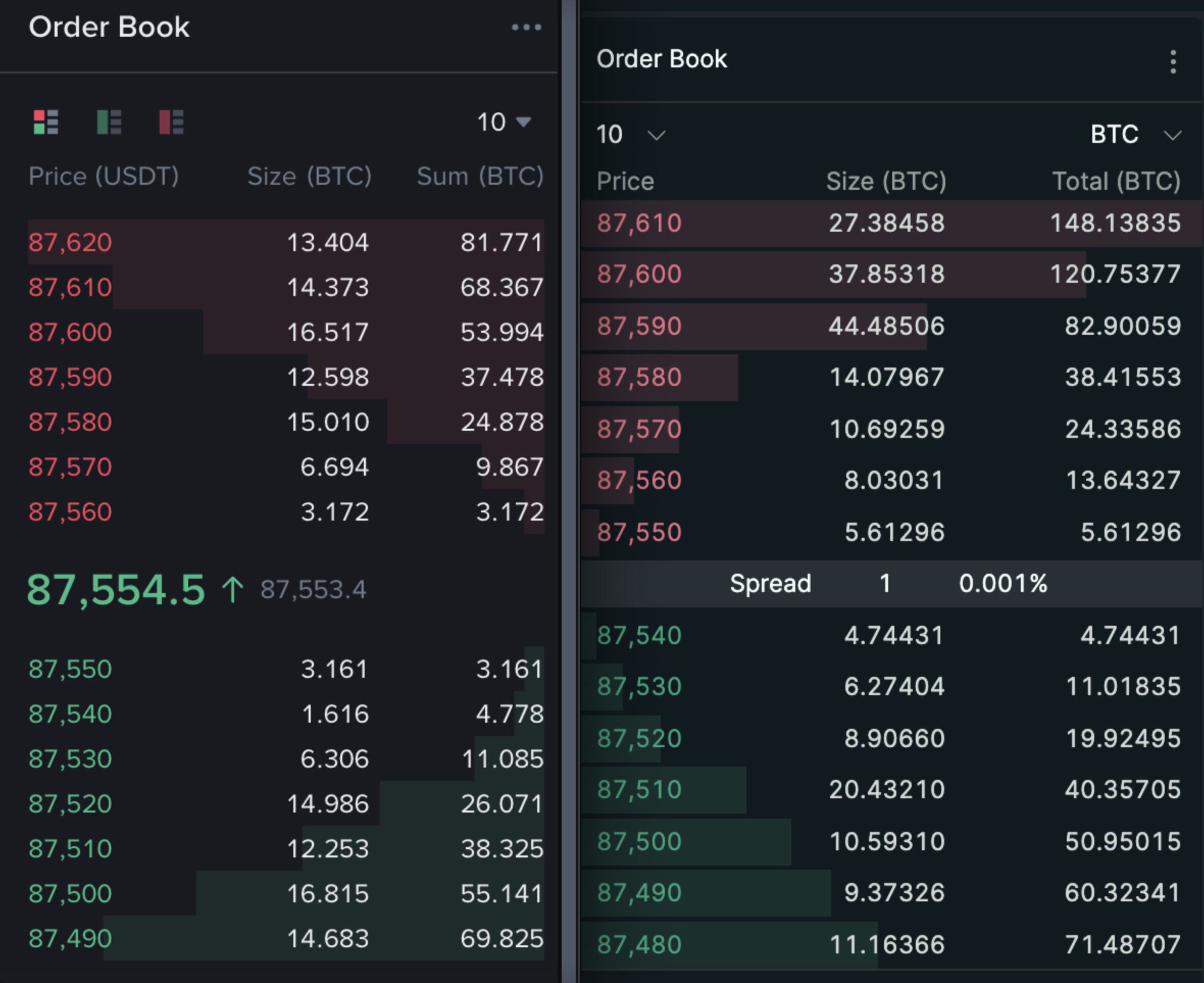

The second thing is that last week, Jeff, the founder of Hyperliquid, posted a comparison of the BTC contract order books on Hyperliquid (right side of the image below) and Binance (left side of the image below) on X. The chart shows that the bid-ask spread for BTC on Hyperliquid is narrower, and the order book depth is thicker.

Jeff then boldly declared: "Hyperliquid has become the world's most liquid cryptocurrency price discovery platform."

This is not an isolated case. By checking the order book status of other mainstream tokens such as ETH and SOL on Hyperliquid and Binance in real time, it can be found that the former's liquidity performance is no less than that of the latter.

The expansion of new targets is progressing slowly.

Over the past year, compared to many second-tier exchanges, Binance has noticeably tightened its pace in officially listing new tokens, delegating more of its high-frequency trading testing to Binance Alpha. However, the performance of many listed tokens has been less than satisfactory. Furthermore, due to the surge in popularity of Chinese memes, Alpha has shifted its focus further towards the BSC ecosystem. Following the 10.11 incident, controversies surrounding Binance have continued to escalate, raising questions within the industry about Binance's listing strategy.

A few days ago, Solana co-founder Natoly Yakovenko (toly) criticized Binance on X and was unfollowed by CZ. In fact, prior to this, there was already a voice in the market suggesting that Solana ecosystem projects were leaving and moving to Bybit. Looking at this trend, Binance may not have the same monopoly on project listings and pricing power as before.

More importantly, with the continued slump in native crypto assets, the industry has turned to asset classes derived from traditional finance, such as stock tokens and precious metals, as a new breakthrough. However, Binance's progress on this path is somewhat slower compared to Hyperliquid and other very active centralized exchanges (such as Bitget, Gate, and Bybit).

Last Monday, Binance officially launched its first cryptocurrency-equity contract, TSLA (Tesla), and today it followed suit with the launches of INTC (Intel) and HOOD (Robinhood). Meanwhile, Binance's competitors, such as Gate and Bitget, are more aggressively expanding into traditional asset classes, from stocks and tokens to precious metals, from indices to commodities, having already begun their battle for potential users.

On the centralized side, Hyperliquid has already leveraged the open architecture of HIP-3 to launch dozens of traditional assets, including pre-IPO stocks such as OpenAI and Anthropic, in a more flexible and customizable market, and has accumulated a considerable trading volume around these assets—traditional assets recently accounted for half of Hyperliquid's trading volume rankings.

What has changed?

Looking at the current arguments together, it's difficult to conclude that "Binance has lost its throne." Binance remains the most important liquidity hub. But what I think is truly alarming is not that Binance's market share has been surpassed in the short term by any specific second-tier player, but rather that Binance is facing continuous structural challenges in its core trading arena.

What Binance is losing is not market share, but the power to define "what an exchange is".

For a long time, Binance was considered the "world's largest exchange" not only because of its highest liquidity, but also because—where price discovery occurs, where mainstream funds trade, and which exchange to test new assets on first—the industry's default answer was Binance.

However, as more and more high-net-worth accounts prioritize "verifiability, fairness, and traceability" over transaction fees and brand, as price discovery begins to be reorganized on-chain, and as the testing ground for new assets gradually shifts from the back-end of exchanges to verifiable market mechanisms on the front end, Binance is not facing the challenges of similar competitors in its most proficient and core area, but rather competitors that may bring about a paradigm shift in the industry.

While the article discusses some specific categories, the underlying issue is the core value of exchanges as a whole: where do prices originate, and who endorses trust?

Perhaps Binance should consider how deep its moat is.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush