Author: Go2Mars' Web3 Research

I. What is market prediction?

First, let's clarify a concept: prediction markets are not gambling, but rather probabilistic predictions of upcoming events. They are market mechanisms based on trading based on the outcomes of future events. Essentially, they are tools that utilize collective wisdom to predict the probability of uncertain events occurring. Participants express their views on the event's outcome by buying and selling "contracts," the value of which ultimately depends on whether the event occurs or what its outcome is. The focus is on information aggregation and predictive accuracy.

In short, the prediction market is similar to trading the "outcome of future events." Participants don't buy stocks, but rather buy and sell judgments about whether an event will occur "yes" or "no." For example, for the event "Will Biden win the 2024 US presidential election?", the market will issue "Yes" contracts and "No" contracts. The contract price directly reflects the market's consensus probability of the event occurring: if the "Yes" contract price is $0.60, it means the market believes there is a 60% probability that Biden will win.

Prediction markets typically use binary contracts (Yes/No contracts), but can also be extended to multi-outcome events. Their advantage lies in incentivizing participants to reveal true information through market incentive mechanisms, thereby improving prediction accuracy.

II. Order Book Transactions in Prediction Markets

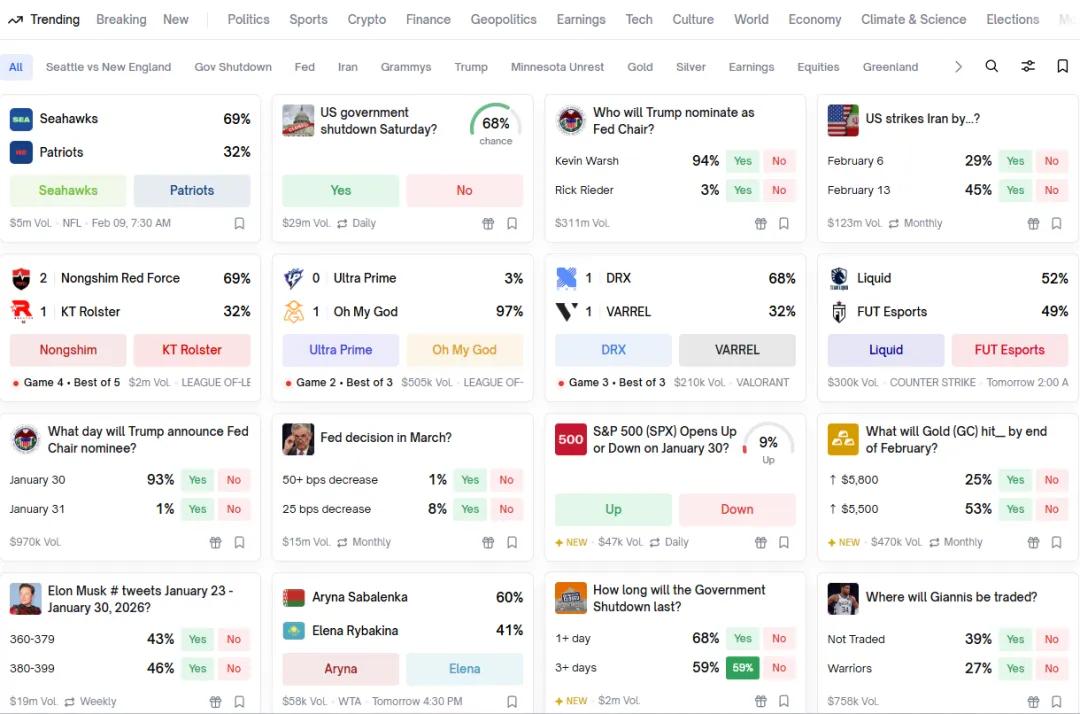

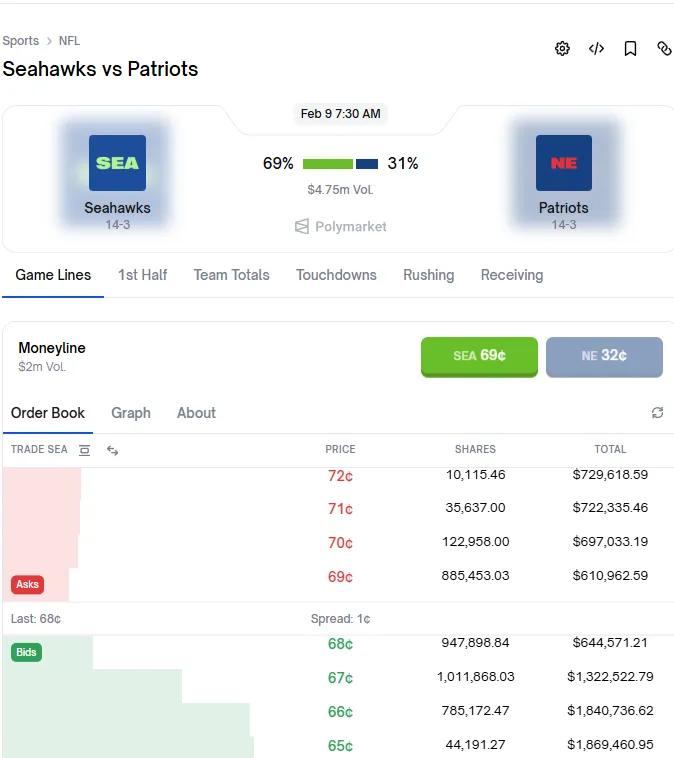

Platforms like Polymarket employ a Central Limit Order Book (CLOB) model, similar to traditional centralized exchanges (such as stock markets). In this model, prices are no longer preset by algorithms but are driven in real-time by buyers and sellers submitting limit orders. Market prices are determined by supply and demand, reflected in the matching of the best bid and ask prices.

Recall what we said earlier: contract prices reflect the market's probability of an event occurring. Indeed, the order book model aligns perfectly with the concept of prediction markets. It allows the market to dynamically adjust probability estimates. However, it's important to note that market prices (market probabilities) don't always perfectly reflect the true probability of an event. Prices can be skewed by FOMO sentiment, independent information channels, or market maker behavior. This creates arbitrage opportunities: identifying value mismatches and buying the undervalued side.

III. How to Arbitrage

There are many arbitrage opportunities in the prediction market, and participants typically play two roles:

Role A: Market maker/liquidity provider buys the undervalued side and sells the overvalued side when odds are extreme, and closes the position to profit when the price returns to rationality.

Role B: The directional neutral arbitrageur predicts the market's direction while using perpetual contracts to hedge against directional risk. The focus is not on betting on whether the market will rise or fall, but on locking in profits by exploiting odds discrepancies.

The specific arbitrage methods are described below. Please note that all arbitrage strategies are not risk-free and are affected by market sentiment, fees, and liquidity constraints.

3.1 Seeking opportunities for value mismatch

Unlike traditional betting where there are fixed odds from the bookmaker, polymarkets determine prices in real time based on user supply and demand. Markets are easily influenced by emotions, leading to price distortions. Prices are determined by supply and demand, forming a "probability." By scanning a large number of events and combining this with human judgment, we identify opportunities where market prices do not match true value, and buy into the undervalued sector.

Note: The market may not correct itself (sentiment may persist), or your probability estimate may be incorrect. It is not risk-free.

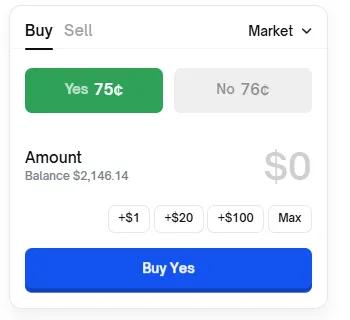

3.2 In-site arbitrage

Basic idea: For the same event, the sum of the Yes and No contract prices should equal 1 (or the sum of multiple outcome events should equal 1). If a deviation occurs, arbitrage can be profited from.

If the total is greater than 1 (the market is generally overvalued): Short the overvalued side and lock in profits.

If the total is less than 1 (the market is generally undervalued): Buy all possible outcomes, and you will definitely make a profit upon settlement (total value ≥ 1).

Basic idea: YES + NO does not equal 1 or the sum of multiple results does not equal 1.

Note: This strategy is susceptible to the following factors:

Transaction fees

Slippage (price fluctuations caused by large orders)

Transaction limits and platform position restrictions

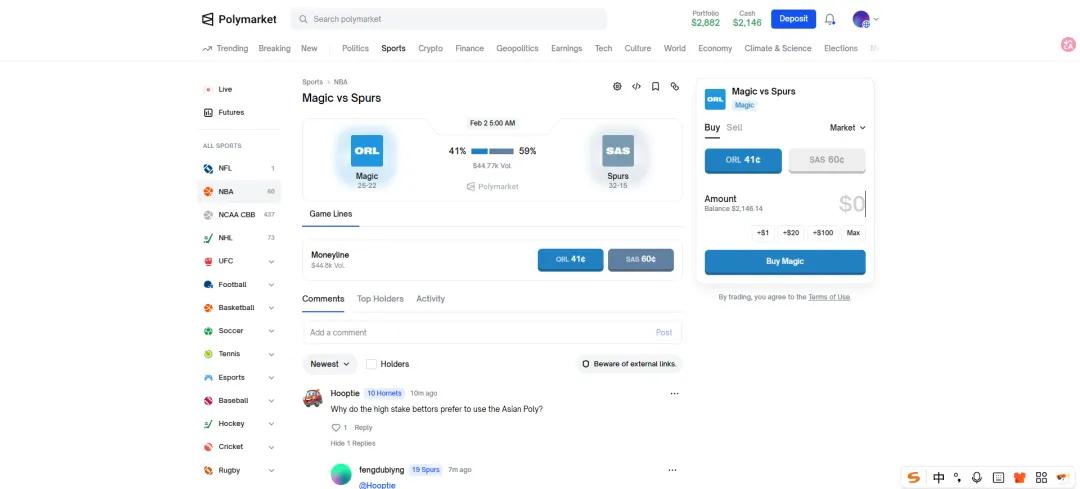

3.3 Cross-platform arbitrage

The same event may have different odds on different platforms (such as Polymarket and Kalshi). Suppose platform A has higher odds for "the event will happen" (market is bullish) and platform B has higher odds for "the event will not happen" (market is bearish). If both platforms describe the same event, you can place bets on both platforms at the same time.

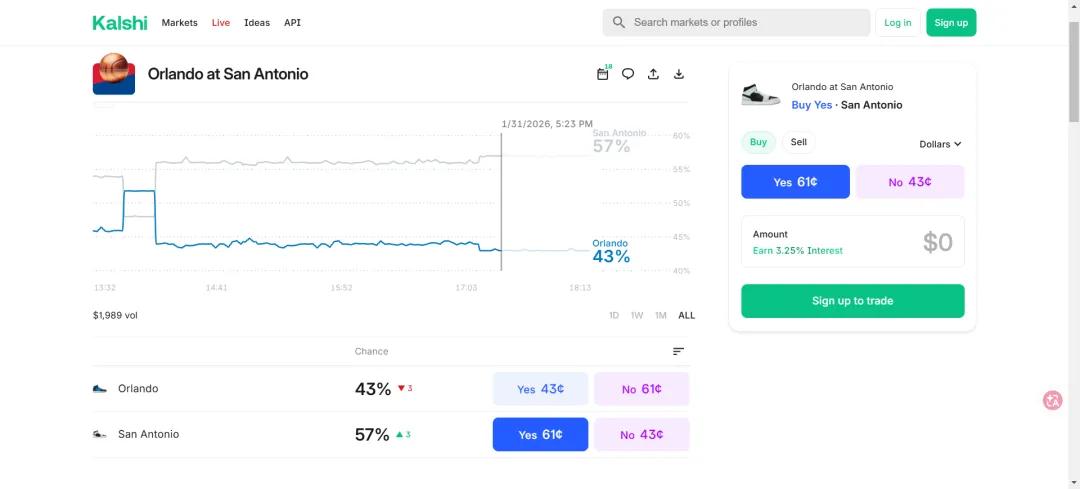

By comparing the actual odds on the Polymarket and Kalshi platforms, we can obtain a table.

platform | Magic (ORL) | Spurs (SAS) |

polymarket | 41% | 60% |

Kalshi | 43% | 57% |

If you bet on the Magic to win (41¢) on platform B and the Spurs to win (57¢) on platform A, the total cost = 41¢ + 57¢ = 98¢.

Regardless of which team wins, you will receive a settlement of $1 (100¢).

Net income = 100¢ - 98¢ = 2¢, rate of return ≈ 2%

Important Notes: Transaction fees, transfer costs, and discrepancies in settlement between platforms may erode profits. Ensure consistency in event definitions.

IV . Summary and Action Arbitrage

The prediction market is rife with automated bots and professional market makers, who capture the vast majority of profits through efficient algorithms and specialized techniques. As ordinary participants, we need to reflect on our competitive advantages when facing these procedural mechanisms. Since we cannot monitor all arbitrage opportunities through high-frequency scanning, we should incorporate more subjective judgment.

Combining AI-assisted tools with an individual's profound insights into specific events and domains will become a key path to standing out. This collaborative approach can effectively compensate for the blind spots of algorithms and achieve differentiated profits.

Action recommendations:

Record keeping and review: For each bet, record the position size, hedging details, and expiration result in detail. Then review and analyze: Are there any anomalies where the sum of Yes/No contract prices deviates significantly from 1? Are there any mismatches such as inverted price ranges? Optimize future decisions through review.

Semi-automated monitoring: Utilize market tools or develop scripts or robots to monitor odds deviations in real time and issue alerts, improving efficiency rather than relying on manual operation.

Small-scale live trading verification: Run the entire process with a very small amount of capital, including predicting market betting and perpetual hedging, to verify the feasibility of the strategy and accumulate practical experience.

Always remember: markets are unpredictable, and arbitrage must be combined with rigorous risk management and continuous learning.