Most tokens don't capture any value from their protocol.

$SYRUP is different.

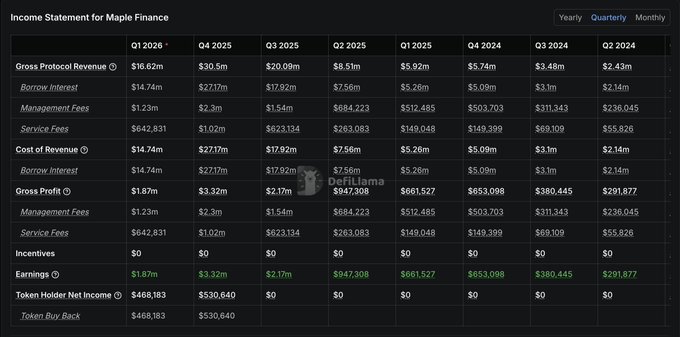

➢ Generated $16.62M in gross revenue in Q1 so far

➢ $1.87M in earnings

➢ $468K distributed directly to token holders via buybacks

➢ 89% of inflows go back to lenders

➢ The remaining 11% margin funds the protocol and staker rewards

This is what real tokenomics looks with evenue generating and value accruing.

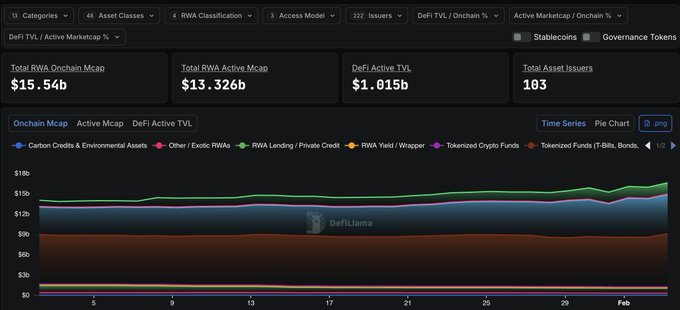

The RWA sector is still tiny ($15B market cap). TradFi capital will keep flowing onchain making protocols with actual cashflows like @maplefinance win in the longterm.

Revenue backed tokens win as real cashflows attract inevitable TradFi capital.

That's what make institutions look at them

SyrUP Only moment.

SyrUP only

only few protocols have positive rev these days

syrup is something big

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content