Source: Tiger Research

Author: Ryan Yoon

Original title: Is This a Crypto Winter? Post-Regulation Market Shift

Compiled and organized by BitpushNew

As the market enters a downturn, skepticism about the crypto market is growing daily. The core question now is: Have we already entered a "crypto bear market "?

Key points

The evolution of the Crypto Winter: Major events → Collapse of trust → Talent drain.

The unique characteristics of this cycle: The past downturn was caused by internal problems; while the current surge and plunge are driven by external factors. We are currently experiencing neither a "winter" nor a "spring."

The post-regulation three-tier market structure: The market has split into compliant zones, non-compliant zones, and shared infrastructure; the past "trickle-down effect" has disappeared.

Limitations of ETF funds: Funds remain within Bitcoin and do not flow outside the compliant zone.

The prerequisite for the next bull market is the emergence of a "killer app" coupled with a favorable macroeconomic environment.

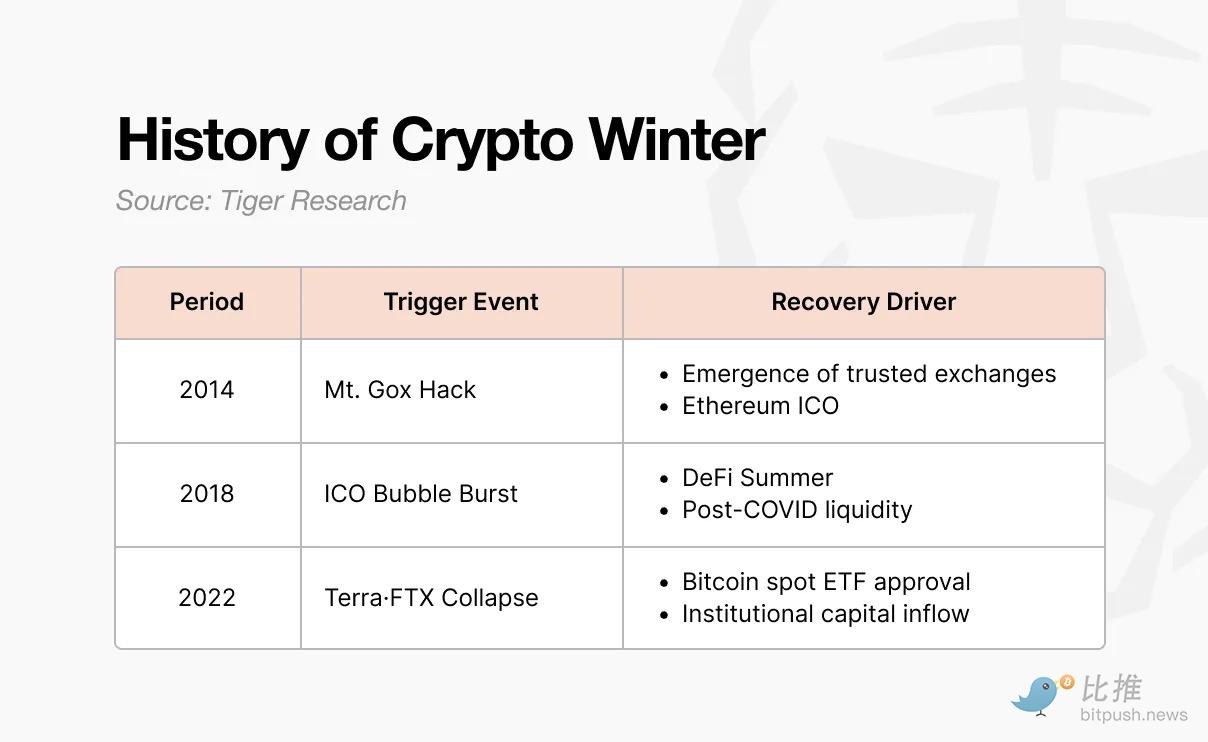

1. How have the various Crypto Winter evolved?

The first Bitcoin winter occurred in 2014. At that time, the Mt. Gox exchange handled 70% of global Bitcoin trading volume. Due to a hack, approximately 850,000 BTC vanished, and market trust completely collapsed. Subsequently, various new exchanges with internal controls and auditing capabilities began to emerge, and trust was slowly restored. Meanwhile, Ethereum was born through ICOs (Initial Coin Offerings), showcasing a new vision and financing method to the industry.

This ICO model became the spark that ignited the next bull market. The frenzy of 2017 was ignited when anyone could issue tokens and raise funds. Projects raising tens of billions based solely on a white paper proliferated, but most lacked any real substance.

In 2018, South Korea, China, and the United States successively introduced stringent regulatory measures, leading to the bursting of the bubble and the arrival of a second financial winter. This winter lasted until 2020. After the COVID-19 pandemic, liquidity began to flow in, and DeFi protocols such as Uniswap , Compound , and Aave gained attention, with funds returning to their original focus.

The third downturn was the most severe. The Terra-Luna crash in 2022 triggered the collapses of Celsius , Three Arrows Capital, and FTX. This wasn't just a simple price drop; it shook the entire industry structure. It wasn't until January 2024, when the U.S. Securities and Exchange Commission ( SEC ) approved a Bitcoin spot ETF, that funds began to flow in again, accompanied by Bitcoin halvings and Trump's pro-cryptocurrency policies.

2. The pattern of the Crypto Winter: Major event → Collapse of trust → Talent loss

The previous three economic downturns all followed the same evolutionary logic: a major negative event triggered a collapse of the trust system, ultimately leading to a large-scale loss of talent.

It all started with major events: whether it was the Mt.Gox hack, the ICO crackdown, or the Terra-Luna collapse and subsequent FTX bankruptcy, although the scale and form varied, the result was the same—the entire market was plunged into turmoil and panic.

Spreading to a collapse of trust: The shock quickly turned into a crisis of trust. People who had been discussing "what to build next" began to question whether encryption technology truly had any practical value. The collaborative atmosphere among builders disappeared, replaced by mutual blame.

This has led to a brain drain: Doubts about the future have caused talent to leave. Those who once fueled the blockchain revolution have become pessimistic. In 2014, they flocked to fintech and large companies; in 2018, they moved to traditional institutions and the AI field. They left for places that seemed more certain.

3. Is it the Crypto Winter now?

On the surface, some of the signs of the past Crypto Winter are still clearly visible today:

Major events:

Trump memecoin: Its market capitalization once reached $27 billion in a single day, before plummeting by 90%.

The "10.10" liquidation event: The United States announced a 100% tariff on China, triggering the largest liquidation wave in Binance's history (US$19 billion).

Trust collapses: Skepticism spreads within the industry, and the focus of discussion shifts from "building" to "passing the buck."

Talent drain pressure: The AI industry is growing rapidly, offering a faster and more lucrative path to monetization than cryptocurrencies.

However, it's difficult to define the current situation as a typical "Crypto Winter." Past winters have erupted from within the industry—the Mt. Gox hack, ICOs going to zero, and the FTX collapse were all examples of the industry destroying itself.

The situation is completely different now:

The approval of ETFs triggered a bull market, while tariff policies and interest rate changes drove a decline. External factors both boosted and dragged down the market.

The builders did not leave either:

New narratives such as RWA (Real-World Assets), perpDEX (Perpetual Contract Exchange), prediction markets, InfoFi, and privacy protocols are emerging and continuing to evolve. While they haven't driven a broad-based surge like DeFi did in its heyday, they haven't disappeared. The industry fundamentals haven't collapsed; only the external environment has changed.

Just as we did not create this "warm spring" ourselves, there is currently no such thing as a "cold winter".

4. Fundamental changes in the market structure after regulation

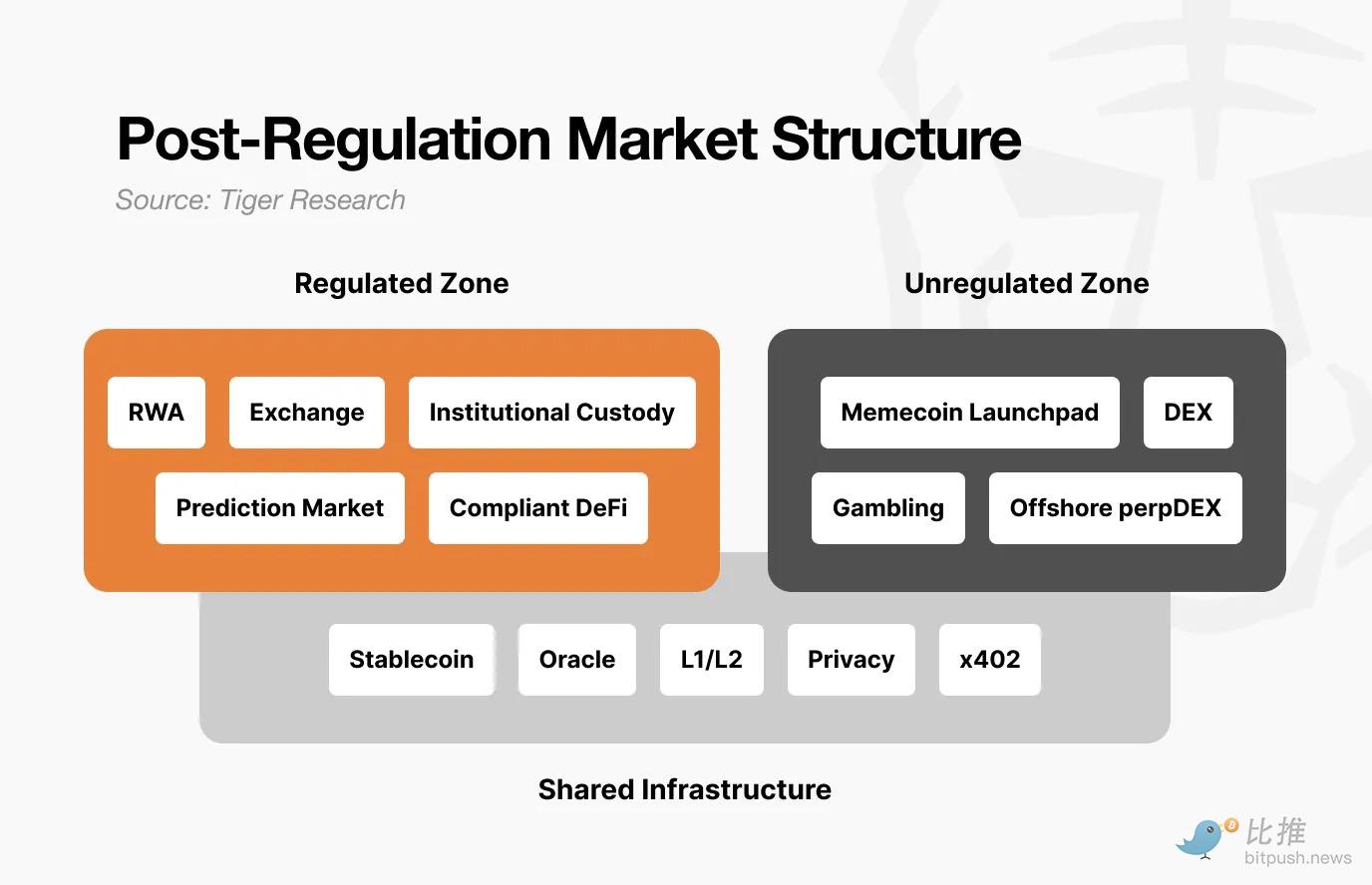

Behind this phenomenon lies a profound evolution in the post-regulatory market structure. Currently, the market has differentiated into three levels: 1) the compliant zone, 2) the non-compliant zone, and 3) shared infrastructure.

The compliant zone includes RWA tokenization, licensed exchanges, institutional custody, legitimate prediction markets, and compliant DeFi. These areas are audited, fulfill disclosure obligations, and are protected by law. While growth is slower, the amount of capital is substantial and stable.

Features: Once in the compliant zone, it's difficult to expect the explosive, hundredfold returns of the past. Volatility decreases, the upper limit is limited, but the lower limit is also guaranteed.

Non-compliant zone: This sector will become even more speculative in the future. Low barriers to entry and rapid pace will make it commonplace for stocks to surge 100 times today and plummet 90% tomorrow.

Significance: This space is not meaningless. The non-compliant zone is a cradle of creativity; once a sector proves effective, it will move to the compliant zone (like DeFi in its early days and prediction markets today). It serves as an "experimentation ground," but it will increasingly become detached from compliant businesses.

Shared infrastructure: This includes stablecoins and oracles. They serve two regions simultaneously. The same USDC can be used for both institutional-grade RWA payments and speculative trading on Pump.fun; oracles provide data verification for tokenized treasuries and support liquidation for anonymous DEXs.

This differentiation has altered the flow of funds.

In the past, Bitcoin's rise would trigger a "drip-drip effect," causing Altcoin to rise as well. Now things are different: institutional funds entering through ETFs stop flowing into Bitcoin, and funds in compliant markets no longer flow into non-compliant markets. Liquidity only stays where value is proven. Even Bitcoin itself, as a safe-haven asset, has not yet been fully proven in the face of riskier assets.

5. Conditions for the next bull market

The regulatory framework is being developed, and the builders are still working on it. Two more conditions need to be met:

New "killer applications" are emerging in non-compliant zones: Something capable of creating entirely new value, similar to the "DeFi Summer" of 2020, must emerge. AI agents, InfoFi, and on-chain social networking are potential candidates, but none have yet reached a scale that will impact the entire ecosystem. A virtuous cycle of "experimentation in non-compliant zones → successful validation → migration to compliant zones" must be established again.

Macroeconomic environment is crucial: Even with regulatory easing, developer efforts, and infrastructure improvements, upside potential remains limited if the macroeconomic environment is unfavorable. The 2020 DeFi boom coincided with the global monetary easing following the pandemic; the 2024 ETF rally also coinciding with expectations of interest rate cuts. No matter how well the crypto industry performs, it cannot control interest rates and liquidity. For the value built within the industry to gain widespread acceptance, the macroeconomic environment must reverse.

A crypto season with the kind of broad-based gains of the past is unlikely to repeat itself. The market has become completely fragmented. The compliant sector will see steady growth, while the non-compliant sector will continue to experience wild volatility.

The next bull market will eventually arrive, but it won't favor everyone.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush