Author: Zhou, ChainCatcher

Since the 1011 liquidation event triggered a chain reaction, liquidity in the crypto market has remained sluggish, with spot trading volume on major CEXs falling to its lowest level since 2024 .

Looking at major global assets, from the second half of 2025 to the beginning of 2026 , safe-haven assets such as gold and silver continued to rise strongly, while the AI theme in US stocks dominated index performance.

At the same time, major crypto exchage are also actively developing precious metals / commodities / foreign exchange contracts and tokenizing US stocks, seeking to break through by leveraging the bull market in external assets.

Exchange traffic dilemma

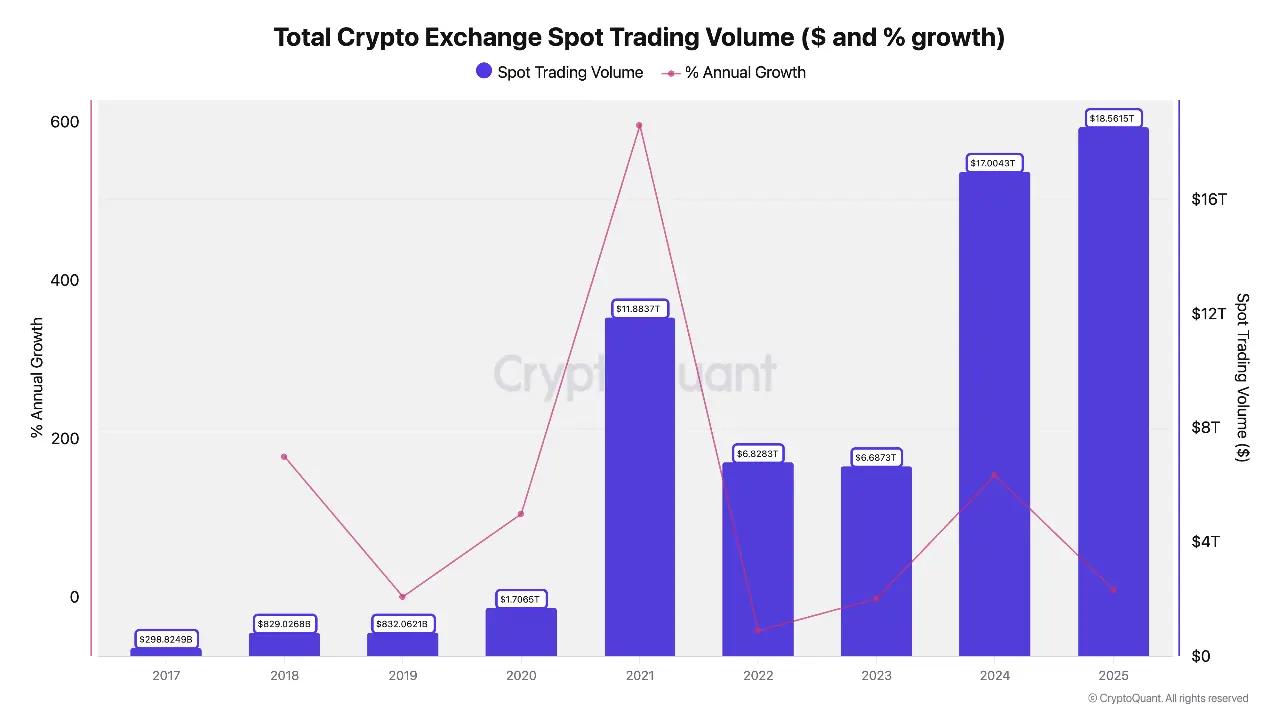

According to a CryptoQuant report, the total spot trading volume of cryptocurrencies in 2025 will be $ 18.6 trillion, a year-on-year increase of only 9% , far lower than the explosive growth of 154% in 2024 ; although the total trading volume of perpetual futures will reach $ 61.7 trillion, a year-on-year increase of 29% , the growth rate has slowed down significantly, especially with the inflection point appearing in the second half of the year.

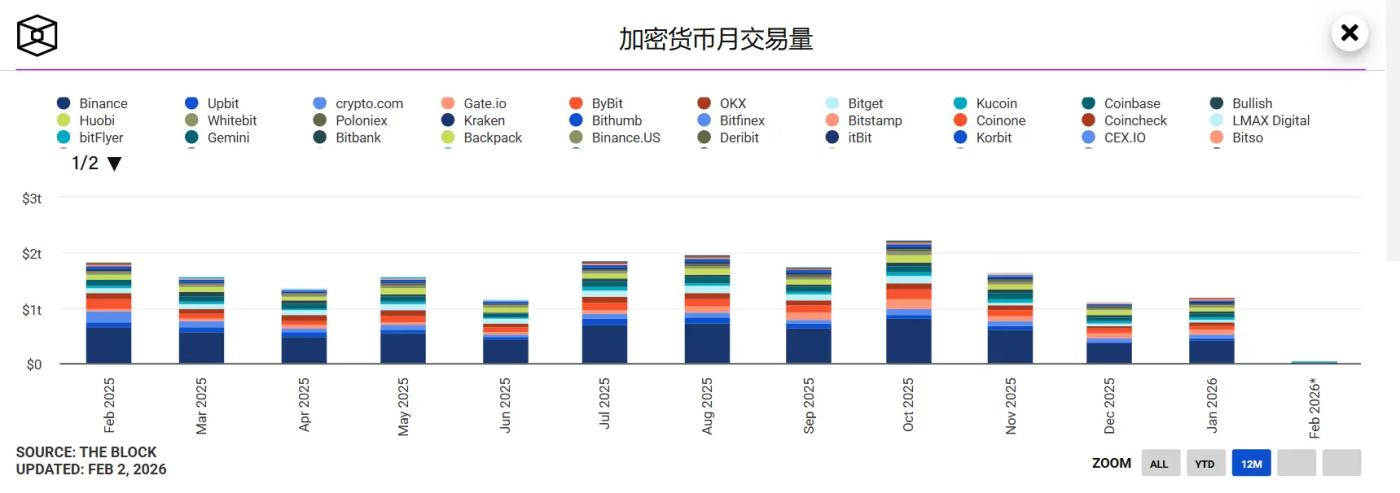

The situation worsened further in 2026. Data shows that spot trading volume on major CEXs plummeted from approximately $ 2 trillion in October 2025 to around $ 1 trillion in January , falling to its lowest level since 2024 .

The situation worsened further in 2026. Data shows that spot trading volume on major CEXs plummeted from approximately $ 2 trillion in October 2025 to around $ 1 trillion in January , falling to its lowest level since 2024 .

The market generally believes that the trigger for this wave of liquidity contraction was the 1011 liquidation event. On that day, the scale of leveraged liquidations reached a record high, destroying a large amount of liquidity and directly leading to a subsequent collapse in spot demand.

Bitcoin's current price has fallen by about 37.5% from its October high. The low volatility environment has led to a wait-and-see attitude among traders, resulting in a decline in both user activity and trading frequency.

Taking Binance as an example, its monthly spot trading volume of Bitcoin has dropped from about $ 200 billion in October to $ 104 billion currently, and even the leading platforms are not having an easy time.

The most direct feeling for ordinary investors is that the rotation of Altcoin is getting weaker and weaker, and the price of meme coins comes and goes quickly. It seems that funds are no longer willing to stay in the crypto ecosystem and some have flowed to traditional channels such as ETFs or the Chicago Mercantile Exchange ( CME ).

On the other hand, a Delphi Digital report points out that decentralized platforms focusing on perpetual futures trading are developing rapidly. CoinGecko data shows that by the end of 2025, the market share of DEXs surged from 2.1% to 11.7%, and total trading volume also jumped from $4.1 trillion at the beginning of 2025 to over $12 trillion by the end of the year. Meanwhile , traditional brokers (such as IBKR and Robinhood ) are also quietly vying for high-net-worth users with their crypto products.

Simply put, the old approach of relying solely on listing new coins or internal incentives to attract traffic is no longer viable.

At the macro level, Federal Reserve policies, geopolitical risks, and the narrative of a strong dollar have suppressed risk appetite; in terms of market structure, Bitcoin still dominates, Altcoin liquidity is getting worse, and high-leverage liquidations are repeatedly undermining investor confidence.

In addition to weak demand, market liquidity is also under pressure. Analysts say that the continued outflow of stablecoins from exchanges, coupled with a decrease of approximately $ 10 billion in the total market capitalization of stablecoins, has further weakened the buying base.

As a result, the growth path of leading exchanges has been cornered: continuing to cling to a purely crypto-centric internal cycle is no longer sufficient to sustain scale expansion. The bull market in external assets has become the only visible window for growth at present.

Go with the flow and break through the limitations of all assets?

Crypto exchage are inevitably seeking new growth opportunities; and the on-chaining of traditional assets is also an industry trend.

The trading pace of traditional markets can no longer keep up with the habits of today's investors. Market conditions never wait for anyone, and real volatility often occurs on weekends, during night trading sessions after geopolitical events, or during breaking news in Asian trading hours.

Crypto users are already accustomed to being able to enter and exit anytime, 24/7 , and to seizing opportunities quickly with high leverage.

Precious metals, commodities, and US stocks—assets with real value—fill this gap perfectly: users can settle with USD stablecoins and participate in the bull market and volatility of external assets around the clock with high leverage, without leaving their familiar crypto platforms.

This is precisely the key logic behind how crypto exchage have found new growth points amid a downturn in pure crypto spot trading.

Since the second half of 2025 , during the period when spot prices of gold and silver have been rising, exchanges have launched a number of related perpetual contracts and reaped the first wave of benefits.

Data shows that Binance's XAUUSDT once saw a peak daily trading volume of nearly $ 300 million, while XAGUSDT reached nearly $ 500 million, far exceeding most Altcoin spot and futures trading.

Entering the early February correction and consolidation phase, gold prices fell from their highs to the $ 4,500 to $ 5,000 range, while silver rebounded after a 30% plunge. The sharp price fluctuations continued to stimulate speculative and hedging demand.

According to Coinglass data, the 24- hour trading volume of Gate XAUT contracts still reached $ 300-500 million during the pullback period, ranking among the top three global assets.

At the same time, all platforms are accelerating the pace of their expansion into non-native crypto asset businesses.

Gate.com launched a celebration event for the launch of TradeFi , establishing a $ 150,000 trading reward pool. Data shows that since its launch, Gate.com's total trading volume has exceeded $ 20 billion, with a peak daily trading volume exceeding $ 5 billion.

Binance is attracting users to trade by reducing transaction fees, announcing a phased zero-fee order placement and 50% discount on takers for XAG and XAU perpetual contracts; exchanges such as MEXC and Bitget are increasing leverage to over 100x and expanding their forex and index contracts.

Furthermore, the tokenization of US stocks is another structural opportunity that crypto exchage are targeting. Currently, the "Seven Sisters" stocks and AI themes are still dominating index performance, and stock tokenization allows crypto users to bet on the US stock market bull run 24/7 without having to go through traditional brokers.

Data shows that in the second half of 2025 alone, tokenized stocks grew by 128% , pushing the total asset value to nearly $ 1 billion.

Currently, Robinhood has listed over 2,000 US stock tokens in the EU and plans to introduce 24/7 trading and DeFi features, including self-custody, lending, and staking; Kraken 's xStocks covers more than 50 tokenized stocks; and Bybit and MEXC 's perpetual contracts focus on popular US stocks such as NVDA and TSLA .

It is worth noting that the guidance issued by the U.S. SEC on January 28 categorizes tokenized securities into direct issuance and third-party models, reducing compliance uncertainty.

Robinhood CEO Vlad Tenev emphasized that on-chain real-time settlement can avoid the risk of transaction freezes like GameStop in 2021. With the SEC exploring tokenized securities and Congress advancing the CLARITY Act, this is a critical window of opportunity to push for the implementation of a regulatory framework for stock tokenization.

Tenev points out that although the settlement cycle for US stocks has been shortened from two days to one day, settlement can still extend to three to four days on Fridays or during long holidays, and systemic risks remain. He believes that tokenizing stocks and putting them on the blockchain can enable real-time settlement, thereby reducing the risk exposure of clearing houses and brokers and alleviating market pressure during periods of high volatility.

How to influence crypto investors?

Currently, the market's overall attitude towards crypto exchage offering various derivatives is positive. Many traders believe that these products represent a friendly new battleground for crypto players.

Essentially, it's a leveraged perpetual contract, operating almost identically to BTC or ETH contracts. The bull market benefits of traditional assets are fully packaged into the efficiency tools of the crypto platform, allowing users to adjust positions and hedge systemic risks at any time.

Many believe that this is the ultimate form of decentralized exchanges: bringing truly valuable assets into a 24/7 ecosystem, freeing traders from the limitations of traditional trading sessions.

However, another voice in the market believes that this wave of TradFi's move into encryption may bring hidden harm, or even be a case of drinking poison to quench thirst.

On the one hand, funds have clearly shifted from spot and futures trading of BTC , ETH , and Altcoins to perpetual contracts for precious metals, leading to a further depletion of liquidity in native crypto assets. The original crypto narrative and stories have been marginalized, attention to innovative themes has declined, and platforms are increasingly resembling CFD casinos rather than crypto infrastructure.

On the other hand, the combination of high leverage and the dramatic fluctuations in precious metals significantly amplifies the risks. For example, a single-day pullback of over 30% in silver resulted in margin calls far exceeding those of pure crypto assets. This is not simply a user-friendly tool; it directly grafts the inherent leverage and gambling nature of cryptocurrencies onto traditional assets. Retail investors who might have entered the market with the intention of preserving value or hedging could easily end up going All In, losing everything after a margin call.

Furthermore, regulatory risks cannot be ignored. While the guidance from the U.S. SEC has reduced some uncertainty, perpetual contracts and tokenized securities in the secondary market still exist in a gray area.

Pessimists worry that if the Claritical Act proceeds or the CFTC tightens its stance, precious metal contracts settled in USD-denominated stablecoins will become a primary target. Platforms may be forced to remove related products or face complete restrictions in certain jurisdictions, ultimately impacting the user experience globally.