Tether 's USDT has just reached a significant milestone, surpassing 534 million users, even as the crypto market as a whole remains under pressure following the sharp downturn that began in October 2025.

According to Tether's recent Q4/2025 USD₮ Market Report, the stablecoin added over 35 million new users last quarter, marking its eighth consecutive quarter of growth exceeding 30 million users.

USDT expands Vai role as a global store of value even as the total crypto market Capital shrinks.

This growth is occurring amidst declining risk appetite . Since the sell-off on October 10th, the total market Capital of cryptocurrencies has lost more than 30%. Despite this, the supply of USDT continues to increase slightly.

Tether reported that its market Capital increased to $187.3 billion, up $12.4 billion in Q4, even as some rival stablecoins saw their market Capital shrink.

Market Capital performance of USDT, USDC , and USDe. Source: TradingView

Market Capital performance of USDT, USDC , and USDe. Source: TradingViewTether argues that this stability is primarily due to the demand for savings, payments, and cross-border money transfers, rather than solely focusing on speculative trading.

The report also highlighted on-chain figures, showing an increase in the balance in long-term investor wallets and record-high volume .

However, the statistics on the total number of users include both on-chain wallets and the estimated number of users on exchanges, making independent verification difficult.

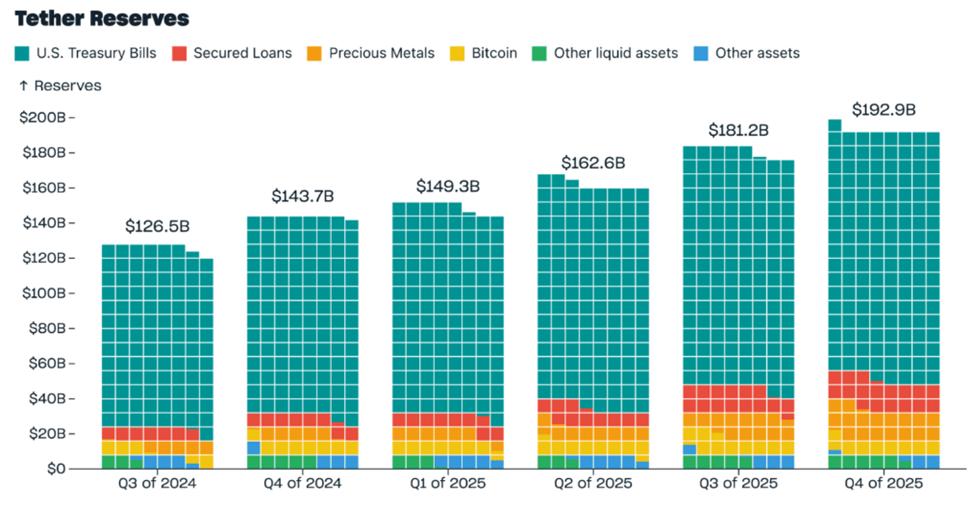

In addition, Tether 's reserves continue to increase. Total reserves reached $192.9 billion, of which $141.6 billion is in US government bonds. If it were a country, Tether would be among the top holders of these bonds in the world.

Tether's reserves. Source: Q4 2025 Market Report

Tether's reserves. Source: Q4 2025 Market ReportIn addition, the company also increased its Bitcoin holdings to 96,184 BTC and its gold reserves to 127.5 tons, demonstrating a strategy of diversifying its asset holdings beyond cash equivalents.

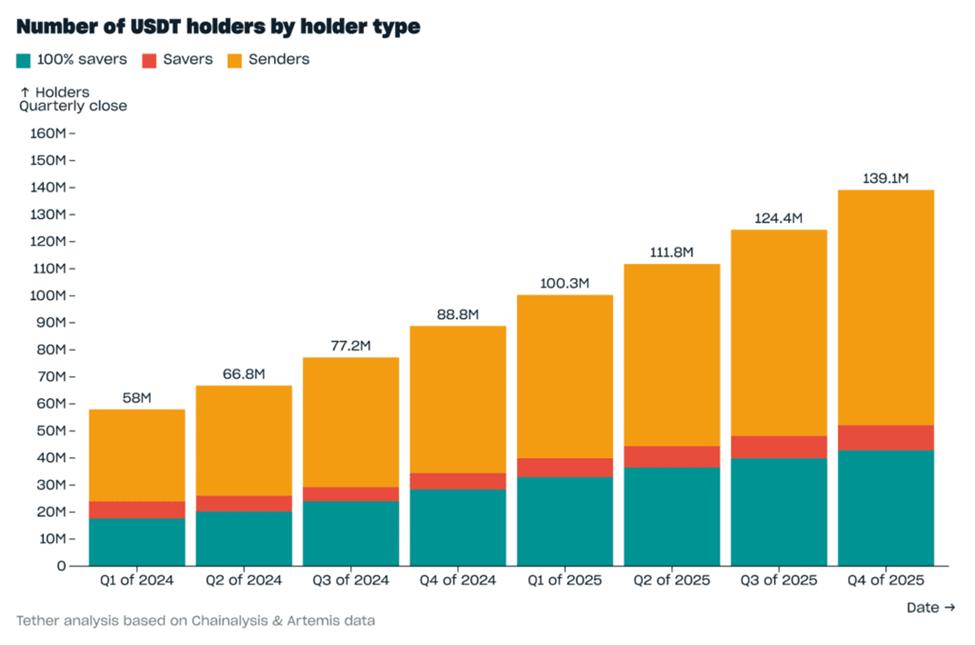

on-chain activity continues to thrive. The number of wallets holding USDT has increased to 139.1 million, while the number of monthly active users has reached 24.8 million – both new records.

Number of USDT holders by user group. Source: Tether Q4 2025 Report

Number of USDT holders by user group. Source: Tether Q4 2025 ReportIn Q4, the total value of on-chain transactions reached $4.4 trillion, while the share of USDT in spot volume on centralized exchanges reached 61.5%. This demonstrates the dominant role of USDT as a primary payment asset in the crypto market.

The surge in Mint volume, exchange rate fluctuations, and Flippening rumors suggest the growing systemic Vai of USDT.

Recent issuance activity suggests that demand for USDT will continue into early 2026. On February 4, 2026, blockchain analytics firm Lookonchain reported thatTether issued an additional $1 billion USDT , part of a total of nearly $3 billion in stablecoins that Tether and Circle created in just three days.

Large token releases are often XEM by traders as a signal that new money will flow into the market, although not all newly issued Token will immediately enter circulation.

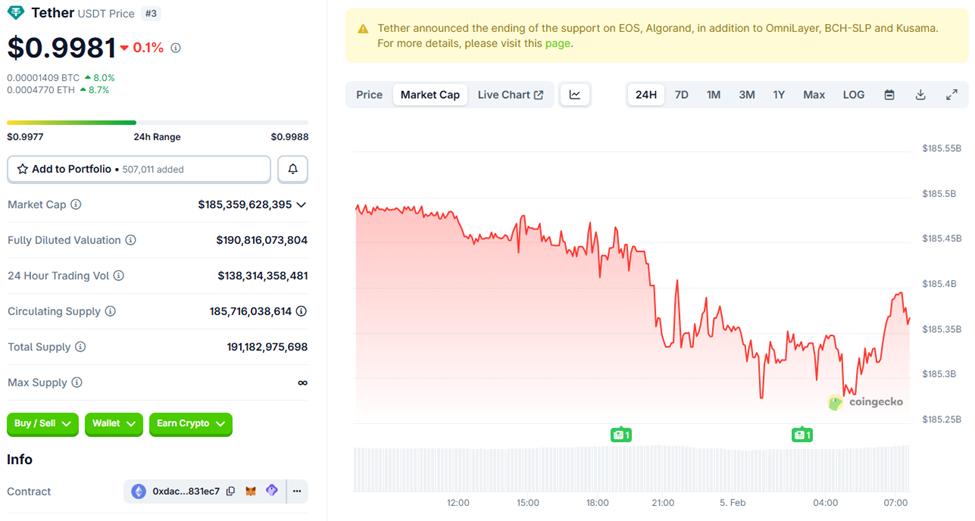

Simultaneously, Tether 's growing dominance has also brought the company under increased scrutiny. There was a period when USDT came under scrutiny when the Token dropped to around $0.9980 – its weakest level in over 5 years.

Although this difference is small and brief, if confidence in the ability to maintain a fixed price is eroded over the long term, the consequences could be significant because this stablecoin is a crucial foundation in the overall market trading structure.

Tether 's USDT has fallen below the $1 mark. Source: CoinGecko

Tether 's USDT has fallen below the $1 mark. Source: CoinGeckoMany estimates suggest that the majority of current crypto volume takes place through USDT pairs, making this stablecoin a key liquidation pillar of the market.

Tether 's expansion has also sparked debate about the stablecoin's position within the crypto ecosystem. Some market observers suggest that, if current trends continue, USDT could become a rival to Ethereum as the second-largest cryptocurrency by market Capital , especially during periods of risk aversion and capital flows into stable assets.

The latest data shows that USDT continues to expand in terms of user numbers, reserves, and volume, despite signs of a shrinking overall market.

However, this growth has concentrated liquidation and systemic importance in a single instrument. The stability of the Tether Peg exchange rate increasingly depends not only on one company but also on the resilience of the crypto market as a whole.