Author | Wu Blockchain Blockchain

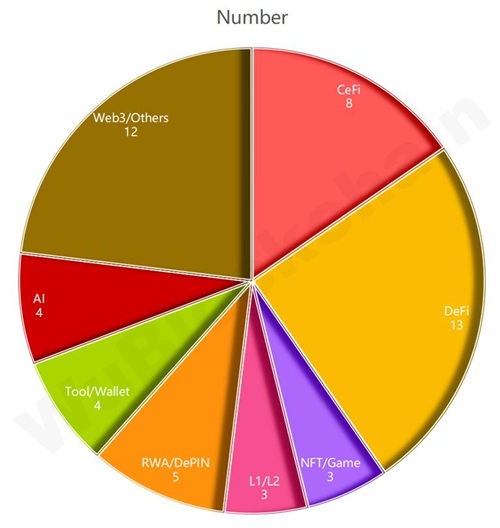

According to RootData statistics, in January 2026, there were 52 publicly disclosed venture capital projects in the Crypto VC sector, a 15% decrease month-over-month (61 projects in December 2025) and a 42% decrease year-over-year (89 projects in January 2025). Note: Since not all funding rounds are announced in the same month, the above statistics may increase in the future. The number of projects in each sector is as follows:

Of these, CeFi accounts for approximately 15%, DeFi approximately 25%, NFT/GameFi approximately 6%, L1/L2 approximately 6%, RWA/DePIN approximately 10%, Tool/Wallet approximately 8%, and AI approximately 8%.

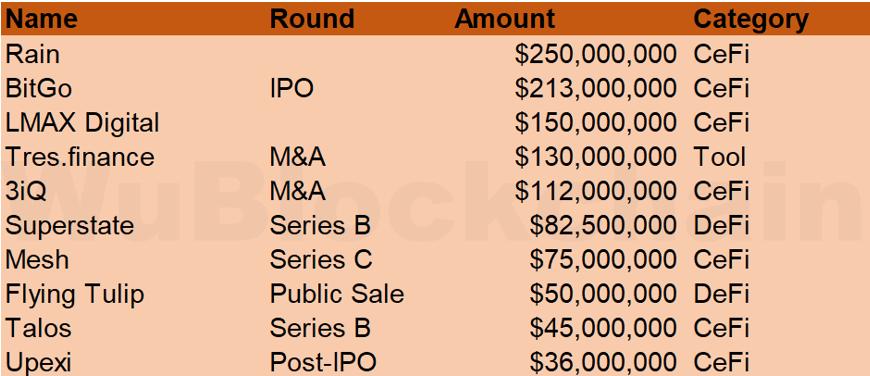

Total funding in January 2026 reached $14.57 billion, a 61% increase month-over-month (compared to $9.06 billion in December 2025) and a 497% increase year-over-year (compared to $2.44 billion in January 2025). The top 10 funding rounds by amount are as follows:

Stablecoin payments company Rain announced it has raised $250 million in its latest funding round, valuing the company at $1.95 billion. The round was led by ICONIQ, with participation from Sapphire Ventures, Dragonfly, Bessemer, Lightspeed, Galaxy Ventures, and others. Rain co-founder and CEO Farooq Malik stated that this round brings the company's total funding to over $338 million.

Crypto custody company BitGo priced its US IPO at $18 per share, higher than the previously announced range of $15 to $17. The company and existing shareholders sold 11.8 million shares, raising approximately $213 million and valuing the company at over $2 billion based on the current share capital. The IPO was underwritten by Goldman Sachs and Citigroup, making BitGo the first crypto company to complete an IPO in 2026.

Ripple and LMAX Group have entered into a multi-year strategic partnership agreement, with Ripple providing $150 million in funding to facilitate the widespread adoption of the RLUSD stablecoin as a margin and settlement asset within LMAX's global institutional trading system. The partnership also includes RLUSD custody through the LMAX Custody segregated wallet and integration with Ripple Prime.

Blockchain infrastructure company Fireblocks has acquired crypto accounting platform TRES Finance for approximately $130 million in a cash-and-stock deal. Fireblocks stated that the acquisition will complement its data analytics and financial management capabilities in the crypto space, helping businesses more comprehensively manage crypto assets scattered across multiple platforms and wallets. This transaction is Fireblocks' second acquisition in the past three months.

Coincheck has signed an agreement with Monex Group to acquire approximately 97% of the equity in Canadian digital asset management company 3iQ. Under the agreement, 3iQ is valued at approximately $112 million. Coincheck will issue 27,149,700 new shares to Monex Group at a price of $4.00 per share as consideration for the acquisition. The transaction is expected to close in the second quarter of 2026, at which point Coincheck plans to achieve 100% control of 3iQ through subsequent acquisitions. Founded in 2012, 3iQ launched some of the first Bitcoin and Ethereum funds listed on the Toronto Stock Exchange in North America and will launch the Solana staking ETF and XRP spot ETF in 2025.

Superstate has raised $82.5 million in Series B funding, led by Bain Capital Crypto and Distributed Global, with participation from Haun Ventures, Brevan Howard Digital, Galaxy Digital, Bullish, and ParaFi. This funding will be used to expand its blockchain-based IPO platform, Opening Bell, and to support on-chain issuance of SEC-registered stocks on Ethereum and Solana. Superstate currently manages over $1.23 billion in assets, primarily through the USTB (United States Government Securities Fund) and the USCC (Crypto Arbitrage Fund).

Crypto payment network Mesh has raised $75 million in Series C funding, bringing its total funding to over $200 million and valuing the company at $1 billion. The round was led by Dragonfly Capital, with participation from Paradigm, Moderne Ventures, Coinbase Ventures, SBI Investment, and Liberty City Ventures.

Andre Cronje's DeFi project, Flying Tulip, has raised further funds through private and public sales. The Series A private sale raised $25.5 million with a $1 billion FDV, bringing its total institutional funding to $225.5 million. Additionally, the project has raised $50 million through Impossible Finance's Curated platform and has reserved $200 million for its upcoming CoinList public sale.

Crypto asset market maker Talos has completed a $45 million Series B funding round, with Robinhood participating in an extended round, valuing the company at $1.5 billion. In addition to existing investors a16z crypto, BNY, and Fidelity Investments, Sony Innovation Fund, IMC, QCP, and Karatage also joined the round.

Upexi has entered into a securities purchase agreement with Hivemind Capital Partners to issue convertible notes with a principal amount of approximately $36 million to lock up SOL as consideration and pledge it. The notes carry an interest rate of 1.0% (paid quarterly), a fixed conversion price of $2.39 per share, and a term of 24 months. The transaction is expected to close on January 14, with no underwriters involved. Upon completion, the company's SOL reserves are expected to increase by 12% to over 2.4 million SOL.