On February 6, amid delayed releases of key economic data and a temporary lack of focus in policy guidance, market sensitivity to political events increased significantly. Trump's high-profile public endorsement of Sanae Takashi on the eve of the Japanese presidential election broke with the precedent of US presidents avoiding interference in allied elections, causing political uncertainty to be priced into risk in advance, leading to a tendency for funds to reduce exposure ahead of time.

The impact of this event extends beyond the Japanese election; it symbolizes a risk to policy continuity. The former US president's direct intervention in the domestic politics of a key ally through his personal influence has led markets to reassess future US-Japan relations, trade and tariff stances, and the stability of the Indo-Pacific strategy. In the absence of non-farm payroll data, political signals have become one of the few directional variables that can be interpreted in the short term.

At the cross-market level, the combination of election and geopolitical risks prompted some funds to become more conservative before the weekend, with a decline in risk appetite for yen-related positions and high-volatility arbitrage trades, reflecting that the market is not yet ready to expand risks again.

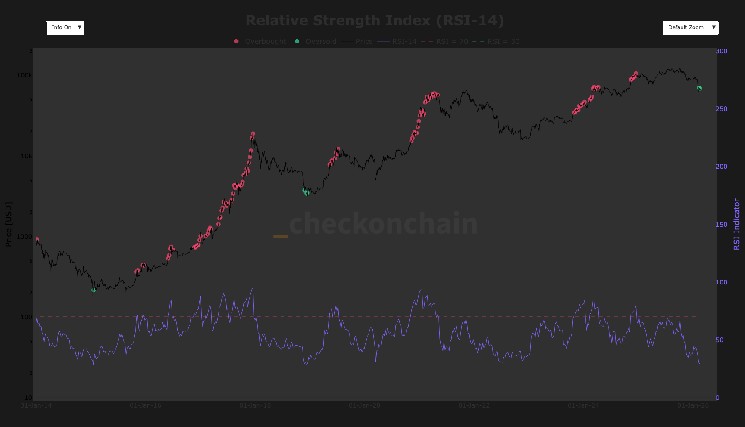

The crypto market at this stage is more of a reflection of overall risk sentiment. BTC has fallen back to near the weekly demand zone, currently priced around $66,000, with a key support level between $62,000 and $60,000. On the upside, it needs to regain the $71,000-$73,000 level for market risk appetite to improve. Until political uncertainty is digested, prices will likely remain in a consolidation phase and rebalancing after deleveraging.