Multicoin Capital launched on October 1, 2017. We started the firm with the view that crypto would eventually reshape global markets. Our logo, a phoenix, represents a new financial system rising from the ashes of the old one.

When we began, permissionless finance was hardly a known concept. Eight years later, it’s becoming a reality. Billions of people and key institutions, from top banks and payment companies to asset managers and the US government, now see crypto as the future of finance. The recent passage of the GENIUS Act and Congressional progress on the CLARITY Act suggest that adoption is on the precipice of real acceleration. We expect crypto to be built into every major operating system, browser, and app, often in ways users won’t even notice.

This post is a spiritual successor to our original Crypto Mega Theses essay from 2019. In that essay, we highlighted three big trends we saw for crypto: (1) Open Finance, (2) Global, State-Free Money, and (3) Web3.

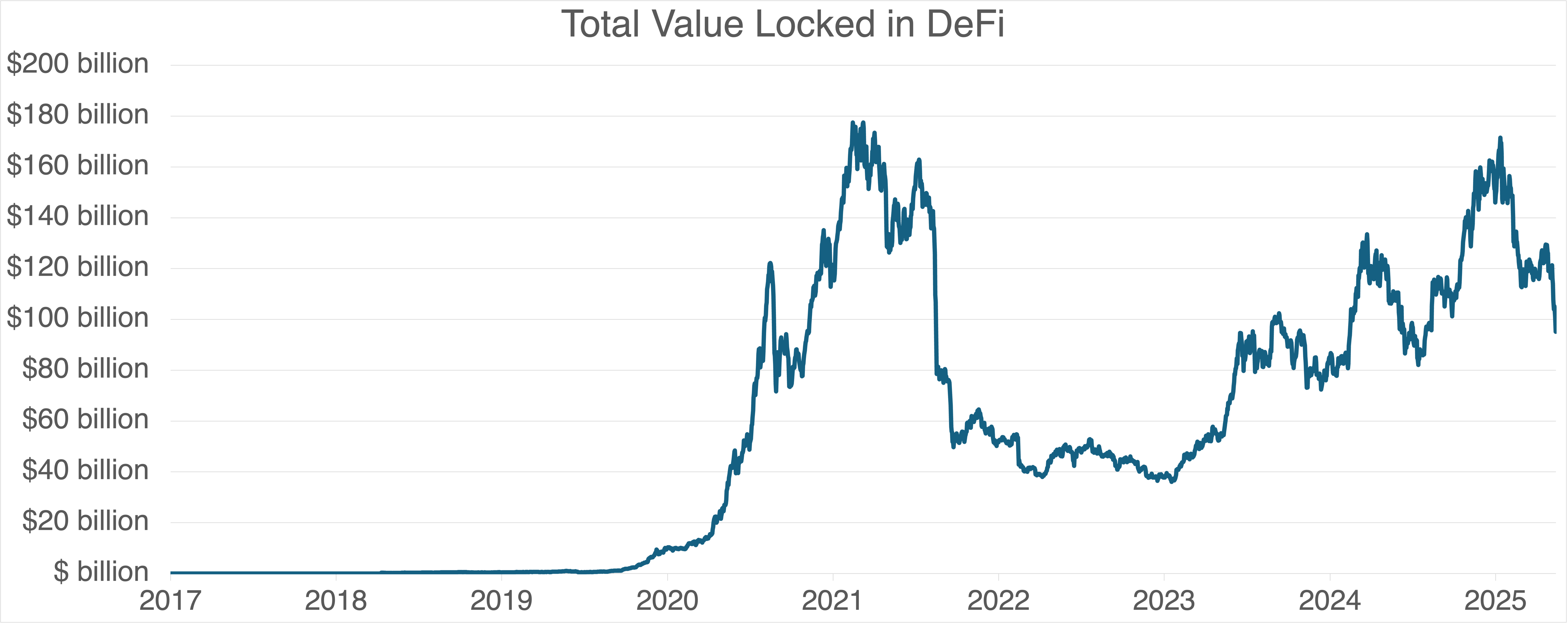

In the years since, our first mega thesis has absolutely exploded. Today, DeFi protocols manage $121 billion in capital, up from less than $1 billion in 2019 when we first published our theses.

Source: DefiLlama

Source: DefiLlama

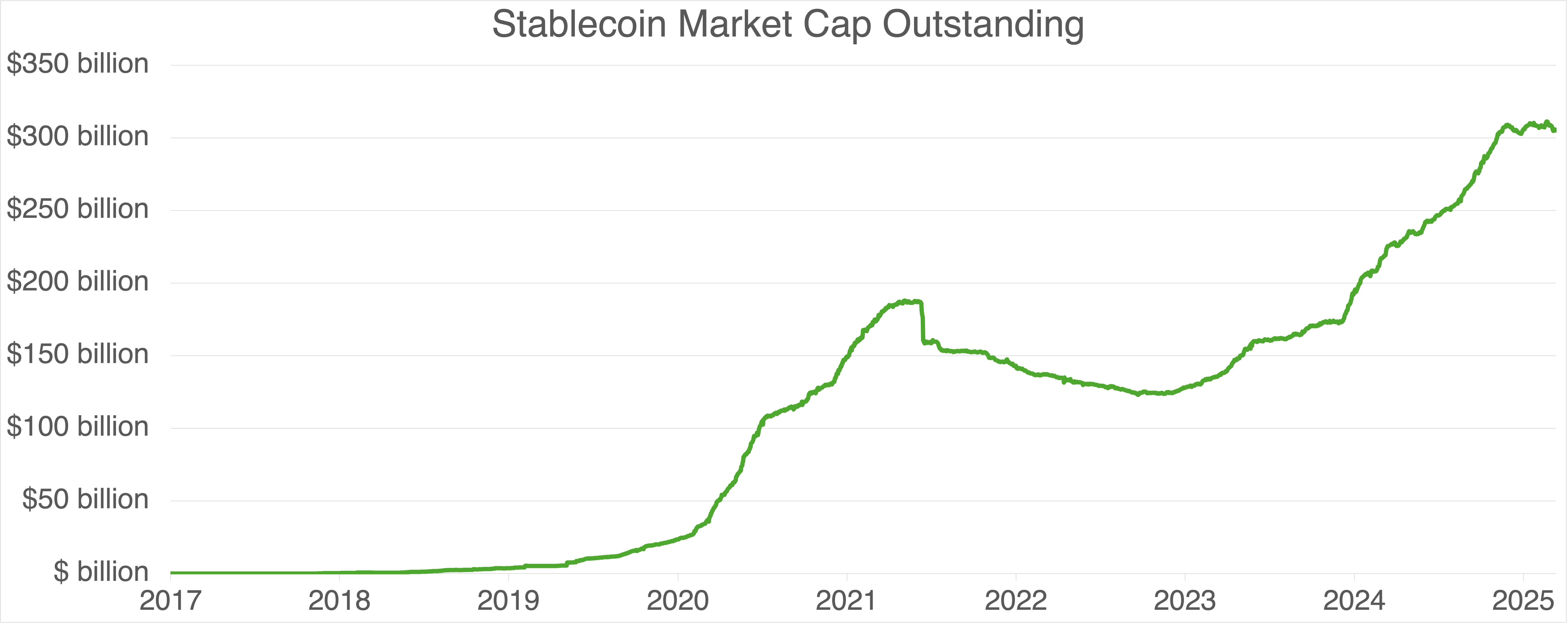

Stablecoins, another subsector within open finance, have also taken off. Aggregate stablecoin market cap has grown from under $1 billion when we published our Crypto Mega Theses to more than $310 billion today.

Source: DefiLlama

Source: DefiLlama

For most people, the U.S. dollar felt like the safest bet and the default way to store value. Lately, though, that trust has started to fade. After the U.S. froze Russia’s FX reserves and began using the dollar as a geopolitical tool, more countries have started to see America as a less reliable partner. Even well-known macro investors like Ray Dalio are now arguing that cash is trash.

Additionally, our second mega thesis, global state-free money, used to be seen as something only fringe libertarians and goldbugs cared about. For most people, USD felt like the safest asset and the default way to store value. Lately, though, that trust has started to fade. After the U.S. froze Russia’s FX reserves and began using the dollar as a geopolitical tool, more countries have started to see America as a less reliable partner. Even well-known macro investors like Ray Dalio are now arguing that cash is trash.

At the same time, years of fiscal dominance and unchecked government spending have weakened purchasing power at home, and political pressure on the Fed has raised doubts about its independence. All of these changes have made the idea of global, state-free money like BTC, ETH, and SOL a lot more compelling.

When SEC Chair Paul Atkins announced Project Crypto in July 2025, it was a turning point for the industry. The CFTC has joined that effort with a focus on harmonization with the confirmation of Chairman Selig. Programmable money and assets have stopped being treated as mere thought experiments and became the national priority they are today. The US’s regulatory framework is starting to take shape, and issuers, exchanges, brokerages, and large financial institutions are scrambling to get into position.

After eight years in this space and more than 100 investments in crypto companies and protocols, we've seen just about everything: transient narratives, brutal bear markets, and too much regulatory whiplash. These experiences have taught us critical lessons about crypto use cases. Not everything needs to be on a permissionless blockchain, not every product needs a token, and not every token can capture sustainable value.

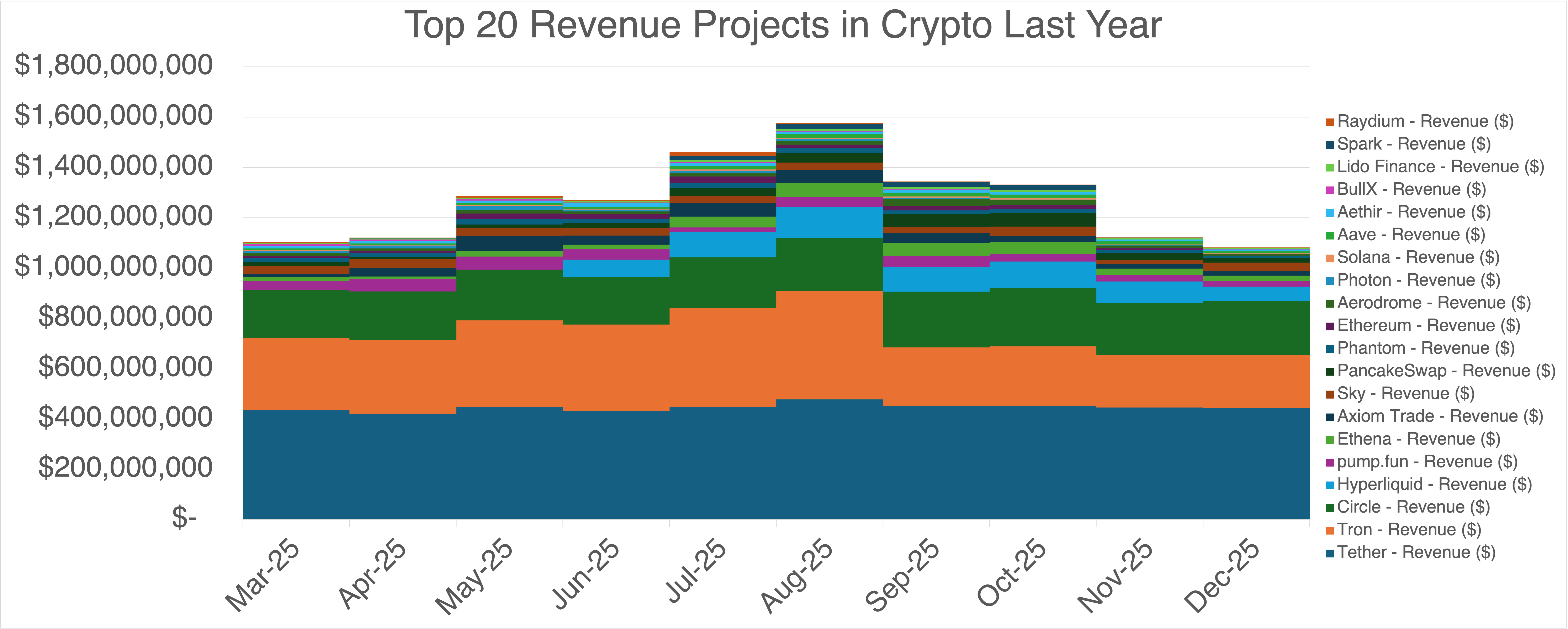

One of our key learnings is that blockchains are fantastic asset ledgers and that’s their core value. Crypto companies and protocols focused on finance and payments, such as DEXs, CEXs, payment firms, crypto trading platforms, lending protocols, launchpads, and stablecoin neobanks and issuers, are the ones that have endured. The data is clear: among the top 20 revenue-generating crypto projects, only one is not directly related to finance or payments.

Source: Token Terminal

Source: Token Terminal

Based on this data and eight years of investing in this still-nascent space, we've developed a new, simple core thesis at the firm:

Blockchains are the first-principles-correct technology to move money, coordinate and program capital formation, and power global financial markets.

In the full blog post linked at the top, we go into detail on eight investment themes that we think will drive the future of crypto and permissionless finance forward over the next decade. Dedicating our careers to investing in crypto is how we’re betting on these fundamental beliefs, and we couldn’t be more excited to be along for the ride.

Multicoin Capital’s Core Investment Themes

1) Fintech 4.0

Stablecoins and blockchains are the first significant innovations in moving money and settling transactions in decades. They make payments and assets programmable and accessible worldwide, lower costs for fintech builders, and start to challenge old monopolies like card networks and big banks.

We’re focused on investing in:

- Specialized stablecoin fintechs that can now be built at lower cost and with better unit economics;

- Products that collapse and capture large portions of the fintech stack (e.g. Altitude); and,

- Companies that make stablecoins accessible to consumers and businesses globally (e.g., p2p.me and El Dorado).

2) DeFi Mullet

As the DeFi stack matures and software development barriers drop, there is value to capture up and down the stack from specialized frontends that own customer relationships, global DeFi backends that benefit from economies of scale, and DeFi middleware that helps connect frontends to backends.

We believe investment opportunities exist across this entire DeFi stack:

- Customer-facing frontends that monetize as order flow engines (e,g. Phantom, Fuse Wallet, and Robinhood);

- Equity in public markets companies building on top of DeFi (e.g. Coinbase/Morpho);

- DeFi middleware companies (e.g., LI.FI, Fun.xyz, and Yield.xyz); and

- DeFi protocols (e.g., Kamino, Drift, Aave, and Ethena) that manage large amounts of risk and compound as more assets move onchain.

3) Financial Globalization

Traditional equity, FX, interest rate, debt, etc. markets are only accessible in certain parts of the world, but blockchains enable worldwide access. Crypto will globalize existing liquid markets, add transparency to dark ones, lower the cost of issuing new assets, and open up trading for new markets. We envision a world where anyone, anywhere can trade any asset at any time.

We’ve invested in several projects focused on increasing market access and will continue to focus on this segment:

- Companies tokenizing liquid markets, like Paxos;

- Protocols building synthetic derivatives contracts to give global access to investors, like Drift, Hyperliquid, and Lighter;

- Operators lighting up dark markets and making them more efficient, like BAXUS and Triumph; and

- Companies leveraging the ability to create new markets, like Kalshi and Sway.

We’re also investing in companies helping push onchain market microstructure forward, such as DFlow, Jito, and FastLane.

4) More Efficient Borrow/Lend

In the past, loan access often depended as much on where borrowers live and who they know, as it did on their true creditworthiness. Crypto changes this by letting money and collateral move directly between lenders and borrowers anywhere in the world. As onchain borrow/lend tools like prime brokerages and DeFi vaults become increasingly common, productive loans can be underwritten globally.

- We’re an investor in borrow/lend protocols, including Kamino and Aave; and

- We want to invest in emerging vault protocols and DeFi prime brokerages as well, and are actively looking for opportunities in these areas.

5) Entertainment Finance

When long-term goals like the American Dream seem out of reach, people start taking bigger swings. Entertainment Finance describes this trend, and crypto is a key market for those taking these risks more openly, with fewer intermediaries taking their egregious cuts.

We’re interested in projects aimed at reducing take rates in the entertainment and degen economies, including Cheddr and Novig.

6) Programmable Ownership

When designed well, we believe tokens are a superpower. They enable programmable ownership in DePIN, crypto-linked equities, and online marketplaces, and are one of the best tools for bootstrapping and scaling networks.

- We helped pioneer the DePIN category with our investment in Helium in 2019, and have since backed projects like Hivemapper, Render, io.net, Geodnet, Pipe, and Gradient;

- We’re investing in novel Internet Labor Markets, which expand the surface area of contribution to arbitrarily bespoke actions, like CrunchDAO and Fuse;

- We’re an investor in many virtual marketplaces that are managed by DAOs, such as Jito, Drift, Kamino, etc.; and

- We’re exploring investing in equity 2.0 structures, where teams are creating novel use cases for their stock.

7) Credibly-Neutral Blockchains

Being credibly neutral at the base layer is extremely important. Financial markets grow faster when competitors feel safe building on shared systems. We believe chains that are neutral by design generally attract more issuers, more liquidity, and more builders over time and that corporate chains are going to struggle attracting third party builders, because, for example, we don’t think E*TRADE will want to build on Robinhood’s chain and Adyen will be skeptical about building on Stripe’s Tempo chain.

We’ve been actively investing in credibly-neutral base layers like APT, SOL and SEI. Over time, we think value capture will move up the stack and we will concentrate our investments in applications building on top of credibly neutral chains.

8) Cryptographic Primitives

Stablecoins give AI agents a straightforward way to send and receive payments, and cryptographic primitives give us a way to verify what’s real online without creating massive data honeypots and introducing unnecessary trust assumptions. Crypto provides a necessary substrate for a world in which internet commerce increases several orders of magnitude driven by the proliferation of agentic systems.

We’re investing in teams building out cryptographic primitives, like Zama, Fhenix, and zkMe.

...

If you’re building along these themes, we’d love to connect. We’re excited to partner with founders pushing the limits of what can be built on crypto rails and digging deeply into the design space.

Reach out to us on X at @spencerapplebaum, @shayonsegupta, and @tushar_jain.