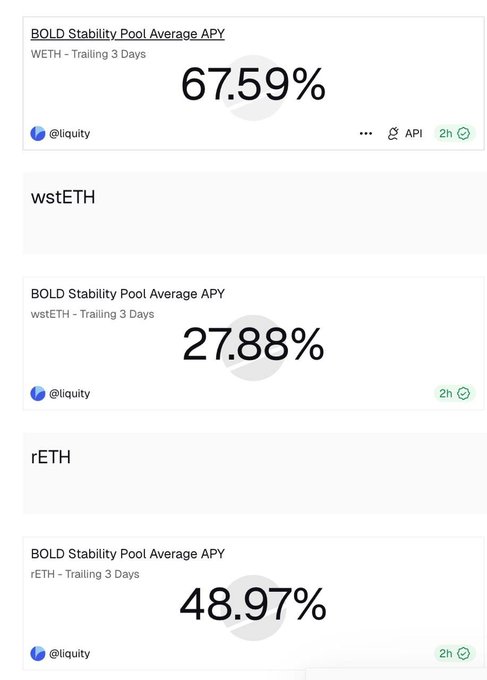

This week's ETH price action caused billions of dollars in liquidations. Lots of open positions and APY chasers got rekt during the recent crash. Meanwhile, @LiquityProtocol V2 processed another liquidation wave exactly as designed, and Stability Pool depositors got paid. The ETH APRs reached 100%+ during the peak time: How it works: 1. ETH nukes → some Troves fall below collateral threshold 2. Stability Pool BOLD cancels their debt 3. SP depositors receive the liquidated ETH on top of ongoing borrower fees (in BOLD) 4. Result: volatility becomes yield You’re literally getting paid when the market panics. Simple strategy: • Hold sBOLD or yBOLD → ~7.5% average passive yield • Buy YT when APR compresses, sell into volatility spikes As a bonus, by holding sBOLD and ysyBOLD, you get exposure to ~10 airdrops from various yield protocols.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content