Foresight News gives you a quick overview of this week's hot topics and recommended content:

01 Market Dynamics

What happened behind the market's "rapid cooling"? Should we buy the dips?

Bitwise Chief Investment Officer: The Crypto Winter has already begun, but spring is just around the corner.

02 Vitalik resets L2

Vitalik's Layer 2 Reset: Can It Save Ethereum?

03 Consensus Hong Kong 2026

"With the opening ceremony just around the corner, here's a sneak peek at the core agenda of Consensus Hong Kong 2026!"

04 Interesting Anecdotes from the Crypto World

CZ, targeted by the gray market

Two "Weathering With You" stars have emerged on Polymarket.

"Behind the Predictions of Two Giants' 'Abandoning Their Core Businesses': Is Opening a Grocery Store Simply a Matter of Excessive Anxiety?"

The Hyperliquid copyright infringement controversy: Is it a technology rights protection effort or a marketing ploy?

"A $300,000 Gold-Plated Trump Statue: A Frenzied Marketing Campaign for Meme Coin"

"First it surged 30 times, then plummeted – are you still willing to get on board with Hayes's 'RIVER'?"

Middle Eastern tycoons have become the biggest financial backers of the crypto.

01 Market Dynamics

From February 5th to 6th, Bitcoin plummeted nearly 18% from $73,000, hitting a low of $60,000. The total market capitalization of the crypto market evaporated by $1 trillion within the month, with over $2.6 billion in liquidations in 24 hours. The Fear & Greed Index fell to 9, plunging the market into "extreme panic." This drop below the key $69,000 level, the peak of the 2021 bull market, inevitably draws parallels to similar market conditions in 2022. Whether it's time to buy the buy the dips has become a focal point in the market. Recommended Article:

What happened behind the market's "rapid cooling"? Should we buy the dips the dip ?

True bottom confirmation often requires a final stress test, frequently marked by the collapse of large institutions. The FTX crash in November 2022 played this role. When this industry giant fell, the market dipped again, but didn't create a new low significantly lower than six months prior. A high-confidence signal is when the market shows resistance to potentially fatal bad news, indicating that potential sellers have largely exited and the market has completed a thorough turnover. After this, although confidence recovers slowly, the downside potential is very limited, forming a broad and solid bottoming area.

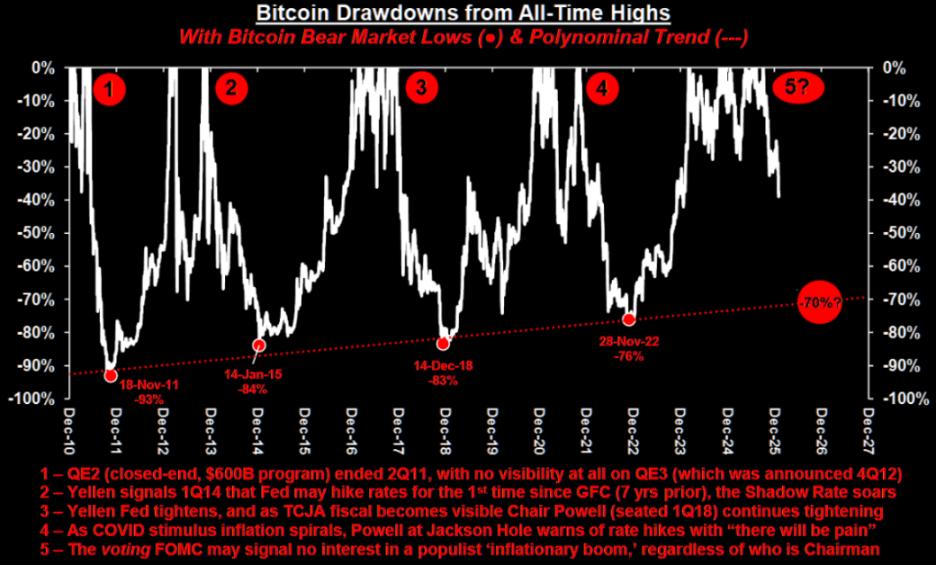

If we analyze the depth of retracements from historical highs to bear market lows, the four lows marked in the chart correspond to approximately 93% retracement in 2011, 84% in 2015, 83% in 2018, and 76% in 2022. Intuitively, the deepest declines in bear markets are gradually converging. Following this trend, it's speculated that the bottom of this bear market might be around a 70% retracement.

In an article, Bitwise Chief Investment Officer Matt Hougan stated bluntly that the Crypto Winter actually began in January 2025, but the inflow of funds into ETFs and DAT has masked the truth. Currently, crypto assets such as Bitcoin and Ethereum have experienced significant declines, and a sense of despair pervades the market. However, based on historical patterns and positive industry factors, he judges that the end of the winter is near, and the spring for the crypto market is not far off. Recommended article:

Bitwise Chief Investment Officer: The Crypto Winter has already begun, but spring is just around the corner .

What needs to be remembered at this moment is that there are actually a lot of real positive factors in the crypto space. Regulatory progress is real, institutional adoption is real, stablecoins and asset tokenization are real, and Wall Street's embrace is real.

In a bear market, positive news may be ignored, but it doesn't disappear. It's stored up as potential energy. Once the clouds clear and market sentiment returns to normal, this accumulated potential energy will be released in a retaliatory manner. What can dispel the clouds? Strong economic growth triggering a broad rebound in risk assets, positive signals from the Clarity Act, signs of sovereign nations adopting Bitcoin, or simply the passage of time.

As a veteran who has weathered multiple Crypto Winter, I can tell you that the feeling before the winter ended was very similar to what it is now: despair, helplessness, and depression. However, the current market pullback has not changed the fundamentals of the crypto market in the slightest.

I believe we will rebound faster and more forcefully. After all, the winter began in January 2025. Spring is certainly not far away.

02 Vitalik resets L2

On February 3rd, Vitalik Buterin published a significant post, making a crucial "reset" to Ethereum's Layer 2 strategy. He directly addressed the disconnect between the 2020 "Rollup-centric" roadmap and reality—the lagging L2 decentralization process and the unexpectedly rapid scaling of L1. He then proposed a "trust spectrum" to reshape the positioning of L2, supplemented by native Rollup pre-compilation and synchronous composability, prompting differentiated responses from mainstream L2 teams and pointing to a new direction for the evolution of the Ethereum ecosystem. Recommended Article:

Vitalik 's Layer 2 Reset: Can It Save Ethereum ?

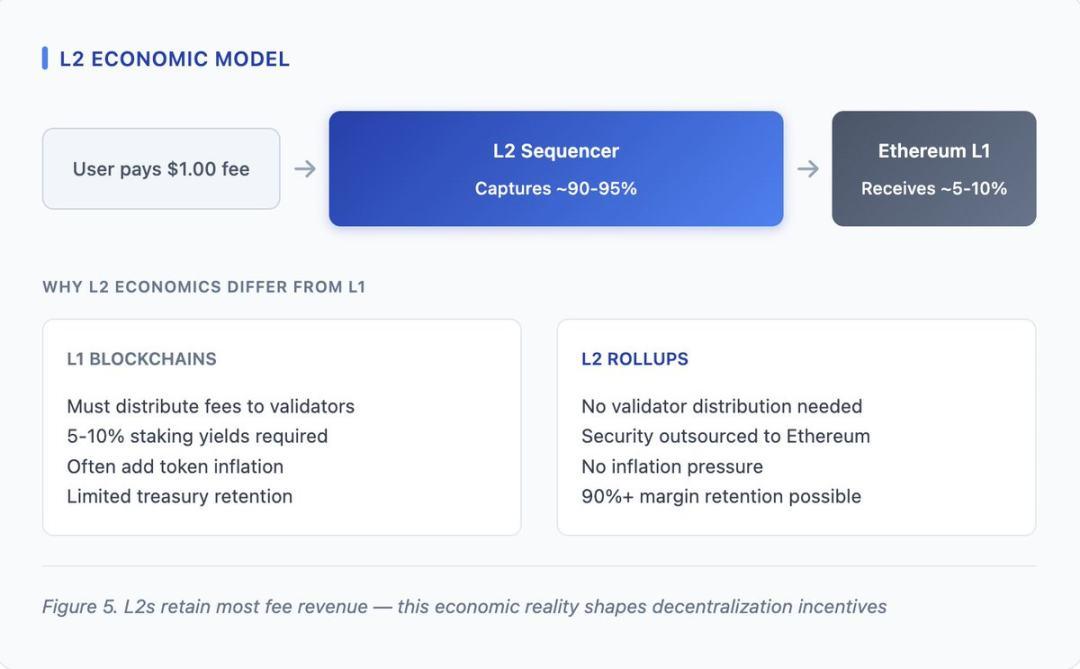

One of the key implications of Vitalik's post is its implicit acknowledgment of the economic nature of Level 2 (L2) servers. When he mentions that "some L2 servers, due to 'regulatory requirements' (the need to retain ultimate control), may 'never go beyond Phase 1 decentralization,'" he is essentially acknowledging that L2 servers are not idealized "branded sharding," but rather commercial entities with legitimate economic interests. The revenue from sorting mechanisms is real, and so are the regulatory compliance requirements—expecting L2 servers to relinquish these interests to conform to ideology is unrealistic from the outset.

03 Consensus Hong Kong 2026

From February 10th to 12th, Consensus Hong Kong 2026, hosted by CoinDesk, will be held at the Hong Kong Convention and Exhibition Centre. This is the second time the summit has been held in Hong Kong, with the theme "Building the Future: From Traditional Finance to On-Chain Innovation." The summit will feature six main stages, bringing together over 15,000 attendees and more than 100 speakers to focus on institutional adoption, DeFi, AI, and on-chain innovation, exploring pathways for the integration of traditional finance and the crypto world. Recommended Article:

Consensus Hong Kong 2026 brought together speakers from the fields of cryptocurrency, traditional finance, AI, and Web3. Below are some of the speakers and their core agendas (in chronological order):

04 Interesting Anecdotes from the Crypto World

In early 2026, Binance founder CZ was frequently targeted by shady actors: composite photos of him appeared on platform X, numerous accounts in the English-speaking region used AI to generate promotional photos with him, and fake lawyer's letters were also circulated. During the same period, the prices of Bitcoin and BNB fell by more than 26%, and the cryptocurrency fear index dropped to the "extreme fear" zone. The trust fraud amplified by AI technology was posing a double risk to crypto users and the market. Recommended Article:

Zhao Changpeng , targeted by the gray market

On January 28, CZ posted an article stating that recent discussions surrounding him had shown signs of organized manipulation of public opinion. He pointed out that some previously inactive accounts or those unrelated to him had suddenly posted highly similar content within a short period, exhibiting clear characteristics of copying and dissemination. The overall behavior resembled a systematic operation rather than a naturally formed discussion atmosphere. This also suggests that the motives behind these actions may not be pure.

Another, more gray area, is the groundwork for subsequent scams. In common encrypted scam chains, fraudsters often need to first establish trust through "professional background" and "insider connections" before gradually guiding users into private communication scenarios. Group photos, event photos, and so-called "offline meeting" records are frequently used material types. The emergence of AI has simply made these materials go from "difficult to forge" to "mass-producible."

Furthermore, it cannot be ruled out that some of these behaviors are related to the KOLs' account creation logic. Currently, personal branding remains one of the fastest-growing paths to traffic. By creating visual evidence such as "participation in industry events" or "appearances alongside celebrities," some new accounts can quickly shed their "ordinary persona" and gain initial attention. In the traffic economy, even if the trust built in this way is not solid, it is enough to support short-term monetization.

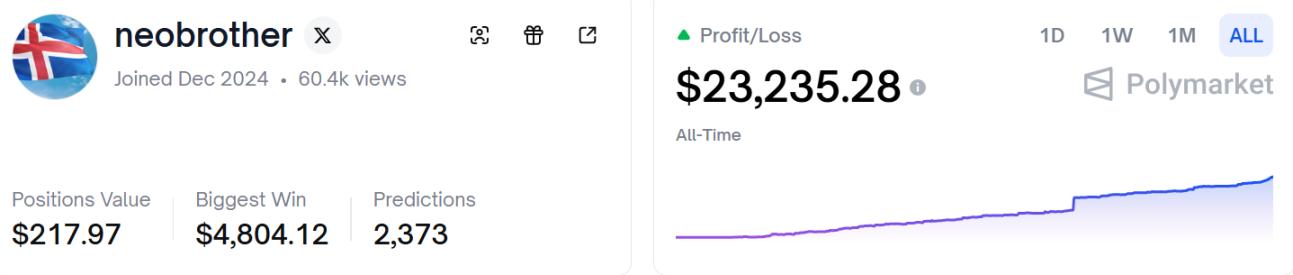

On the Polymarket platform, two "weather children" have quietly made a fortune by predicting the weather. neobrother, driven by data, uses a "temperature ladder" strategy for precise positioning, accumulating over $20,000 in profits; Hans323 targets low-probability opportunities, earning a staggering $1.11 million in a single trade through asymmetric risk-reward. Their methods are revolutionary and provide new examples for investing in the prediction market; however, ordinary users should be wary of the risks. Recommended article:

Two "Weathering with Children" have emerged at Polymarket .

If someone told you that there are some clever traders who can make money by predicting the weather and temperature, would you believe it?

The trader pictured above, named neobrother, has been betting heavily on the weather in various cities on Polymarkets, accumulating profits exceeding $20,000. He's not a blindly speculative gambler, but a highly data-driven, vertically focused expert skilled in leverage and odds. neobrother's trading record almost exclusively focuses on weather forecasts, particularly the daily maximum temperatures of major cities worldwide (Buenos Aires, Miami, Ankara, Chicago, New York).

He doesn't gamble on "the overall trend," but only on "precision," much like a grid arbitrageur in the meteorological field.

In February, the online prediction market duo, Kalshi and Polymarket, intensified their competition, both expanding offline: Kalshi distributed free groceries in New York, while Polymarket announced the opening of a permanent free grocery store. This move was not only clever marketing but also reflected the fierce competition in the prediction market—on one hand, there's compliant expansion and a battle for traffic; on the other, there's regulatory pressure and the emergence of new competitors. The industry battle has begun. Recommended article:

The opening of Kalshi and Polymarket is not just a marketing campaign, but a battle to capture users' attention.

Wars, political events, elections, and sporting competitions are drawing global users online, with 24/7 uninterrupted global betting, rule disputes and controversies, wealth stories and insider trading unfolding simultaneously—only money and minds never sleep. Perhaps future hot events like the World Cup and the US presidential election will continue to drive the prediction market's trading volume and popularity to new heights.

Before the outcome was decided, none of the contestants dared to let their guard down.

In early 2026, Hyperliquid was at the height of its success—the HIP-4 proposal was launched on the testnet to build prediction market infrastructure, and its token HYPE surged by over 40% against the market trend. However, Sky Guo, founder of its competitor Cypherium, suddenly accused HyperLiquid's HyperCore engine of infringing on patent US 11,411,721 B2, which focused on improvements and applications of the HotStuff algorithm. Just before HYPE's unlocking, this controversy—whether a technical rights protection dispute or a marketing ploy—attracted industry attention. Recommended article:

Whether the accusations are solid evidence or mere marketing ploys, Hyperliquid appears to have reached a crossroads. As its business expands, the community's calls for greater transparency are growing. Faced with allegations of infringement, will Hyperliquid maintain its advantage of being an opaque entity, or will it prove its innocence through partial open-source releases or third-party audits? This hinges on the foundation of trust in its decentralized narrative.

In 2026, a cryptocurrency marketing campaign surrounding Trump sparked heated debate: PATRIOT token supporters spent $300,000 to create a 15-foot-tall gilded statue of Trump, "Giant Trump," hoping to leverage his popularity to boost the token's price. Although the statue's base was installed at Trump's golf resort, it became embroiled in copyright disputes and a token price crash, highlighting the madness and volatility of the Meme coin market. Recommended Article:

" A $300,000 Gold-Plated Trump Statue: A Frenzied Marketing Campaign for Meme Coin "

Now, unexpectedly, the plan appears to be nearing completion. Last month, a pedestal made of concrete and stainless steel was erected at Trump's golf resort in Doral, Florida. According to records reviewed by The New York Times, Mark Burns, one of the organizers of the project and a close friend of Trump, told collaborators that the president plans to attend the unveiling ceremony of the statue there.

"This statue looks fantastic," Trump wrote in a letter to Burns last December.

At the start of 2026, River, the native token of the blockchain-abstract stablecoin system, experienced extreme price fluctuations: it surged over 30 times from $2 at the end of 2025 to $87, only to plummet to $11 within six days. Behind this surge, Arthur Hayes spearheaded the project, and $12 million in funding was raised, but allegations of price manipulation and early-stage concentration of tokens surfaced, drawing widespread attention and scrutiny in the cryptocurrency market. Recommended Article:

What is certain at present is that RIVER underwent a dramatic repricing process, going from a rapid rise to a rapid fall, in a very short period of time. Market attention has shifted from narrative and growth expectations to whether there are anomalies in the distribution of tokens and the flow of funds. The address clusters and related clues raised by Bubblemaps have further amplified suspicions of early token concentration, profit-taking by related addresses, and distribution through exchanges. The funding rates and position crowding mechanisms mentioned by CoinGlass provide another explanatory framework, suggesting that the derivatives structure may have amplified the magnitude of price fluctuations.

For the market, the RIVER incident serves as a reminder that tokens with low circulation and high elasticity are prone to extreme price movements when sentiment and structure resonate. When negative signals appear in the token supply and trading structure, price adjustments tend to be faster and deeper.

In early 2026, Middle Eastern tycoons made frequent moves in the crypto. MGX of the UAE, and its backer Tahnoun, which controls $1.5 trillion in assets, invested $2.5 billion in the Trump family's crypto project WiFi and Binance, also driving the rapid rise of the stablecoin USD1. In fact, Middle Eastern capital has long been deeply involved in Web3, and coupled with the UAE's inclusive policy towards crypto, it has become a key "financial backer" that cannot be ignored in the crypto. Recommended Article:

Middle Eastern tycoons have become the biggest financial backers of the crypto .

The UAE has a very tolerant attitude towards crypto and is one of the fastest countries to advance crypto legislation. The Dubai Virtual Assets Regulatory Authority (VARA) is the world's first independent regulatory body specifically for virtual assets, and Abu Dhabi Global Market (ADGM) was one of the first entities to launch a comprehensive digital asset framework regulatory sandbox. Companies such as Tether, Circle, and Ripple have already obtained operating licenses or permits in the UAE. Binance, on the other hand, received full regulatory authorization from the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority (FSRA) in December 2025, becoming the first crypto exchage to obtain a global license under the ADGM framework.