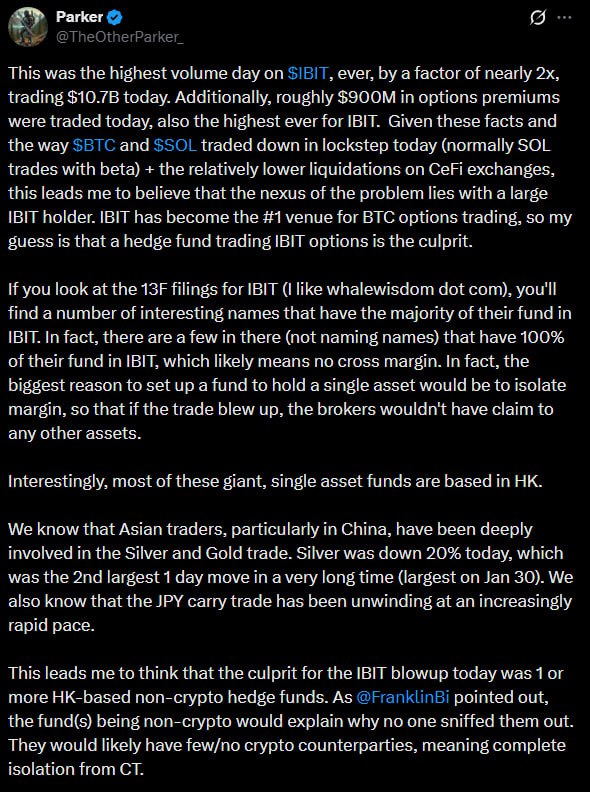

IBIT's Record Trading Volume and Hong Kong-based Fund Liquidations? 1. The typically conservative Nasdaq requested the SEC to lift the contract limit on BTC/ETH ETF options, skipping the usual 30-day grace period and leading to immediate implementation on January 21st. 2. With the 25,000 contract limit removed, IBIT has become a "financial nuclear weapon" capable of generating the most powerful leverage in the global cryptocurrency market. 3. Nasdaq's rapid movement suggests that a certain large fund has already reached its limit, and brokers likely rushed to ease regulations to legally liquidate it. 4. On January 29th, a week after the limit was lifted, Bitcoin plummeted. This suggests the first major position adjustment in the new unlimited leverage environment. 5. During this decline, IBIT reached a record high, recording $10.7 billion in trading volume, double its normal level, and $900 million in options premiums. 6. The fact that Solana, which should normally exhibit higher volatility, plummeted in line with Bitcoin, and that the liquidation on the exchange (CeFi) was small, confirms that the primary culprit in this crisis was a traditional financial fund. 7. The funds with 100% IBIT exposure, as revealed in their 13F filings, are based in Hong Kong, a typical risk isolation structure designed to prevent brokers from accessing other assets in the event of an incident. 8. The fund suspected to be the primary culprit bet on IBIT ultra-high gamma options, but its balance sheet is likely completely destroyed by a combination of negative factors, including a 20% plunge in the silver market. 9. Because this hypothesis was not a crypto-focused fund, it was not detected by information networks such as Crypto Twitter (CT), and was able to secretly increase its leverage within the existing financial system. 10. The conclusion of this hypothesis' liquidation will be revealed in the 13F filing, which will be filed approximately 45 days later, regarding the IBIT exposure of a specific Hong Kong-based fund. The moment your holdings hit "0," it will be officially confirmed. This is a hypothesis for this recent decline. It's interesting and well-written. x.com/TheOtherParker_/status/2...

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content