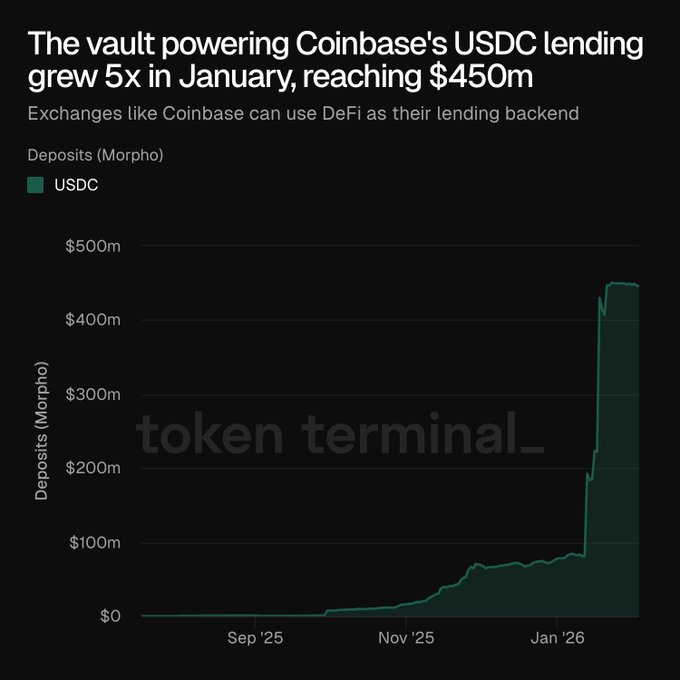

Coinbase just made DeFi its lending engine. • Steakhouse’s USDC vault on Morpho went 5x in January to ~$450M. • ~$428M is deployed to borrowers posting cbBTC collateral. • Depositors earn ~4.21% APY. > Flow is the signal • USDC in the Coinbase app → routed to @Morpho vaults • cbBTC borrowers tap that liquidity → @coinbase keeps the UX CeFi is becoming the frontend. DeFi is becoming the balance sheet. If more exchanges copy this playbook, Morpho style rails become the default backend for CeFi lending. Source: @tokenterminal

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content