The rationale for favoring FiSV is as follows: Firstly, this company has historically held a monopoly in the financial industry. Almost all banks use FiSV for their back-end core systems. Banks generally don't have particularly advanced development technologies and have little incentive to switch, which is a key advantage. Secondly, merchants use FiSV for their Clover and POS systems, meaning FiSV holds a monopoly on the consumer side. Think of it as an overseas version of Meituan. Why the sharp drop? Because the previous leadership team (whose CEO also came from a finance background and had a prominent reputation) relentlessly exploited and squeezed employees to improve financial reports. They even installed software to constantly monitor employees, and failure to meet certain criteria resulted in immediate layoffs. To avoid being laid off, some employees even took their laptops to the bathroom. There were also numerous other issues, such as the executives' private jet scandal. The new leadership team is very strong, beyond imagination, and includes former Stirpe executives, making them generally more reliable.

This article is machine translated

Show original

小隐寺

@xiaoyinsi2025

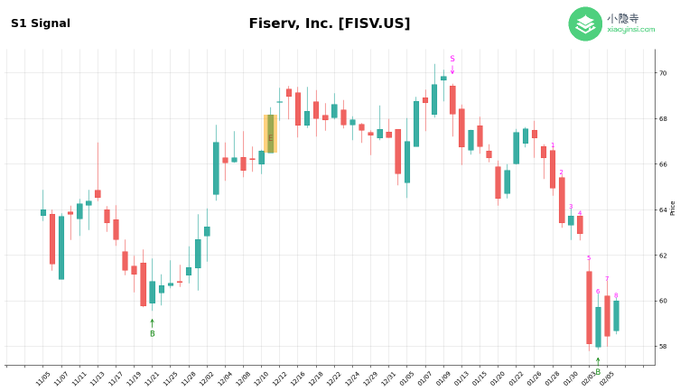

fisv:

我们认为目前价格是低估中,该公司上一届管理层出现了严重的问题,对员工进行了各种监控、压榨,新的这一届管理层非常强,而且业务基本面没有问题,我们认为60美元的fisv,是一个很好的机会。

结合s1信号如下:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content