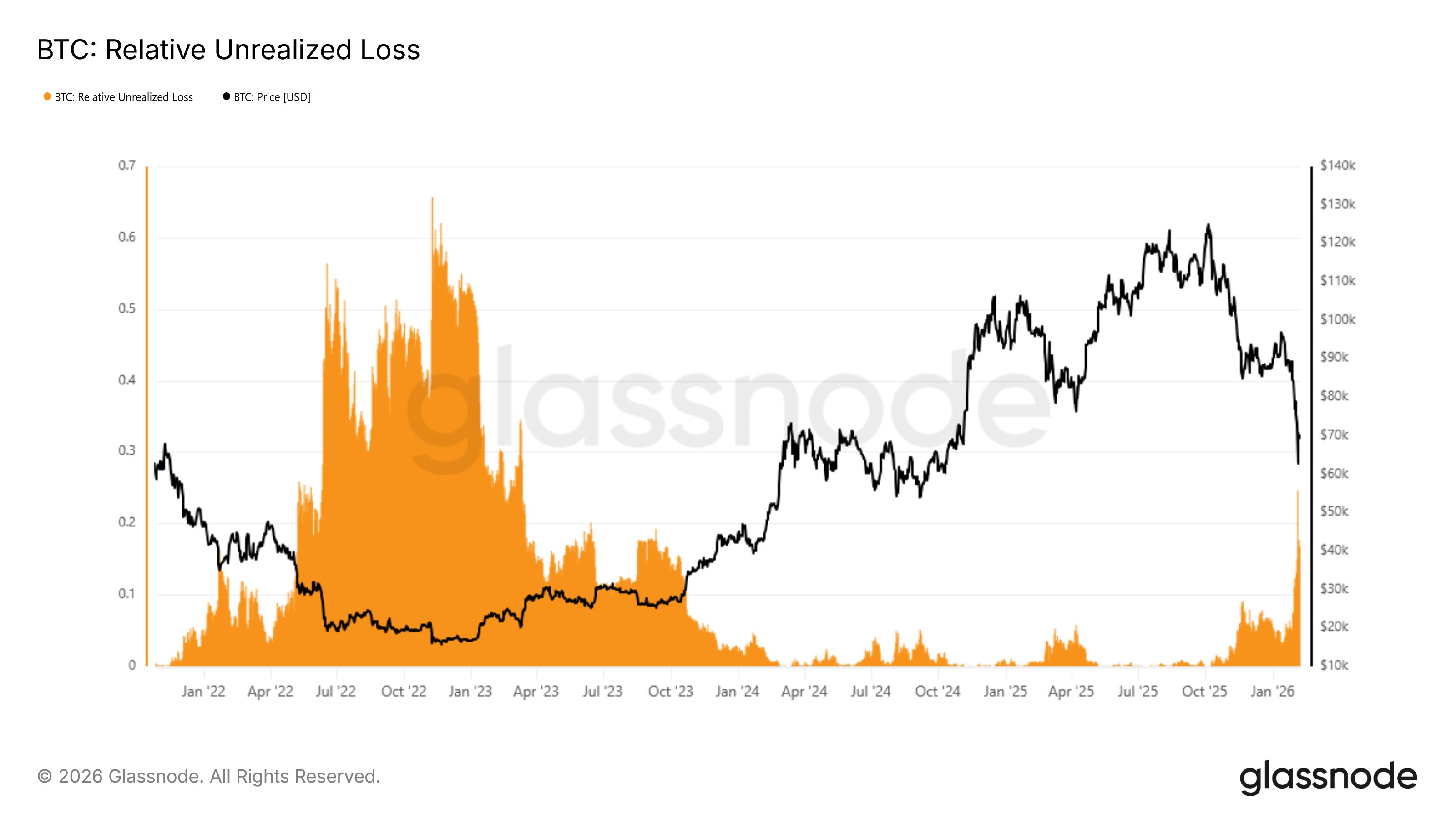

The latest Bitcoin correction has pushed unrealized losses to levels similar to those seen during severe bear market phases.

This data is worth watching for market enthusiasts, especially bulls, as it reflects the current state of the market cycle. Specifically, unrealized losses have reached 16% of the crypto market cap, suggesting that a considerable number of Bitcoin holders are holding at a loss.

Key Points

- The latest Bitcoin correction has pushed unrealized losses to levels similar to those seen during severe bear market phases.

- Specifically, unrealized losses have reached 16% of the crypto market cap, suggesting that a considerable number of Bitcoin holders are holding at a loss.

- The recent spike suggests that stress is building across the market.

- The current structure echoes that in early May 2022, another period marked by heavy selling and deteriorating sentiment.

Bitcoin Unrealized Losses at 16%

On-chain data from the market intelligence platform Glassnode has tracked how much of the market is sitting on paper losses.

A shared chart highlighting Bitcoin’s relative unrealized loss shows that at $70,000, unrealized losses account for roughly 16% of total market capitalization. This means that about one-sixth of Bitcoin’s value is currently held at a loss.

The unrealized losses followed a period of severe price correction in Bitcoin. The pioneering cryptocurrency has retraced 11% and 23% in the past seven and 30 days, respectively, as whale sell-offs and market uncertainty heightened. This has wiped billions off the crypto market cap, affecting holders.

Interestingly, that figure marks a sharp shift in sentiment compared to just months ago, when unrealized losses were relatively lower. Notably, the Glassnode tweet was in response to an October 30 post that noted unrealized losses then were 1.3% of BTC’s market cap.

At the time, analyst “CryptoVizArt” argued that the market had not yet experienced the kind of pain typically associated with a true bear phase. According to him, mild downturns historically push unrealized losses above 5%, while deeper bear markets can push the metric above 50%. With losses rising to 16%, the market may be cloer to a bear market.

What Does It Mean for Bitcoin?

Relative unrealized loss measures the share of Bitcoin’s supply that is underwater compared to the current price. When this metric rises, it usually means more holders are trapped above their cost basis, which increases market pressure and the risk of capitulation.

The recent spike suggests that stress is building across the market. Long-term holders are still relatively resilient, but shorter-term participants are feeling the strain as prices trend lower. This growing pool of unrealized losses often appears during transitional periods when bullish momentum fades, and fear starts to dominate.

A Familiar Pattern From 2022

Glassnode noted that the current structure echoes that in early May 2022, another period marked by heavy selling and deteriorating sentiment. Back then, Bitcoin peaked around $40,032 before sliding sharply to $29,451 within weeks.

That drop triggered a noticeable rise in unrealized losses, similar to what is unfolding today. Notably, the correction didn’t immediately signal the end of the downturn, as Bitcoin slid further before reaching its bottom in November 2022.

While this doesn’t guarantee further declines, it suggests Bitcoin may already be in the early stages of a broader bear market. Historically, these periods take time to unfold before a clearer recovery begins.