my humble thoughts after @Eli5defi's article

I've mentioned this to many that I'm not convinced any current RWA perps solution actually works at scale

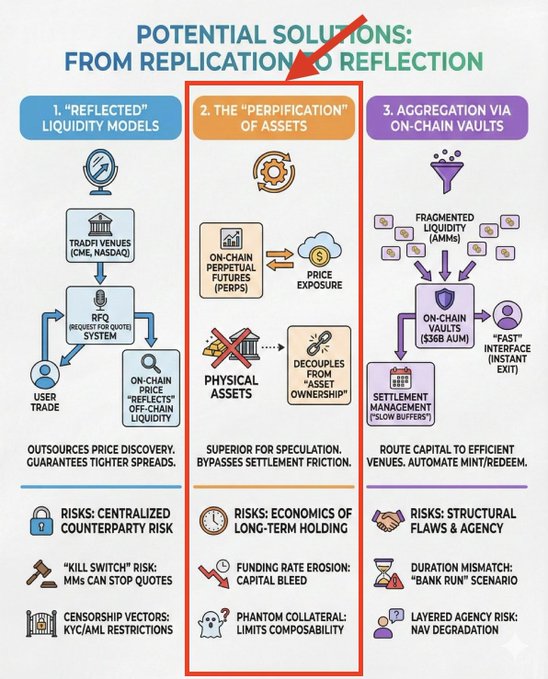

perpification of assets fails the industry terribly

the core problem I see = spot tokenization fundamentally doesn't work at scale

CME gold futures $20M trade = 3bps slippage

tokenized gold perpetuals $4M trade = 150bps slippage

50x worse execution for tokeniztion innovation, makes no sense

market makers won't provide depth because economics don't work:

- mint fees 10-50bps

- warehouse inventory T+1 to T+5 settlement

- opportunity cost vs instant-settle crypto strategies

death spiral. shallow liquidity → low volume → MM exits → worse liquidity

funding rate erosion destroys long-term potential

so we have contradiction:

- spot tokenization: proper collateral but no liquidity

- perp exposure: great liquidity but bleeding cost and no collateral use

I'm positioned for perpification winning trading volume and spot tokenization staying niche for collateral use cases

- but nobody's building the bridge between them

- that's the opportunity

- how do I get perp-level liquidity execution with spot-level composability and no funding bleed

- whoever solves that captures entire RWA market

perpification is future of trading exposure

spot remains future of ownership.

until then RWA remains broken regardless of perp numbers

twitter.com/arndxt_xo/status/2...

Yess, i think perpification sits like temporay band-aid until we have better solution.

Perps gained traction because we have perps season rn, so possibly we might see something innovation from it.

Thanks for the shout-out as well Ser!

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content