Citadel, Ark Invest, and Tether back LayerZero as it launches the Zero blockchain - ZRO price goes on a rollercoaster. Photo: Decrypt.

Citadel, Ark Invest, and Tether back LayerZero as it launches the Zero blockchain - ZRO price goes on a rollercoaster. Photo: Decrypt.

Early this morning (February 11th), LayerZero officially announced the launch of its new layer-1 blockchain called Zero , backed by giants Citadel Securities, Ark Invest, and Tether.

— LayerZero (@LayerZero_Core) February 10, 2026

LayerZero Labs CEO Bryan Pellegrino said: “We believe this technology has the potential to bring the entire global economy onto the blockchain. Our mission is to build permissionless, reliable infrastructure to power future economic systems.”

According to LayerZero, both Citadel Securities and Ark Invest have made strategic investments by purchasing ZRO Token . For Citadel , this is a rare move, as the leading Wall Street quantitative trading firm typically invests in crypto companies rather than directly purchasing Token.

Citadel will contribute its expertise on market structure and assess the applicability of this technology in trading, settlement, and clearing processes. In the past, Citadel has urged the U.S. Securities and Exchange Commission (SEC) not to exempt DeFi protocols from regulation for exchanges and brokerage firms.

On Ark Invest's side, in addition to acquiring ZRO, the company run by Cathie Wood also became a shareholder in LayerZero Labs and served as an advisor to the Zero project. The female leader called this a rare opportunity at the intersection of finance and the internet, emphasizing the potential for connection between blockchain technology and traditional Capital markets.

As Zero sets out to power the world economy, we are bringing on a world-class advisory board.

— LayerZero (@LayerZero_Core) February 10, 2026

We cannot think of a better group to help us accelerate the inevitable future:

- @CathieDWood (ARK Invest)

- @mblaugrund (ICE)

- Caroline Butler (formerly BNY Mellon) pic.twitter.com/4v2BCL3DDe

LayerZero claims that Zero is not a typical layer-1 blockchain but is designed with a heterogeneous architecture, separating transaction processing and confirmation to overcome speed and scalability limitations. The company promotes this network as capable of reaching 2 million transactions per second, with performance approximately 100,000 times faster than Ethereum and 500 times faster than Solana, aiming to handle the continuous volume of the financial market rather than just serving cryptocurrency applications.

Alongside the launch of Zero, LayerZero also announced a partnership with Google Cloud to research blockchain application models in the artificial intelligence economy. According to Google Cloud, as AI systems gradually become economic actors, blockchain and cryptocurrencies will require infrastructure with the reliability of cloud computing.

LayerZero has also partnered with DTCC , the organization behind much of the clearing and custody operations of the U.S. stock market, in an effort to Tokenize stocks, ETFs, and U.S. Treasury bonds, while improving speed, scalability, and connectivity between systems. The parent company of the New York Stock Exchange, Intercontinental Exchange , is also XEM the possibility of using the Zero blockchain to support 24/7 trading.

We're building Zero with the world's foremost experts on markets, tokenization, and beyond.

— LayerZero (@LayerZero_Core) February 10, 2026

Day Zero Partners

- @citsecurities , the next-generation global market maker

- @The_DTCC , the world's largest clearinghouse

- @ICE_Markets , the global leader in market infrastructure pic.twitter.com/R4EiHuMiEG

ICE, parent company of @NYSE , has been at the forefront of market innovation for 25+ years. @ICE_Markets is examining potential applications of Zero as it prepares its trading and clearing infrastructure to support 24/7 markets and potential integration of tokenized collateral. pic.twitter.com/A0siscggXg

— LayerZero (@LayerZero_Core) February 10, 2026

Most recently, Tether Investments – the investment arm of the world's largest stablecoin issuer – announced a strategic investment in LayerZero Labs to advance multi- chain connectivity technology. Tether stated that LayerZero is currently the platform used to build USDt0 and XAUt0, omnichain stablecoin versions based on the Omnichain Fungible Token standard. These Token allow value to move between multiple blockchains without liquidation Shard , a common problem with traditional bridges. In less than a year, USDt0 has processed over $70 billion worth of cross- chain transactions.

Tether is investing into LayerZero Labs because they believe in our vision for the future.

— LayerZero (@LayerZero_Core) February 10, 2026

To see for yourself what the future is, tune in at 4:30pm EST today. https://t.co/7ssu8SjmOM pic.twitter.com/72q7IDaeJ2

Tether CEO Paolo Ardoino believes that LayerZero not only acts as a bridge between blockchains but could also become the infrastructure for a new financial model, where AI actors autonomously operate wallets and conduct Microtransaction.

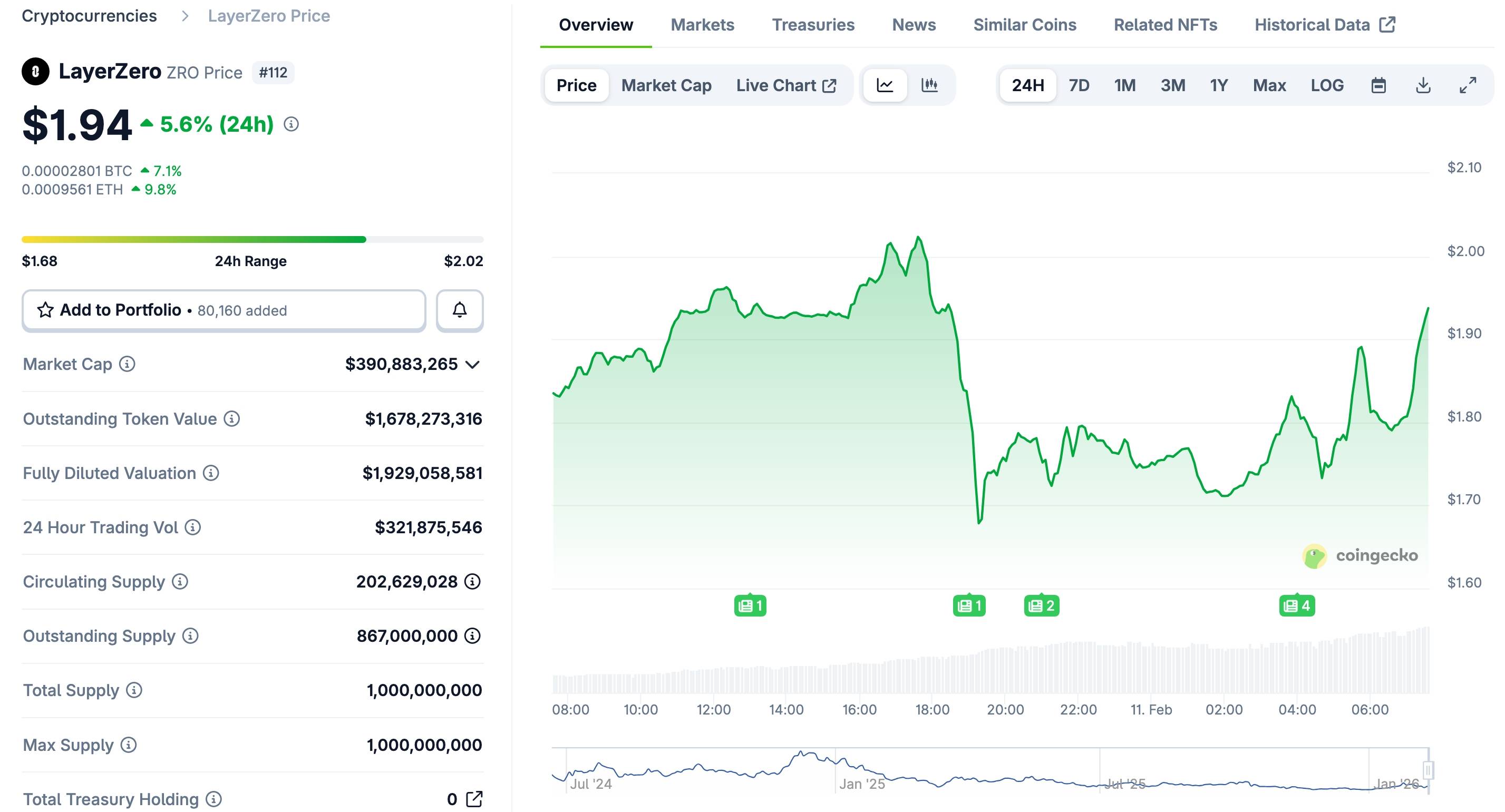

In the market, information about the Zero blockchain initially did not have an immediate positive effect on the price of ZRO . Investors reacted cautiously due to concerns about deployment costs and the risk of supply dilution, causing the Token to fall sharply shortly after the news was announced.

ZRO price fluctuations over the last 24 hours, screenshot from CoinGecko at 08:10 AM on February 11, 2026.

ZRO price fluctuations over the last 24 hours, screenshot from CoinGecko at 08:10 AM on February 11, 2026.

However, the sell-off quickly stalled as details of Citadel, Ark Invest, Google Cloud, and Tether involvement became clearer. In the following trading hours, ZRO reversed course and rose again. As of now, ZRO is trading around $1.8-$1.9 per Token, lower than previous short-term highs but having recovered from the Dip after the initial drop.

Coin68 compilation