Robinhood has officially launched its Robinhood Chain into the public testnet phase, paving the way for developers to test the application ahead of the mainnet launch.

Robinhood launches public testnet for blockchain built on Arbitrum

Robinhood launches public testnet for blockchain built on Arbitrum

Testnet testing Tokenize and DeFi

According to an announcement made on February 11th by Robinhood, a leading US financial services and brokerage app company, the Robinhood Chain has entered the public testnet phase with the goal of creating a testing environment to detect errors and improve network stability before officially going live.

The Robinhood Chain public testnet is live 🛠️

— Robinhood (@RobinhoodApp) February 11, 2026

Developers can now build on a financial-grade Ethereum Layer 2 built on @ Arbitrum — designed to support tokenized real-world and digital assets.

Start building with the core foundation of Robinhood Chain: https://t.co/yHCQRh5x3j …

Johann Kerbrat, Senior Vice President and Head of Crypto at Robinhood, Chia :

“The Robinhood Chain testnet lays the groundwork for an ecosystem that will shape the future of Tokenize real assets, while also enabling builders to access DeFi liquidation within the Ethereum ecosystem,”

Robinhood also stated that this testnet is aimed at builders familiar with building perpetual DEXs, lending platforms, and financial institutions, thereby laying the foundation for an ecosystem centered around Tokenize real assets on Ethereum layer-2, built on Arbitrum .

- In the coming months, developers participating in the testnet will have access to “testnet-only assets,” including Stock Tokens, to support integration testing. Additionally, Robinhood will allow direct testing with the Robinhood Wallet, helping to more closely simulate how end users interact with applications built on the network.

Ambition to expand stock Token and 24/7 trading.

- Robinhood Chain is a private blockchain developed by Robinhood, built as Ethereum layer-2 and utilizing Arbitrum's technology infrastructure. This network is designed to be an on-chain platform directly serving Robinhood's financial products, from cryptocurrencies to Tokenize traditional assets like stocks.

Instead of focusing solely on scaling Ethereum's performance, Robinhood Chain aims to restructure how financial services operate, enabling near 24/7 transactions, near real-time payments, and deep integration with DeFi, while remaining firmly entrenched within the Robinhood ecosystem.

- In June 2025, the company launched stock tokens for European customers, providing access to over 2,000 US-listed stocks with 24/5 trading hours, with these Token issued directly on Arbitrum One.

- The Robinhood Chain testnet is XEM a crucial link for testing the technical infrastructure before these features are deployed on a larger scale.

Robinhood's move to expand its own blockchain comes amid a slowdown in the company's crypto segment. According to financial reports, Robinhood's crypto trading revenue in the fourth quarter of last year decreased 38% year-on-year to $221 million, significantly lower than the $268 million of the previous third quarter.

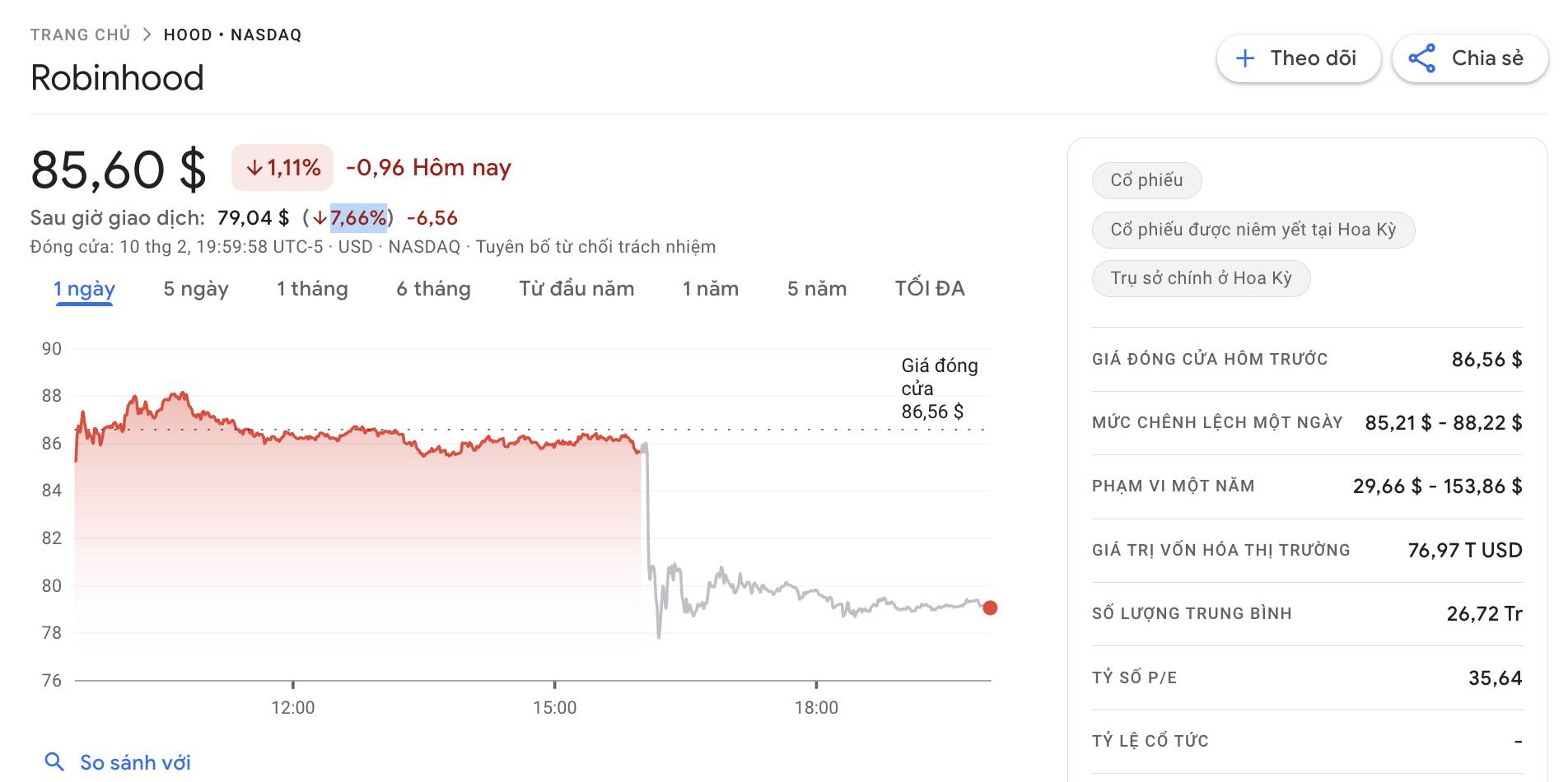

- Robinhood's HOOD stock also recorded a drop of over 7.66% after after-hours trading and is currently trading around $79.04.

HOOD stock price fluctuations over the past 24 hours, screenshot from Google Finance at 1:30 PM on February 11, 2026.

Coin68 compilation