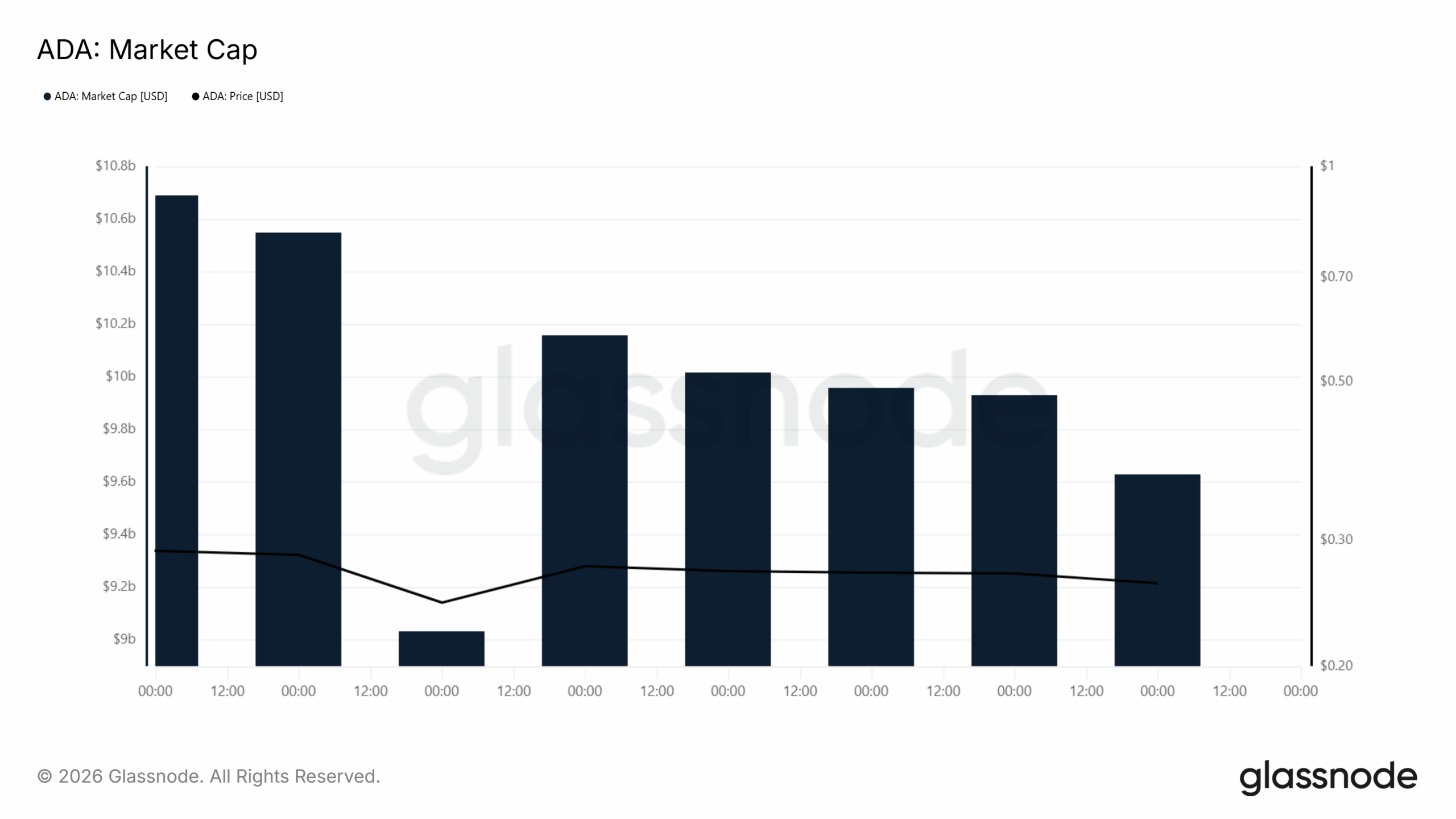

Cardano price prediction trends have become the focus of attention based on fresh data from Glassnode revealing that the $ADA market capitalization reduced over the past few days from more than $10.6 billion to the $9.6 billion mark. At the same time, the $ADA prices have been moving away from the $0.30 mark and towards the $0.25 price range.

Summary

Market participants are now focusing on whether $ADA manages to stabilize above this point or if the downtrend extends from this level. All technical indicators, including those on higher and lower timeframes, are showing weakening momentum with the price compressing around a demand area.

Data Shows Declining Market Capitalization

A chart provided by Glassnode, monitors the $ADA market capitalization as well as the $ADA price in USD terms. According to this chart, the $ADA valuation has been declining steadily, reducing over time, though not abruptly.

There is a noticeable dip in the chart before the market cap approached the $9 billion mark. A minor price hike is seen following the dip before the slope continued on the same path. As the circulating supply remains stable, the observed changes should be attributed to the price action.

The price line on the same chart affirms this. Price went down from the $0.29 to $0.30 range to the $0.25 to $0.26 range. It is a series of lower highs and lower lows. This is in line with the downtrend in market capitalization.

Cardano Price Prediction as Support Faces Pressure

The current Cardano price is focused around the support zone of $0.24–$0.25. According to past data, the area has represented previous periods of buying action. The current price is trading directly over this point.

On a positive note, resistance is found close to $0.27 to $0.29. $ADA’s recent short-term attempts to go up met resistance around that range. The overall trend remains down as long as $ADA doesn’t trade above that range.

Momentum indicators provide context. Relative Strength Index, analyzed on the Daily chart, has been tracking the lower trend line near the 30s, which is indicative of weakening momentum. Generally, such oversold signals do not constitute confirmation of upcoming changes without accompanying volume expansion or shifts.

Technical Structure Reflects Controlled Selling

Lower-timeframe charts appear to be showing a compression pattern developing around support. Price action has been consolidating within reducing boundaries, which suggests lower volatility. Compression movements do not tend to be directional by themselves.

The nine-period exponential moving average slopes downwards on higher timeframes. Alignment indicates that there is overall prevailing sell pressure. The trend remains in place until it goes past that average.

This is fortified by market capitalization movements as well. If the market capitalization were to drop continuously below $9 billion, it is expected to reflect the further contraction. Moreover, consolidation may occur around these elevated levels.

Broader Outlook for Cardano Price Prediction

The broader Cardano price prediction depends on the $ADA reaction at present levels. In case buyers can defend $0.24 region and price closes above short-term resistance, a bounce may set up toward $0.30 zone. A breach of support on strong volume would see the downtrend continue.

If data from Glassnode provides valuation context, price charts provide structure and momentum. In combination, the latter suggests $ADA trades at a technical inflection point.

During the time being, $ADA trades near support, with declining market capitalization and subdued momentum. The subsequent move will more than likely indicate the short-term course in this Cardano price prediction.