BlackRock partners with Uniswap to bring Tokenize bond funds to DeFi, causing UNI to surge. Photo: Diaro

BlackRock partners with Uniswap to bring Tokenize bond funds to DeFi, causing UNI to surge. Photo: Diaro

BlackRock continues to expand its presence in the decentralized finance (DeFi) sector by paving the way for trading its Tokenize US Treasury bond fund directly on the blockchain, through partnerships with Uniswap Labs and Securitize.

Today, we are announcing a strategic integration in collaboration with @Securitize , to make @BlackRock USD Institutional Digital Liquidity Fund (BUIDL) available to trade via UniswapX through Securitize pic.twitter.com/eXfnLTUkVU

— Uniswap Labs 🦄 (@ Uniswap)February 11, 2026

According to an announcement made yesterday, shares of the BlackRock USD Institutional Digital Liquidity Fund ( BUIDL ) will be distributed to eligible investors through UniswapX technology. This is an Off-Chain order routing system developed by Uniswap Labs, which aggregates liquidation and settles transactions directly on the blockchain.

Uniswap is currently one of the world's largest decentralized exchanges by cumulative volume , operating on automated market-making smart contracts (AMMs). With UniswapX, the platform is expanding into a model more suited to institutional trading, allowing market makers to compete by quoting prices and matching orders through an auction mechanism.

BUIDL transactions will be executed through Securitize Markets using a “request-for-quote” (RFQ) model, connecting verified institutions and bringing transactions to on-chain settlement via smart contracts. This mechanism allows institutional market makers such as Wintermute, Flowdesk, or Tokka Labs to participate in quoting, thereby improving liquidation depth compared to a pure AMM model.

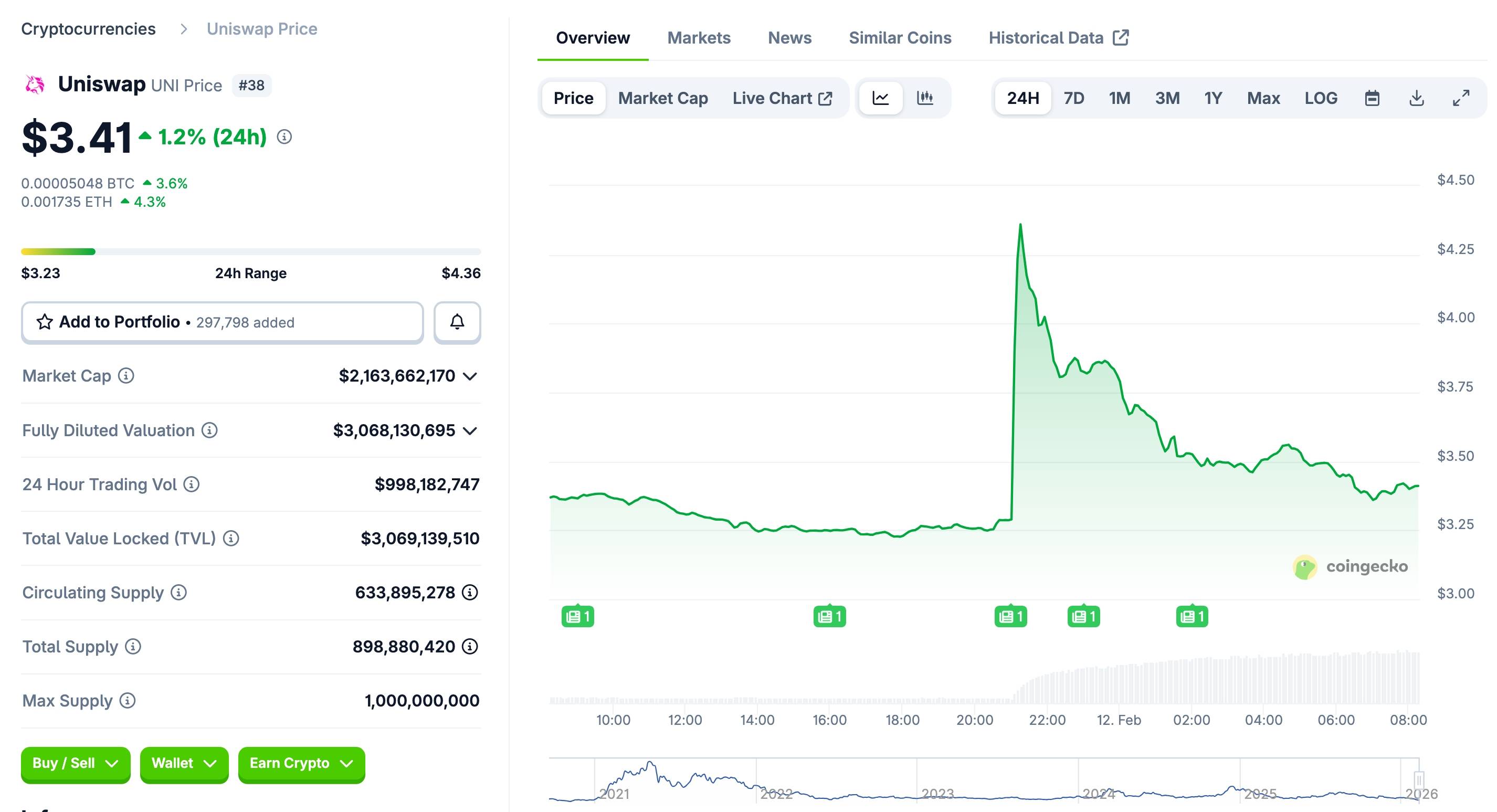

BlackRock also announced that it had invested in the Uniswap ecosystem by purchasing an undisclosed amount of UNI Token . Following this announcement, the price of UNI briefly surged by approximately 20% to nearly 30% before correcting back to its previous price range.

UNI price fluctuations over the past 24 hours, screenshot from CoinGecko at 08:15 AM on February 12, 2026.

UNI price fluctuations over the past 24 hours, screenshot from CoinGecko at 08:15 AM on February 12, 2026.

The agreement marks the first time BlackRock has directly utilized DeFi trading infrastructure for a Tokenize product. Previously, BUIDL had enabled on-chain transfers and participation in some forms of liquidation mining, but had never been directly integrated with a large-scale decentralized trading platform.

BUIDL, issued by Securitize, is backed by US Treasury bonds and cash equivalents. It is currently the largest institutional-grade Tokenize fund on public blockchains, with total assets under management of approximately $2.4 billion as of February 11th. Unlike stablecoins, BUIDL is a yield-generating product that directly reflects the yields on US government bonds.

BlackRock has recently expanded its BUIDL deployment to include BNB Chain and Solana , and integrated with DeFi protocols like Euler through wrapped versions.

Securitize, an operator of licensed brokerage firms and alternative trading systems (ATS) in the US, serves as the Tokenize and compliance layer for BUIDL. The company states that investors trading through UniswapX will undergo pre-auditing and be whitelisted to maintain legal oversight while accessing DeFi infrastructure.

Coin68 compilation