I've been in the cryptocurrency industry for six or seven years, and for the past two years I've also been deeply involved in the AI field, based in Silicon Valley. Because I'm in both circles, one very obvious feeling I've had is that in mainstream Silicon Valley circles, the word "crypto" is mentioned less and less, but what crypto does is used more and more.

I want to bring back some insights from the AI field for Crypto practitioners to reference.

This misalignment is most evident in YC.

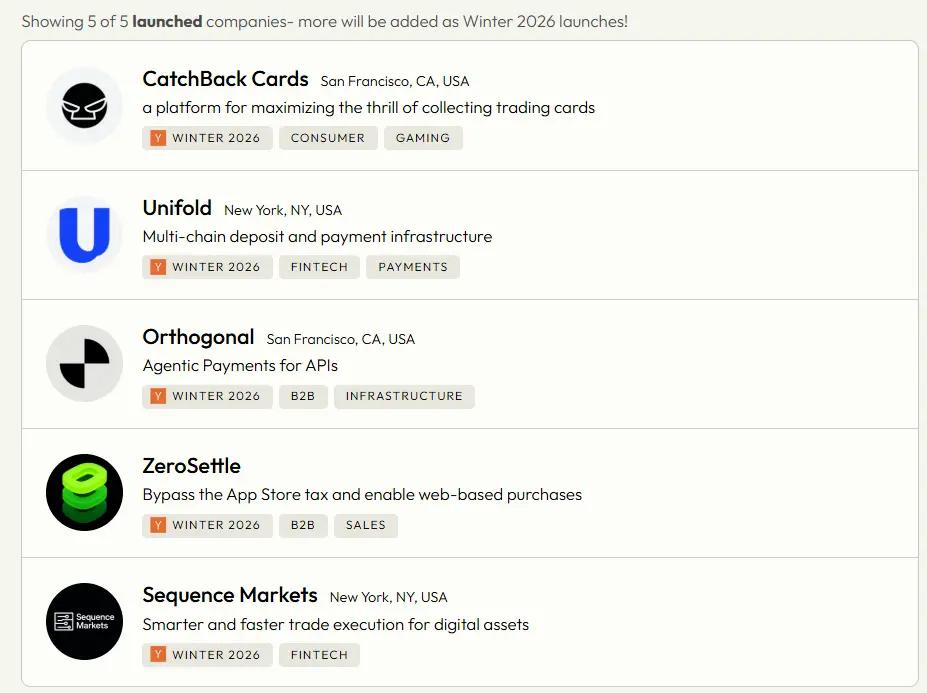

YC Winter 2026 has just been announced, and out of 149 companies, 5 are related to crypto. This number isn't high, but if you look at historical data, you'll find a very clear story behind these 5 companies.

A set of data

YC started investing in Crypto projects in 2014, and has invested in 177 companies to date. I've broken down the number of investments in each batch; the changes are quite clear.

In 2018-2019, the number of companies invested in each batch was 3-7, showing a steady upward trend. In 2020, the number of companies invested in each batch was 5-7, indicating an acceleration. In 2021, the number of companies invested in each batch jumped directly to 13-15. 2022 saw the peak – 24 companies were invested in during the Winter batch, and 20 companies were invested in during the Summer batch, totaling 44 crypto companies invested in in one year.

Then there's the cliff.

In 2023, they still managed to invest in 10-13 crypto companies per batch, sustaining the business for a year. But things started to collapse in 2024—7 in Winter, 4 in Fall, and a mere 1 in Summer. That entire summer, Y Combinator only invested in one crypto company.

In 2025, Winter saw a brief rebound to 10 companies, but then Spring and Summer saw a drop to only 2 companies per batch.

By Winter 2026, there will be 5 companies.

If you're a crypto professional, seeing "back to 5 from 1" might seem like a sign of recovery. But if you look at what these 5 companies are actually doing, you'll find they're practically two different species from the 24 companies in 2022.

What are the Crypto companies that Y Combinator invested in doing in 2022? DeFi protocols, NFT infrastructure, DAO tools, L2 scaling, blockchain games, and social tokens.

What will these 5 companies be doing in 2026? Stablecoin deposit API, new cross-border banks, transaction execution engines, AI Agent payment gateways, and attention-based exchanges.

No one is building a blockchain, no one is developing a protocol, and no one is working on any of the traditional "Crypto tracks" that you can name.

This isn't a recovery; it's a complete overhaul.

Three deterministic projects

Let's quickly go through the three that are relatively easy to understand first.

Unifold, a New York-based team, is Stripe, a cryptocurrency deposit platform. A single API and SDK allows any app to integrate cross-chain, cross-token on-chain deposits with less than 10 lines of code. Co-founder Timothy Chung previously worked at Streambird (a wallet-as-a-service, later acquired by MoonPay and becoming MoonPay Wallets), and also at Polymarket and Instabase. Another founder, Hau Chu, is a Cornell Tech graduate. This is a typical developer tool business—users don't need to know the underlying cryptocurrency.

SpotPay, a San Francisco-based team, is a new cross-border bank based on stablecoins. CTO Thomas previously worked at Google and was Brex's fourth engineer. CEO Zsika is also a Google alumnus, holding a Stanford MBA, and grew up in the Caribbean and Latin America, experiencing firsthand how painful cross-border remittances can be. The product is straightforward: one account handles overseas receipts, local payments, global spending (with a physical card), and savings with interest. It runs on a stablecoin at the bottom, but the front end is a Fintech app with no visual connection to cryptocurrencies.

Sequence Markets, based in New York, is a five-person team that provides intelligent trading execution for digital assets. They help institutional investors with intelligent routing across exchanges to obtain better prices and lower slippage. They operate entirely non-custodially, never touching user assets, focusing solely on the technical layer—a typical "water-selling" model.

The common thread among these three companies is clear: Crypto is the conduit, not the selling point.

Two projects worth discussing further.

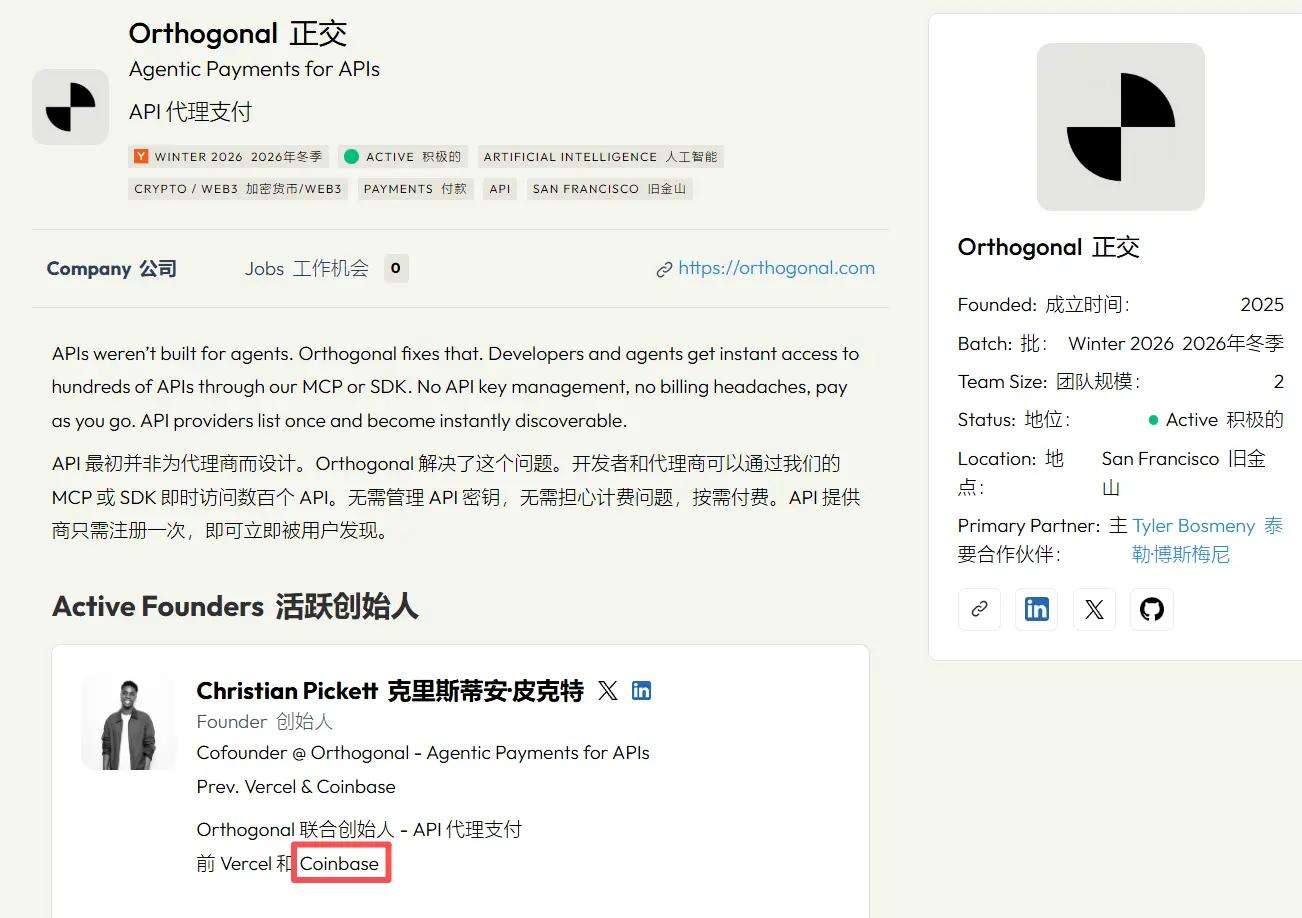

Orthogonal—When an AI agent spends money, it uses Crypto.

I think crypto professionals should take a serious look at this project.

Founder Christian Pickett previously worked on payments at Coinbase and also at Vercel. Bera Sogut worked on reCAPTCHA and Maps APIs at Google, and also at Amazon Robotics. He was a two-time ACM ICPC (International Collegiate Programming Contest) world finalist.

The problem they're trying to solve is this: There are increasingly more AI agents, and these agents need to call various paid APIs to complete tasks. However, agents don't have credit cards or bank accounts, and can't go through the registration-card binding-payment process like humans. The current approach is for developers to pre-charge the agents or bind their own API keys. This works when there are only a few agents, but when thousands or tens of thousands of agents need to independently call hundreds of paid services, this system can't handle it.

Orthogonal provides a unified gateway: Agents connect via MCP or SDK to instantly access hundreds of paid APIs, paying only for each request. There's no need to manage API keys or establish billing relationships. API providers are listed once and can be discovered and used by all agents. The underlying settlement uses Crypto, supporting the x402 protocol—an on-chain implementation of HTTP 402 Payment Required.

Why is this relevant to the cryptocurrency industry? Because real-time machine-to-machine micropayments are precisely what the traditional financial system struggles with—credit cards have transaction fees, bank transfers have delays, and these frictions that are tolerable in human transactions become fatal flaws in scenarios where agents call APIs thousands or tens of thousands of times daily. Cryptocurrencies, with their programmability, instant settlement, and permissionless nature, are naturally suited to this scenario.

A noteworthy timeline: YC highlighted "Infrastructure for Multi-Agent Systems" in its Fall 2025 RFS (Research Consulting), and submitted it to Orthogonal six months later. Early supporters included a number of YC alumni companies developing agent products, such as Precip (W24), Riveter (F24), Andi (W22), and Fiber AI (S23), indicating that this need was not theoretical but a real phenomenon.

Here's an interesting intersection : A recent viral article from Orange stated that "Agents are the new owners of software," and SaaS needs to shift from B2B and B2C to B2A (to Agent) . If this assessment holds true, then payments between agents become a fundamental infrastructure problem that must be solved—and Orthogonal is betting on Crypto to solve it.

Forum – Turning “Attention” into a Tradeable Asset

This project has the greatest potential, but also the greatest risk.

Founder Owen Botkin previously long equity trading at Balyasny (one of the world's top hedge funds). Joseph Thomas was an engineer at NASA and Dreamwave AI. YC's partner for this project is Jared Friedman, one of YC's core partners.

Forum aims to be "the first regulated attention exchange." Specifically, it constructs indices from data from search engines, social media, and streaming platforms to quantify the "degree of attention" received by a topic, brand, or cultural phenomenon, and then allows users to long or short on changes in this level of attention.

For example, if you believe a brand is about to lose public attention due to a PR crisis, you can short its attention index. If you believe a cultural phenomenon is rapidly gaining momentum, you can long.

Their core argument is that attention is the primary driver of business success in the digital age; advertising, traffic, and user growth are ultimately all about monetizing attention. However, attention itself has never been directly priced or traded.

This project doesn't currently have Crypto/ Web3 tags, but the combination of "regulated exchange" and "creating new asset classes" strongly suggests it will involve tokenization. The term "new financial primitives" first appeared in Y Combinator's RFS in Spring 2026, and Forum is precisely heading in that direction.

For the cryptocurrency industry, Forum represents a much broader direction than stablecoin payments—if the tokenized object is no longer a JPEG or a share of real estate, but something previously unquantifiable like "attention," then it's a completely different story. Of course, it's too early to say whether it will work.

Changes in RFS

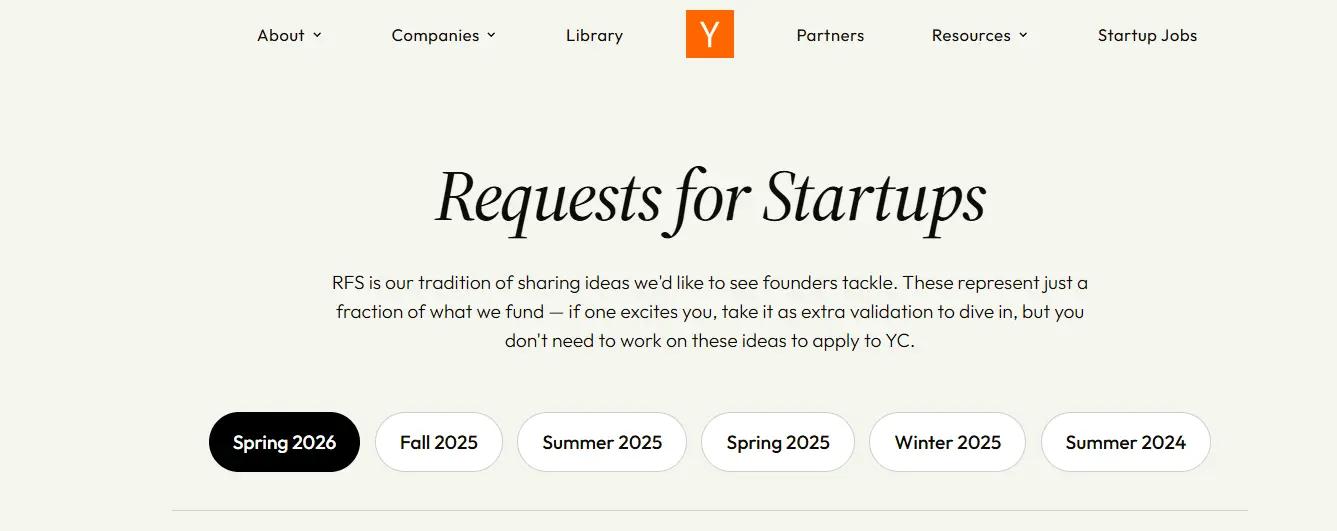

Besides looking at what YC has invested in, it's also worth looking at what YC has publicly stated it wants to invest in.

YC releases a Request for Startups (RFS) every quarter, which is essentially an official guide for project selection. I've compiled the Crypto-related content from the last three issues:

Summer 2025: 14 directions, but Crypto wasn't mentioned at all. Even the discussion on "AI for Personal Finance," which focuses on investment and tax optimization, completely omitted Crypto. YC's attention was entirely focused on AI.

Fall 2025: There was still no dedicated Crypto section, but two directions were foreshadowed – "AI-Native Hedge Funds" (the digital asset market is 24/7 and data is open, making it naturally suitable for AI quantitative analysis) and "Infrastructure for Multi-Agent Systems" (this is the scenario that Orthogonal later entered).

Spring 2026: Change is coming. Daivik Goel wrote a special article on "Stablecoin Financial Services," directly naming the GENIUS Act and the CLARITY Act, two US stablecoin laws, stating that stablecoins are in a regulatory gray area between DeFi and TradeFi. His original words were: "The regulatory window is open. The rails are being laid."

The introduction to RFS at the same time also introduced the term "new financial primitives" for the first time, listing it alongside AI-native workflows and modern industrial systems.

This is the first time in nearly two years that YC has dedicated a separate topic to Crypto-related areas at RFS. The wording is also very specific—it doesn't say "blockchain" or "Web3," but rather "stablecoin financial services," and gives specific directions: yield-bearing accounts, tokenized real-world assets, and cross-border payment infrastructure.

What I think

As someone who works in both the Crypto and AI sectors, I think this data is actually good news for us Crypto professionals—it's just that the way it's good might be different from what many people expect.

YC hasn't given up on Crypto, but YC has redefined what kind of Crypto companies are worth investing in.

In short : YC is no longer investing in Crypto, but in companies that use Crypto.

What's the difference? The former's value proposition is "I am building the Crypto ecosystem," while the latter's value proposition is " I am solving a real problem, and Crypto happens to be the most suitable tool."

Users of the former need to understand what wallets, gas fees, and on-chain interactions are. Users of the latter have no idea they are using Crypto—SpotPay users think they are using a banking app, Unifold customers think they are integrating a payment SDK, and Orthogonal's Agent doesn't even have the concept of "thinking."

What does this mean for us?

First, the good news: the stablecoin payment sector has gone from being a consensus within the industry to becoming mainstream in Silicon Valley. Y Combinator's dedicated presentation at RFS, the progress of the GENIUS Act and CLARITY Act, and Stripe's acquisition of Bridge—these signals combined indicate that the compliance path for stablecoins is being cleared. For teams that have been deeply involved in this sector, both the funding environment and market awareness are improving.

Secondly, there are new opportunities: Agent payments are a demand that has grown from within the AI industry, and Crypto practitioners have a natural advantage in capitalizing on it. Machine-to-machine real-time micropayments, programmable money, and permissionless settlement—these are things we've been talking about for years, and suddenly they have their most concrete application scenarios in the Agent economy. It's not that we're looking for scenarios; the scenarios are coming to us.

Of course, there's also the reality we need to face: the profiles of our competitors have changed. SpotPay's CTO is Brex's fourth engineer, and Orthogonal's founders come from Coinbase and Google—these people aren't crypto natives, but they bring with them the engineering capabilities and product methodologies of traditional tech companies. For those of us in the crypto industry to compete with them, understanding blockchain technology alone isn't enough; we also need to catch up on product experience and engineering.

Furthermore, L1/L2, DeFi protocols, NFTs, and DAO tools—not that they're without value, but they're no longer a priority for mainstream Silicon Valley accelerators and VCs. This doesn't mean these areas are dead, but if you're working in these areas, your fundraising strategy and narrative may need adjustment.

Finally, regarding the data line "24→1→5", I think the most accurate interpretation is neither "Crypto is recovering" nor "Crypto is declining", but rather: Crypto is being redefined.

YC spent two years figuring out one thing— the greatest value of crypto might not be becoming an independent industry, but rather becoming the infrastructure for other industries. Whether this judgment is correct remains to be seen. But as someone who is involved in both sectors, I believe there are numerous opportunities for crypto practitioners—provided we are willing to look at ourselves from a different perspective.

Crypto doesn't need to disappear, but Crypto's best product is one that users might not even feel Crypto's presence at all.

This is not a compromise; it may be the greatest victory.

You may disagree with this assessment, but this is the stance expressed by the most influential startup accelerator in Silicon Valley, backed by real money.

Data sources: YC Directory (Crypto/Web3 tags, 177 companies in all batches), YC Winter 2026 Launch List (149 companies), YC Request for Startups (Summer 2025 / Fall 2025 / Spring 2026). Detailed information on the 5 Crypto-related projects comes from the YC website and publicly available information from each company.