Source: DeFi Report

Author: Michael Nadeau

Compiled and edited by: BitpushNews

Looking back at 2021, retail transactions accounted for 88% of Coinbase's total revenue. However, last year (2025), as the company diversified into subscriptions, services, and institutional infrastructure, this proportion dropped to 48%.

This article will analyze Coinbase 's ongoing transformation and what this means for the company's profitability, competitive position, and long-term valuation.

Let's begin.

Revenue performance from 2021 to 2025

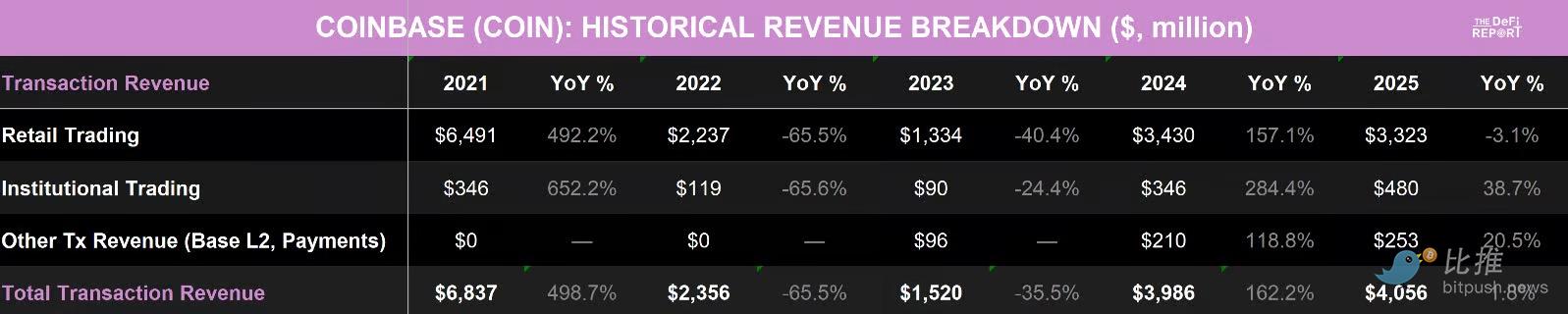

Transaction revenue

Data source: Coinbase 10k, SEC filings

Data source: Coinbase 10k, SEC filings

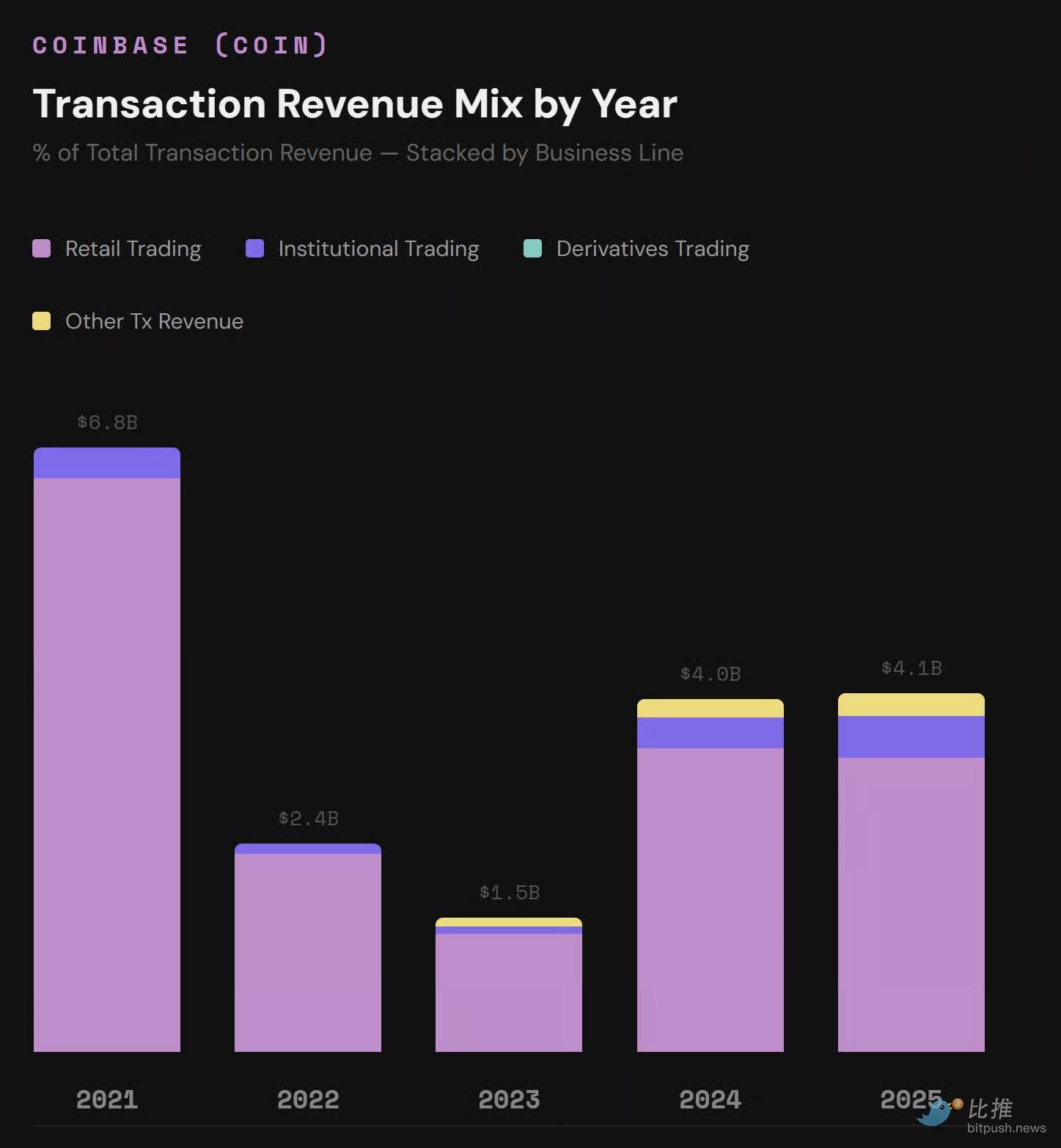

Revenue composition visualization:

(Based on Coinbase 10k and SEC filing data)

Key points about transaction revenue:

Retail dominance is slowly waning: In 2021, retail transactions accounted for 95% of transaction revenue and 88% of total revenue. By 2025, these proportions are projected to drop to 82% of transaction revenue and 48% of total revenue, respectively.

Institutional trading share is growing: In 2025, institutional trading will account for 12% of total trading revenue, up from 5% in 2021.

Other transaction revenue: Currently accounts for 6.2% of total transaction revenue. This mainly comes from Base L2 sorter fees and payment revenue—a completely new project that did not exist before 2023.

A more resilient revenue structure: When retail transactions slowed in 2022, Coinbase lost almost all of its revenue. Now, revenue is supported by three lines rather than a single source, which helps smooth out cyclical revenue fluctuations during bear markets.

Not yet back to peak: Despite some progress, trading revenue has not yet recovered to 2021 levels. In fact, trading revenue in 2025 is down 40% from 2021 (primarily due to a 48% decline in retail trading revenue).

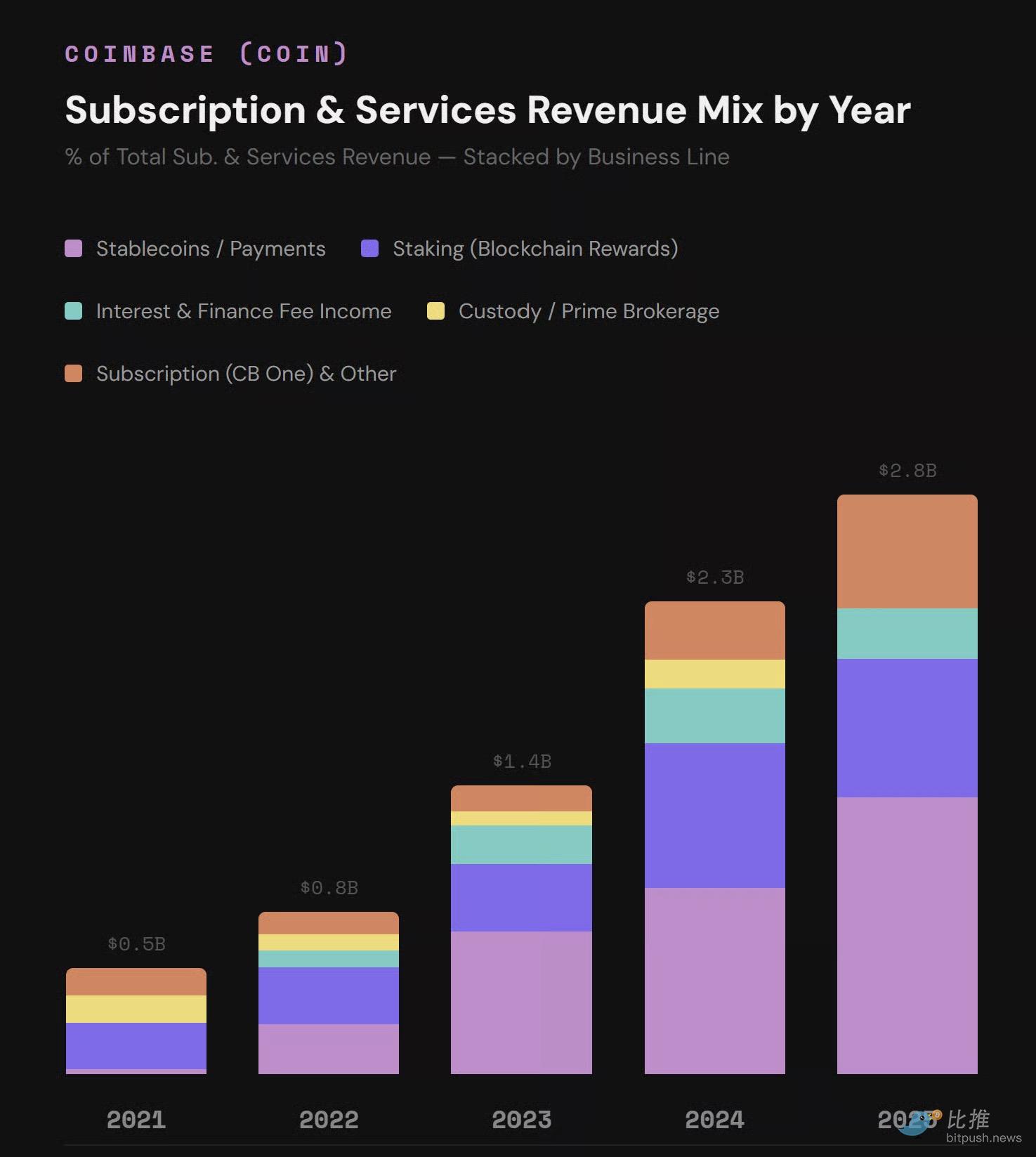

Subscription and service revenue

Data source: Coinbase 10k, SEC filings

Data source: Coinbase 10k, SEC filings

Revenue composition visualization:

(Based on Coinbase 10k and SEC filing data)

Key takeaways from subscription and service revenue:

Strong overall growth: This segment has grown 5.5 times over the past 4 years, with a compound annual growth rate (CAGR) of 53%. Most notably, the business continued to grow every year even during the bear market of 2022.

Stablecoins as a Pillar: Stablecoins have become the largest single revenue source in the sector, growing to $1.35 billion in 2025, a 52-fold increase from 2021, accounting for 19% of total revenue in 2025. This revenue stems from the partnership with Circle (USDC): Coinbase receives 100% of all USDC revenue generated within its platform (exchanges, Prime institutional services, custody) and 50% of the remaining revenue from all USDC reserves outside the platform (other exchanges, DeFi, wallets, etc.). In fact, Coinbase receives more than half of Circle's revenue through this protocol.

Staking: Revenue peaked at $706 million in 2024, then declined by 4% in 2025. We believe this was primarily due to the growth of DeFi and a significant decrease in ETH staking rewards.

Subscription revenue (Coinbase One): Grown 96% in 2025, accounting for 7.7% of total revenue. Coinbase One currently has over 1 million subscribers and generates recurring revenue similar to SaaS. Note that starting in 2025, hosting fee revenue has been incorporated into this category.

Revenue breakdown: Subscriptions and services currently account for 41% of total revenue. These revenues are recurring, low-volatility, and steadily growing, effectively offsetting the decline and volatility of retail transaction revenue.

In summary: Coinbase's total revenue grew by 9.4% in 2025, but it was still down 6.4% from the peak in 2021.

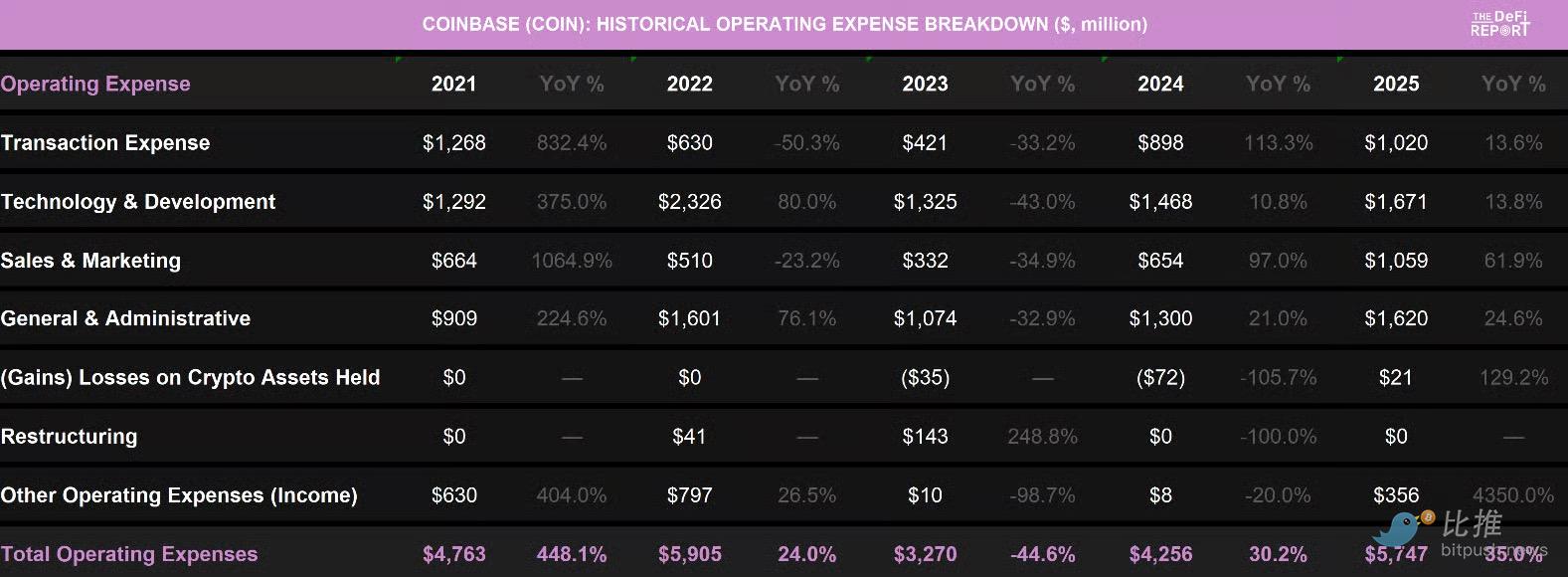

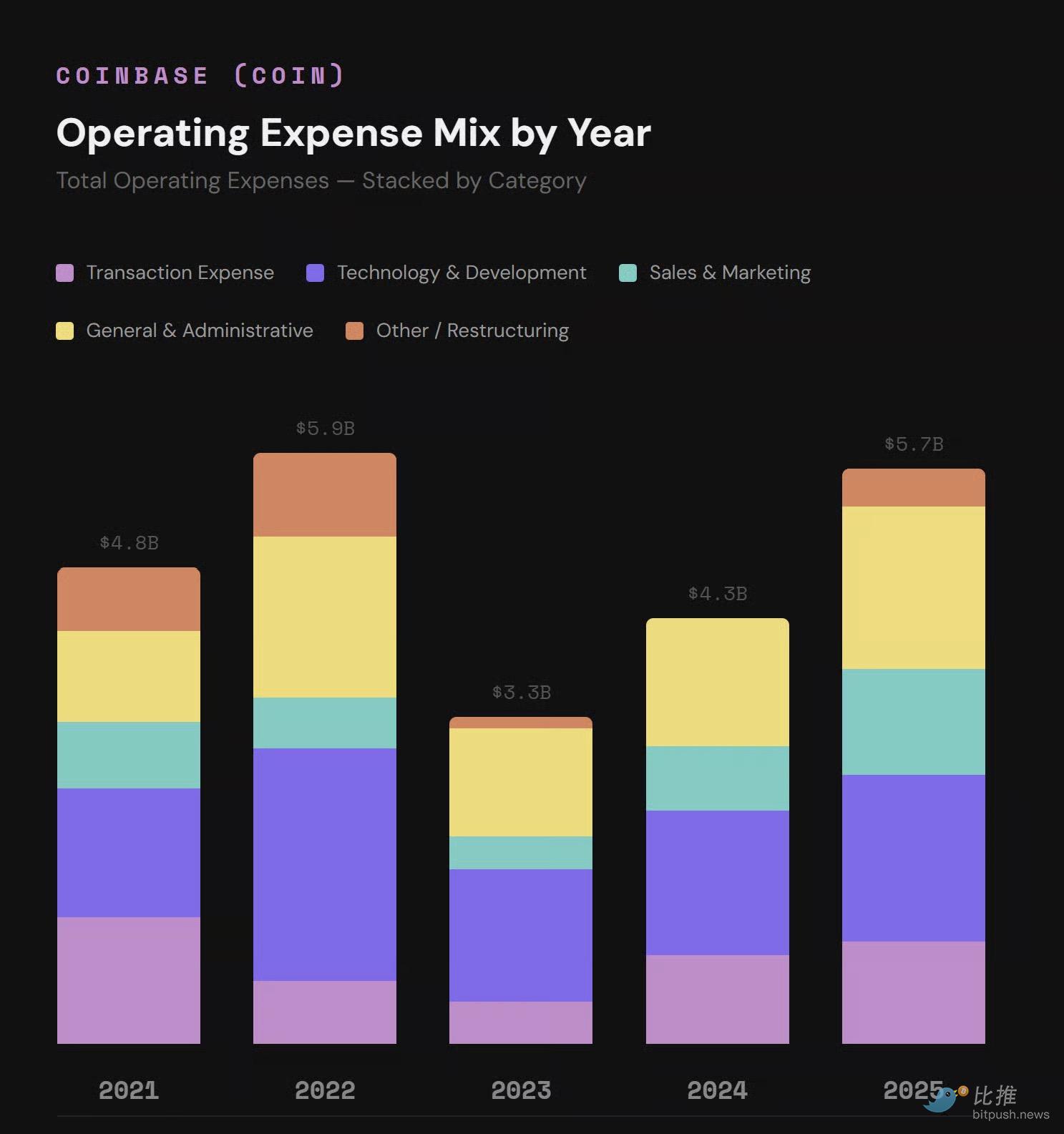

Operating expenses for 2021-2025

Data source: Coinbase 10k, SEC filings

Data source: Coinbase 10k, SEC filings

Expenditure composition visualization:

(Based on Coinbase 10k and SEC filing data)

Key points regarding operating expenses:

Once teetering on the brink of bankruptcy: In 2022, Coinbase's operating expenses reached a staggering $5.9 billion, while its revenue was only $3.2 billion. At the time, the company was burning through cash at an alarming rate, with technology and development expenses alone reaching $2.3 billion and administration and management (G&A) expenses reaching $1.6 billion.

Structural adjustments: This situation was resolved in 2023. By restructuring the workforce (laying off 950 people), optimizing the hiring process, and refocusing on core products, the company reduced operating expenses by 45%.

Operating leverage is emerging: While current operating expenses have returned to 2022 levels, the business is now twice the size it was then, successfully turning operating deficits into operating leverage. Coinbase's operating profit margin is projected to be 21% in 2025.

Expenditure distribution: 17.7% of expenditure is transaction-related (variable costs that vary with business size); 18.4% is used for sales and marketing (this item continues to grow, mainly for USDC rewards, NBA sponsorship and Coinbase One customer acquisition).

Management and R&D: The remaining 57.3% comes from Technology and Development (growing 13.8% in 2025) and Administration (growing 24.6%). Given the potential decline in revenue expectations for 2026, we believe Coinbase may again lay off staff to reduce fixed costs during the bear market.

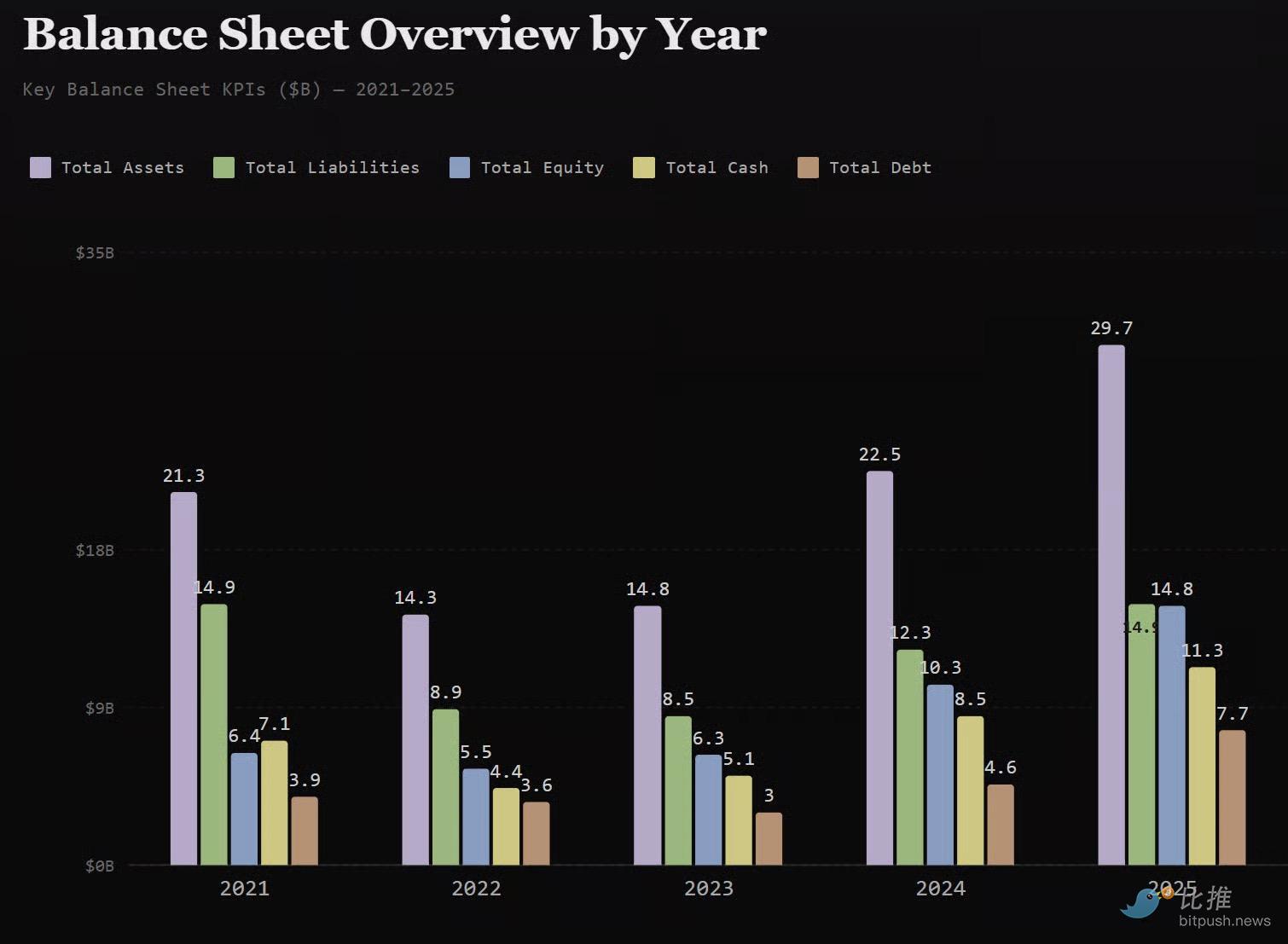

Balance Sheet for 2021-2025

Data source: Coinbase 10k, SEC filings

Data source: Coinbase 10k, SEC filings

Balance Sheet Visualization:

(Based on Coinbase 10k and SEC filing data)

Key points:

Debt Status: $1.27 billion in debt will mature this June. Of the total $7.7 billion in debt, approximately 40% is convertible bonds with a 0% interest rate; another $1.26 billion will mature in 2030 with an interest rate of only 0.25%. Current annual cash interest expense on existing debt is approximately $65 million (combined interest rate below 1%). In comparison, Coinbase earned $297 million in interest and other income in 2025 alone, with interest income being 4.5 times its interest expense.

Liability Structure: Of the total liabilities of $7.2 billion, $6.2 billion are "pass-through items," with hedged assets (client escrow liabilities and collateral return obligations) on the other side of the balance sheet. The remaining $1 billion are current liabilities related to accounts payable and operations.

Asset composition: In addition to cash (at an all-time high), Coinbase has $4.2 billion in goodwill related to the acquisition of Deribit, $2 billion in crypto assets (BTC & ETH), $623 million in strategic investments (including Circle equity), and $310 million in tradable investments. An additional $3.3 billion is in operating assets (receivables, loans, equipment).

Significant Changes: The most notable change in 2025 stems from the acquisition of Deribit (a leading derivatives exchange). Goodwill jumped from $1.1 billion to $4.2 billion, and intangible assets increased from $47 million to $1.4 billion as a result of the transaction.

Overall assessment: Coinbase's balance sheet is in its healthiest state in history. A net cash position of $3.6 billion (excluding $2.9 billion in crypto and strategic assets) means it has ample incentive to weather challenges, make strategic acquisitions, and invest in new product lines. Furthermore, its debt structure is extremely low.

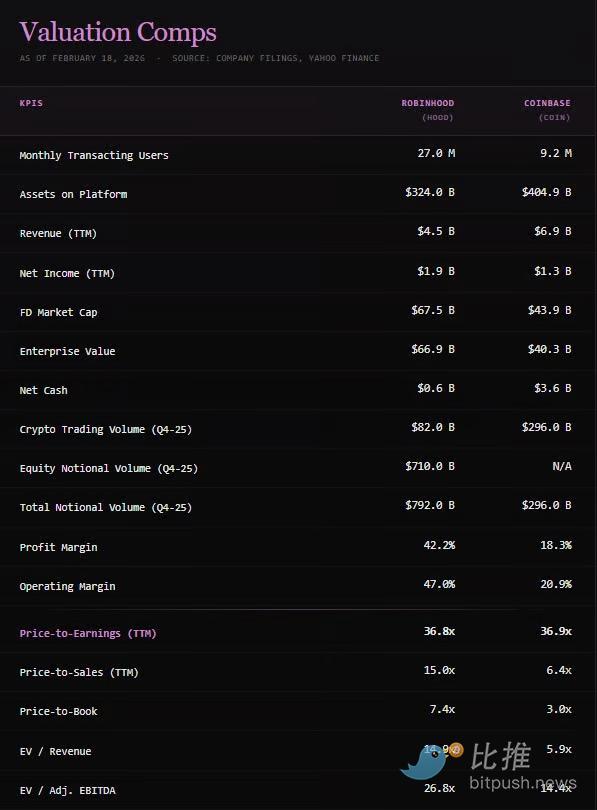

Competitive Landscape

Data source: Yahoo Finance

Data source: Yahoo Finance

COIN vs HOOD

When discussing Coinbase's competition, we focus on Robinhood . Both companies are led by their founders, were founded around the same time (Coinbase in 2012, Robinhood in 2013), both serve millennials and Gen Z, and both are building crypto-based financial infrastructures.

We believe that both companies have the potential to reach a valuation of $1 trillion and become leading financial institutions of the future.

Valuation comparison with HOOD

Data source: Coinbase 10k, SEC filings

Key points:

Valuation Divergence: While both companies have nearly identical trailing price-to-earnings ratios (P/E) of 37, COIN is only half that of HOOD in almost every other metric. This suggests that the market has a higher regard for Robinhood's earnings quality and growth trajectory compared to Coinbase.

The reason lies in profit margins: Robinhood's 47% operating profit margin and 42% net profit margin are more than double those of Coinbase (21% and 18%, respectively). This results in Robinhood having 45% more revenue than Coinbase (2.09 billion vs. 1.44 billion) despite having 35% less revenue.

Two points to note:

Coinbase's operating expenses in 2025 include $345 million in costs related to the data breach and Deribit integration costs, which are non-recurring expenses.

Robinhood has stronger cost control and a more streamlined operation. We believe this stems from a focus: Robinhood focuses on retail customers, while Coinbase tries to cater to both institutional and retail segments, resulting in an overly broad product line and higher operating costs.

Cash Flow: Coinbase holds $11.3 billion in cash (nearly three times Robinhood's $4.3 billion), and with crypto assets and strategic investments, the total available resources of $14.1 billion provide a stronger survival buffer.

Debt nature: The vast majority of Robinhood's debt ($11.8 billion) is operating brokerage debt (securities lending and hedging, etc.), with almost no long-term corporate bonds. Coinbase, on the other hand, holds $7.7 billion in corporate bonds, but at extremely low interest rates.

Buybacks and Reductions: Robinhood began aggressive buybacks in Q3 2024 (repurchasing $910 million). Coinbase began buybacks in 2025 ($408 million) and stated it would look for opportunities during the bear market. Meanwhile, CEO Brian Armstrong's reduction of holdings (approximately $550 million reduced between April 2025 and January 2026) has drawn negative attention. While this may seem unfavorable, we believe the market reaction is excessive, as this is a normal, pre-planned reduction by executives and represents only 3.3% of their holdings.

Risk factors

Increased competition: Traditional brokerages (Schwab, Fidelity) are expanding their crypto businesses; Binance remains a major player in the international market; and companies like BlackRock and Fidelity are building competing infrastructure for institutional clients.

Regulation: Coinbase is playing a role in the Clarity Act negotiations. If the new regulations favor traditional institutions, it will severely impact native crypto services.

Cyclicality: Despite revenue diversification, 59% of revenue is still directly related to crypto prices and market sentiment.

Interest Rate Risk: Stablecoins account for 19% of total revenue. A significant interest rate cut by the Federal Reserve would directly impact this revenue. Coinbase warned in its Q1 2026 guidance that revenue could decrease by $100 million to $150 million as a result.

Security Risk: The data breach in May 2025 resulted in $345 million in financial losses and reputational damage.

Concentration Risk with Circle: An often underestimated risk is that the GENIUS Act could make their partnership illegal. The legal point of contention is whether Coinbase, as the custodian of users' USDC, falls under the category of "holders" prohibited from paying interest under the Act. While we believe it does not, investors should remain vigilant.

Conclusion

Despite the challenging fourth quarter, Coinbase's underlying business structure is stronger than ever before. The company boasts $11.3 billion in cash reserves, a $2.8 billion subscription and service revenue base (representing 41% of total revenue), and a leading position in institutional custody and stablecoin infrastructure.

Currently, COIN's valuation on P/S (price-to-sales ratio), P/B (price-to-book ratio), and EV/EBITDA is only about half that of Robinhood. Given its stronger balance sheet, we believe COIN offers a highly attractive risk-reward ratio for investors who firmly believe in the long-term growth of the crypto capital markets.

We exited most of our COIN positions in the third/fourth quarter of last year (profiting 270%), but currently still hold positions with an average entry price of $99.58 and are looking for opportunities to add to our positions.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush