The macroeconomic environment is still not optimistic, but the Ethereum Layer 2 ecology continues to grow against the trend.

Written by: Peter Jonas, Foresight Ventures

Market View Macro Liquidity

Currency Liquidity has tightened. The Bank of Japan raised interest rates in disguise, and short-term global Liquidity remains tight. The Federal Reserve said last week that as long as the US inflation level remains high, it may accelerate interest rate hikes in 23 years and may maintain high interest rates for a longer period of time. The continued contraction of funds may trigger a black swan event in the market, which also provides an excuse for the Fed to cut interest rates. The U.S. stock market continued to fall, and the encryption market has been relatively strong in the past two weeks.

The whole market

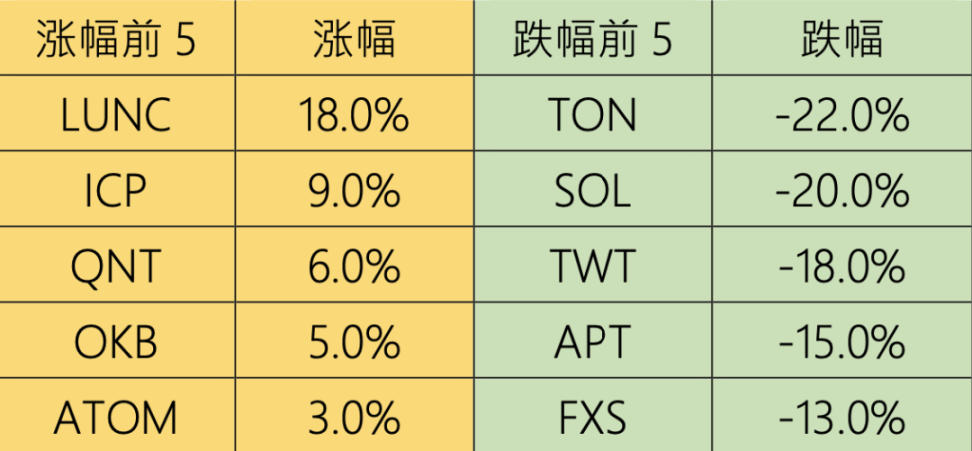

The top 100 gainers by market capitalization:

This week, the encryption market generally fell, and BTC fell by 2%. The main highlight of the on-chain market recently is that L2, arbitrum and optimisim are more active than the Mainnet, and the development of zk ecology is slightly delayed. Over the past two months, 60% of all Ethereum transactions occurred on L2.

SOL: hit a new low in stages. The two largest NFT projects on the Solana chain moved to the ETH chain and the Polygon chain. Multicoin Capital, one of the largest investors in SOL , has withdrawn 90% of its net worth, and Alameda continues to sell SOL.

BLD: Up 70% recently. BLD is a smart contract development platform based on the Cosmos ecology, and its main selling point is that it can use the javascript language. BLD is a coinlist public offering of 80 million US dollars, and the team comes from Google and Microsoft. The disadvantage is that the market value is slightly larger, and it will be unlocked in January next year.

BTC market

Data on the chain

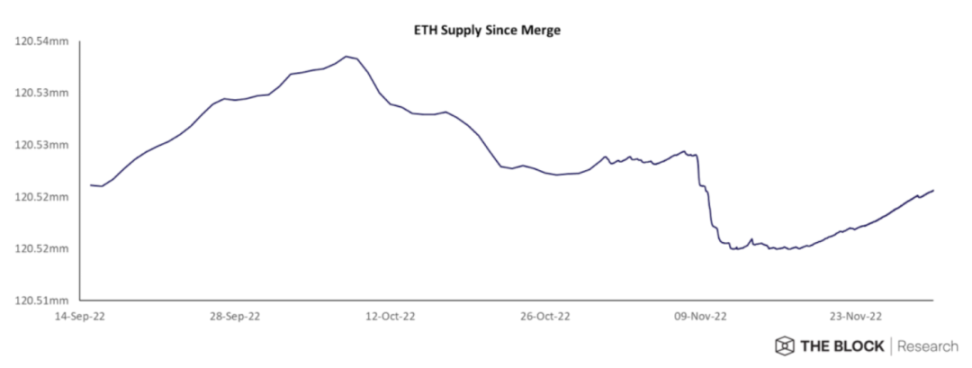

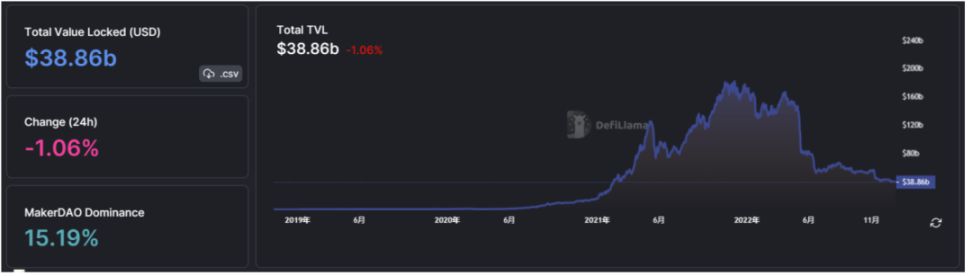

One month after the Ethereum merger, Ethereum daily emissions entered a net deflationary state. But the move to POS leads to the fact that the security of Ethereum has nothing to do with miners, but everything to do with the price of Ethereum. The drop in the price of the L1 public chain has caused the lock-up volume of the DeFi ecosystem to drop by 75% from the high point. At present, the L2 of Ethereum is dominated by the Optimism and Arbitrum of the OP route, and other solutions such as Celestia with professional division of labor; zkSync, Scroll, and Polygon Hermez of the zk route are also catching up.

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the index is greater than 6, it is the top interval; when the index is less than 2, it is the bottom interval. MVRV fell below the key level 1, and holders are generally in the red. The current indicator is -0.24, which is in the green Bottom Fishing range.

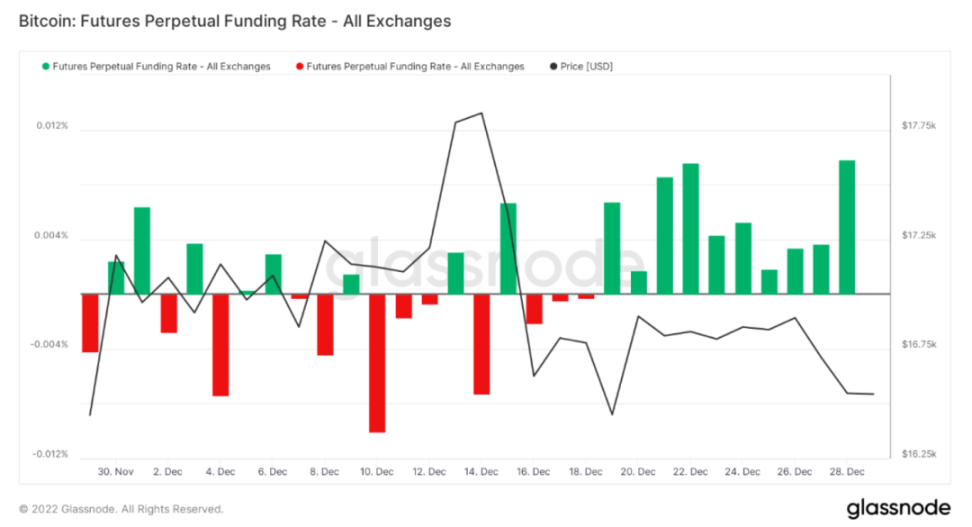

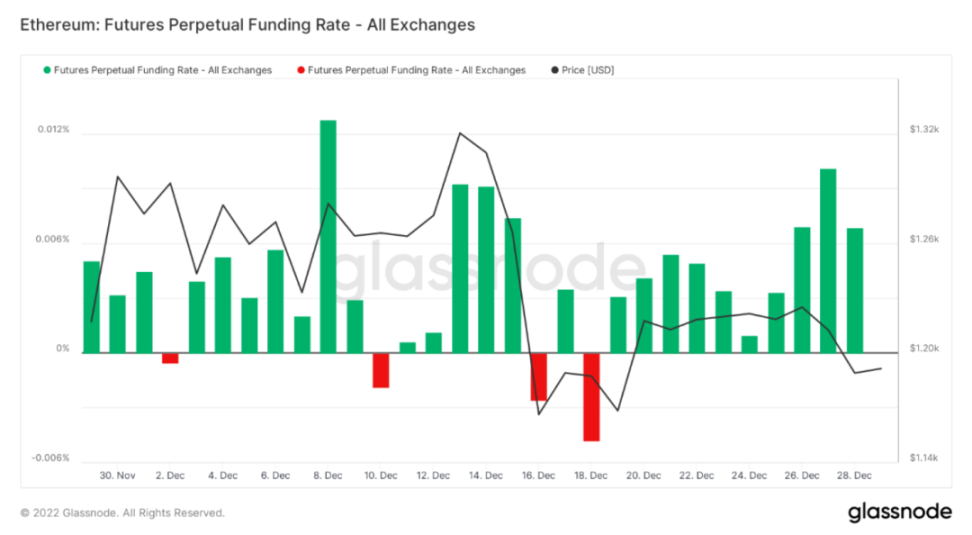

futures market

Futures funding rate: This week, the rate is the main one. The market sentiment is bullish. ETH is stronger than BTC. The fee rate is 0.05-0.1%, with more long leverage, which is the short-term top of the market; the fee rate -0.1-0%, with more short leverage, is the short-term bottom of the market.

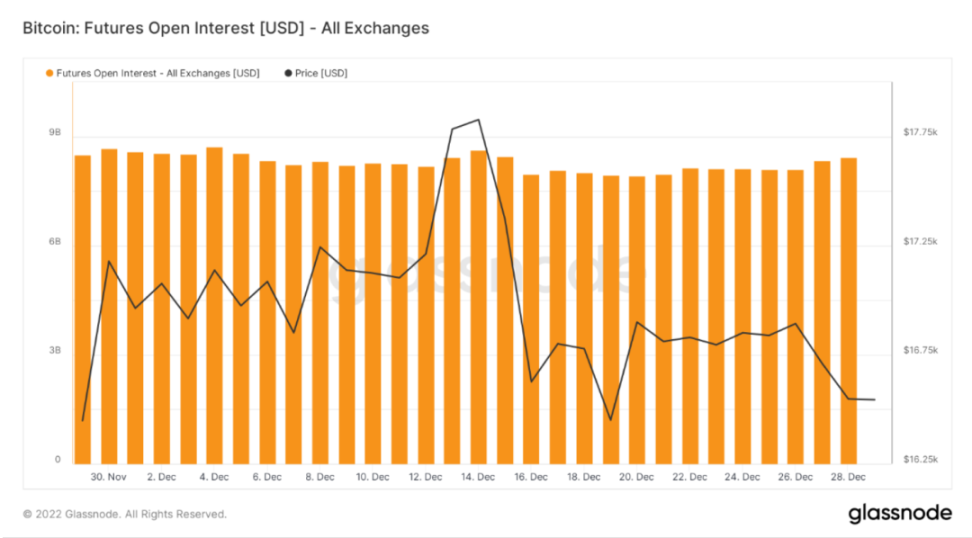

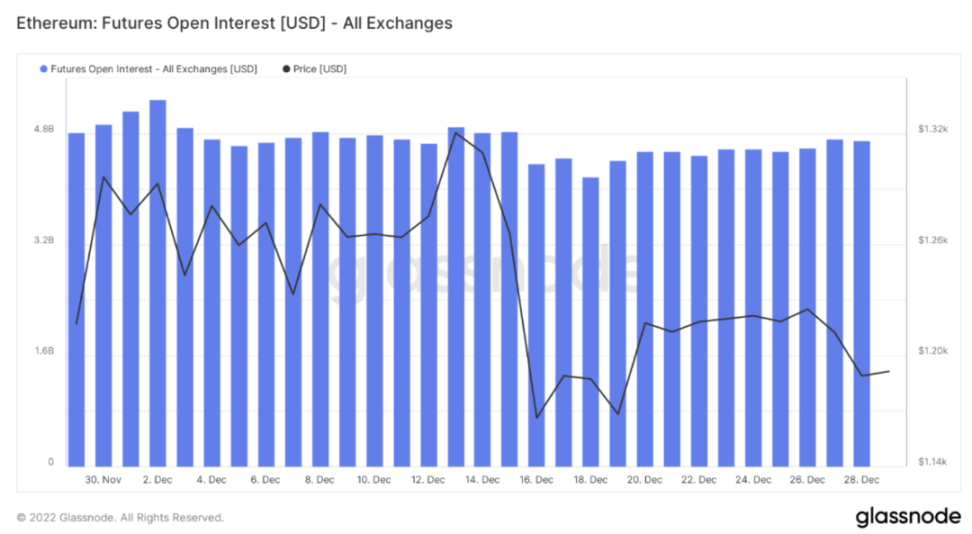

Futures open interest: The total open interest increased slightly this week, and the bulls may be preparing for a rebound. For the full year, BTC futures volumes are down 50%, and ETH is down just 30%.

Futures long-short ratio: 1.9. The sentiment among retail investors is bullish. The long-short ratio data fluctuates greatly, and the reference significance has been weakened.

Spot market

This week, the market was quiet and without any fluctuations, and the trading volume of the whole market fell back to the level of the last bear market in 2019. The market capitalization of the crypto market started 2022 with $2.2 trillion and ended the year with less than $1 trillion. In this round of bear market, BTC fell below the high point of the last round of bull market in June 2017, which was the first time in history, and the top 10 cryptocurrencies by market value fell by more than 80% on average. The market is quietly waiting for the boots of the last drop to hit the ground.

The total lock-up volume of the market data public chain

The overall TVL has changed little this week, and it still maintains a downward trend. This week, it decreased by 0.86B, with a decrease of 2.16%, which is slightly lower than the decline of BTC and ETH . bigger trend.

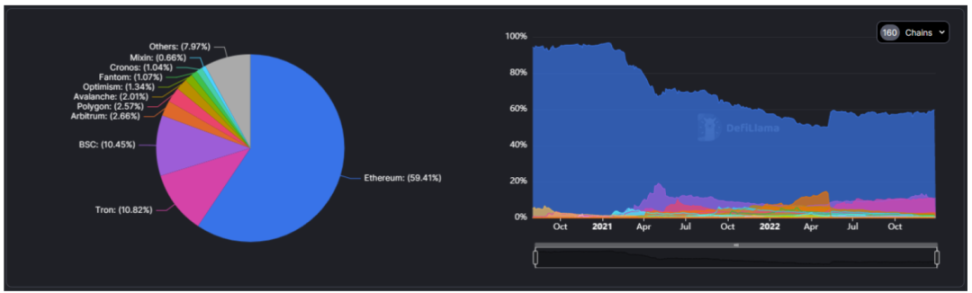

Proportion of public chain

This week, the proportion of each chain has basically leveled off, and there has been no major change in each chain. In the last round of bull market, due to the influence of a hundred flowers blooming, the proportion of the ETH chain has been gradually declining. Since Terra burst in May 21, there has been a After a substantial increase, affected by the growth of Tron, there was a slow decline again, and it began to increase in mid-July. So far, the proportion has increased by 4%, and the living space of each chain has gradually decreased.

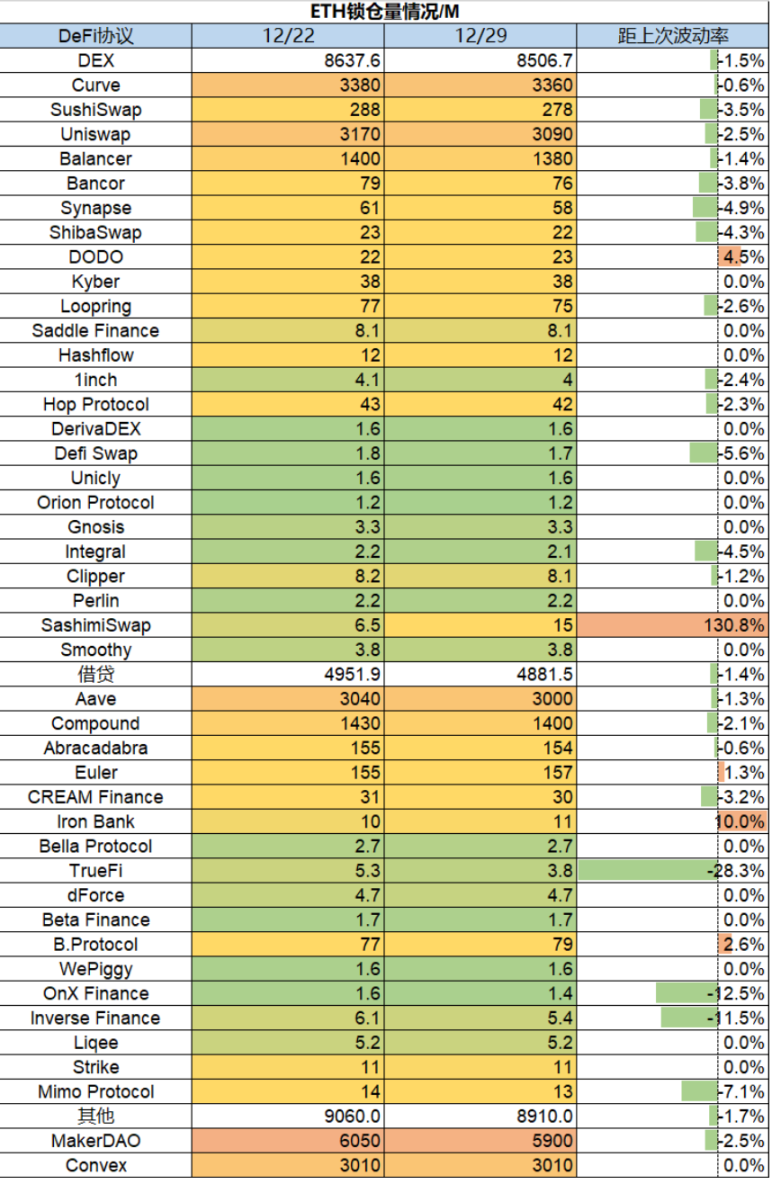

ETH locked position situation

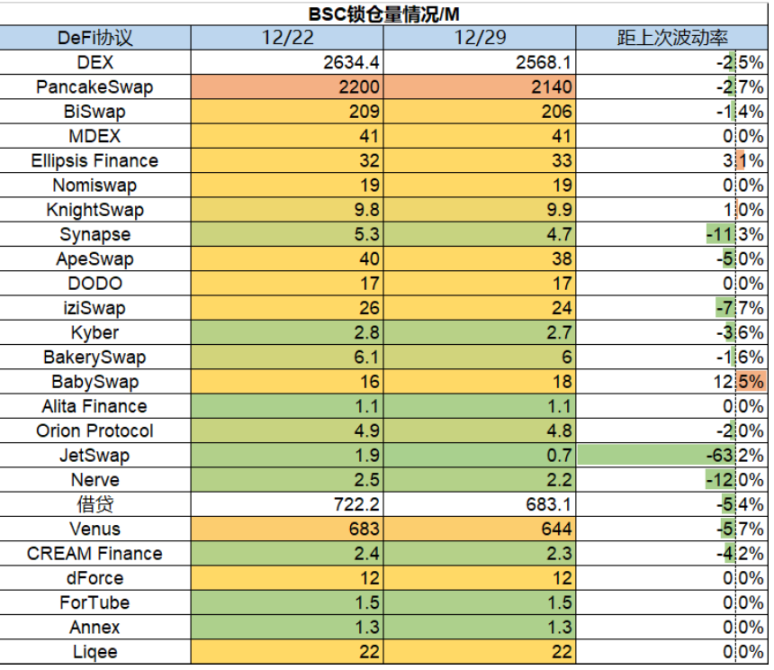

BNB Chain Lockup Amount

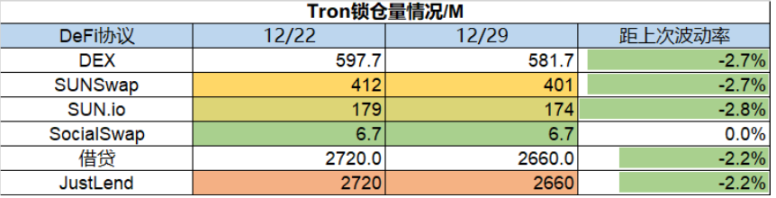

Tron Lockup Amount

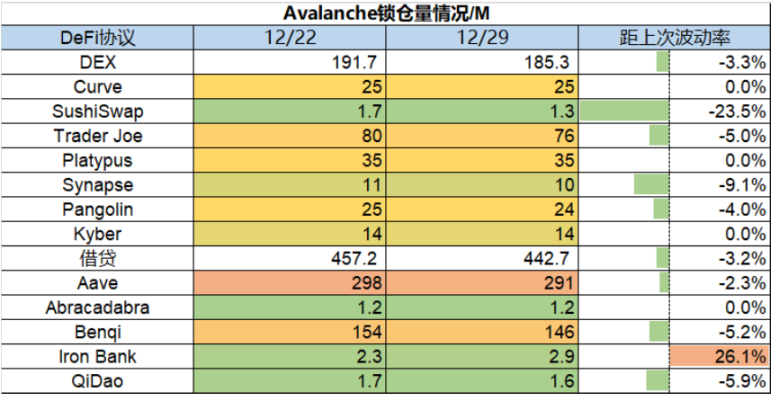

Avalanche Lockup Amount

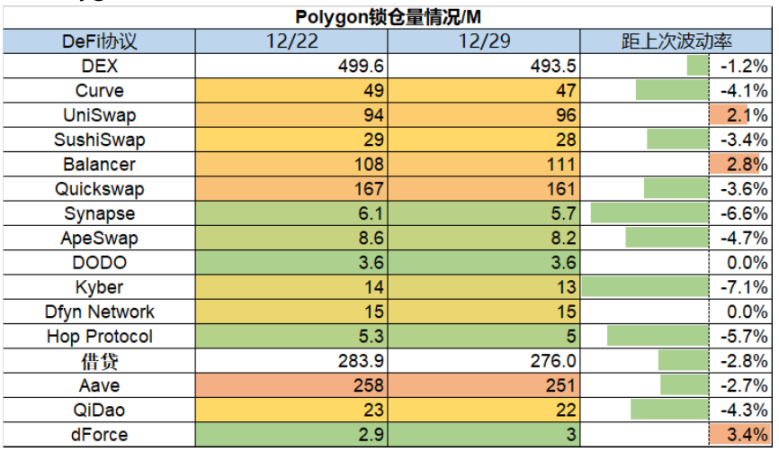

Polygon lockup volume

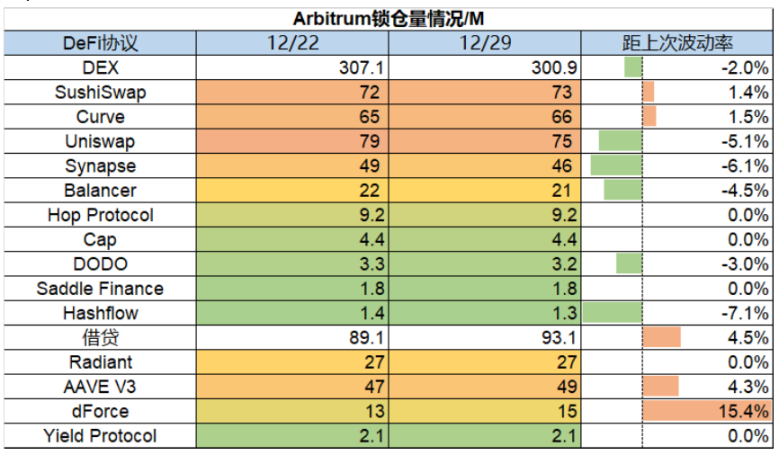

Arbitrum Lockup Amount

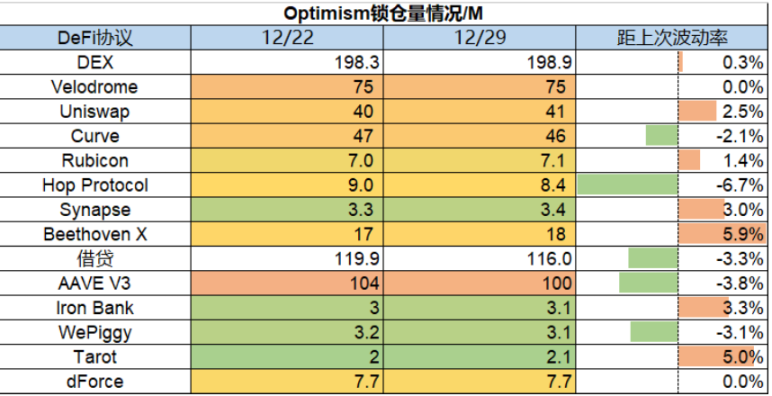

Optimism Lockup Amount

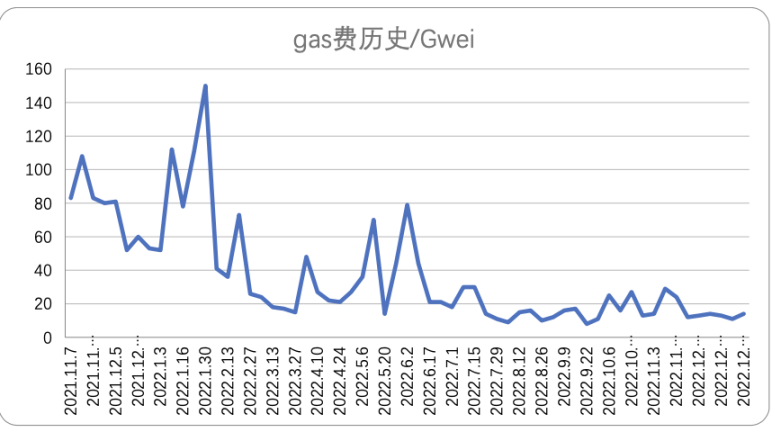

ETH Gas fee history

This week, there was a slight increase in gas on the chain. There was no surge in gas on the chain, and there was a lack of hotspots. The current average transfer fee on the chain is about , the average transaction fee is about $3.1, and the average transaction fee of OpenSea is about $1.2. Through the gas consumption on the chain, we can see that there are two new large consumers recently, Voitz and Blur. Voitz is an AMM protocol for interest rate swaps, which supports fixed-rate and floating-rate exchanges of Stablecoin on AAVE and Compound, and also supports ETH pledge Lido and Rocket’s interest rate swaps have added some new innovations to Uniswap’s LP injection; Blur is currently the hottest ETH chain aggregation NFT market. According to Gas consumption calculations, the current transaction volume is about one-third of Opensea.

NFT market data changes

NFT-500 Market Cap

Overview of NFT market transactions

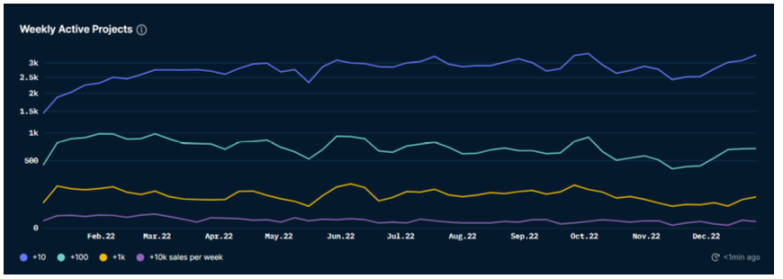

Weekly active projects

The total value of the NFT market has been growing slowly recently. Judging from the number of active projects, it has been growing steadily for four consecutive weeks. More and more projects will issue Tokens after issuing NFTs as a standard configuration for projects. Although the market is cold at this time, but in the next In a cycle, there may be a situation where NFT grows before Token. Judging from the recent transaction situation, there is an ASCII Birds. Although the transaction displayed is extremely active and the transaction volume is huge, but from the perspective of the mainstream transaction market, it may be the project party’s self-refreshing behavior, and there is no transaction on Opensea. Pudgy Penguins, a veteran blue-chip project, experienced a double surge in transaction volume and number of transactions within this week, and its floor price doubled in a short period of time to 6.5 ETH.

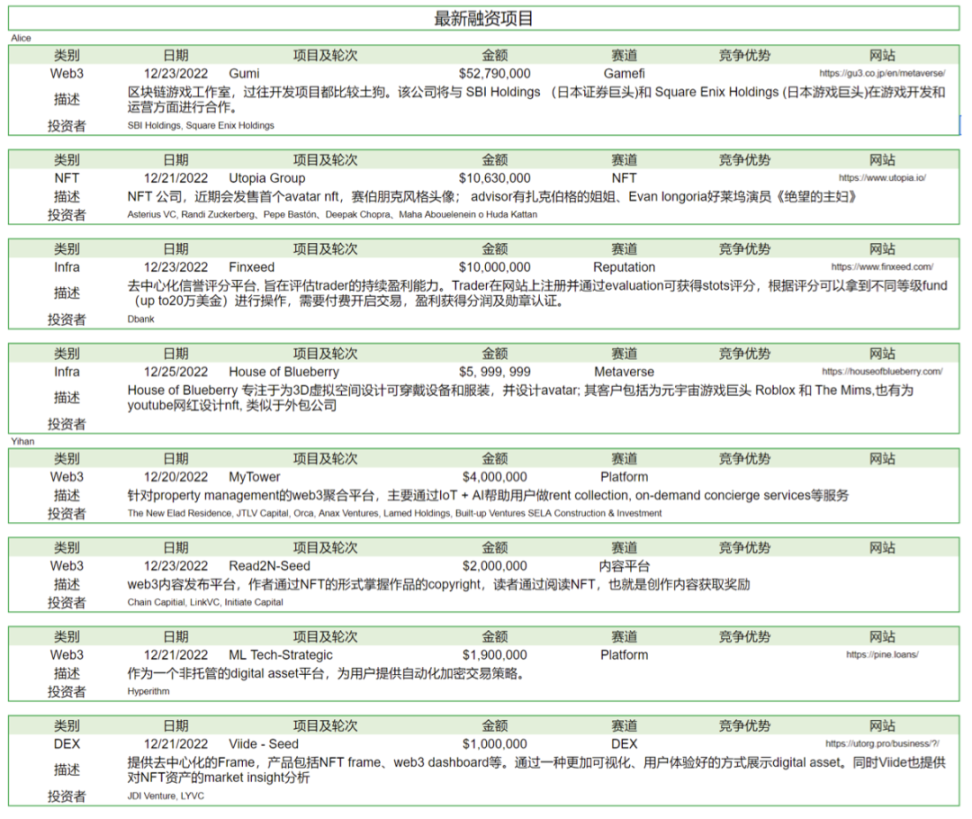

The latest financing of the project