- zkSync is arguably the most exciting L2 right now. It has already deployed its mainnet "Baby Alpha" and expects to launch its full mainnet early in the first quarter of 2023. This will be the first EVM-compatible Validity Rollup, and 150 projects have already indicated they will deploy on zkSync, including most of the DeFi blue chips.

- Additionally, zkSync will launch the first L3 proof-of-concept in 2023. The prospect of L3 is purely hypothetical so far, and it will be very interesting to see how it works out in practice.

- zkSync's focus on EVM compatibility is a key design choice that could make or break it. It has advantages and disadvantages, and the advantage lies in the infrastructure and ecosystem of EVM. Other projects are also focusing on developing new VMs that they hope will be better at building applications suitable for mass adoption. While the native account abstraction in zkSync will provide a great user experience, it remains to be seen whether it will be consistent with the EVM in the long run.

- It remains to be seen how customizable and performant the L3 will be, and how much autonomy they will have in arbitrarily designing how it operates. But one thing is for sure, zkSync deserves to be watched closely as it approaches and deploys on mainnet.

This report will provide an overview of zkSync and its main features. Also included is an assessment of its potential competitive advantage, an overview of account abstraction, and an analysis of zkSync's envisioned L3 future.

Introduction What is zkSync?

zkSync is a universal smart contract Validity Rollup platform. It focuses on aligning with the Ethereum community and is considered by most to have the potential to be the first EVM-compatible Validity Rollup on mainnet.

Where is zkSync at today?

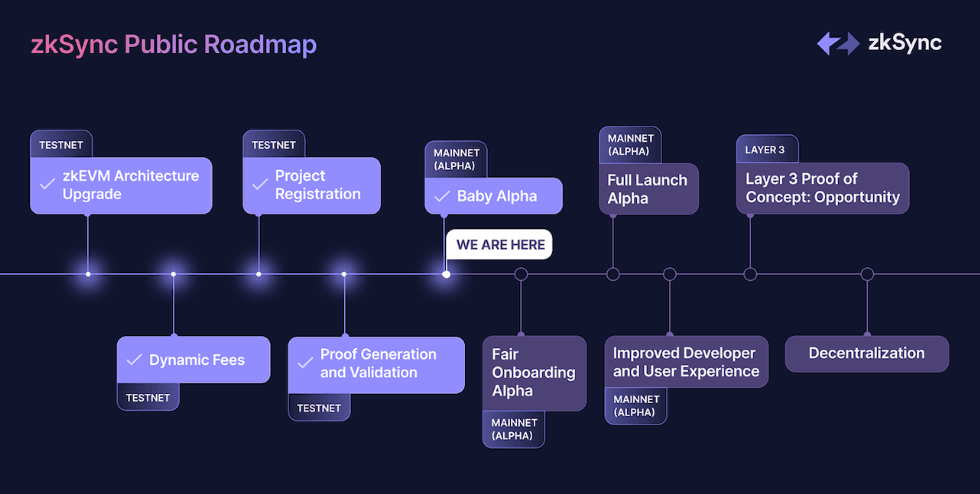

Source: zkSync

- On October 28th, zkSync released their "Baby Alpha", which is limited to teams using the mainnet.

- After that, the "Fair Onboarding Alpha" will be limited to projects that have registered to participate. This means they will be able to test their product for any bugs or issues before real users come in. At this stage, all code is open source.

- Finally, a full Alpha release will be released (expected early Q1 2023).

This gradual approach makes sense, as a bad release could have serious negative consequences not only for zkSync, but for Ethereum scaling projects as well. Funding Matter Labs has raised $458 million, with its most recent Series C funding round being $200 million co-led by Blockchain Capital and Dragonfly. Previous funding includes a $200 million ecosystem fund, a $50 million Series B round led by a16z, and $8 million in Series A and Seed rounds. zkSync is so well capitalized that it is a force to be reckoned with in the L2 war.

- Starkware: $273 million in total funding

- Fuel: $81.5 million in total funding

Fundraising does not mean success, but zkSync has raised a significant amount of capital to continue to fulfill its vision. zkSync is expected to be the first real-time universal Validity Rollup compatible with Ethereum, which may give it a very significant advantage. In addition, it has been consistent with the Ethereum community, which can help it build a strong ecosystem and a competitive moat, while other Rollup may need to work hard to overcome difficulties when they are deployed to the main network. So what are its main features?

main feature culture

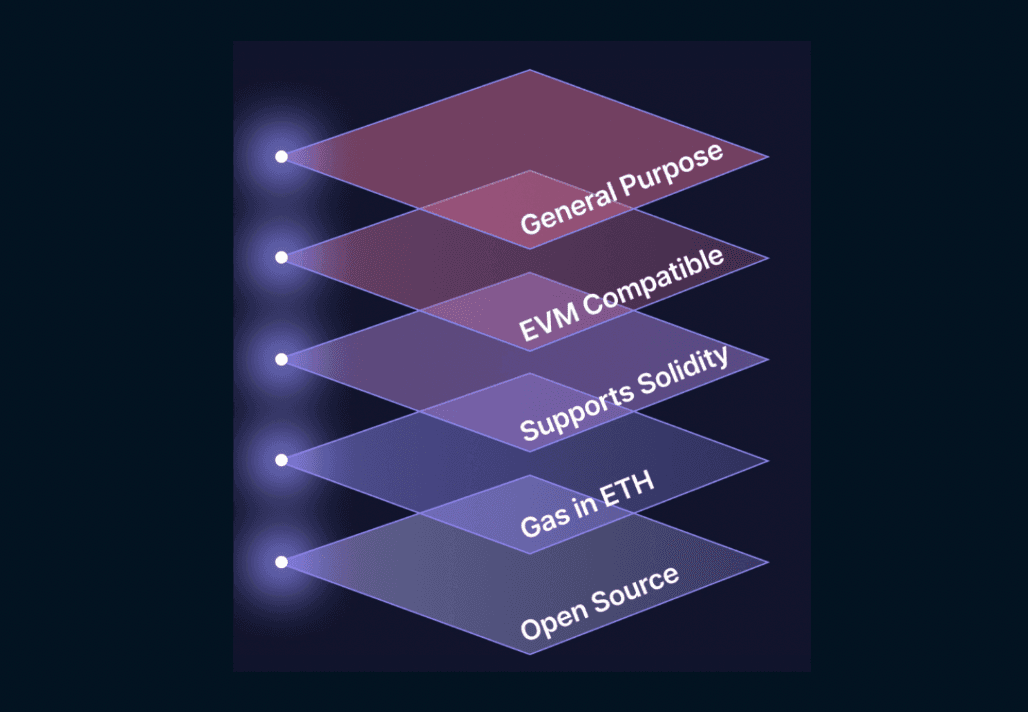

zkSync positions itself as a scaling solution focused on Ethereum. It does its best to stay in tune with the Ethereum community. Of course most Rollups are consistent with Rollup, because it has many excellent developers and huge user activity. However, some are still open to the possibility of being deployed on other chains and in different configurations (this view makes sense; why limit yourself to one network?) zkSync is entirely focused on Ethereum, and starts with Proud to demonstrate its alignment with the Ethereum community on 5 key qualities:

- universal

- EVM compatibility

- Support Solidity

- ETH payment gas

- open source

Source: zkSync This shows that zkSync is focused on aligning with Ethereum. The network effect of EVM is very strong, so this strategy makes sense at least in the short term. However, one argument against this approach is that the EVM has many design limitations, and that other virtual machines and programming languages are better suited for future applications, which would help bring cryptography into the mainstream. This is the approach other scaling solutions like Starkware and Fuel are taking. However, the wealth of infrastructure surrounding the EVM spills over, with 9 out of 10 top TVL chains being compatible with the EVM, so this is no coincidence.

EVM compatibility

- zkSync achieves EVM compatibility by having a VM that adapts to EVM development tools and works well with validity proofs. It's not exactly equivalent to the EVM, as Matter Labs chose a design that handles validity proofs more easily.

- This design relieves Matter Labs of the burden of building a system compatible with all EVM opcodes, which are much more complex (e.g. Scroll).

- This means that dApps ported to zkSync may need to make some adjustments instead of using the same design as the EVM.

- zkSync compiles code written in Solidity into Yul. Yul is an intermediate language that compiles Solidity to bytecode in LLVM (compiler framework). This enables zkSync to achieve EVM compatibility. Future plans to support languages such as Rust and Javascript have been discussed within the community. This may increase the number of projects that deploy to zkSync with minimal changes, such as those already written in Rust for other blockchains. If it works, it could greatly expand the tools available to builders while maintaining composability between applications.

Different Validity Rollup Designs

zkSync's EVM compatibility happens at the language level, while Hermez and Scroll go a step further by building a VM that can interpret EVM bytecode (an approach that is significantly more complicated to build and has long been considered infeasible). By deploying at the language level, zkSync does not require validity proofs at all steps performed by the EVM, which should make the proof process easier to decentralize. Proponents of the full zkEVM consider zkEVM at the bytecode level to be the gold standard in terms of security. Deploy on zkSync

- zkSync also adds additional risk (due to differences between the two environments) since the EVM is not implemented at the bytecode level. Will this be a problem? If it is a problem, how big is it? These all remain to be seen. zkSync claims that 99% of the code can be deployed directly to zkSync 2.0 without any changes.

- zkSync promises to open source everything this year, and we can describe zkSync as being compatible with the EVM at the language level. This means that zkVM compiles an EVM language (such as Solidity) to a SNARK-friendly VM. This adds some compiler risk to the protocol.

Token Economics

Token utility is a questionable subject. There is no consensus on how to incorporate desirable value accretion mechanisms into tokens to give them fundamental value. The reason for this is due to the desire for the project to avoid falling within the scope of safety regulations. For example, a protocol like Uniswap (arguably the golden boy of DeFi) has a token with an indeterminate fundamental value. While it is used for governance and rewards, it has no real value-added properties that give it long-term fundamental value (except for governance (which itself is of questionable value)). Layer 2 tokens have the added caveat that they are built on top of another tokenization protocol (e.g. ETH). Adding additional tokens on top adds additional risk and friction points. However, incentives are also necessary to grow and maintain the ecosystem.

- zkSync chose to pay gas fees in ETH, which is a strong signal of loyalty to Ethereum and the Ethereum community. Some Rollup have taken certain actions to appease the Ethereum community, but without showing real loyalty, paying for gas with ETH is a strong statement in the real sense.

- Doing so also helps avoid additional friction (given that transactions need to be settled in base-layer ETH anyway). Using native tokens as fee tokens can be detrimental to user experience. Ultimately, user experience will win out in the increasingly competitive Rollup space.

- Other than that, Matter Labs has remained mum on the purpose of the token.

- The approach of adopting typical PoS tokens would introduce additional censorship risk to the second layer, so it is also considered undesirable.

- Governance of Rollup is also potentially problematic as this introduces additional risk of governance capture. In terms of ownership, most tokens are effectively centralized, with only a few participants able to influence governance decisions. This increases the risk.

- The team claims that two-thirds of the tokens will be distributed to the community/ecosystem, while one-third will be used to incentivize the team and investors. This is a healthy split, as many tokens are designed to favor insiders, and a third of tokens should provide sufficient incentives for contributors. For example, Starkware has 50% of its token supply allocated to insiders, and zkSync CPO Steve Newcomb has said that 50% of Arbitrum's token supply is also allocated to insiders.

How strong is the moat first-mover advantage?

While being first to market will undoubtedly give zkSync a first-mover advantage, how strong is that advantage and how sustainable is it? In order to explore this, it is necessary to research EVM-compatible chains. In the 2020/21 bull market, EVM-compatible chains have risen rapidly due to the fact that they provide an alternative for users of the Ethereum mainnet, which at the same time is very expensive. This brings up the following players:

- BNB Chain

- Polygon

- Avalanche

- Fantom

All of these chains are growing very fast. However, the easy deployment across EVM chains makes developers and users very mercenary, and people can move from one chain to the next quickly, arguably without any loyalty. Take the BNB chain as an example; while it has a first-mover advantage, few projects are considered to have lasting value.

Will zkSync be attacked by mercenary developers/users?

zkSync may be different because it is closely connected to the Ethereum community. It is generally believed that Validity Rollup is one of the most promising scaling technologies, and zkSync’s cooperation with Ethereum, especially the use of ETH as a gas token, may make developers inclined to develop on it. In fact, 150 Ethereum projects have already indicated that they plan to deploy on zkSync, including AAVE, Uniswap, Chainlink, Curve, and more. However, the long-term success of Rollup will depend on the design and user experience of other EVM-compatible Validity Rollups being built, such as Scroll. If these companies can come out with an objectively better product, the first-mover advantage becomes meaningless. However, if zkSync and its L3 ecosystem can generate strong traction before competing competitors launch their products, its first-mover position could give it a significant competitive advantage.

account abstraction

Account abstraction refers to the goal of reducing two account types on the blockchain to one, which reduces complexity for users as they will no longer need to distinguish between different account types. Ethereum has been working on it since 2017, however, it was a very challenging task and was also put on hold by supporting the scaling roadmap. Now, zkSync (and other L2s like Starkware and Fuel) will incorporate the account abstraction by default. Essentially, accounts can implement arbitrary logic. While on the surface, this might not seem exciting, it actually leads to some very interesting UX improvements.

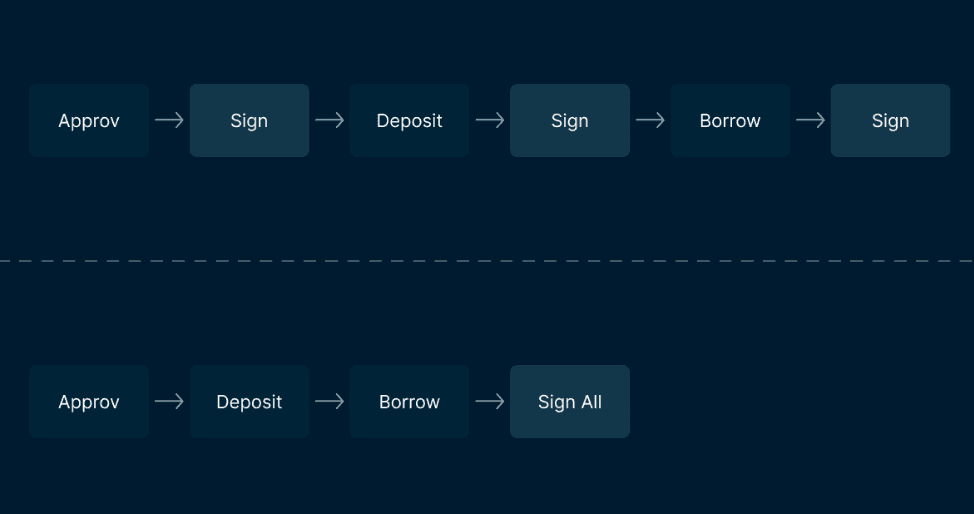

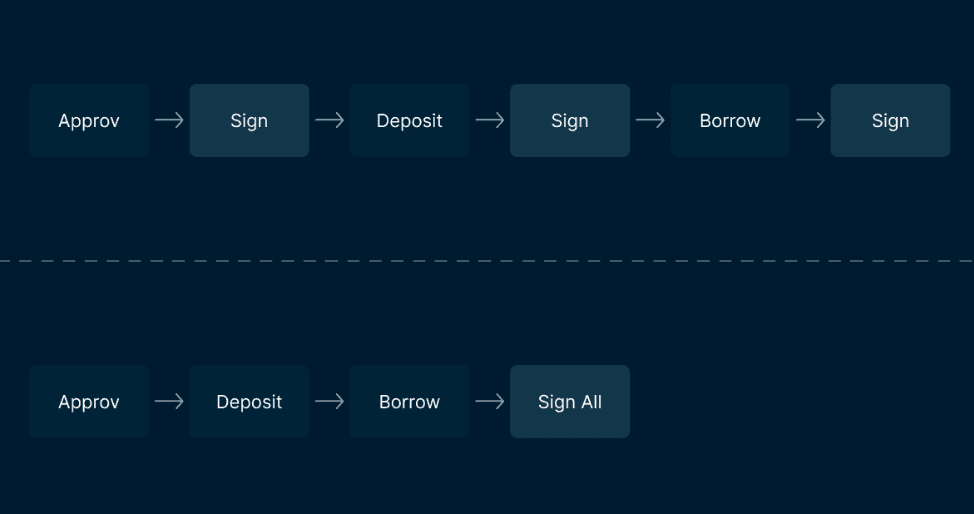

Approve multiple transactions at once

Using dApps on Ethereum is frustrating because every on-chain interaction requires a transaction (and gas fee). This is bad user experience. With account abstraction, multiple transactions can be bundled together. The image below shows how it will greatly improve the user experience:

social recovery

One of the biggest UX issues in the crypto space is seed phrases, and the whole ramifications of forgetting them. Social recovery enables users who have lost their private keys to authorize a new wallet as the rightful owner. can be:

- hardware wallet;

- trusted friends/relatives;

- third party services;

- Or even a combination of the above two.

With social recovery, users still have custody of their funds and control over their assets. Vitalik is an advocate for social recovery wallets, which he says is his "preferred method" of securing wallets.

multi-factor authentication

Account abstraction allows users to set up their accounts to: 1. require signatures from multiple keys; 2. execute transactions only when specified conditions are met. While this sounds similar to using a multisig like Gnosis safe, account abstraction can provide wallets with better customizability and usability than typical multisigs. Account abstraction can provide users with some customization features to improve user experience. The security level can be adjusted according to the user's needs.

Any token can pay for gas

The account abstraction can use any token to pay for gas. While it’s not yet certain whether zkSync will enable this feature, it’s assumed that it can be run in the background, allowing the exchange of fee tokens for ETH.

session key

This allows the wallet to pre-approve certain rules for interacting with the dApp so that users can use it as often as they want without having to sign transactions. This especially applies to blockchain games.

- dApps can be used freely within specified boundaries, which enables users to maximize ease of use (and effectively reduce risk) while maintaining boundaries.

- Currently, users need to trust an entity to sign on their behalf (or sign themselves).

plug-in

Account abstraction enables plugins, which means users can add and remove features after creating an account.

limited time deal

Another potential feature of the account abstraction is time-bound transactions - users can create transactions that execute at a specified future time.

Volition

zkSync is also intended to operate as a Volition, known as zkPorter. zkPorter allows users to choose between Validity Rollup(on-chain data availability) and Validium (off-chain data availability). This allows users/developers to choose the desired security for their specific application. For example, gaming applications might choose Validium because the additional cost of Validity Rollup security is unnecessary for them, while DeFi applications might choose Validity Rollup because of its enhanced security and on-chain data availability. zkPorter off-chain data will be sent to the Guardian Network - which will be a PoS network secured by zkSync (not yet released) tokens. This increases the trust assumption of two thirds of honest validators and demonstrates the trade-off between Validium and Validity Rollup. Validium is much cheaper, but also less secure.

What is L3L3?

In order to understand the meaning of "Layer-3", it is necessary to understand L2 Rollup first. L2 Rollup refers to blockchain scaling solutions that handle transactions on Ethereum L1, settlement and data availability on L1. L3 is to L2 what L2 is to L1.

- L3 enables custom extensions for specific applications that require computation outside the EVM.

- The general consensus is that L3 enables custom features for applications and leverages L2 for scalability, such as privacy.

- L3 is for Validium which may be suitable for specific application use cases such as gaming and enterprise applications.

L3 places state and execution on multiple servers, which is necessary for compute-intensive applications. Expected benefits include:

- Solutions to prevent MEV may result in little or no MEV.

- Can be optimized for application:

- fee market

- hardware requirements

- Wait

Fractal Hyperchain

Fractal Hyperchain is the term Matter Labs uses to describe their vision for L3 on zkSync. All Fractal Hyperchains will be constrained by the same circuit technology and verified by the same prover. Its meaning is:

- There is a native bridge between Hyperchains by having the same prover. Bridges have been a key factor in ecosystem failure, and native, trustless bridges will be the key to scalability, secure composability, and interoperability. Matter Labs says that in the future, there will be no bridges between Hyperchains at all. However, this is purely hypothetical. Despite claims of "unlimited" performance, no single solution is likely to scale infinitely, so it will be interesting to see how much scalability L3 delivers when it is released.

- L3 will be highly customizable, with many specific application chains envisioned.

- L3 users can choose from 3 data availability options according to their needs:

- Validity Rollup(highest security, highest cost)

- Validium (data off-chain availability, fastest and cheapest)

- Volition (applications/users can choose between Validity Rollup and Validium for transactions).

- zkSync expects to launch a L3 proof of concept in the first quarter of 2023, and claims that some big brands are looking to deploy on zkSync’s L3.

- Matter Labs also stated that their LLVM compiler can support any modern programming language, such as Solidity, Rust, C++, etc., which will open up the landscape.

Source: zkSync

The Importance of Scalability and L3

While the purpose of zkSync is to scale Ethereum, it is somewhat ironic that many existing blockchains currently have large amounts of unused block space. This is because there is currently no application that can attract a large number of users. The potential scalability and customization enabled by L3 paves the way for mass adoption of Web3 technologies. Ultimately, the success of these scaling platforms will depend on being able to develop applications suitable for mass adoption.

The main battleground in the Validity Rollup war may be prover

While there are many Validity Rollup solutions competing to launch their mainnet products and trying to build the best ecosystem, Matter Labs’ Chief Product Officer believes that the focus should be on which project can build the best prover. In order to realize the vision of L3 Hyperchain, the prover of zkSync needs to be recognized as the best in the industry. If this happens, it could spur a slew of builders looking to deploy L3 in composable and interoperable networks enabled by shared provers.

- If projects/networks use the same prover, they will be able to interoperate with each other (protected by cryptography (in theory)). Our vision is that most on-chain activity will utilize the same prover, which will enable huge advances in the potential of Web3 technology.

- On the Bankless podcast, the Chief Product Officer of Matter Labs used the metaphor of SSL to describe the potential of zkSync. SSL, which stands for Secure Sockets Layer, is the protocol used by browsers and servers to authenticate, encrypt, and decrypt on the Internet. Before SSL, e-commerce was niche and many people didn't believe it was possible to put their credit card details online. However, with the widespread adoption of SSL and confidence in the technology, e-commerce has grown and prospered.

If zkSync's prover can be accepted as a safe and reliable universal standard, then the vision of a huge network of secure and interoperable Fractal Hyperchains may become a reality. This of course also depends on whether L3 and the blockchain technology itself can achieve product-market fit on a global scale.

decentralized

By implementing proto-danksharding and danksharding, Ethereum will move from a bandwidth-constrained environment to one with abundant bandwidth. Nansen’s report explains Ethereum’s scaling roadmap. There is an argument that Rollup today is overly focused on data optimization rather than bandwidth optimization, causing problems around the state of growth. In turn, it also brings the challenge of decentralizing prover/sequencer in the future. L3/Fractal Hyperchain may provide a satisfactory solution for reducing state growth. However, this remains to be seen, and if they live up to their potential to carry a lot of on-chain activity, there may be problems at the L2 layer in the future. Decentralization sits at the end of many Rollup roadmaps, but it’s unclear how and how quickly this will be achieved.

Composability

Validity Rollup can be combined with settlement layers, such as Ethereum L1. In order to achieve this, a proof of validity needs to be generated for each block. Of course, the Validity Rollup technology has not yet reached this level; nevertheless, the speed at which it has developed surprised even Vitalik Buterin. This will enable L3 to be composited with the underlying L2.

- However, this requires waiting for the next block combination to come back. For most applications this should not be a problem. One way to solve this problem is for L2 to provide L3 transaction pre-confirmation, which should make L3 and L2 transactions atomically composable.

- Ultimately, it is possible that there are n L3s that make up the same unified state, and a simple proof of validity can verify all L3s. This leads to full composability.

Polynya believes this is a viable path forward in terms of maximizing security, decentralization, and scalability. This is exciting, however, it remains to be seen how these Rollup /L3s will work in practice. zkSync is leading the way here and will likely provide the first instance of L3.

in conclusion

- zkSync’s latest round of financing is US$200 million, and the total ecosystem financing is US$485 million, making it one of the best-capitalized L1/L2 with a good expansion roadmap.

- Its consistency with Ethereum is notable, as evidenced by paying gas fees in ETH. While this will appeal to Ethereum builders, it's unclear how strong their first-mover advantage as a general-purpose EVM-compatible Validity Rollup will be.

- Native account abstraction can help significantly improve the user experience, potentially pushing encryption technology into mainstream use.

- L3 will be a key battleground for ZK- Rollup, and zkSync is seeking to become the accepted standard for hosting L3. Their L3 PoC will go live in the first quarter of 2023, and it's something to keep an eye on.

- A key challenge (for which there is no clear solution yet) will be decentralized provers.