Note: This article comes from @ThorHartvigsen Twitter, and MarsBit organizes it as follows:

30 agreements with strong catalysts in the coming months

bookmark this list

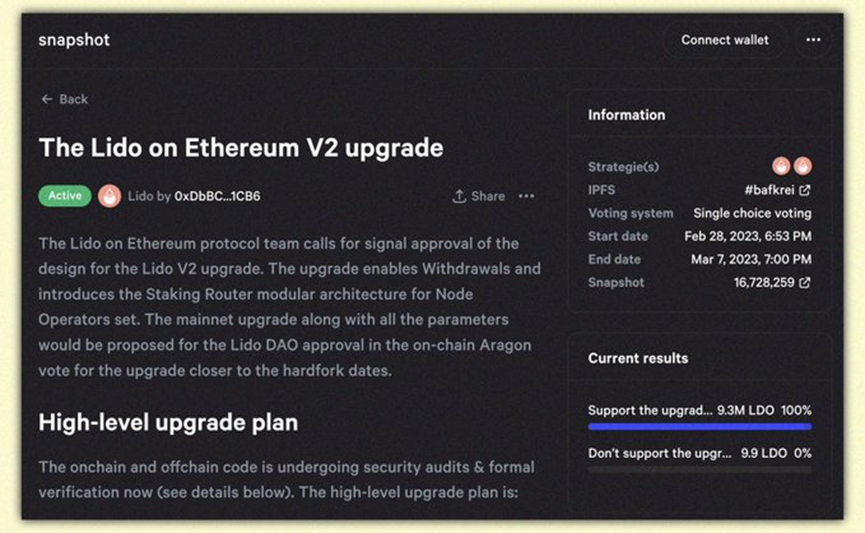

Lido V2:

• Staking Router: Allows anyone to become a node operator through a modular plug-and-play model (aimed at increasing decentralization)

• Withdrawal: stETH holders can withdraw cash directly from Beacon Chain Shanghai Station

Visible big support:

Velodrome 2.0 will be released in the first quarter

• VELO FED: veVELO holders have a say in $VELO monetary policy

• Custom and adjustable trading pair fees

• A new approach to centralizing liquidity pools

•Overall UI/UX improvements

and more.

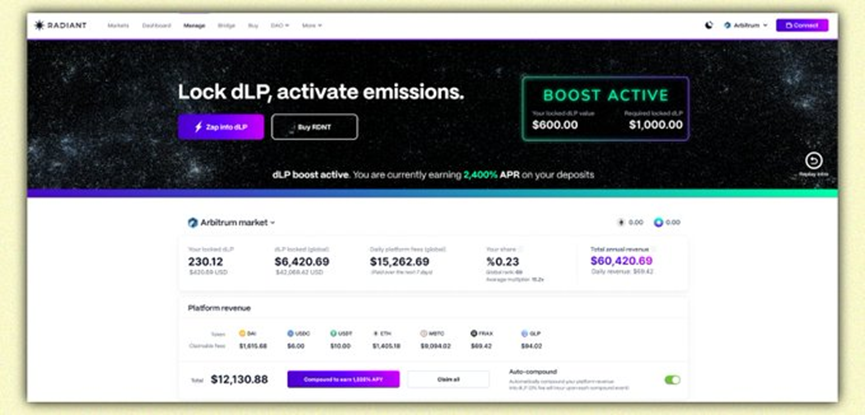

Radiant V2 will be available in a few weeks:

• Cross-chain expansion (BNB chain priority)

• New assets for lending and lending, including stETH, BNB, potentially GLP, gDAI, and more through governance votes

• Reduced RDNT emissions through dynamic mobility

• Redesigned UI/UX

• fUSD v2: On-chain fee system for builders and users (option to pay transaction fees with fUSD)

• FVM: Solidity compatible, faster execution. Tests show ~4500tps and 98% data storage reduction. The main network is planned to be launched by the end of 2023

• Andre is back

Atlas upgrade:

• Ready to Withdraw (Shanghai)

• 8 ETH mini pools! (The remaining 24 ETH are provided by the protocol to operate validators). Lower Barriers to Entry + Increased Decentralization

• Gas fee optimization (40% reduction)

Atlas is scheduled for March/April.

• PLS V2 tokenomics before late March: lock up $PLS to gain multiplier points for vaults, earn real income from bribes, receive esPLS, and more

• More governance token integration with upcoming $plsRDNT and plvRDNT vault

8 @GMX_IO

GMX will launch V2 sometime this year (probably Q1/Q2, currently undergoing audits), which will introduce a host of new tradable assets, not just cryptocurrencies (synthetic pairs).

There are also rumors in Discord about cross-chain expansion after V2.

Optimism is building the OP stack: a modular blockchain framework for easily building various scalable rollups (OP chains).

Coinbase's Base is the first to use the technology.

The first stage is Bedrock (Q1 23'). Read the following:

https://twitter.com/ThorHartvigsen/status/1625152444144693250

• Cross-chain extension to BNB chain

Liquidity Ledger V2:

• V2 pool fee conversion for $sJOE stakers

• Limit orders and permissionless liquidity book pools

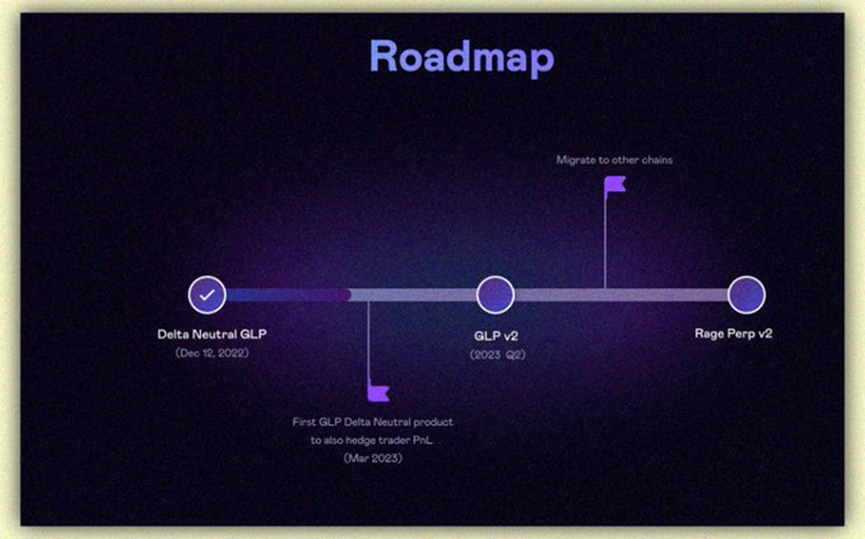

11 @rage_trade

• Vault upgrade to GLP risk: PnL for hedging traders

• GLP v2 integration (upgrade after GMX synthesis)

• Cross-chain extension

• Rage perp v2: Potential new staking options besides tricrypto

Synapse is building the Ethereum native optimistic rollup (Synapse chain):

• Cross-chain messaging: call a contract on one chain and execute it on another

• Bridge for cross-chain dapps w/ Synapse

•coming soon

Synapse is building an Ethereum-native optimistic rollup (Synapse chain):

• Cross-chain messaging: invoke a contract on one chain and execute it on another

• Built for cross-chain dapps with Synapse bridge

• coming soon

https://twitter.com/Slappjakke/status/1625867750152499200

13 @fraxfinance

• frxETH continues to grow as Frax has the most competitive staking yield

• FIP-188: $FRAX fully collateralized (backed from 92% to 100%)

• Overall growth of $FRAX and the Frax ecosystem ($FPI, veFPIS, FraxSwap, Fraxlend frxETH, etc.)

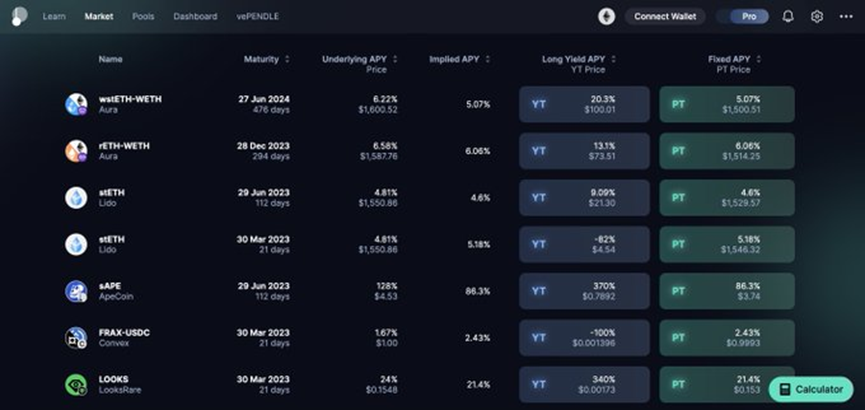

14 @pendle_fi

Pendle offers very high yields by splitting assets into main tokens and yield tokens.

TVL is only going up throughout 2023.

They recently cross-chained to Arbitrum with GLP and will add gDAI + other assets in the future.

Synthetix V3:

• $ETH and other assets as synth collateral

• LPs will be able to choose synths to allocate liquidity (higher risk = higher fees)

• Massive adoption of products built on Synthetix (Kwenta, Lyra, Thales, etc.)

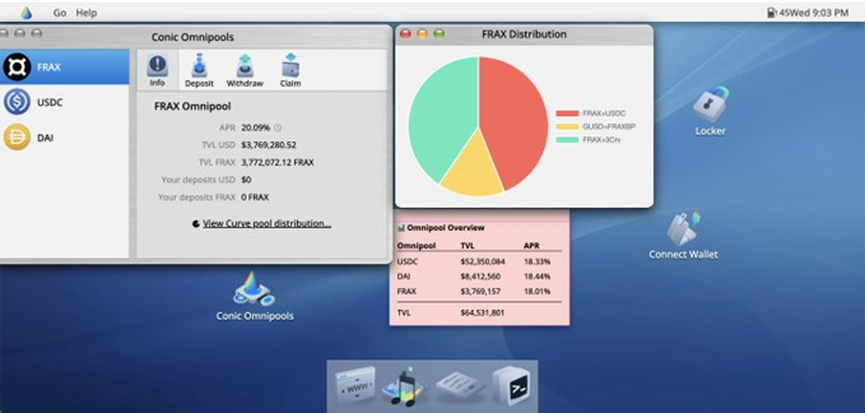

Conic offers omnipools on Curve (divide user liquidity into different pools and stake it on Convex). Users earn CRV + CVX + CNC

The deal reached 65 million TVL within 1 week.

catalyst:

• Wider adoption of high-yield products

• Additional assets

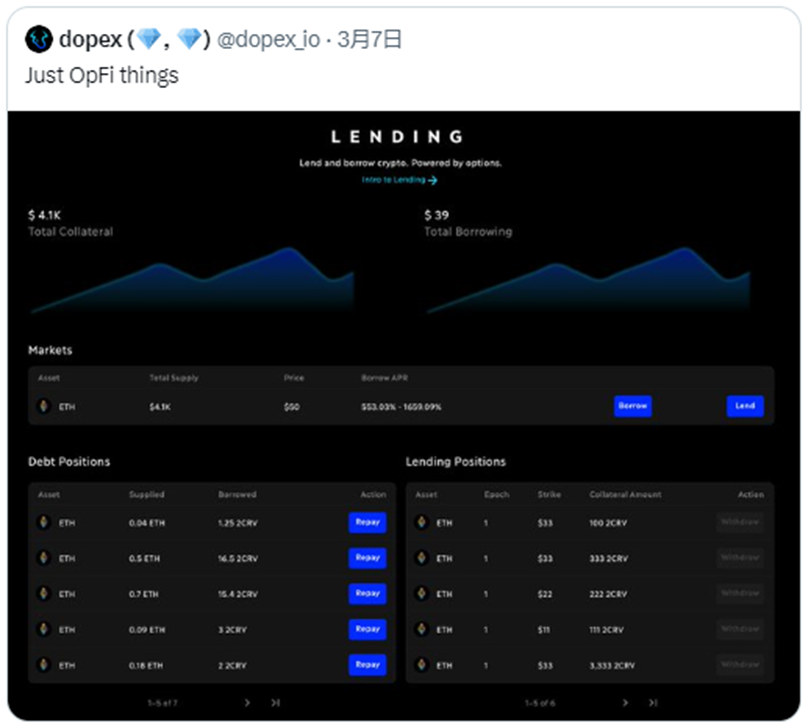

17 @dopex_io

• rDPX v2: Ability to mint synthetic tokens with rDPX as part of collateral (rDPX is under deflationary pressure). The first asset will be dpxETH (not LSD)

• Dopex OpFi products: DeFi products that use on-chain options in the background.

https://twitter.com/dopex_io/status/1633025764785377280

18 @0xPolygon

Polygon is building various chains:

-Polygon Supernets

- Polygon Avail

- Polygon Zero, Miden & zkEVM

-Polygon Nightfall

zkEVM will launch on mainnet on March 27th. Read more about it in my thread below.

https://twitter.com/ThorHartvigsen/status/1625152500574863361

19 @dYdX

dYdX is launching their own AppChain (v4), built using the Cosmos SDK, to create CEX-like performance in a decentralized manner. This includes:

• No gas fee for transactions

• Off-chain order books run by validators

• $DYDX as native gas token

https://dydx.exchange/blog/dydx-chain

As stablecoins gain adoption, Curve will benefit significantly by being the largest on-chain stablecoin liquidity hub.

crvUSD is getting closer to launch, which creates additional revenue for Curve/veCRV.

https://twitter.com/ThorHartvigsen/status/1621157021147103233

21 @CamelotDEX

• More protocol integrations (launchpad and liquidity pools)

• Improvements in the "plugin" version of xGRAIL. Read below:

https://twitter.com/CamelotDEX/status/1633161124232437760

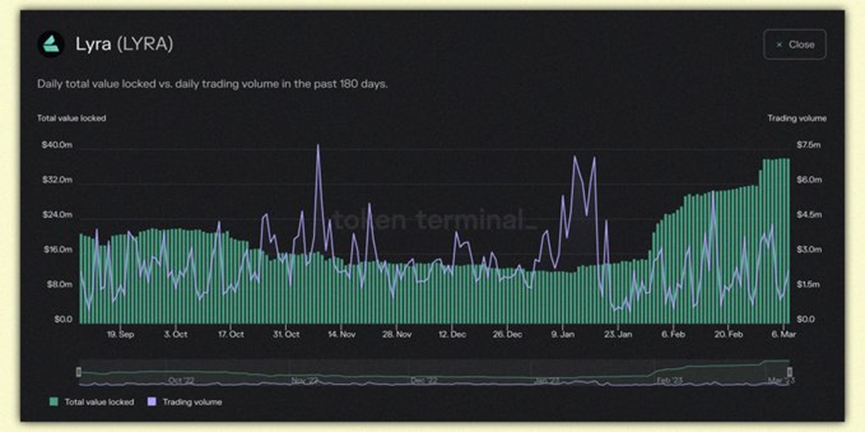

22 @lyrafinance

Lyra recently rolled out a "Newport" upgrade (integrating Arbitrum deployments from GMX folks) with $ETH and $wBTC options.

In the long run, DeFi options have huge potential, and Lyra could be one of the leading protocols to benefit as adoption expands.

23 @cosmos

A few days ago, the first part of the Interchain Security (ICS) upgrade was approved by governance and will launch on March 15.

ICS allows application chains to borrow the Cosmos hub validator set to improve security without having to bootstrap themselves (for a fee).

24 @MakerDAO

Maker has several things in the future, including:

• Spark Protocol: The first product is Spark Lend, inspired by Aave V3, with direct Maker credits (April)

• EtherDAI: support native ETH LSD $DAI

Great post:

https://twitter.com/DefiIgnas/status/1623531193512894466

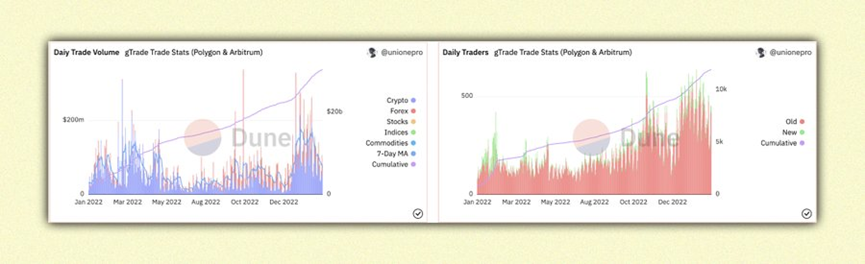

gTrade has established itself as one of the leading decentralized perpetual trading platforms, with the addition of new assets including commodities and indices following the launch of Arbitrum+, and a significant increase in trading volume.

There's no official roadmap, but there's plenty of teasing on Discord.

26 @AaveAave

Aave launched their native stablecoin $GHO :

• Overcollateralized by assets on Aave

• Supply is controlled by "facilitators" (entities chosen by the DAO)

• $GHO minted as collateral for discounted $AAVE

• Game Developer Program (GBP) in cooperation with Arbitrum: Encourage game developers to build in the Treasure DAO ecosystem.

• @MagicSwap _v2: Future game economy supporting ERC-20 tokens and NFTs . plan for the second quarter of this year

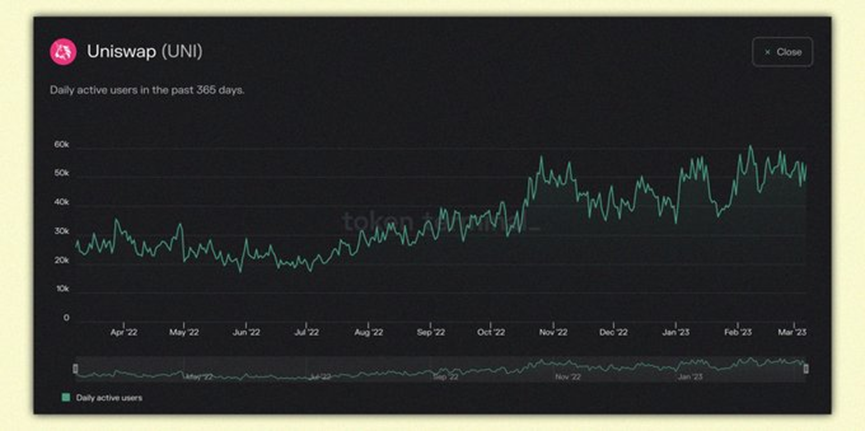

28 @Uniswap

Uniswap recently released their upcoming mobile app.

Uniswap remains the leader among DEXs, with around 50,000 daily users as of March.

Mobile apps can play an important role in broader retail onboarding.

29 @Filecoin

Filecoin will launch the Filecoin Virtual Machine (FVM) and Filecoin EVM (FEVM) on March 14.

FVM will allow custom smart contracts to be built on top of Filecoin, opening up a variety of new use cases such as tokenized data, data DAOs, and more.

30 @Kwenta_io

• Significant volume/user growth since v2 launch in February

Some upcoming features in Q1/Q2:

• Lyra Partnership

• Cross Margin v2

• Kwenta SDK

• Fee conversion for stakers

• UI/UX improvements

. . and more.

That's it! If you find this research valuable, consider showing your support by liking/retweeting the first post

And follow me for V2 of this list in the future.