The original text was first published on Deep Tide TechFlow: https://m.techflowpost.com/article/2237

There is a consensus that the core narrative of the crypto market this year is LSD. Therefore, we can see that many protocol products are beginning to move closer to LSD, such as Frax Finance launched frxETH, MakerDAO is about to launch ETHD, Yearn is about to launch yETH and so on. Stader Labs, an old-fashioned pledge agreement, is also following the trend and launching Ethereum LSD-related products.

In this highly competitive track, we can roughly divide the track into three layers. The bottom layer is SSV.Network and Obol Network with DVT (Distributed Verifier Technology) technology as the core. Lido, Rocket Pool and other protocols, they are responsible for helping users to stake Ethereum more easily and more capital efficiently. The top layer is the DeFi layer. The DeFi layer protocol will use various DeFi methods to increase the yield of related LSD Liquidity certificates such as stETH.

The upcoming ETHx from Stader Labs falls under the second layer.

The original product idea of Stader Labs was to provide Liquidity staking services for Terra, but with the collapse of the Terra building, Stader began to turn to Multichain expansion and provide Liquidity staking services for Polygon, BNB Chain, Near, Fantom, Hedera and Terra 2.0 . According to statistics from DeFiLlama, the current total locked value (TVL) of Stader is 109 million US dollars. Its native token$SD has a market cap of 24 million and an FDV of $160 million.

Whether ETHx to be launched by Stader Labs will become its new TVL booster, let us explore Stader's LSD product design and model.

Hybrid node operator model

Stader hopes that the main composition of ETHx's node operators will be family Stakers and independent node operators, with the aim of providing permissionless node operator support to stakers using Stader. This also strengthens the degree of decentralization of ETHx on another level and reduces the risk of being punished by Ethereum pledge. In the process, Stader will use DVT technology to achieve product goals.

In addition to permissionless node operator support, Stader will also introduce permissioned node operators. Licensed node operators will participate in Stader's staking ecosystem through a whitelists. Permissionless node operators require Collateral asset(security deposit), while permissioned node operators have no/low asset collateral requirements.

By adopting DVT technology, Stader's advantage is that it can reduce the risk of unlicensed node operators' deposit requirements and deposit forfeiture, thereby attracting more unlicensed node operators to ensure the decentralization of Ethereum staking. Currently, Stader has been tested on the SSV testnet.

The advantage of this is that at the beginning of the ecology, Stader meets the user's demand for Ethereum pledges by obtaining licensed node operators.

Liquidity Staking Scheme

Thanks to the use of DVT technology, Stader has reduced the minimum Ethereum pledge requirement to 4ETH. Compared with Rocket Pool, its minimum pledge requirement is 16ETH. To run a permissionless node, you also need to pledge $SD worth 0.4 ETH, which is the native token of Stader. At the same time, node operators can also participate in the governance of the Stader protocol through pledged $SD.

In order to further lower the threshold for node operators, Stader allows them to borrow $SD worth 0.4 ETH in the form of unsecured loans. In exchange, $SD holders will receive $SD incentives reserved for node operators and 10% of node operator commissions.

From the perspective of overall cost, the 4.4 ETH cost requirement of Stader node operators is lower than that of other decentralized Ethereum Liquidity staking agreements, which is also the advantage of Stader. In addition, in order to attract more node operators to join, Stader will also provide 800,000-1.5 million $SD as incentives for node operators.

At the same time, as the concept of modularity became popular, Stader’s Ethereum Liquidity staking solution also launched a Liquidity staking modular smart contract—anyone can use Stader’s pre-built components to build their own staking solutions.

Liquidity Collateral Certificate

The advantage of Lido is that there is no Ethereum pledge threshold and stETH is issued as a Liquidity pledge certificate. The ETHx launched by Stader is also applicable to various DeFi scenarios. Stader's confidence comes from the DeFi partners it developed when expanding its business, such as agreements such as AAVE and Balancer. Currently, Stader has reached a cooperation with Aura Finance to start $SD-$ ETH Yield Farming cooperation.

The four application directions of ETHx DeFi are:

Yield Farming: Stader's $ ETH-$ETHx LP has reached cooperation with Balancer, Quickswap, BeethovenX, Apeswap, Wombat and other agreements.

Lending: Stader ETHx has reached cooperation with lending agreements such as AAVE, 0vix, and Granary.

Stablecoin: QiDAO will support ETHx as collateral to mint Stablecoin.

Options trading and option vaults: Stader has partnered with Olive Finance and Delta THETA in this regard.

In the distribution of Stader's partners, we can clearly see Stader's previous Multichain stable partners and the future Multichain expansion of ETHx. The expansion of Multichain will promote the emergence of ETHx application scenarios. At the same time, unlike other LSD protocols that focus on Multichain expansion on Ethereum Layer 2, ETHx will expand to more non-Ethereum Alt-Layer 1 ecosystems.

Native token$SD

In addition to potential operator incentive selling pressure, the new product will be reflected in the following four aspects for Stader's native token$SD:

Node operators need to pledge $SD for node operations.

$SD holders can lend tokens to receive $SD incentives and a 10% node operator deposit.

Stader launched a new token economics $xSD, $SD holders can get $xSD by staking $SD. $xSD holders will receive a certain percentage of revenue sharing from the agreement, and $xSD holders will also receive agreement governance rights. Holders can redeem for $SD at the real-time exchange rate for a period of 7 days.

A certain percentage of revenue from the agreement will be repurchased in $SD and pledged as $xSD.

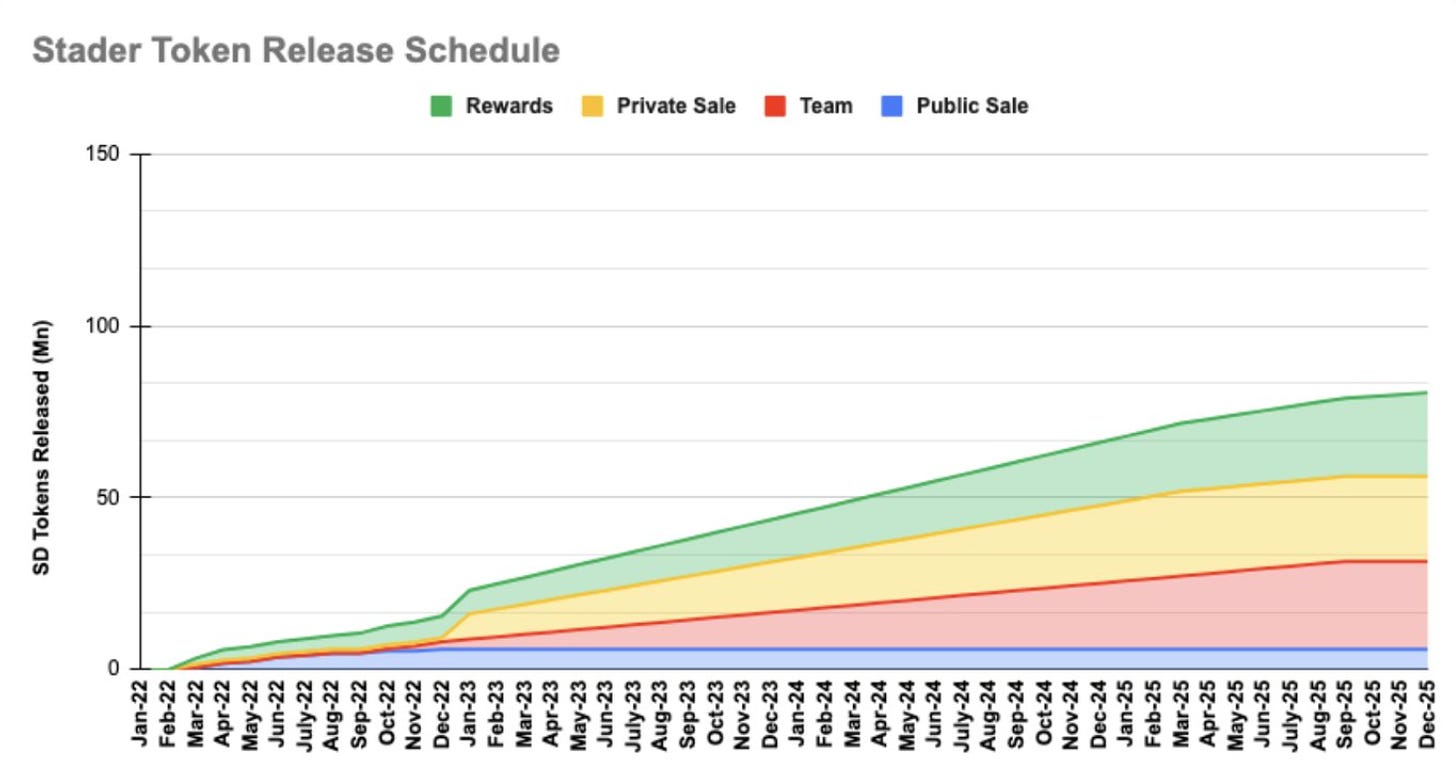

But it should be noted that there is also a certain selling pressure on $SD. In addition to the rewards for node operators mentioned above, after the unlocking was postponed, it started unlocking the team share in January this year.

at last

It has to be mentioned that the ETHx model launched by Stader today is an optimization of the degree of decentralization and cost of the Liquidity staking scheme in the existing market, as well as a promotion of the adoption of DVT technology.

From the overall product design perspective, Stader has a certain advantage in the current Liquidity staking solution. But other Liquidity staking solutions are also adjusting and optimizing their existing products. For example, Lido V2 will soon launch the Staking Router function, allowing anyone to become a node operator through modular plug-and-play modules to promote decentralization ;Rocket Pool also launched Mini Pool, lowering the ETH threshold to 8ETH. It is foreseeable that the competition on the LSD track will become more and more fierce in the future. Therefore, building a DeFi ecosystem around Derivatives such as stETH/ETHx will be a new battlefield.

Weibo: @雨中疯着

Twitter: @qiaoyunzi1

Notion database: https://tasteful-resolution-466.notion.site/81e0728219f24bc6b6f40159936b4106