With the end of the USDC unanchor crisis and its Liquidity recovery, USDC also rose back to $1 yesterday, seemingly regaining its status as a Stablecoin giant in the past. Concerns about the Stablecoin linked stablecoin have intensified concerns about the dollar-linked Stablecoin. If USDC is not a stable asset class, where should we store our $1? Today I will introduce a decentralized lending protocol, which is also a revenue protocol focused on Stablecoin: Liquity Protocol (LUSD & LQTY), and LUSD is also a Stablecoin that has been talked about in the market recently.

Introduction to Liquidity Protocol

Liquity Protocol is a decentralized lending agreement, also known as Collateralized Debt Protocol - Collateralized Debt Protocol (CDP), you can apply for interest-free loans by mortgaging ETH(ETH is the only type of collateral accepted by Liquity), and obtain LUSD Stablecoin loans. As a DeFi protocol, Liquity Protocol has the characteristics of immutability, Non-custodial, and free governance, and is a completely decentralized DeFi protocol.

The difference between LUSD and USDC and USDT Stablecoin is that the latter is 1:1 pegged to the U.S. dollar. If assets and liabilities are separated from 1:1, then such Stablecoin will collapse and become unstable. The difference with LUSD is that instead of being pegged to fiat currency (physical cash stored in a bank), LUSD is pegged to ETH . And the agreement is anti-censorship, no regulatory agency can prohibit the issuance of LUSD, the agreement is completely operated by code, and the code is immutable.

The Liquity Protocol’s interest-free lending mechanism is that the protocol charges a one-time borrowing and redemption fee. This fee is algorithmically adjusted based on the most recent redemption time. For example: if more redemptions happen in the near future (meaning that LUSD may trade below $1), the borrowing rate (fee) will increase, discouraging borrowing.

Borrowing on this project requires the borrower to open a trove through the Ethereum address. Each address can only have one trove. Deposit a certain amount of ETH in the treasury, and you can withdraw the corresponding amount of LUSD, provided that The mortgage rate cannot be higher than 110%, and the minimum loan amount is 2000 LUSD. Of course, users can pay off their debts and close their vaults at any time. Although ETH also has the risk of price decline, the agreement will immediately liquidate the position of LUSD to ETH to ensure the agreement's full 1:1 mortgage-to-loan ratio.

Liquidity Protocol use cases

Its use cases include:

-Borrow LUSD by mortgaging ETH ;

- Deposit LUSD to the Stablecoin pool to ensure Liquidity;

- Pledge LQTY to earn fees paid for borrowing and redeeming LUSD;

- When LUSD is below 1 USD, exchange 1 USD of LUSD for 1 USD worth of ETH.

Liquity revenue sources are:

-LUSD Bonds

- Staking LQTY

-LUSD stable pool

LUSD Bonds Earnings

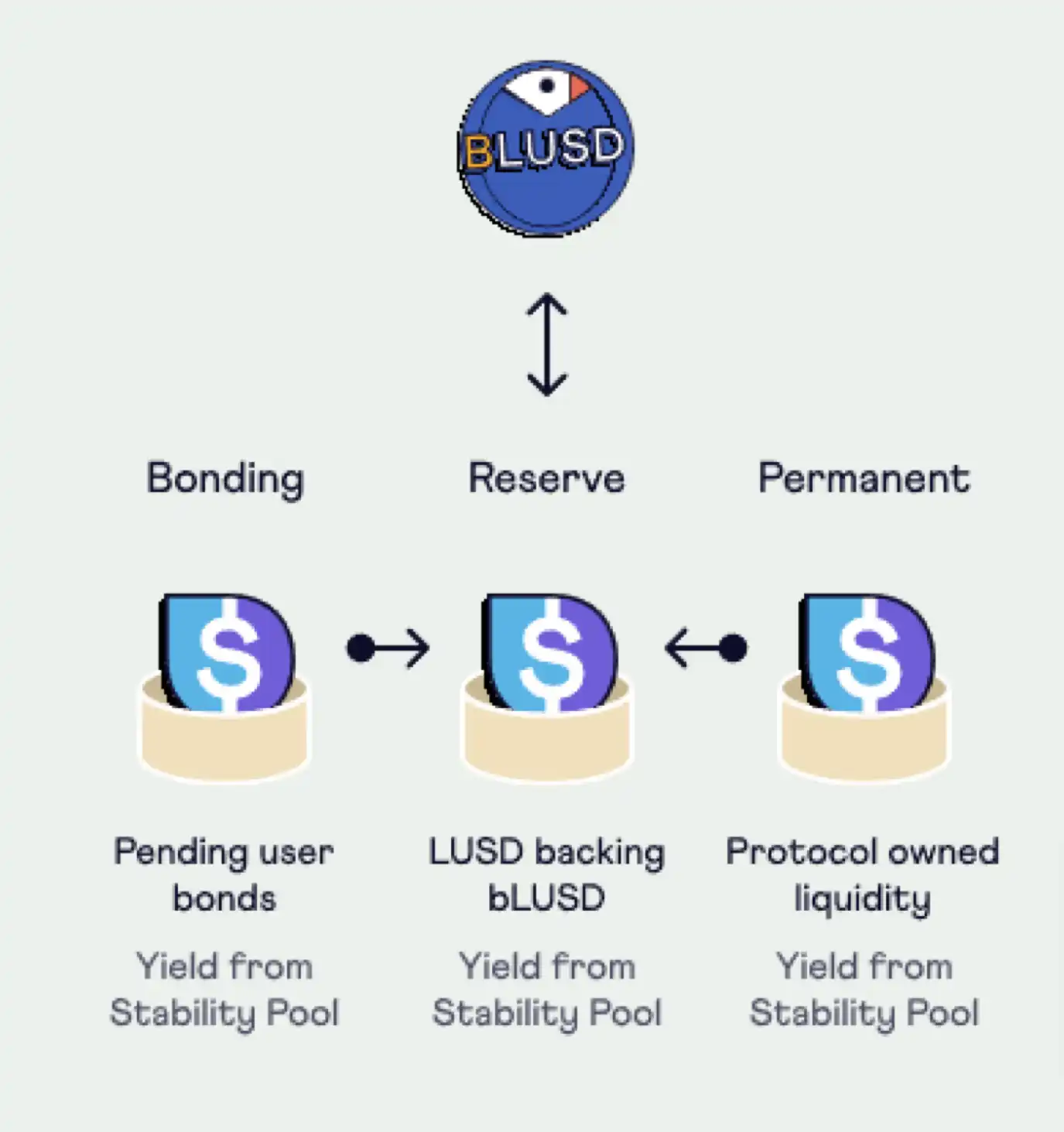

Bond has an enhanced auto-compounded yield that can be held or traded. Yield growth was also achieved by converting its earnings into bLUSD through three different sources. Bond itself can be technically used as an NFT and traded on OpenSea.

The advantages of bLUSD are:

It provides a higher yield than depositing LUSD in a stable pool;

The income generated is automatically harvested and compounded;

It is also an ERC-20 token that can be used as collateral for a reserve price increase.

Staking LQTY

Earn part of the protocol fees (ETH, LUSD) by staking LQTY. After starting the staking, users can earn borrowing and redemption fees in proportion. DefiLlama data shows that LiquityProtocol ranked 11th by fees in the past 24 hours.

The redemption mechanism of Liquity Protocol is that users can redeem 1 dollar of LUSD to 1 dollar of ETH without limit according to the price, and the LUSD will be destroyed, but the redemption process needs to pay a certain fee. As mentioned above, with the amount of redemption As more LUSD increases (meaning LUSD may fall below $1), the borrowing fees charged will also increase, making borrowing less attractive, a mechanism that prevents new LUSD from entering the market and pushes the price below $1.

LUSD stable pool

Deposit LUSD in the stable pool to earn LQTY income and ETH income in liquidation. The current APR is about 8.42%. As mentioned above, the liquidation income comes from trove. When users deposit ETH to lend LUSD, with The price of ETH fell, and the user did not increase the position or repay part of the debt, which would cause the mortgage rate to be lower than 110%, and then the liquidation of trove would occur.

Special mechanism of LUSD

So how does LUSD maintain a stable peg to ETH and maintain its own circulating supply? LUSD has several special mechanisms.

The hard peg mechanism means that LUSD can be exchanged for ETH at 1:1. The system charges a one-time redemption fee, which will increase each time. If there is no redemption over time, it will gradually decrease to zero. LUSD is destroyed upon redemption.

For example, if Peg = $0.98, the arbitrageur buys LUSD at $0.98 and redeems it at $1, making a profit of $0.02, and the buying pressure on LUSD will make its price rise; if Peg = $1.15, the arbitrageur buys LUSD at 110% The mortgage rate takes out the max borrow and sells LUSD for a profit of $0.05. LUSD selling pressure lowers the price.

The soft peg mechanism means that LUSD also benefits from the indirect dollar parity mechanism, and the LUSD dollar parity as the Schelling point is one of them. Since Liquity Protocol regards LUSD as equivalent to the U.S. dollar, the parity between the two is The implicit equilibrium state of the protocol.

In addition, the same mechanism of LUSD’s borrowing and redemption fees also prevents LUSD supply from getting out of control. Deposit ETH to borrow LUSD, and the borrowing fee and redemption fee have the same operation method (more people issue LUSD, and the fee will rise).

Liquity Protocol's stable pool as a Liquidity reserve is also a source of Liquidity for debt repayment in liquidated positions. If the stable pool is exhausted due to liquidation, the debt and collateral will be equally distributed. This mechanism is also a risk buffer for Liquity Protocol.

Liquity Protocol also has a special recovery mode designed to deal with large-scale liquidation. When the total collateralization rate (TCR) of the system is lower than 150%, the positions with a collateralization rate lower than 150% can be liquidated. The recovery mode is designed to encourage deposits Deposit ETH and repay debt.

How to get LUSD

In addition to staking ETH to obtain LUSD, users can also obtain LUSD on other Cex or Dex

Dex: Uniswap, Curve

CEX: Gemini

Liquity Protocol Partners and Token Economy

Liquity Protocol's cooperation lineup is also very strong, including Pantera Capital, Polychain, Nexus Mutual, Synthetix, Coinbase, Velodrome, OlympusDAO, Gemini, Huobi, and LUSD is also the top ten Stablecoin by market value.

LQTY has a maximum supply of 100 million and a circulating supply of 91 million. Coinmarketcap shows that its current market cap is approximately $285 million