The data in this article is as of 2023/3/8

Project Overview

Velodrome Finance is a native DEX built on Optimism, an Ethereum L2 scaling solution. The purpose of Velodrome is to create a trading platform that provides deep Liquidity , low transaction fees and low slippage, thereby promoting the development of the Optimism ecosystem. Its launch date is June 2, 2022.

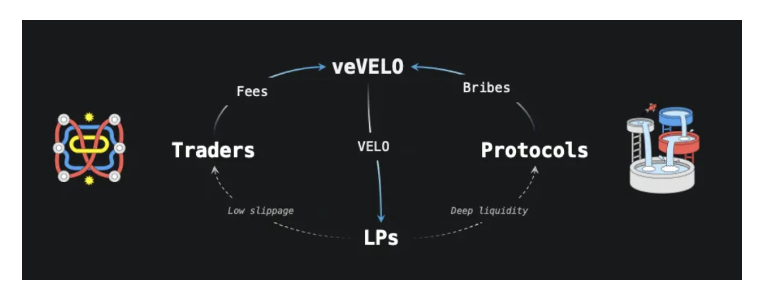

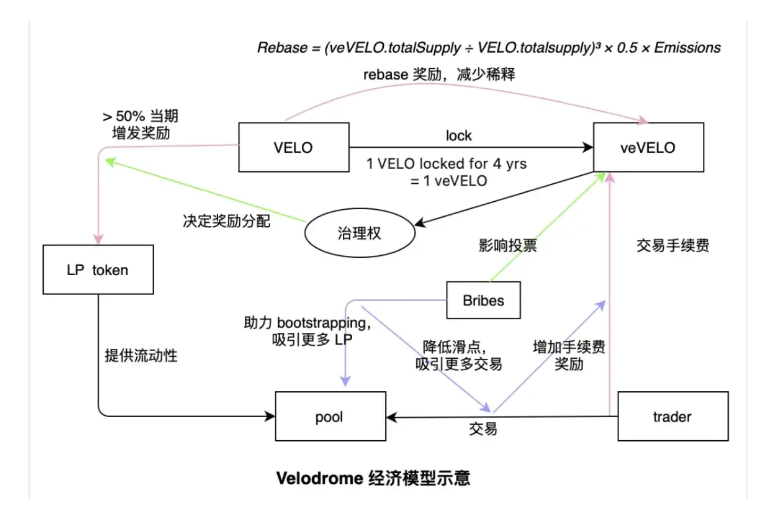

Velodrome rewards Liquidity (LPs) and users who actively participate in governance through the issuance of its native token VELO, and the distribution of veVELO (veNFT). LPs will receive VELO tokens as rewards, and users participating in governance can propose and vote by locking VELO (veVELO) to decide which token pairs LPs can receive VELO token rewards. In return, voters receive transaction fees and bribes collected during the period. (Related reading: " Velodrome's TVL Alchemy: ve(3,3) mechanism, veVELO distribution and bribery situation ")

Interpretation Project

Velodrome background

The founder of Velodrome Finance is a German engineer and entrepreneur named Lasse Clausen. At the same time, Velodrome's development team includes professionals from Optimism, ConsenSys, and other blockchain technology companies. They launched veDAO before, aiming to interact with the Solidly ecosystem and create long-term value for the veDAO community. Their professional and deep knowledge of Solidly, the original veNFT protocol, and the ve(3,3) mechanism have made Velodrome the go-to resource for support.

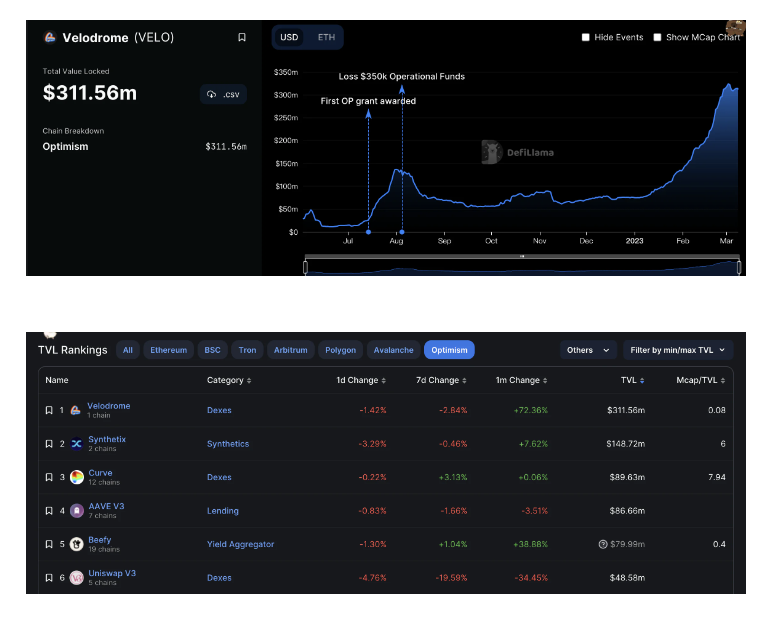

The TVL of Velodrome has grown rapidly in a short period of time, becoming the dex protocol with the largest TVL in Optimism, accounting for 34%. As of March 8, 2023, it has reached 311 million US dollars, a growth rate that exceeds other DeFi projects such as AAVE, Curve, and UniSwap on Optimism.

How Velodrome earns

Velodrome has 4 ways to earn money:

- LP pledge

Obtain sustainable rewards through LP staking;

- transaction fee

Become a veVELO holder and share the transaction fees generated by the agreement through voting;

- bribe

Velodrome has a built-in bribery feature designed to incentivize Liquidity by bribing voters. Bribe rewards are distributed to voters proportionally, and voters can claim their rewards within 24-48 hours after the snapshot.

- rebase

In order to prevent the dilution of voting rights due to the additional issuance of veVELO, a rebase reward mechanism has been introduced, and veVELO holders will receive additional veVELO rewards.

whitelists

Holders of veVELO with more than 0.1% can create a proposal to whitelist certain whitelists, and the whitelists tokens can be used in the liquidity pool. Other veVELO holders can vote to approve or reject the proposal. If the required number of proposals is not reached, it is passed by default; if approved, the token is whitelists. The use of the Voledrome whitelists protects the capital value of the liquidity pool and reduces irreversible risks.

Commissaire (Emergency Bureau)

Initially composed of 7 members of the Velodrome team and the Optimism community to vote against tokens on the whitelists.

Token Economic Model

The types of tokens involved in Velodrome:

- VELO: the native token of the Velodrome protocol;

- veVELO: Obtainable by locking VELO, which complies with the ERC-721 standard (also known as veNFT);

- WeVE: veDAO governance token.

Here we will talk about VELO tokens, contract address (OP): 0x3c8b650257cfb5f272f799f5e2b4e65093a11a05

Current price: $0.12

Current Market Cap: $21,984,101

24-hour trading volume: $8,209,869

Fully diluted market cap: $105,059,454

Circulation: 183,974,958

Total Supply: 879,194,847

Maximum Supply: 879,194,84

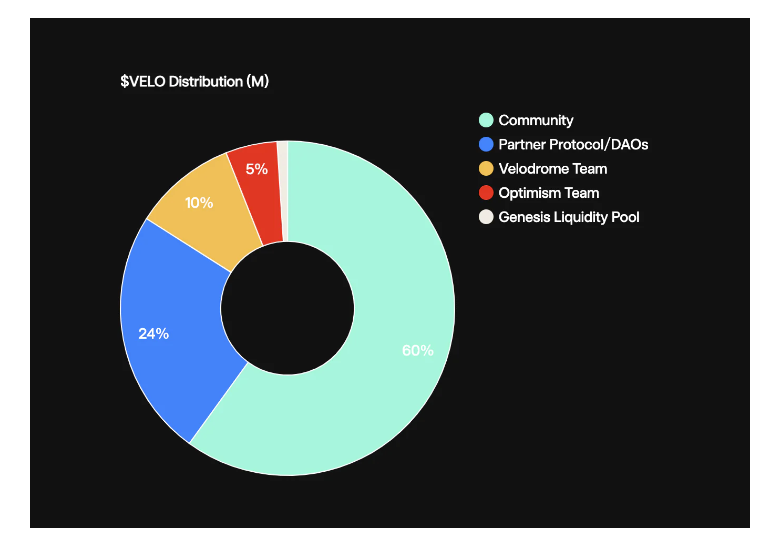

Token distribution

Community: 60% (240 million)

Protocol Partners/DAOs (distributed as locked veNFTs): 24% (96 million)

Velodrome team: 10% (40 million)

Optimism team: 5% (20 million)

Genesis Pool: 1% (4 million)

60% of the community is mainly used for AirDrop, including:

- WeVE holders: 108M, accounting for 27% of the total, WeVE holders burn their WeVE and receive USDC and VELO on OP ;

- Cross-chain DeFi users: 60M, accounting for 15% of the total, received on Velodrome, targeting scope: Curve.fi, Convex Finance, Platypus Finance, TreasureDAO, Redacted Cartel;

- Holders of OP ecosystem tokens: 72M, accounting for 18% of the total, received on Velodrome, and the objects are the screened list of OP AirDrop recipients.

Emission rules (release rules) - ve(3,3) token model

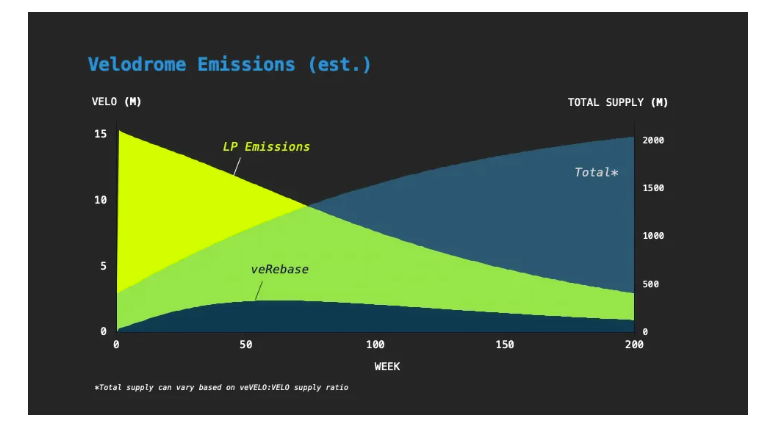

The initial supply of VELO tokens is 400 million, and the weekly LP emission starts from 15M (3.75% of the initial supply), which will decrease by 1% every week. The additional issuance (Rebase) of veVELO will be recalibrated according to the formula to reduce the degree of dilution of voting rights, and the supply of veVELO will not affect the weekly LP emission.

The weekly recalibration formula is:

Rebase = (veVELO.totalSupply ÷ VELO.totalsupply)³ × 0.5 × emissions

VELO is locked for a maximum of 4 years, following the following linear relationship:

Locked for 4 years, 100 VELO = 100 veVELO

Locked for 1 year, 100 VELO = 25 veVELO

There are currently 1 week, 1 month, 1 year, and 4 years of lockup options.

All are stored in the form of veNFT. The longer the lock-up period, the more veVELO you will get.

Problems with Solidly models

Distribution and additional issuance of tokens

Solidly took a snapshot before the release, and allocated veTokens to the top 20 protocols on Fantom according to the TVL on Defillama. Due to the excessive issuance in the first 8 weeks, the project fell into a dilemma of insufficient incentives. Although this situation is very beneficial to the initial users, it is a big pit for the long-term development of the entire project.

Excessive rebase rewards

In Solidly, holders of veToken can get 100% dilution protection in the additional issuance, which means that their tokens will not be excessively diluted. However, the current issuance amount is inversely proportional to the locked amount, that is, the higher the locked amount, The less the increase is. Since most of the additional issuance rewards will flow to veToken holders, the rewards received by Liquidity Provider will be greatly reduced, resulting in insufficient attraction for new Liquidity.

veNFT development stalled

Solidly will get an NFT after locking the tokens. There can be multiple NFTs in the account, and the total is the veNFT balance. This NFT method provides more innovative possibilities for the project. However, Solidly does not iterate on this basis.

protocol instability

Investors take advantage of the loopholes in Solidly's additional issuance mechanism to create pools with their own trading pairs to obtain additional issuance rewards.

Velodrome improvements

For the problems existing in Solidly, Velodrome has made the following improvements:

Voting rewards (i.e. bribes) tied to emissions

In Solidly, voting rewards can be claimed before voting is emitted.

Velodrome does this by introducing new mechanisms that limit each voter to only one "valid" voting decision per epoch, and treat internal (from fees) and external bribes differently, which can only be rewarded once per epoch, and Can only be claimed after the start of the next period.

ensure revenue generation

In Solidly, there are voters who exploit vulnerabilities to direct issuance to invalid pools. Velodrome addresses this problem in three ways:

- Add a management mechanism to identify trading pairs, valid trading pairs enter the whitelists, and trading pairs in the whitelists can be used in the pool;

- Add an emergency "Commmissaire" that can terminate invalid pools in the ecosystem;

- Increase the initial transaction fee rate from 0.01% to 0.02%, ensuring voters are incentivized to channel emissions into efficient Liquidity.

Extended decay time of emissions

In Solidly, the protocol's emissions decay too quickly, resulting in too little incentive for later participants. Velodrome has made some minor adjustments, including modifying the emission growth function, canceling negative votes (you cannot vote against it), stopping the increase of LP emissions for voters, and adjusting the initial distribution to be closer to retail investors to ensure the future of the agreement. Appeal.

Provide white glove support

To ensure sufficient resources to support contributors and expand its product line, the Velodrome team directs 3% of permanent emissions to the team's multisig wallet.

data analysis

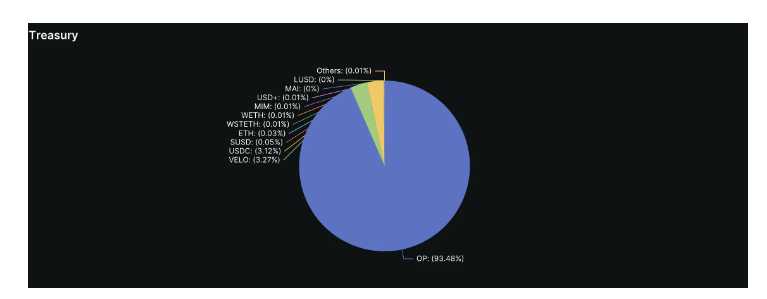

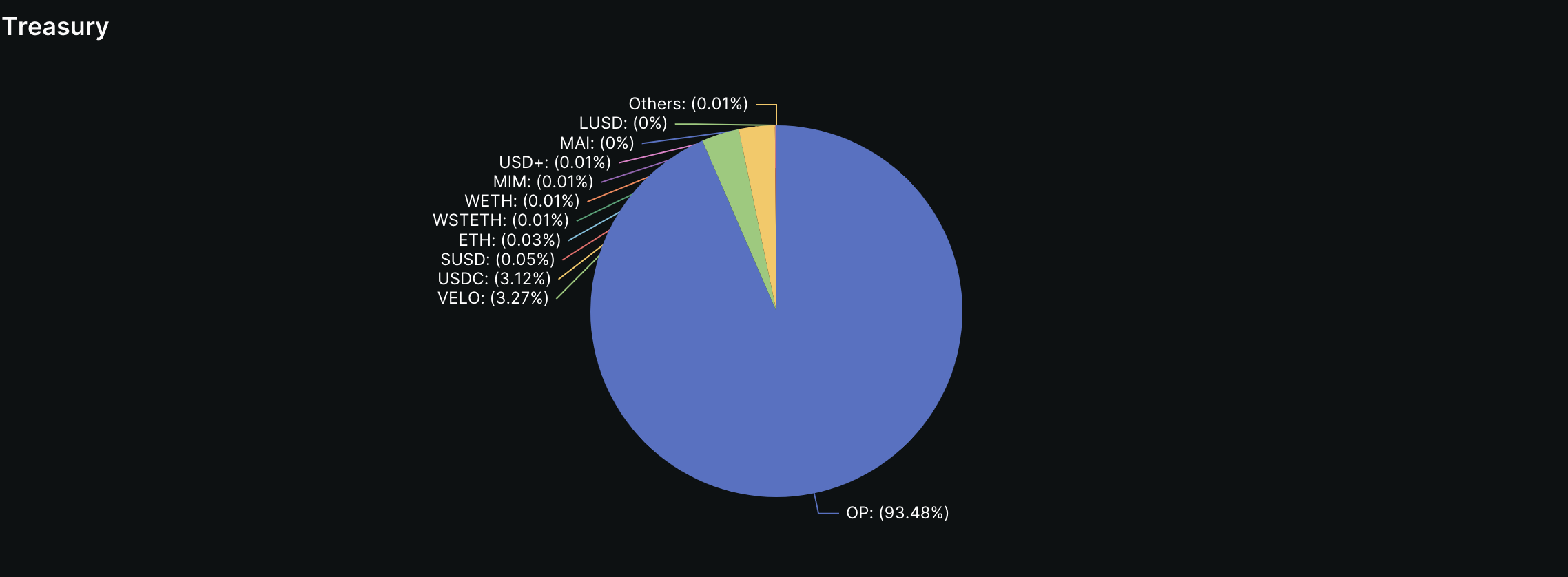

In the Velodrome treasury, 93% of the assets are OP, worth $4.45M, followed by VELO, accounting for 3.27%, worth $1.55M; then USDC, accounting for 3.12%, worth $1.48M.

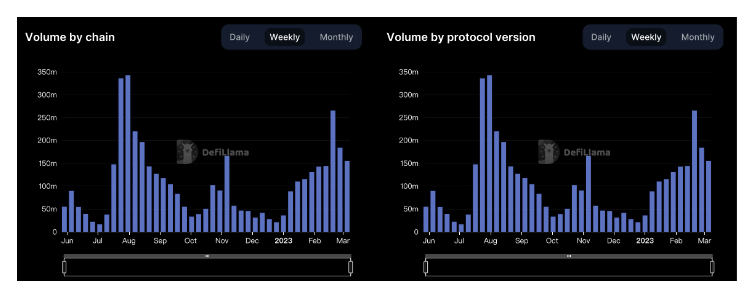

The transaction volume on the OP chain is related to the transaction volume on the Velodrome protocol. Every time the OP is active, it will drive the transaction volume on the Velodrome of this track, and the two have common interests.

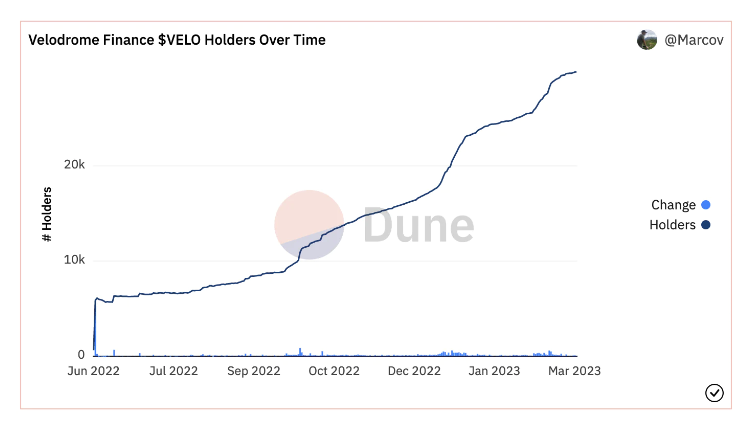

VELO token holders reached 29,858 as of today, reaching a new high.

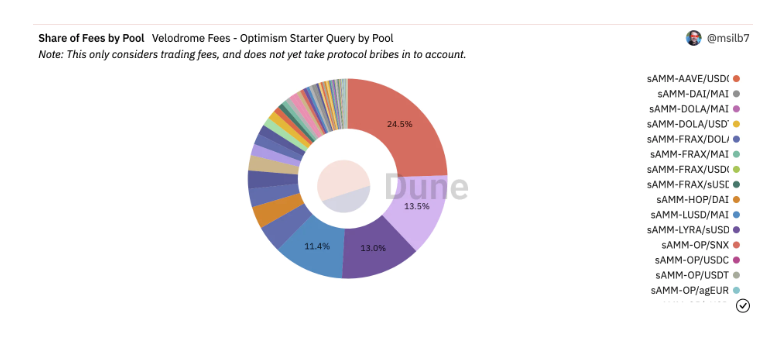

Among the transaction fees shared by the pool, OP/USDC accounted for the largest 24.5%, worth 28,000 US dollars; followed by USDC/ SNX, accounting for 13.5%, worth 15,000 US dollars; WETH/USDC, accounting for 13%; VELO/USDC, accounting for than 11.4%.

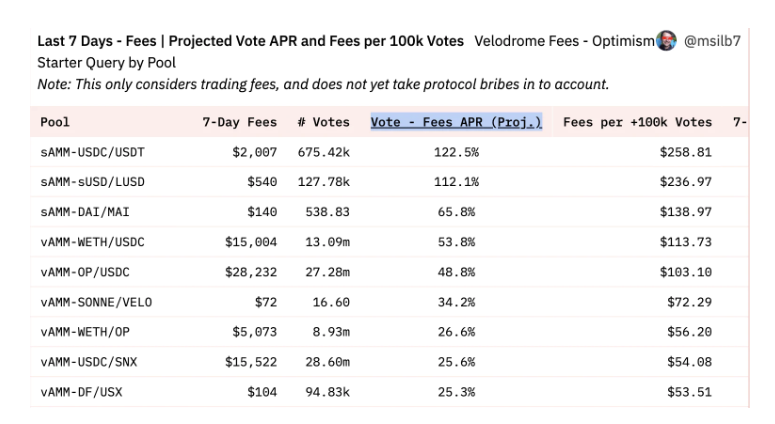

According to the annualized rate of voting income, the highest is USDC/USDT, with an APR of 122.5%; the second is sUSD/LUSD, with an APR of 112%; the third is DAI/MAI, with an APR of 65%. The table change also showed a maximum cost of $258.81 per 10,000 votes.

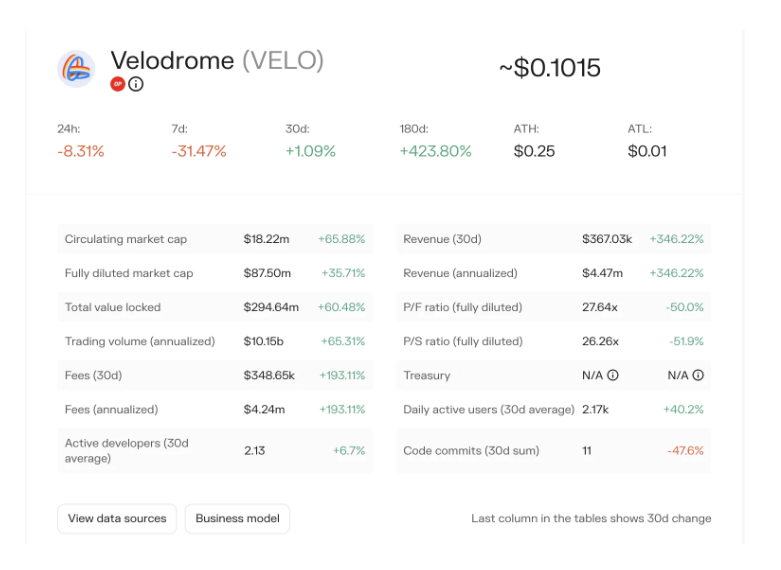

The figure shows that the 30-day fee is US$348,000, and the annualized fee is US$4.24 million, an increase of 193%; the 30-day profit is US$367,000, and the annualized profit is US$4.47 million, an increase of 346%; It was 2170, an increase of 40%.

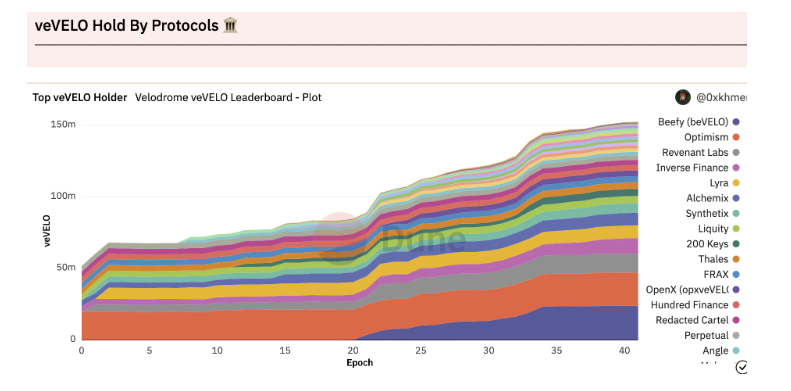

In the ranking of veVELO holding agreements, the first place is Beefy, with a quantity of 23,835,589, a decrease of 41,331 from the previous period; the second place is Optimism, with a quantity of 23,165,871, a decrease of 40,560 from the previous period; An increase of 17,504.

Position status:

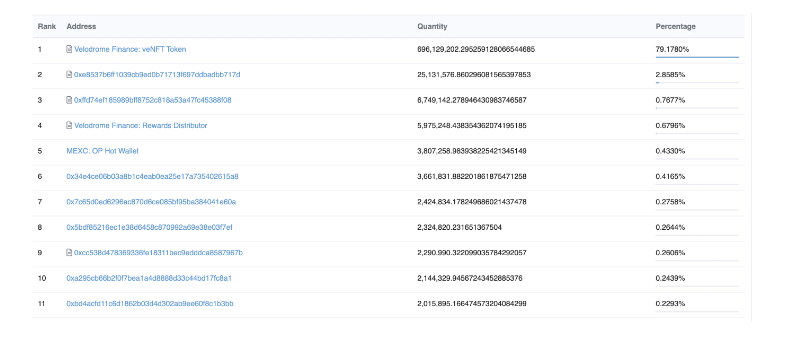

The first holder, accounting for 79.17%, has an amount of 696,129,202.29, which is used to lock up VELO;

The second holder, accounting for 2.85%, the number is 24,818,071.56, VELO/USDC pool;

The third holder, accounting for 0.75%, the number is 6,642,584.53, VELO/ OP pool;

The fourth holder, accounting for 0.67%, has an amount of 5,974,873.24, which is used for reward distribution.

The fifth holder, accounting for 0.42%, the number is 3,698,658.82, the hot wallet of Matcha.

Summarize

Velodrome draws on the experience of Solidly, a decentralized exchange on Fantom, to create a preferred market that integrates AMM and the entire financial platform into a single agreement, simplifies the transaction process, and provides users with a better transaction experience.

In order to improve the rigid situation that Solidly was previously controlled by several top protocols, the initial distribution method of VELO was adjusted, and a variety of holders were built, which was bound to the interests of OP holders, fully mobilizing the users and users in the OP ecosystem. Experienced DeFi users, etc., to complete the cold start together.

The reward model of bribery also attracts more and more effective Liquidity. At present, a bribe of 1 US dollar can bring 1.5-2 US dollars of VELO additional issuance rewards.

Because of the improvement in the amount of additional issuance, the weekly reduction is 1%, so that the rebase will not be over-protected, so that the income can be maintained for a longer time, and the reward space for LP has been increased.

Its ve(3,3) mechanism creates a positive cycle, which is also an ideal flywheel:

Bringing higher rewards through bribery will help the pool to obtain more Liquidity and achieve a cold start --> a deep Liquidity pool can reduce slippage and attract more traders --> more traders , the transaction fee reward is naturally high, coupled with the stimulation of bribery, it will attract more and more veVELO holders --> more users choose to lock their positions, and they will maintain stable Liquidity and continue to raise the water level too high.

Velodrome also plans to make deeper use of veVOLE (veNFT) in 2023, including: veNFT is tradable, divisible, and lendable, etc., allowing users to have more flexible investment options, and may also be used as a new protocol. Source of income.