At 9 o'clock tonight, Beijing time, the ARB AirDrop collection will start soon. There are only about 3 hours left until the AirDrop application. In addition to participating in ARB transactions, providing Liquidity for ARB trading pairs in DEX is also an additional way to earn income.

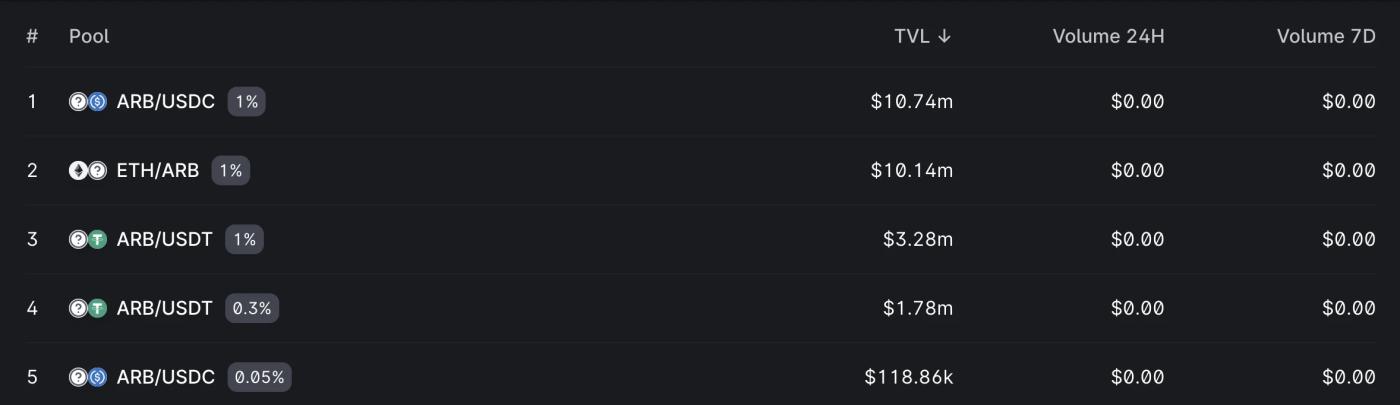

Currently, there are 15 LP pairs of ARB tokens on Uniswap. Total Liquidity has exceeded $26 million.

Among them, the Liquidity of ARB/USDC and ETH /ARB exceeded 10 million US dollars. Since ARB tokens have not yet been applied for, these LP pools only have a single currency, that is, only USDC or ETH has been added.

It is worth noting that in the LP pools with the Liquidity, the handling fee is as high as 1%. This also means that LPs can earn extraordinarily high trading income. How can ordinary users participate in it?

Uniswap Add LP Tutorial

1. Click Pools on the top bar of Uniswap to enter the Liquidity pool interface.

2. Click "New Position" to add a new position.

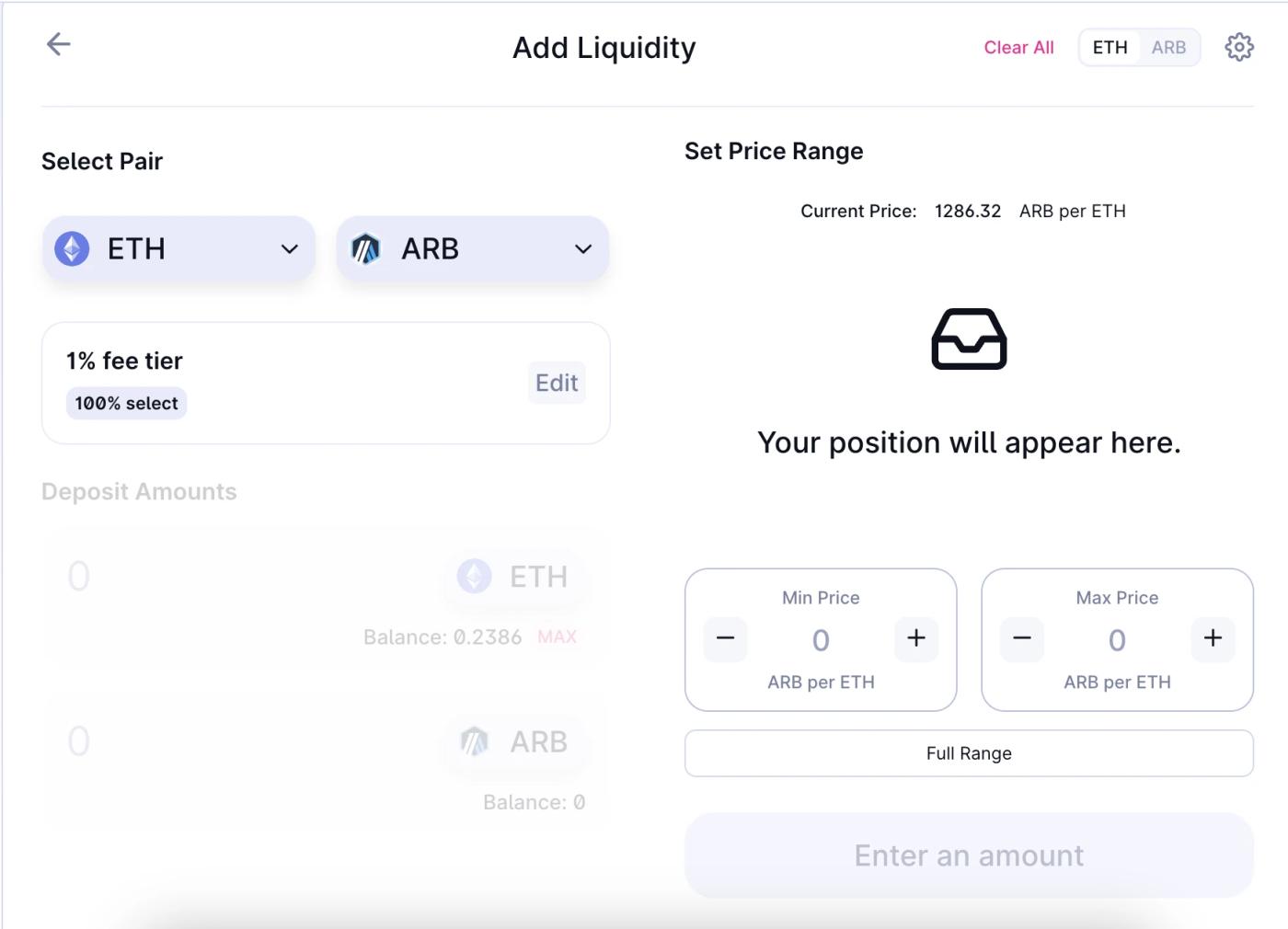

3. In the new page, users can set the LP they want to add. You can set USDC or ETH or other tokens according to your preferences and form an LP currency pair with ARB.

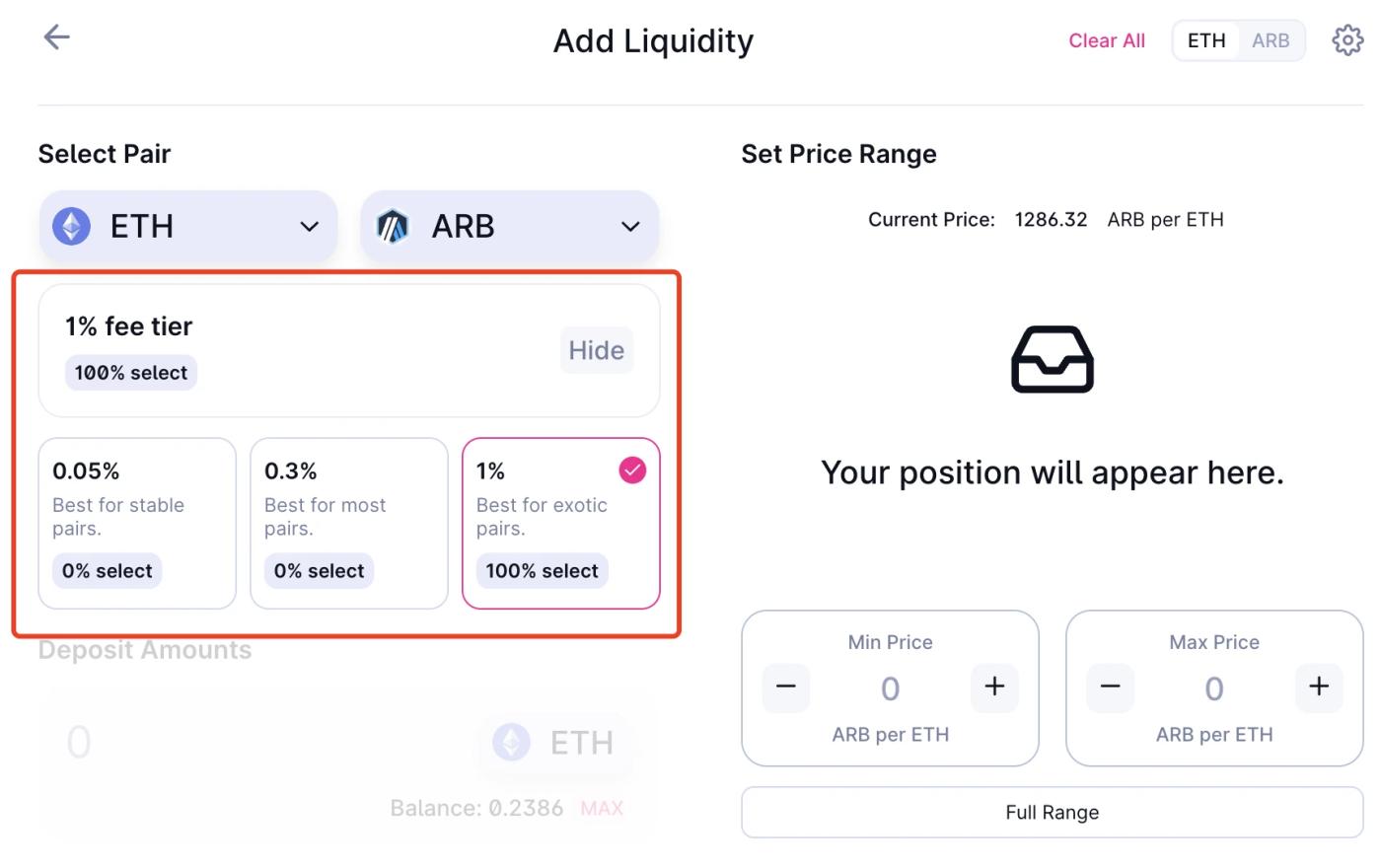

4. After setting the LP currency pair, you need to set the transaction fee.

LPs of Uniswap V3 usually use a transaction fee of 0.05%, which is more reasonable, but we can find from the Uniswap pool list that the top-ranked LP pools all set the transaction fee to the highest level of 1%.

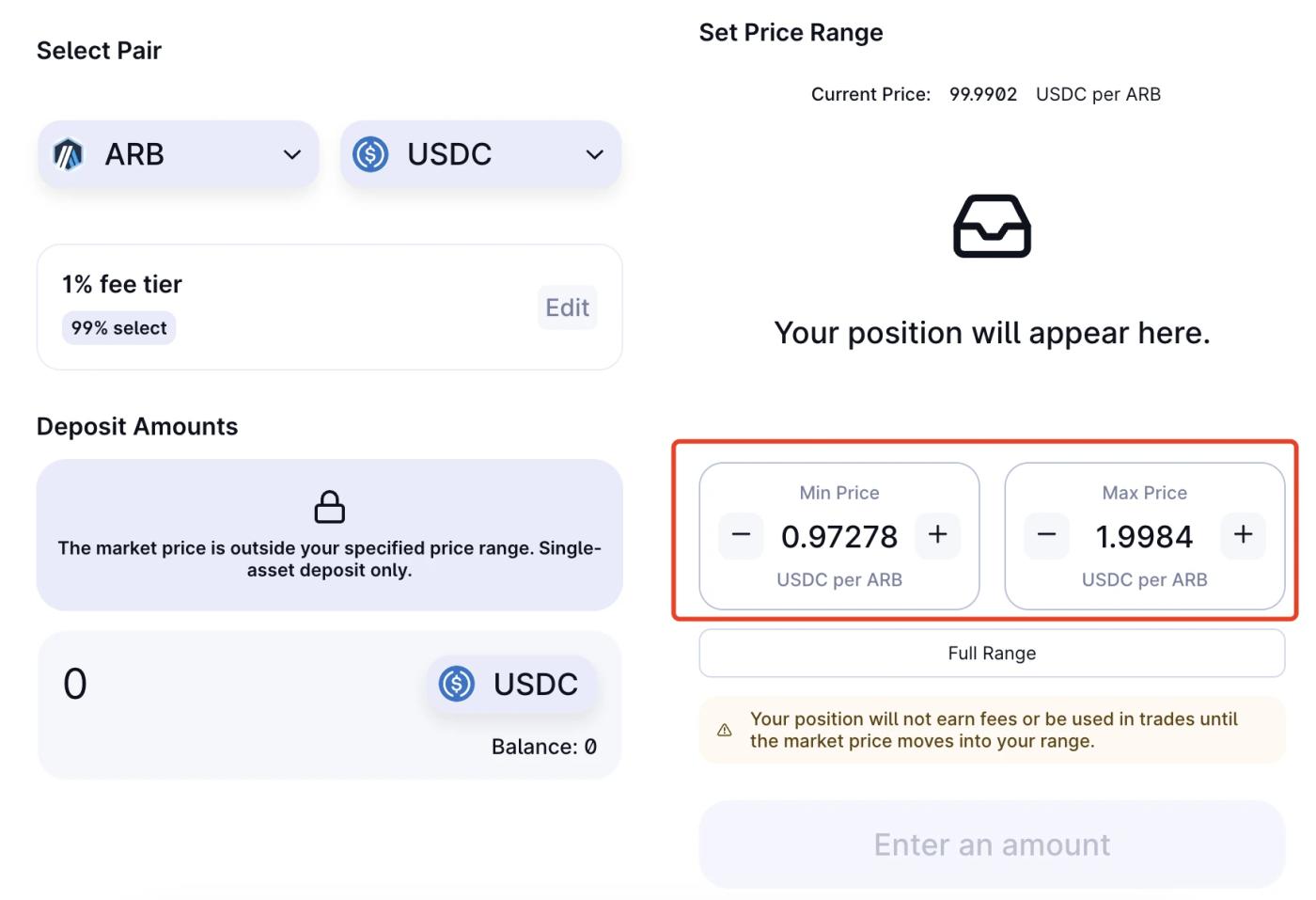

5. Then the user needs to set the market-making interval. It is different from common AMM such as Uniswap V2 and Pancake. Under the V3 mechanism, users can choose the market-making interval by themselves.

For example, if the market-making range of ARB/USDC is set to be between 0.97 and 1.99 USDC per ARB, then when the market price enters this range, we can provide Liquidity to the market and earn fees.

6. Set the amount of funds invested, and click Confirm to start market making.

Since Uniswap V3 sets a price range, it only makes markets within a certain range, so the possibility of large Impermanent Loss is reduced. It is more friendly to LP providers, but it also tests users' ability to judge the market.

Why no ARB coins?

Interestingly, as an LP, we only need to provide USDC, not ARB. Why?

At present, ARB is not open for trading, so we can understand it as the spot price is outside our market-making price range. When the spot price is outside the market-making price range, LPs must all make markets in a single currency.

We hope that the market-making range is between 0.97 and 1.99 USDC. When the market price reaches 0.97 USD, if the market continues to rise, it means that people use USDC to buy ARB from the pool, so there must be more currency in the pool than it is now. Many, sufficient USDC. Therefore, at this time, LP needs to provide Liquidity to the agreement in USDC. And wait until the price breaks through $0.97 to start earning fee income.

(If the user is making a market in a "sky-high" range, only ARB needs to be provided.)

How Much Money Can LPs Make?

As a popular currency, let’s assume that ARB’s trading volume on the first day of Uniswap is 100 million US dollars, and use this as a basis to try to calculate the income of LP. (Assumed figures are for calculation purposes only and do not represent market forecasts.)

Currently, most LP pools set the handling fee at 1%. That is, a transaction volume of US$100 million within 24 hours can bring LPs US$10 million in revenue. At present, LPs with US$26 million share the US$10 million together, which means the return on the first day is as high as 38.5%.

It should be noted that since V3 includes a market-making range, and it will no longer participate in market-making when it exceeds the range, there will be a large number of invalid LPs in the LP of 26 million US dollars. The LPs who actually participated in the division of 10 million US dollars are much lower than 26 million US dollars, so the LP return rate will be higher than 38.5% (of course, if the interval is set incorrectly, the return rate will be lower ).