Arbitrum is a Layer 2 Blockchain that launched its token on March 23 with the biggest AirDrop ever with an average total value of over $1B. In this on-chain analysis of the Arbitrum project, Hak Research will delve into the dynamics of major wallets and ecosystems instead of going into the usual tokens of the token.

Arbitrum Overview

Arbitrum is currently a Layer 2 Blockchain built on the Ethereum network using the most successful Optimistic Rollup technology, far ahead of the current 2nd competitor, Optimism .

Behind Arbitrum is a powerful backer with names like Pantera, Polychain Capital, Coinbase Venture, Parafi Capital, .. and the amount raised through 3 rounds of funding is $123M with a valuation up to $1.2B according to information in the records of Alameda Research.

ARB . Token On-chain Analysis

Amount of AirDrop distributed

According to Spot Onchain , the total amount of ARBs requested by users has reached over 1 billion tokens equivalent to nearly 87% of the AirDrop issuance. If you compare this number with Optimism, another Layer 2 competitor that also released an AirDrop , Arbitrum is completely ahead with only 76% being claimed.

Another fact is that Arbitrum AirDrop to more than 600K wallet addresses while Optimism only AirDrop about 250K but still has a smaller number of claims.

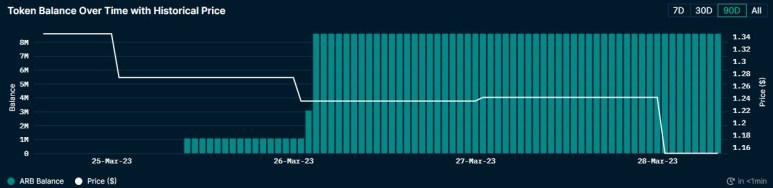

Amount of ARB on exchanges

The amount of ARB loaded on decentralized exchanges in the first 24 hours after listing is very large, but the token price did not drop too sharply during this period. Currently, the majority of ARB tokens available on exchanges are about 55% of the total supply, which is not a small number.

Analysis of wallets with prominent transactions

Wallets marked as Winter Mute continuously withdraw tokens from exchanges, some argue that this is a collection action by this notorious market maker.

However, this is not a consolidation move when:

- 0xcce wallet received $40M ARB token from Arbitrum DAO Treasuary then continuously loaded it to different CEX exchanges like Binance, OKX,.. I can confirm this is a sub-wallet of Winter Mute when this wallet has received 0.1 ETH from main wallet on 20/3.

- Wallet 0xba0 received 10M tokens then transferred nearly 2.8M directly to Winter Mute wallet.

- This wallet marked as Winter Mute also bought 40M tokens continuously within 2 days of token launch and transferred most of it to Binance.

Thus, we can calculate the total amount of tokens from the wallets of Winter Mute holding about 41.7M, 8.3M less than the initial amount received from the Arbitrum DAO Treasury. The part that Winter Mute himself bought on Dex is not too big when it only has about 1.7M ARB

The marked wallet owned by Amber has continuously withdrawn 8.6M tokens from the OKX exchange at an average price of about $1.25 per token.

Up to now, this wallet is losing about 10%, equivalent to nearly $ 1M.

Wallet 0xB15 collects continuously on DEX after the token is listed 5M Arbitrum token then continues to withdraw another 5M token from Binance to the wallet a few hours ago, in total this wallet is holding 10M ARB but the average price is quite high at $1.3 and recorded a loss of ~$2M.

Arbitrum Project On-chain Analysis

TVL by Arbitrum

The TVL of the entire Arbitrum ecosystem has increased by more than $500M right after the project launched its token information on March 16, which is one of the very positive signals even though there has not been any incentive program yet. through.

Currently, to overcome the ATH mark at the uptrend time in November 2021, Arbitrum's TVL only needs to increase by more than 10% and the fact is that the potential to develop the ecosystem is huge.

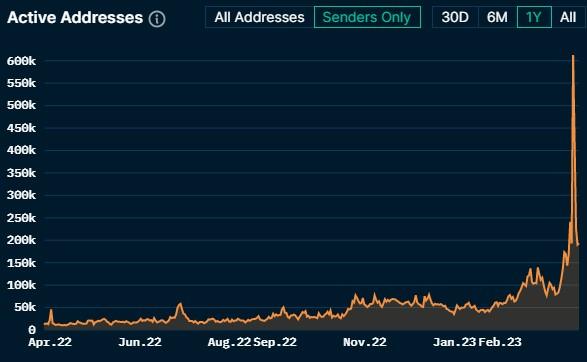

Number of active wallet addresses on Arbitrum

The number of active wallet addresses per day on the Arbitrum network has been increasing steadily every day throughout 2022, however on the day of claiming the token AirDrop , a new record was reached of 600K wallets.

The sudden increase in the number of wallets also caused the Arbitrum network to be blocked for many hours, which can also be considered as a stress test for the blockchain.

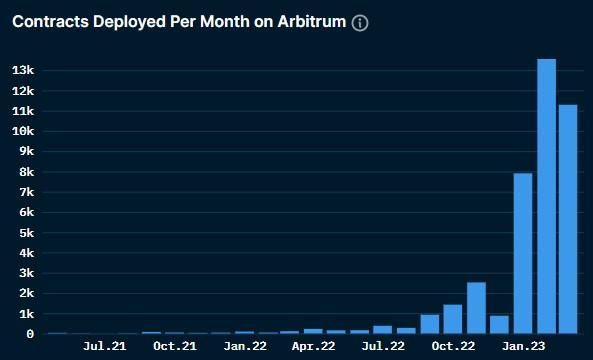

Amount of smart contracts deployed on Arbitrum

This is an indicator that can be used to gauge whether the ecosystem is really attractive to developers. The number of deploying smart contracts on Arbitrum every month continuously sets a record, proving that developers as well as projects are very interested in this ecosystem.

Although on the positive side, this factor is contributing greatly to the development of the entire Arbitrum ecosystem, but there are still some developers who deliberately take advantage of the excitement of users to conduct scams. island, people still need to be very careful when using Arbitrum.

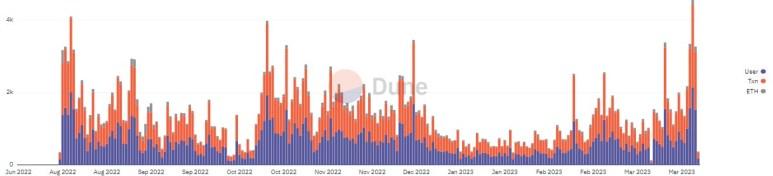

Amount of tokens bridged to Arbitrum Nova

Compared to Arbitrum One, Arbitrum Nova has not really attracted too many users when the amount of ETH bridge through this network has not increased too strongly recently.

Summary

The On-chain situation of shark wallets is quite similar when it comes to temporary losses, a large amount of tokens empowered for Winter Mute are still on CEX exchanges and the purpose of use is unknown in the near future. This.

Arbitrum token launch has opened a new turning point for the entire ecosystem by opening the door to development in a sustainable and decentralized way. There will be a lot of opportunities for us in the near future on Arbitrum especially in investment and farming.

Hopefully, through this Arbitrum project On-chain analysis article, people have been able to make some projections for the largest Layer 2 ecosystem in time and find opportunities to change positions.

The post Arbitrum (ARB) Project On-chain Analysis appeared first on HakResearch .